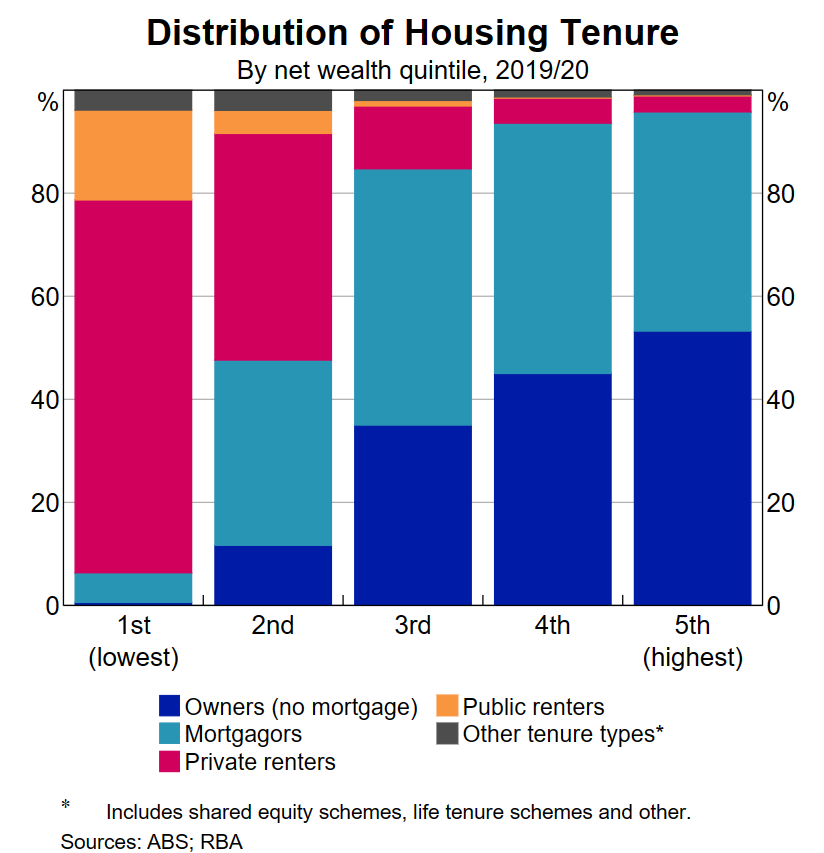

Data released last year by the Reserve Bank of Australia showed that poorer Australians dominate the nation’s rental tenancies:

“Nearly 90% of all households in the lowest wealth quintile were renters in 2019/20”, according to the RBA.

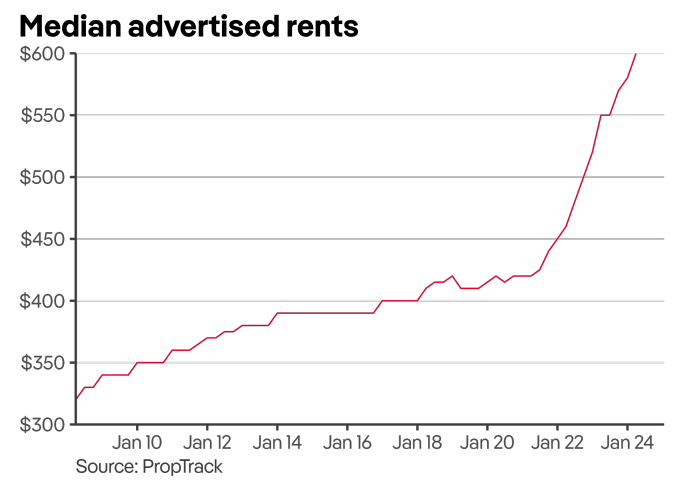

As we all know, Australian renters have experienced hyper-inflation in housing costs, with median asking rents soaring 38% since the beginning of the pandemic, according to PropTrack:

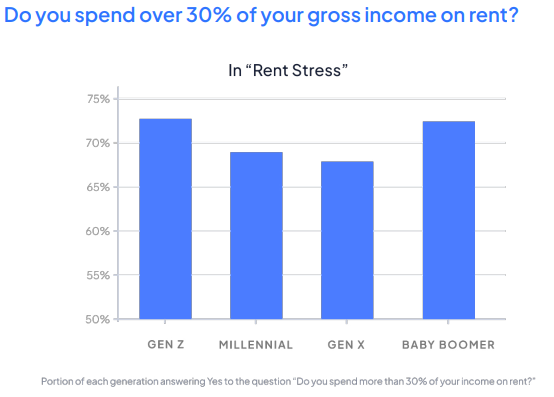

A recent survey from InfoChoice found that 70% of renters were is “stress”, defined as spending more than 30% of their incomes on rental payments:

Source: InfoChoice

In turn, data from peer-to-peer listing site flatmates.com.au showed demand for shared housing skyrocketed in January.

