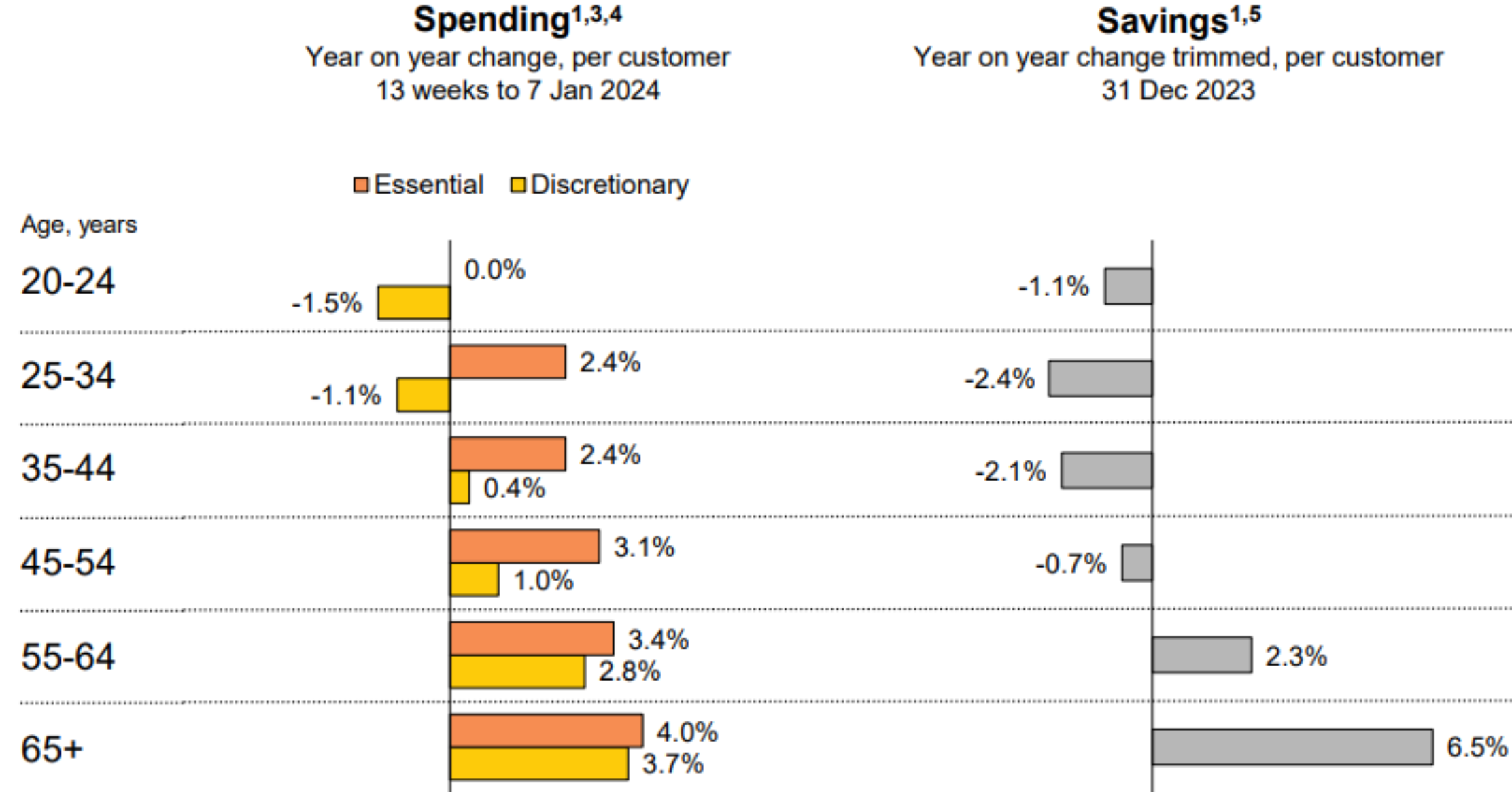

I reported on Tuesday how Australia’s baby boomers are growing their financial war chest, lifting their savings by 6.5% last calendar year, despite spending more than other cohorts:

At the other end of the spectrum, younger Australians are outright cutting their spending while they watch their savings shrink.

