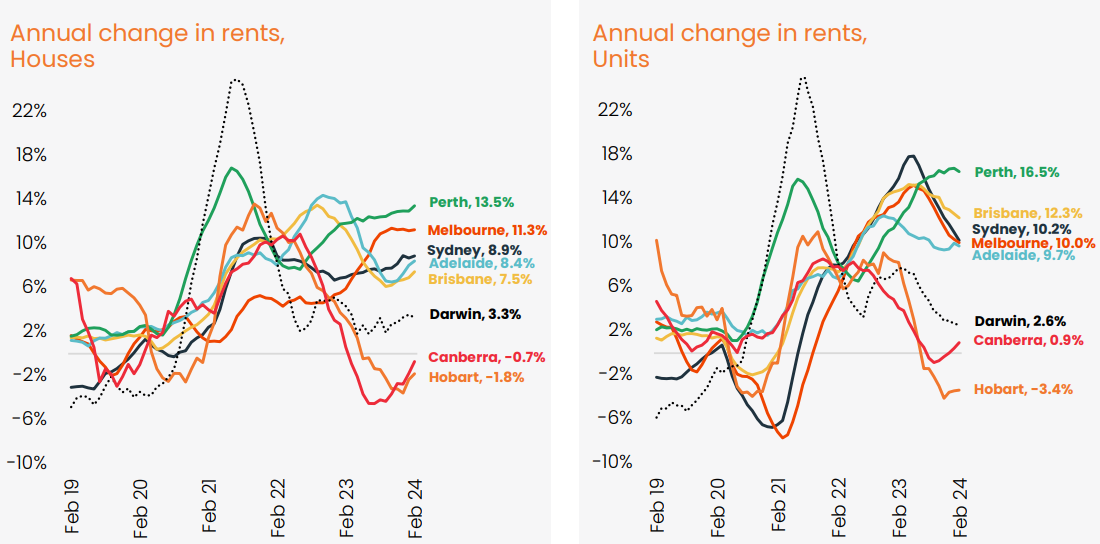

Earlier this month, CoreLogic reported that rental growth had reaccelerated, with advertised rents climbing by 0.9% in February, the highest reading since March last year.

This re-acceleration also saw the rolling quarterly change in rents rise to 2.4%, the highest since May last year.

Source: CoreLogic

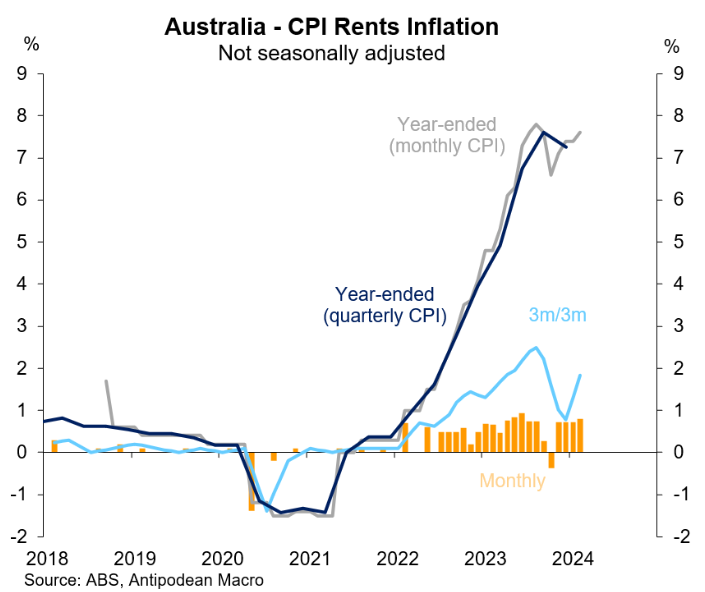

On Wednesday, the Australian Bureau of Statistics (ABS) released its monthly CPI inflation survey, which showed that overall rental growth in Australia rose to an annual rate of 7.6% in February, up from 7.4% in January:

ABS noted that the rise in annual rents “reflect strong demand for rental properties and tight rental markets” and came despite the increase in subsidies via the Commonwealth Rental Assistance Scheme (CRAS) in September 2023.

CPI rents are 7.6% higher over the year, but are 9.3% higher when excluding the rent assistance impact.

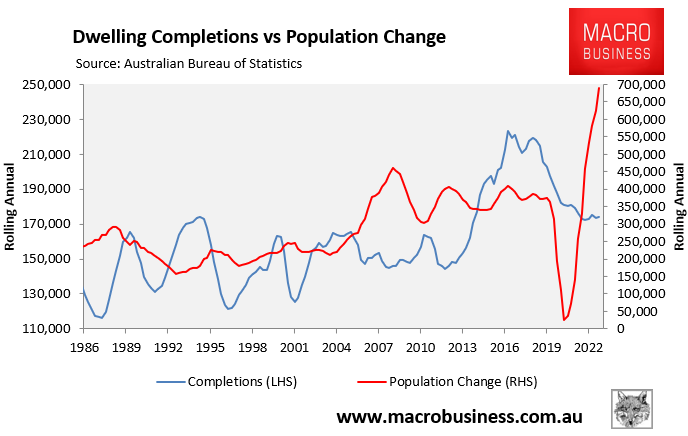

The primary driver of the surge in rents is obvious: the record surge in net overseas migration at the same time as actual dwelling construction is falling.

