By Gareth Aird, head of Australian economics at CBA:

Key Points:

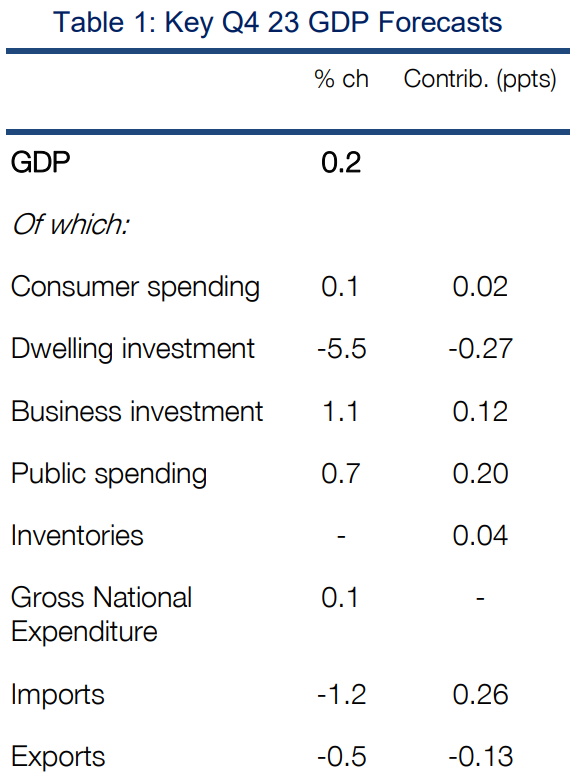

- We expect Q4 23 real GDP increased by a small 0.2%/qtr, which would take the annual rate to 1.4%.

- Household consumption is forecast to have edged higher in the December quarter.

- Business investment, public demand and net exports are anticipated to contribute to quarterly growth.

- Residential construction will fall solidly.

- We expect nominal GDP to have increased by 1.4% over Q4 23 and for the annual rate to be 4.2%

Another quarter of very little economic growth:

The Q4 23 national accounts, due on Wednesday 6 March, are expected to show that economic momentum was weak over the December quarter.

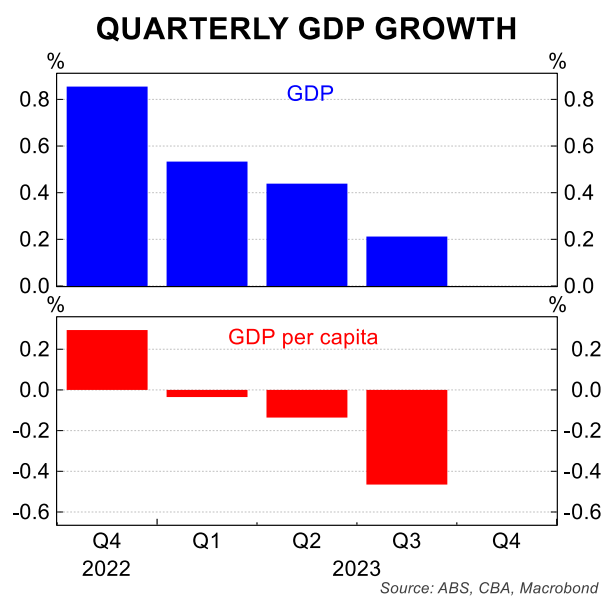

On our preliminary forecast real GDP rose by 0.2%/qtr in Q4 23. Such an outcome, revisions aside, would see GDP growth comfortably below trend at 1.4%/yr.

On a six-month annualised basis GDP growth will be 0.8% on our forecast.

Against strong growth in population, the national accounts are anticipated to confirm that the per-capita recession continued in the final quarter of 2023. Indeed output per person should record a significant contraction in H2 23.

For context, output per person fell by 0.5%/qtr in Q3 23 and by 0.1% in Q2 23.

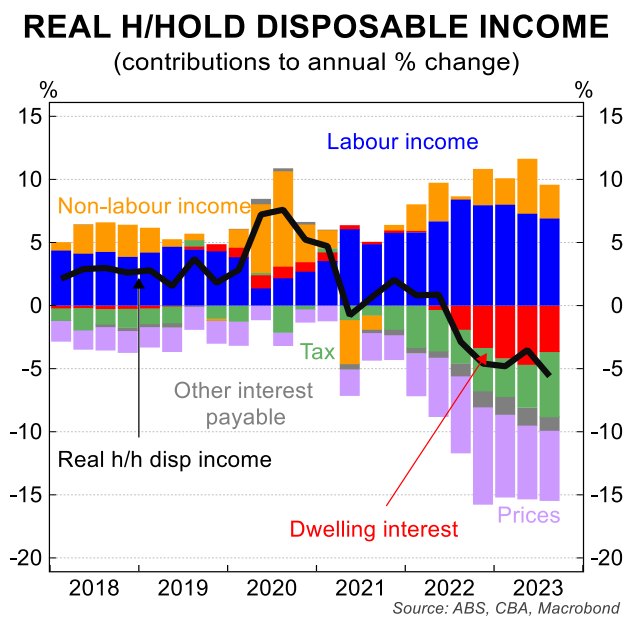

The RBA’s highly aggressive rate hiking cycle has clearly worked to slow demand growth in the economy. A lift in tax payable has also weighed on household purchasing power along with the effects of elevated inflation and rising mortgage repayments.

