I haven’t seen this report so can’t comment directly but here are Goldman’s new iron ore forecasts:

- Q1 US$120 a tonne

- Q2 US$115 a tonne

- Q3 US$105 a tonne

- Q4 US$100 a tonne

- 2025 $95

- 2026 $93

- 2027 $92

- 58% benchmark price to be 89% in 2024, 86% in 2025, and 83% in 2026 and 2027.

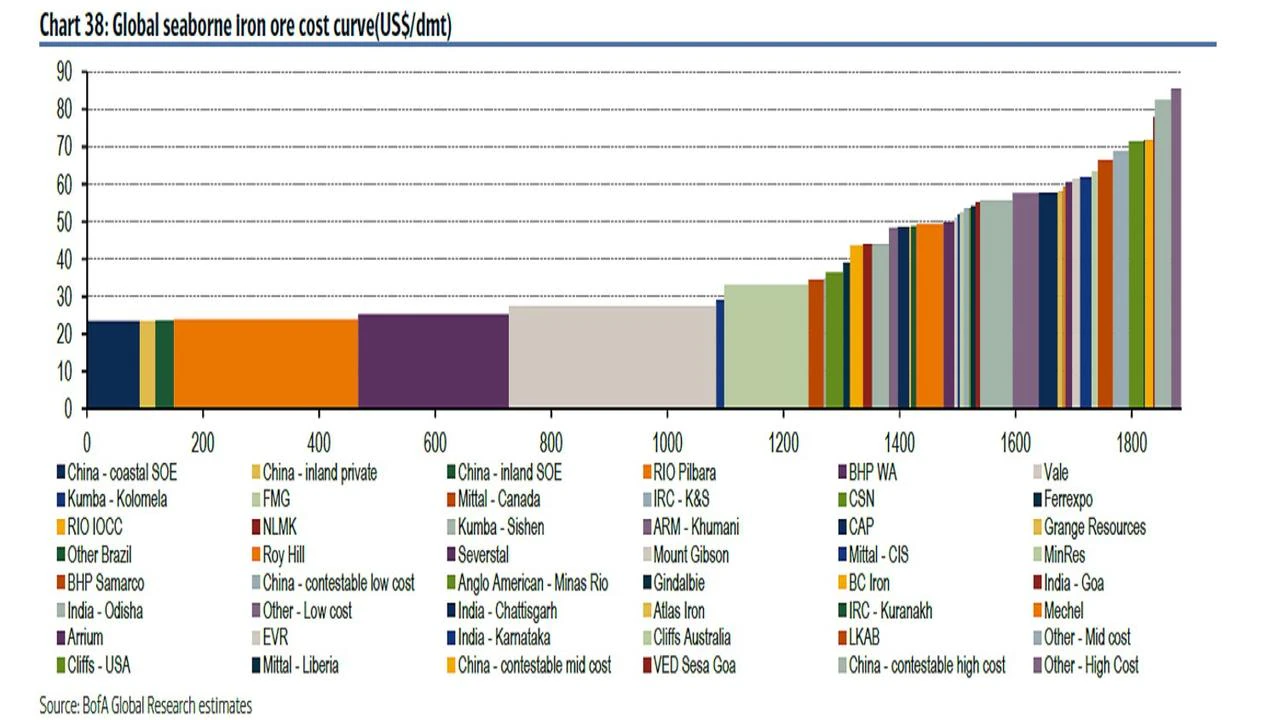

None of these prices is anywhere low enough to cause any rationalisation in seaborne supply.

Yet, Goldman’s Chinese property outlook quite rightly includes this doozy:

Advertisement

That 50% fall in property contruction volumes over 2025/26 coincides with ramping supply from Simandou, Brazil and Australia.

All things equal, it will mean a swing to surplus of 100-200mt of iron ore through 2027. Then another 100mt by 2030.

This will require a deep cost curve shakeout of sustained prices at $50 or so.

Advertisement

My fun case of $20 is when we get the downside panic that comes with it.

Goldman’s price outlook is nonsense.

Advertisement