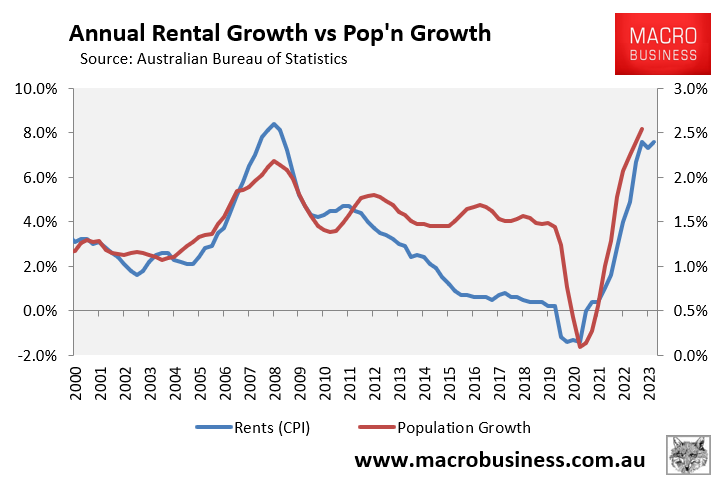

The next chart plots the surge in Australia’s population growth with the surge in CPI rental inflation, which shows the obvious correlation:

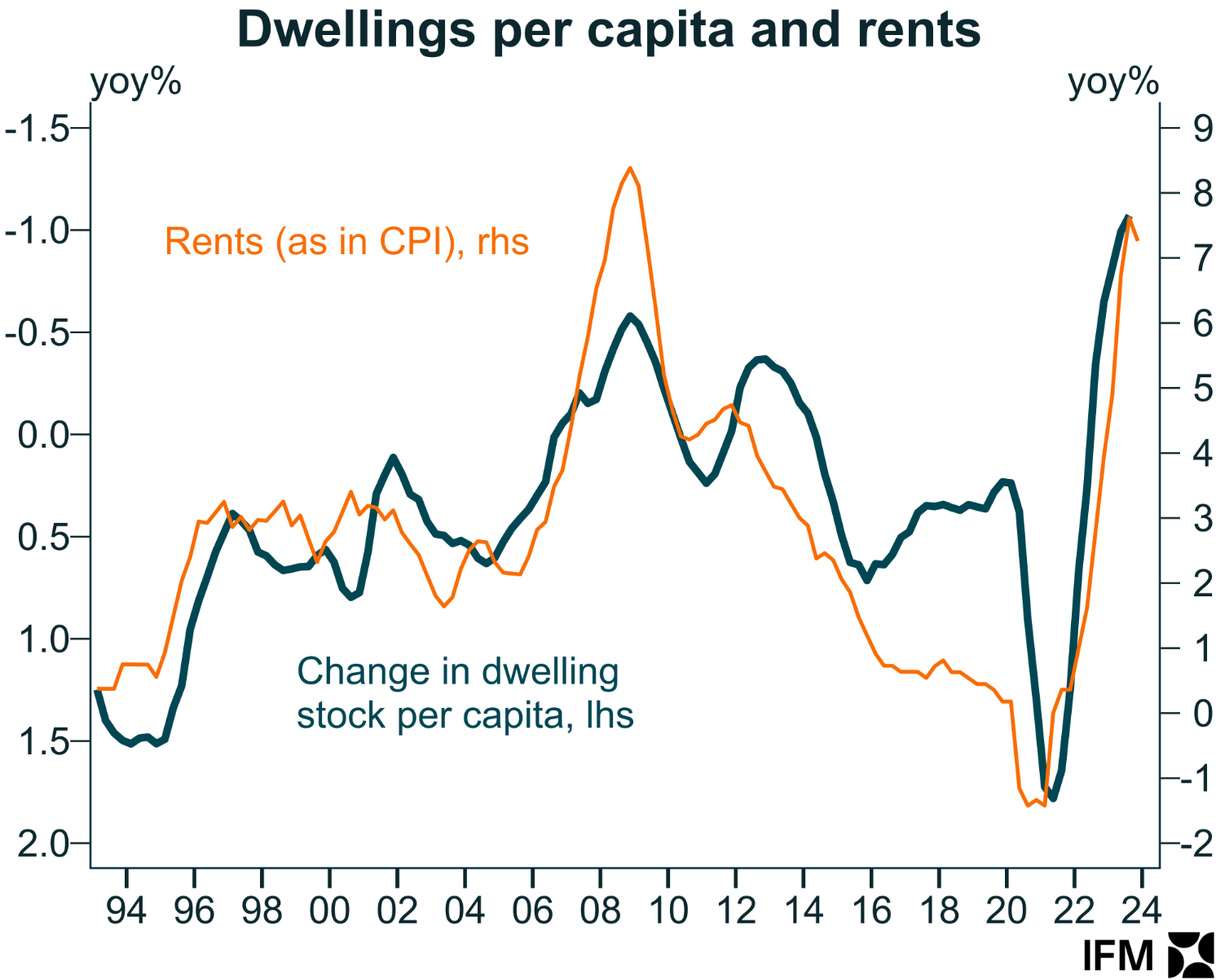

The next chart from Alex Joiner at IFM Investors, which plots the change in the dwelling stock per capita against rents, shows similar:

Source: Alex Joiner (IFM Investors)

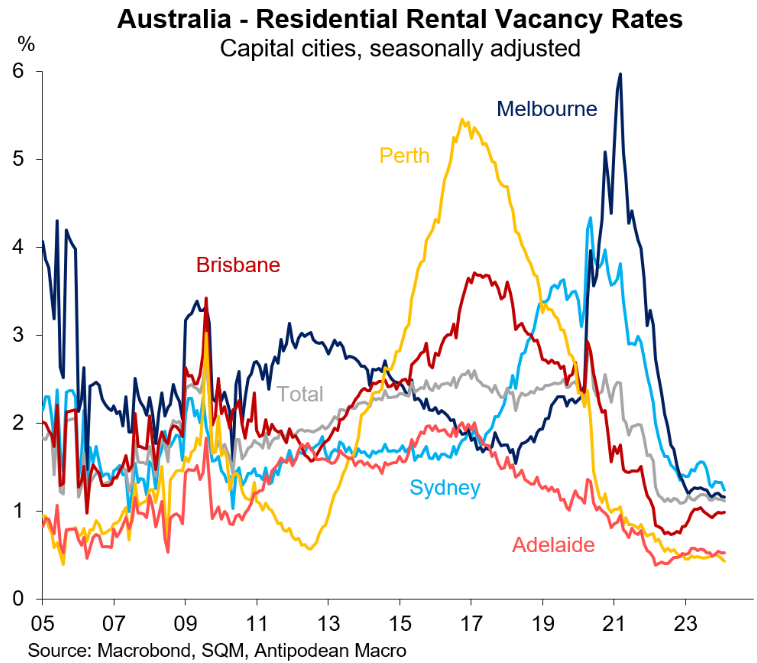

So long as the federal government continues to force feed migrants into a supply-constrained housing market, rental vacancy rates will remain perilously low and rental inflation will remain elevated.

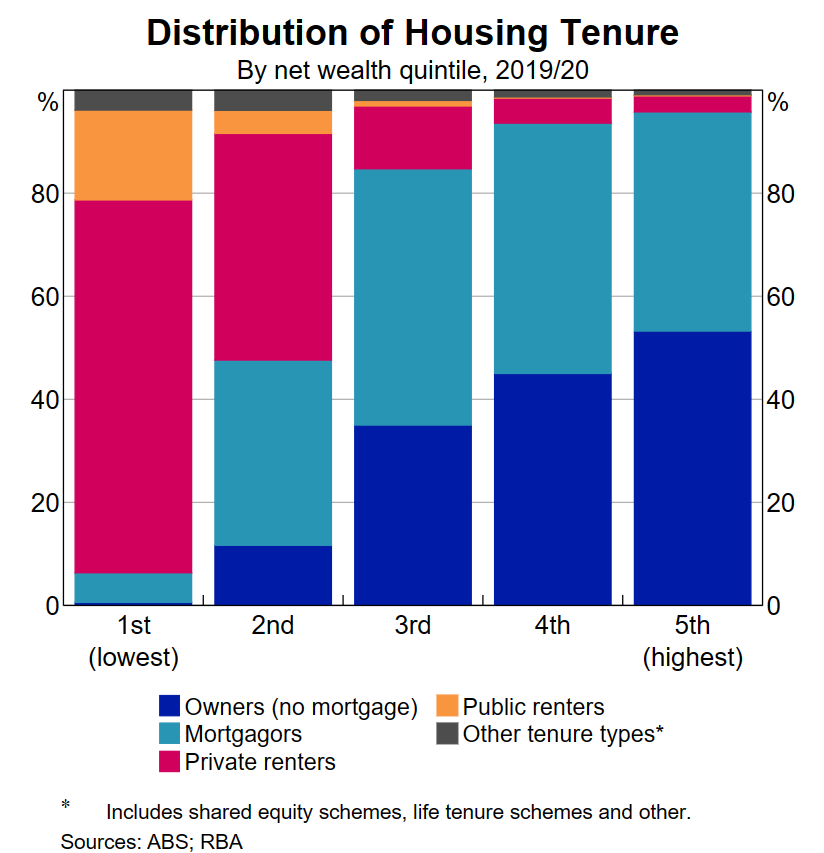

This will harm lower socioeconomic Australians the most, given they are most likely to rent:

The deterioration in Australia’s rental situation is an inequality disaster in the making.

There is an existing traffic jam, and the Albanese government is effectively directing overseas traffic into the traffic jam.