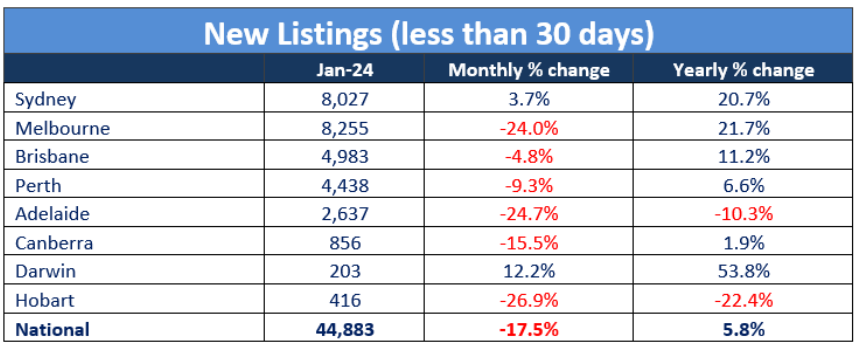

SQM Research released data this week showing the strong rise in new listings across Sydney and Melbourne, up 20.7% and 21.7% year-on-year respectively:

Source: SQM Research

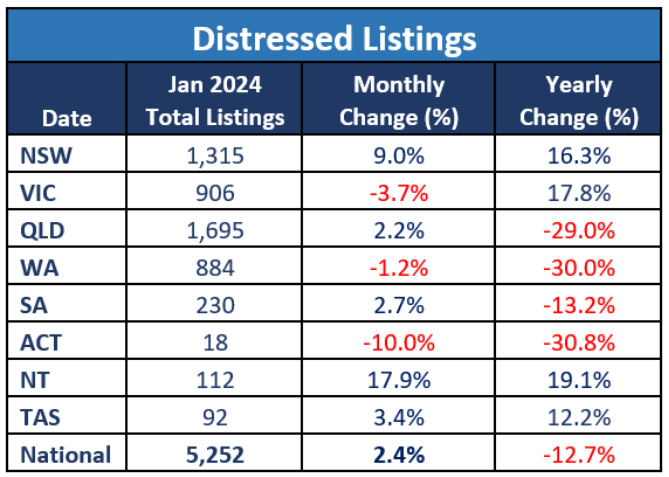

SQM also showed that there has been a sharp annual rise in distressed listings across both markets:

Source: SQM Research

“There is now a concerning trend emerging out of NSW and Victoria for ongoing rises in distressed listings activity”, noted SQM Research managing director, Louis Christopher.

“The nine percent rise in NSW for the month was very abnormal and suggests some vendors in NSW are increasingly desperate to offload their properties”.