“January marked the busiest month in flatmates.com.au history, with a record-breaking 212,000 active members using our platform to search for a new home or housemate, an increase of 6% on last year’s record”, community manager Claudia Conley said.

“The cost-of-living and rental crisis is leading even more people to turn to shared accommodation than usual”, Ms Conley said.

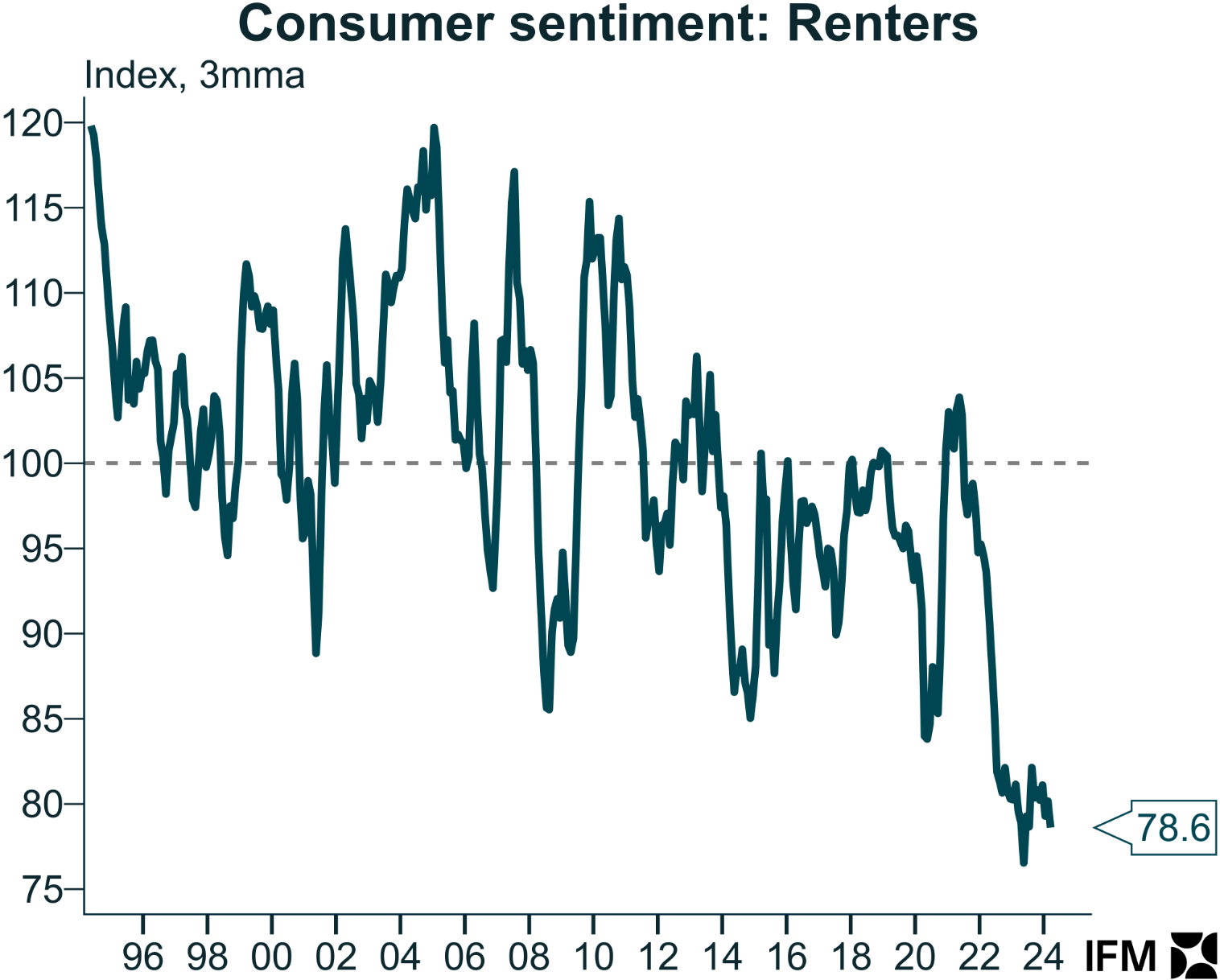

With this background in mind, it was not surprising to see renter consumer sentiment tracking near all-time lows, according to Westpac’s latest consumer sentiment index:

Source: Alex Joiner (IFM Investors)

“The rental crisis continues to take a toll and there’s little reason to think anything will get better near term”, noted Alex Joiner, chief economist at IFM Investors.