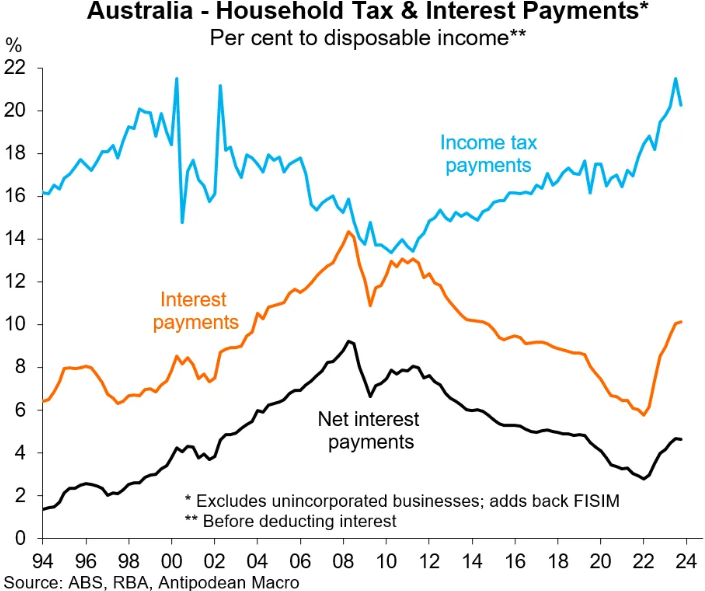

The baby boomers’ good financial fortune reflects the fact that they have lower (or no) mortgage debt, a higher proportion of households do not need to rent because they own their homes outright, they earn higher interest on savings, and rising income tax payments are not smashing most.

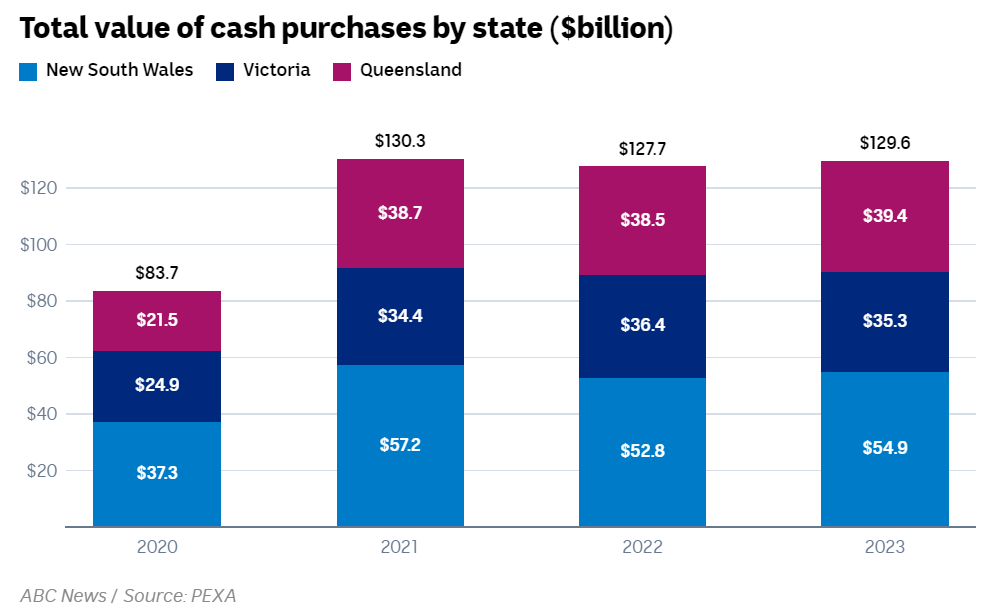

Data from PEXA also shows that an increasing number of homes sales across Australia’s three largest states are cash purchases, primarily to older Australians:

Last year, the total value of residential sale settlements in the eastern states was $454.7 billion, with $129.6 billion of these paid for in cash.

In percentage terms, 28.5% of properties purchased in NSW, Queensland and Victoria in 2023 were bought without a mortgage, often by older, retired and ‘asset-rich’ Australians, according to PEXA.

PEXA’s chief economist, Julie Toth, said the high share of cash purchases helps to explain the resilience of Australian house prices in the face of aggressive interest rate hikes from the Reserve Bank of Australia (RBA).

“The relatively large share of purchases that are continuing without the mortgage pressures, and without really being all that vulnerable to interest rate rises, helps explain why that resilience was persisting”, she said.

“Over the three to four years that we have visibility of this data, the cash purchase group has persistently been at least 25 per cent across the three major markets”.

“It does seem to be a structural feature that we can expect to see continue forward”.

Toth also noted that the large number of older buyers unimpacted by the RBA’s rate hikes could exacerbate intergenerational inequity.

“This could be exacerbating the existing intergenerational wealth divide when it comes to housing affordability”, she said.

Australia’s baby boomer generation already dominates home ownership and wealth in Australia.

According to the above data, they are further tightening their grip on the nation’s homes and wealth.