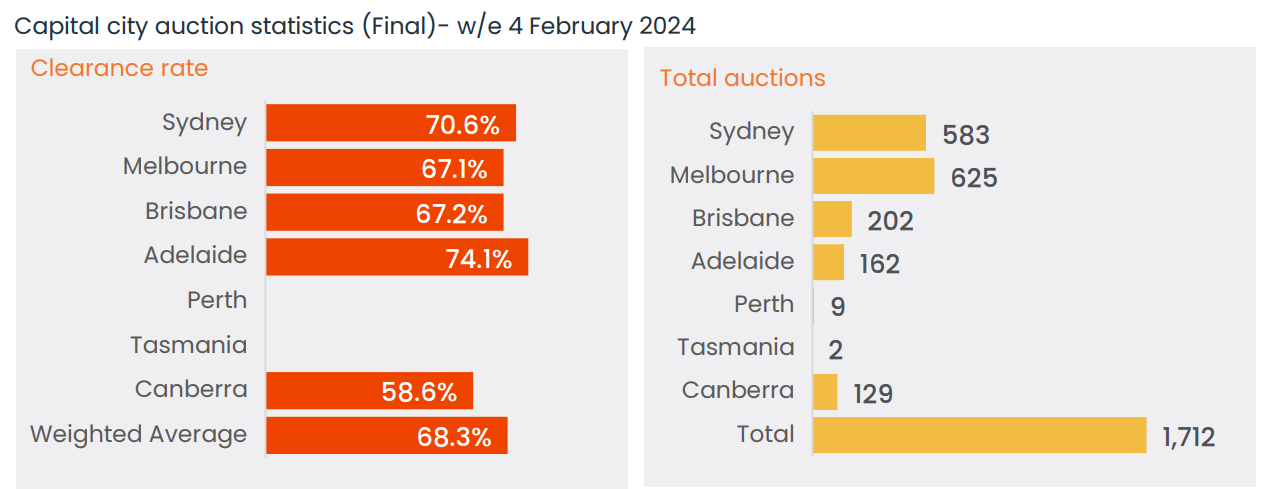

Last weekend recorded the second strongest auction volumes for the first weekend of February on record, according to CoreLogic.

Luckily for vendors, results were strong with 70.6% (Sydney) and 67.1% (Melbourne) of homes selling:

Source: CoreLogic

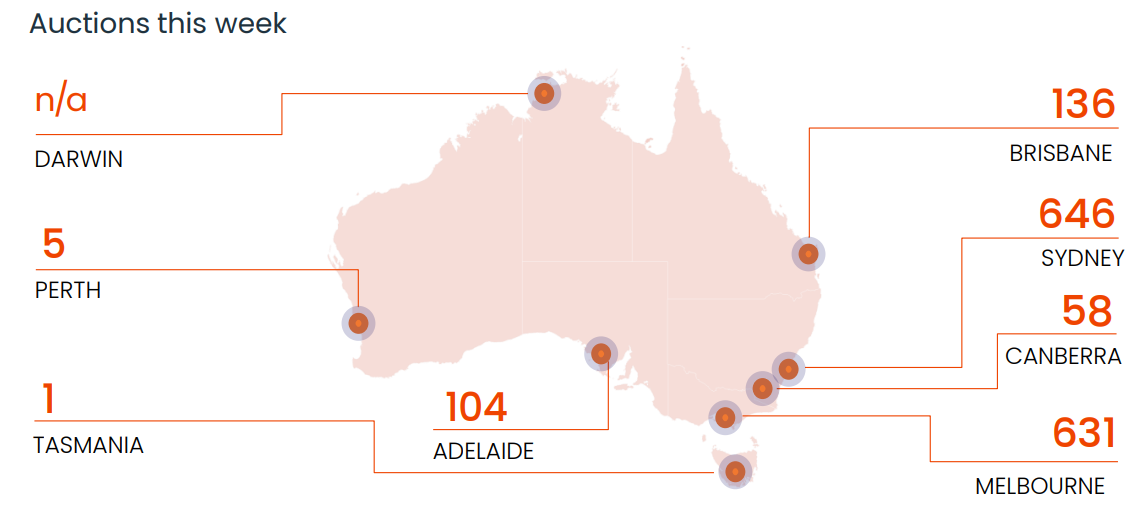

This weekend will see auction volumes increase further across both markets:

Source: CoreLogic

Sydney’s auction numbers are scheduled to rise by 10.8% this week, with 646 homes set to go under the hammer, up from 583 the previous week. This week last year, 601 auctions were auctioned throughout the city.

631 homes in Melbourne are scheduled for auction this weekend, up slightly from 625 the previous week and more than the 564 held this time last year.

Louis Christopher at SQM Research cautioned against reading too much into last week’s strong auction results:

“I caution the industry right now not to get too far ahead of itself and not overly read into the jump in clearance rates last week”.

“Yes, it may be a positive sign. Yes, there may be an interest rate cut at some point this year. However, the market right now is very mixed, and vendors need to realise that buyers will be sensitive to any economic slowdown that maybe presently occurring”.

It will be interesting to see whether last week’s strong clearance rates continue in the face of rising volumes and whether the RBA’s decision to hold interest rates plays a role.