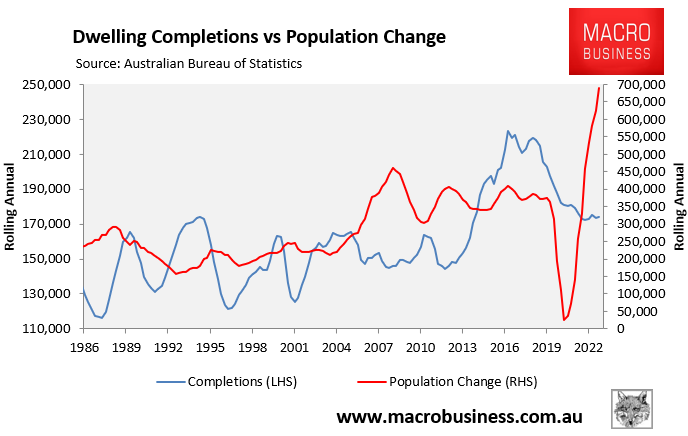

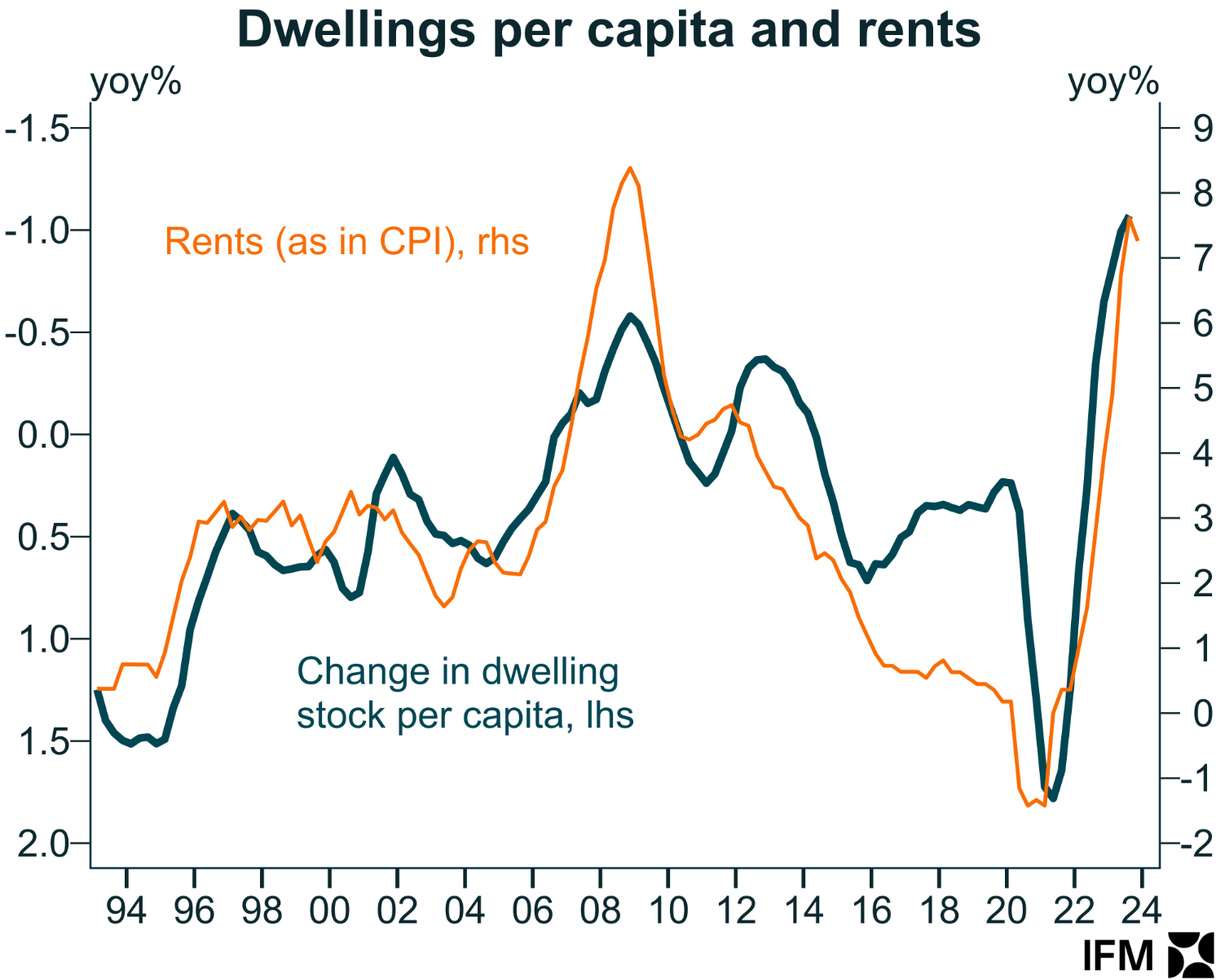

Absolutely. The next chart from Joiner, published last week, shows that rents have soared because population demand is running way ahead of supply:

Source: Alex Joiner (IFM Investors)

With Australia’s population growing at a record rate at the same time as dwelling construction is falling, there are more bad times ahead for Australian renters.