The stronger-than-expected labour market data in Q4 has spooked bank economists into believing that the Reserve Bank of New Zealand will hike the official cash rate further over coming monetary policy meetings.

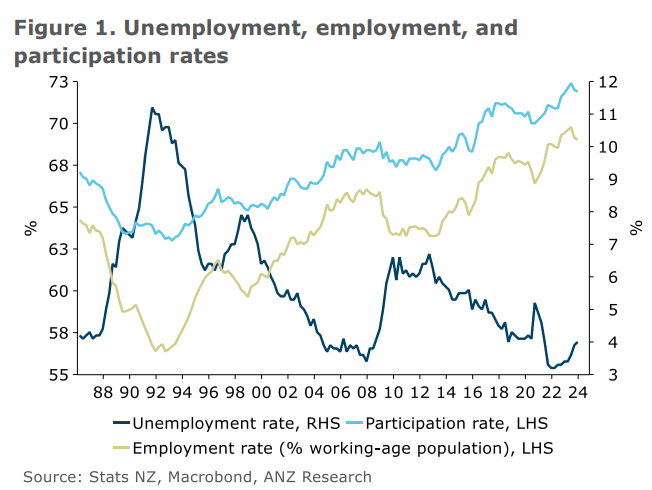

To recap, New Zealand’s unemployment rate increased from 3.9% to 4.0%, below the Reserve Bank’s forecast of 4.2%:

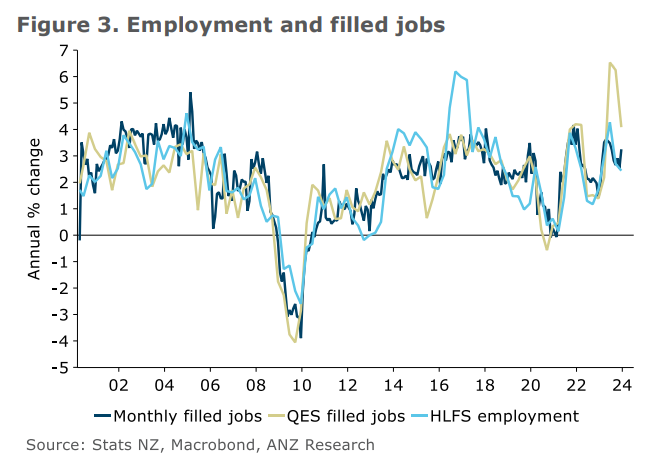

Employment increased by 0.4% over the December quarter, stronger than the Reserve Bank’s expectation of a 0.2% quarterly increase:

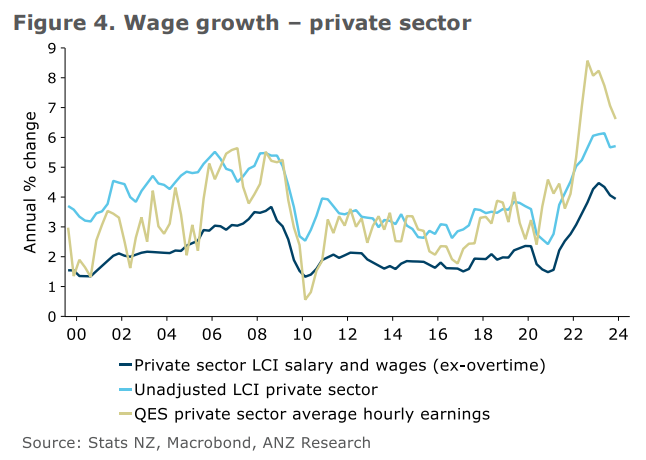

Finally, annual wage growth eased, but by less than what the Reserve Bank expected:

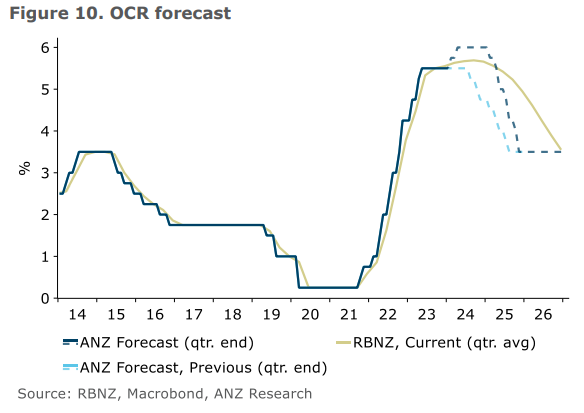

On Friday, ANZ Economics published a note projecting that the Reserve Bank will hike the official cash rate (OCR) by 0.25% at both its February and April meetings:

We are now forecasting 25bp hikes in both February and April, taking the OCR to 6%. We are now forecasting cuts from February 2025, ultimately taking the OCR back to 3.5% as before.

The RBNZ warned in November that “If inflation pressures were to be stronger than anticipated, the OCR would likely need to increase further.”

Data since then has been a series of small but pretty consistent surprises in that direction.

In the meantime, yields have fallen substantially. The 2-year swap is 70bp lower than its October 2023 peak.

Also, at the end of the day, it’s worth noting that two more OCR hikes only counter the 50bp increase in the long-run neutral OCR seen in the last two MPSs. Policy is “running to stand still” in that context.

We see the risks as balanced around our updated forecasts. As we’ve stated, February is a line-ball call. If they don’t hike in February, we think they will in April, unless we start to see meaningful downside surprises.

On the other hand, risks are tilted towards cuts coming earlier than February 2025, given we think restarting hiking will have pretty powerful shock value, as it’s been widely expected that rates have peaked.

The RBNZ will be well aware that restarting hiking cycles when per capita GDP is down 3% y/y might appear counterintuitive. But at the end of the day, they have a job to do: to get inflation sustainably down to 2% in the medium term.

We just don’t think the RBNZ Committee will feel confident that they’ve done enough to meet their inflation mandate. The buck stops there.