We will finalise our forecast on Tuesday 5 March once all of the partial data has been released. But at this stage on the expenditure side we expect to see:

– A small lift in household consumption: CBA(f) +0.1% (note that this is the key source of uncertainty). Retail trade volumes rose by 0.3% (worth around one third of household consumption). Non-retail sales are anticipated to lift by a slightly smaller margin as households curtail discretionary expenditure.

– Residential construction is forecast to post a solid decline comprising large falls in both new construction and alterations and additions: CBA(f) -5.5%.

– An increase in business investment driven by an lift in non-residential construction partially offset by a small decline in plant & equipment: CBA(f) +1.1%;

– A lift in public demand comprising a trend-like increase in recurrent expenditure and a decent lift in public investment: CBA(f) +0.7%.

– A small fall in inventories which would be neutral on growth.

– A modest 0.2ppt positive contribution to growth from net exports. Import volumes are forecast to fall by more than export volumes. Consumption goods imports have softened in line with weaker domestic demand.

See Table 1 below for our Q4 23 GDP call by component of GDP(E).

The terms of trade will record a decent lift over Q4 23 due to the increase in commodity prices and a more muted rise in import prices. The ABS trade prices data suggests an increase in the terms of trade of 3.0%/qtr in the December quarter.

The lift in the terms of trade will have a positive impact on nominal GDP, the broadest measure of national income. Nominal GDP will also capture the solid lift in consumer prices over the quarter (recall that the Q4 23 trimmed mean CPI rose by 0.8%/qtr).

We put the GDP deflator at 1.2%/qtr in Q4 23 which means we expect a quarterly increase in nominal GDP of 1.4% and an annual lift of 4.2%.

The savings rate is forecast to hold at a below-average level of 1.1% in the December quarter.

Real household income will continue to be pressured by rising taxes paid as a share of income, higher interest payments and elevated inflation. We expect real household disposable income to be broadly flat in the December quarter and down by 2.3% over the year.

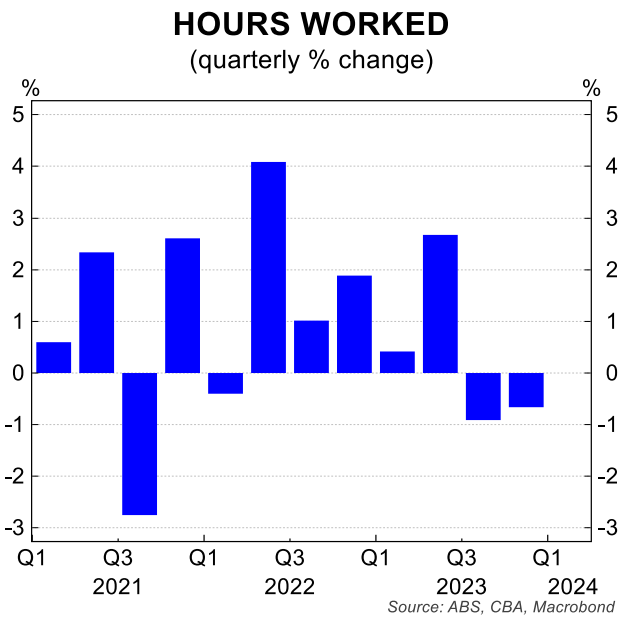

Productivity is anticipated to lift again given the decline in hours worked. According to the monthly labour force survey hours worked fell by 0.7%/qtr in Q4 23. This is a significant decline and means the risk to our real GDP call is to the downside.

The RBA has forecast real GDP to be 1.5%/yr in Q4 23, which implies a quarterly outcome of 0.3%. If real GDP is in line or below our forecast it would represent an undershoot relative to the RBA’s expectations.

A miss of 0.1ppts for quarterly growth would not likely shift the dial from an RBA communication perspective. But a more substantial downside surprise could be the catalyst for the RBA to jettison its hiking bias at the March Board meeting (policy decision to be handed down on 19/3).

Our base case continues to see the RBA commence an easing cycle from September.