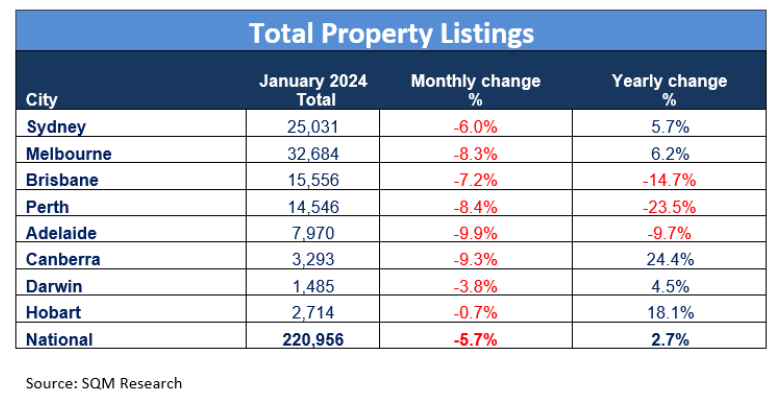

SQM Research has published property listings data for January, which were up 2.7% year-on-year, led by Melbourne, Sydney and the smaller capital cities:

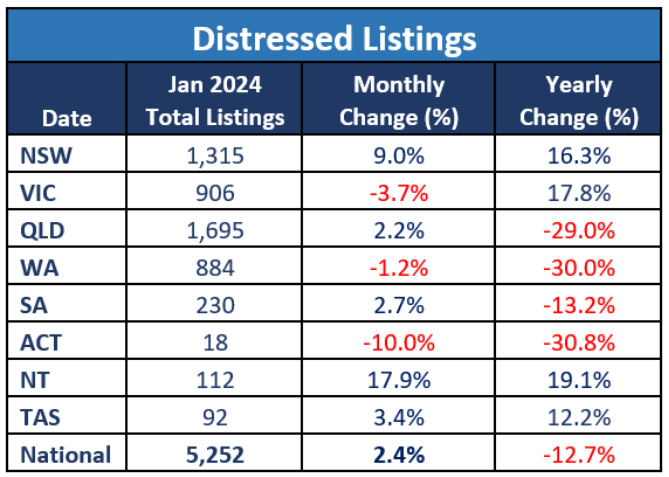

The more interesting statistics was that distressed listings jumped 9.0% in NSW in January, to be up 16.3% year-on-year:

The number of distressed property listings have also risen sharply in Victoria, the Northern Territory and Tasmania over the past year, according to SQM Research.

Commenting on the results, SQM Research managing director, Louis Christopher, noted that “some vendors in NSW are increasingly desperate to offload their properties”:

“There is now a concerning trend emerging out of NSW and Victoria for ongoing rises in distressed listings activity”.

“The nine percent rise in NSW for the month was very abnormal and suggests some vendors in NSW are increasingly desperate to offload their properties”.

Last weekend’s auction listings were the second-strongest start to February in CoreLogic records dating back to 2008.

Yet, “Sydney’s early clearance rate came in at 76.3% with 434 results collected – the city’s highest preliminary result since the week ending July 20th 2023 (77.5%)”, reported CoreLogic.

However, SQM’s Louis Christopher cautioned against reading too much into the ‘strong’ auction result:

“I caution the industry right now not to get too far ahead of itself and not overly read into the jump in clearance rates last week”.

“Yes, it may be a positive sign. Yes, there may be an interest rate cut at some point this year. However, the market right now is very mixed, and vendors need to realise that buyers will be sensitive to any economic slowdown that maybe presently occurring”.

It makes sense that some NSW vendor’s are “desperate to offload their properties”.

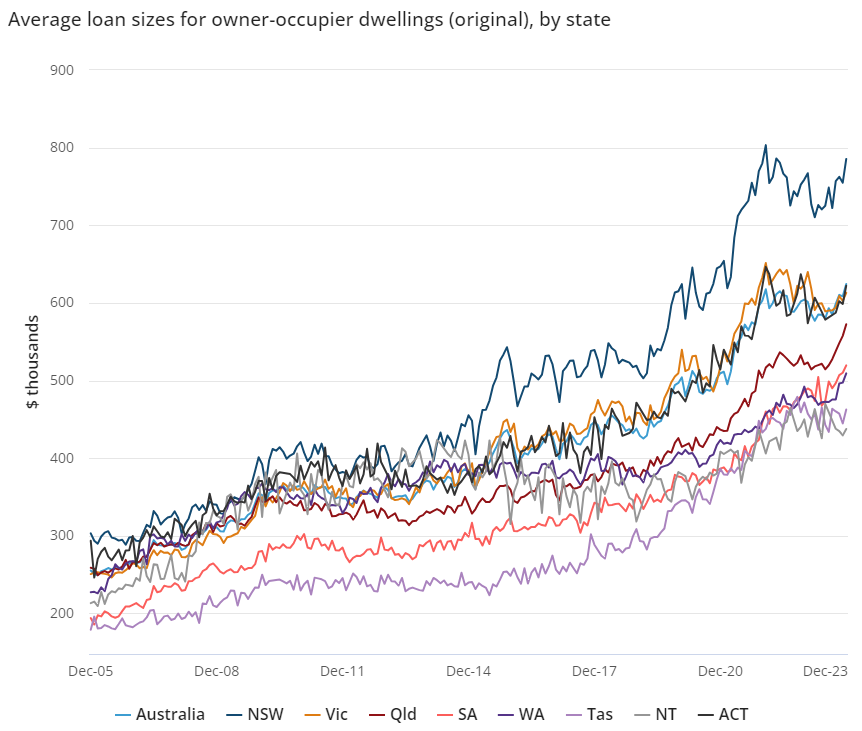

NSW mortgage holders carry by far the largest mortgages in the nation, averaging nearly $800,000:

Source: ABS

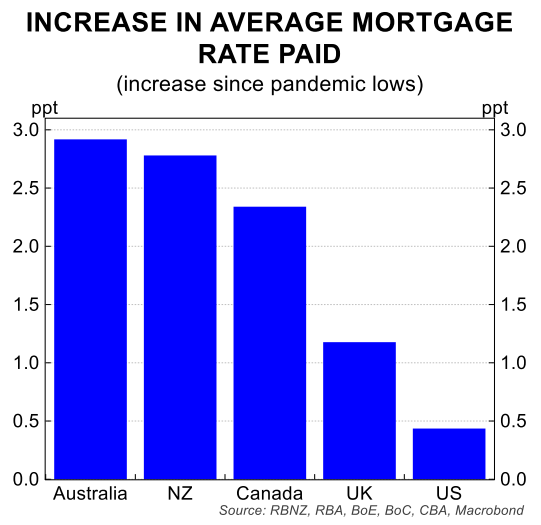

They have, therefore, been hit hardest by the RBA’s aggressive interest rate hikes, which have seen average mortgage rates in Australia rise by nearly 3%:

Somebody carrying an $800,000 mortgage would now be paying roughly $1,400 a month more in repayments following the RBA’s rate hikes.

That is a harsh financial burden to bear.