The AFR is the most dangerously stupid newspaper in Australia:

Interest rates may be heading lower as inflationary pressures sparked by the pandemic recede. Still, they are unlikely to stay there as major geopolitical and macroeconomic forces will push them higher.

That’s the view of macroeconomic and market experts who identified supply chain constraints, shifting geopolitical objectives and an ageing global population as driving inflation higher over the next three to five years.

Australian Financial Review economics editor John Kehoe (left), former treasurer Peter Costello, United States Studies Centre CEO Michael Green and BlackRock global chief investment strategist Wei Li. Oscar Colman

“In the near term, markets may not be appreciating how quickly inflation can fall through the simple mechanics of the pandemic unwind,” BlackRock’s global chief investment strategist Wei Li told The Australian Financial Review Business Summit on Monday.

“In the long-term, markets may not be appreciating how different the new regime is in terms of the supply side constraints.

“Three is the new two in this environment” she said referring to annual inflation rates that central banks will be able to achieve over the long run.

“After inflation gets to target, it could cause a roller coaster rebound back higher than what markets are currently expecting.”

Peter Costello, the former treasurer and chairman of Nine Entertainment, publisher of the Financial Review, said global sharemarkets were running strong on the expectation that central banks would cut rates aggressively once they neared their inflation targets.

“The market now believes that interest rates have peaked, and they are going to fall, and have priced in those interest rate reductions,” Mr Costello said.

“What happens if they don’t materialise as soon as the market expects?

“There is a fair bet to make that the market may have run beyond itself.”

Mr Costello said many decisions facing governments were difficult and expensive, but the attitude was not to worry about it because “monetary policy is going to lift all the ships”.

“I just get the feeling that monetary policy’s running out of oomph,” he said.

Ms Li said an ageing population created investment opportunities in the healthcare and leisure sectors but would also usher in an era in which there were excess savings in the system.

“The interest-rate dynamic is going to shift, which is another reason that we do think that rates are staying higher for longer.”

A population that was living longer also translated into more government spending, “and again, higher rates”, she said.

Ms Li mentioned five global megatrends that would drive investment decisions: artificial intelligence; geopolitical fragmentation; an ageing population; the energy transition; and a change in capital markets toward provide capital.

Wrong, wrong and wrong.

Monetary policy has never been more powerful. It is distorted beyond recognition, but its power is not in doubt.

How do today’s runaway asset prices translate to lost monetary power? We haven’t even cut rates yet, yet the mere sniff of it is enough for asset prices to run like a pack of salivating Pavlovian dogs.

As for aging populations? Who cares? If the current OECD estimates are correct, AI will destroy 3 million jobs in Australia by 2030, while Peak Fat launches labour participation for Boomers and everybody else.

That’s before we even mention Canberra’s institutionalised response to everything: more immigration and the permanent labour supply-side shock.

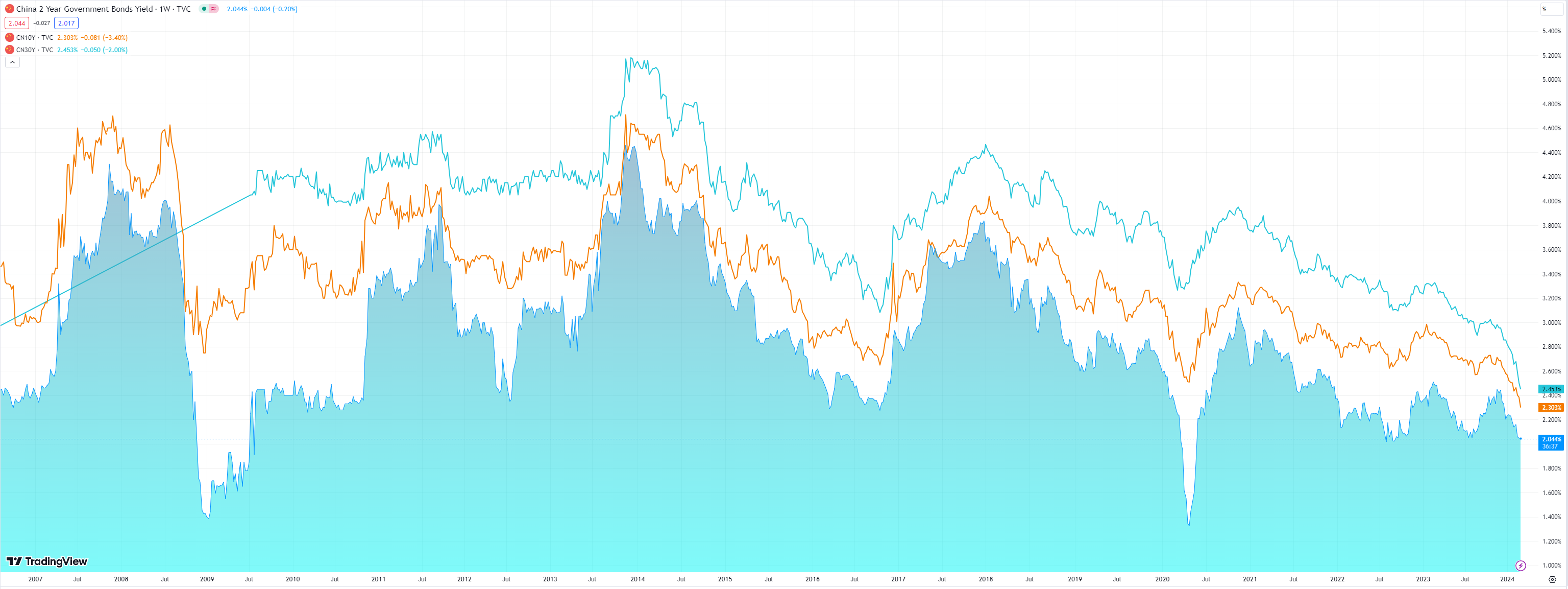

Dare I even mention China? Does the following chart of Chinese bond yields suggest incoming inflation?

China is caught in a vortex of depression economics that Beijing does not even recognise, making it much worse. It is going to export mass deflation.

Since Canberra can’t even utter the word “China”, how can we expect it to understand what it is doing? Bloomberg:

The continuous deterioration of the Chinese economy since last year has profound long-term geopolitical consequences. In his decade in power, President Xi Jinping has made a series of risky bets because he assumed, over-optimistically as it turned out, that sustained growth would underwrite his global ambitions.

Now that the Chinese economy continues to lose steam, as demonstrated by deflation, the persistent fall in manufacturing activities, and a worsening real estate crisis, he appears to have made another fateful bet — that China’s wounded economy can recover on its own without a robust stimulus package.

The US will respond with inflationary tariffs as Chinese goods are dumped worldwide but not in Australia. Here, we will see a convergence of MASSIVELY deflationary AI job losses, crashing goods prices, smashed bulk commodity income, and mass immigration, a nightmare scenario for wage growth and inflation.

Australia’s future is deflation covered with deflation sauce, and the Hoi Poloi are busy burnishing their inflation-fighting credentials.