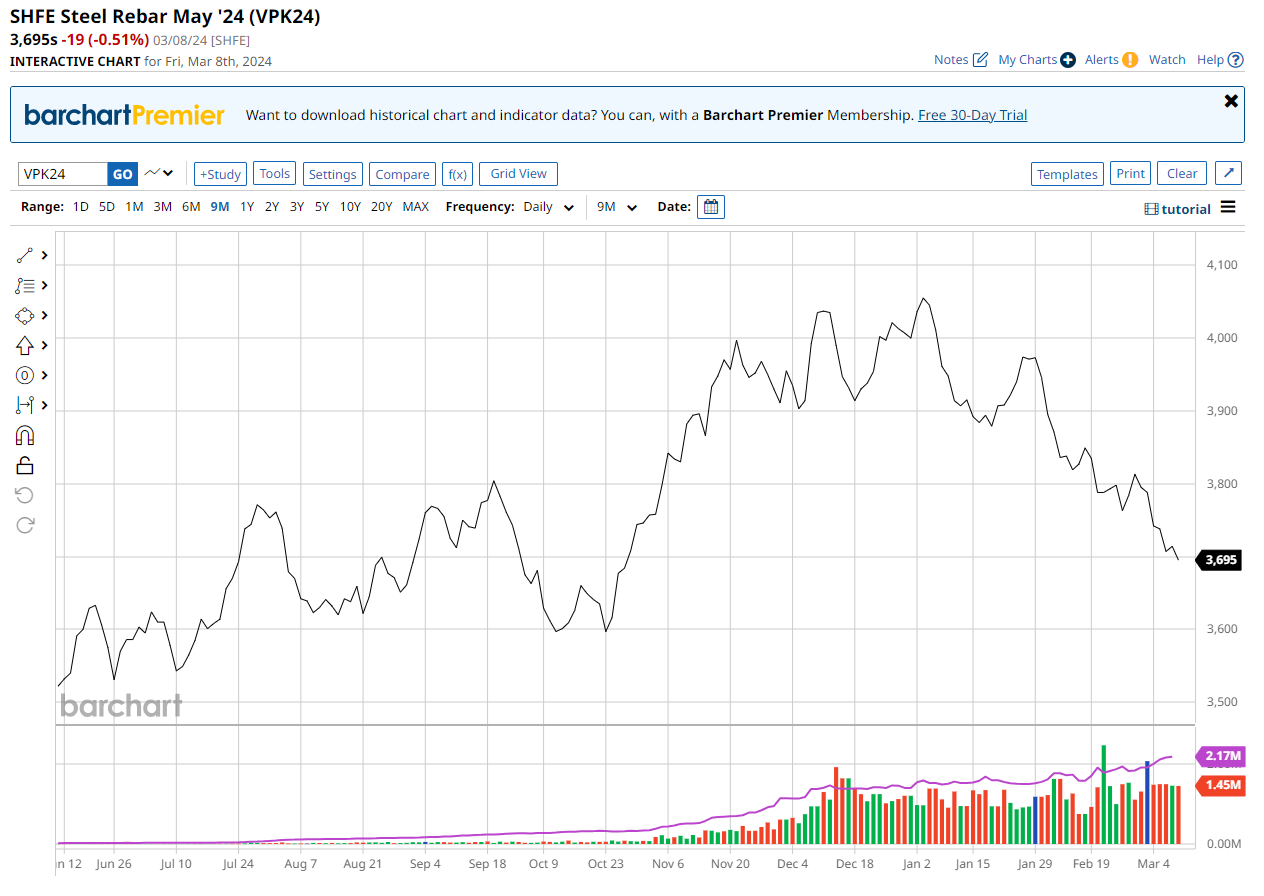

Rebar futures continue to lead the way lower:

Dalian iron ore futures broke the support line on its perfect little descending triangle Friday night:

On the weekly chart, the death cross is dead ahead:

Coking coal is already there:

MySteel indexes are bad:

Scuttlebutt is bad:

Average daily hot metal output dropped for a third straight session by 0.3% week-on-week to 2.22 million tons, as of March 8, while stocks at major ports surveyed climbed by 2% on the week to 141.51 million tons, the highest since February 2023, data from consultancy Mysteel showed.

“Lower hot metal output weighed on sentiment, contributing to price fall, and we believe the key is downstream steel demand recovery,” said Cheng Peng, a Beijing-based analyst at Sinosteel Futures.

“If downstream demand does not pick up, higher hot metal may result in more steel products, which will in turn pressure ore prices.”

Traders had expected production in hot metal to pick up this week, but a lower number left them disappointed, analysts said.

Concerns of a potential further decline in ore demand in the coming weeks also soured sentiment.

Several steel mills in southwestern China’s Yunnan province planned to cut steel production in March to curb loss, according to a document issued by the provincial steel association on Thursday, reducing construction steel products by a total of around 500,000 tons.

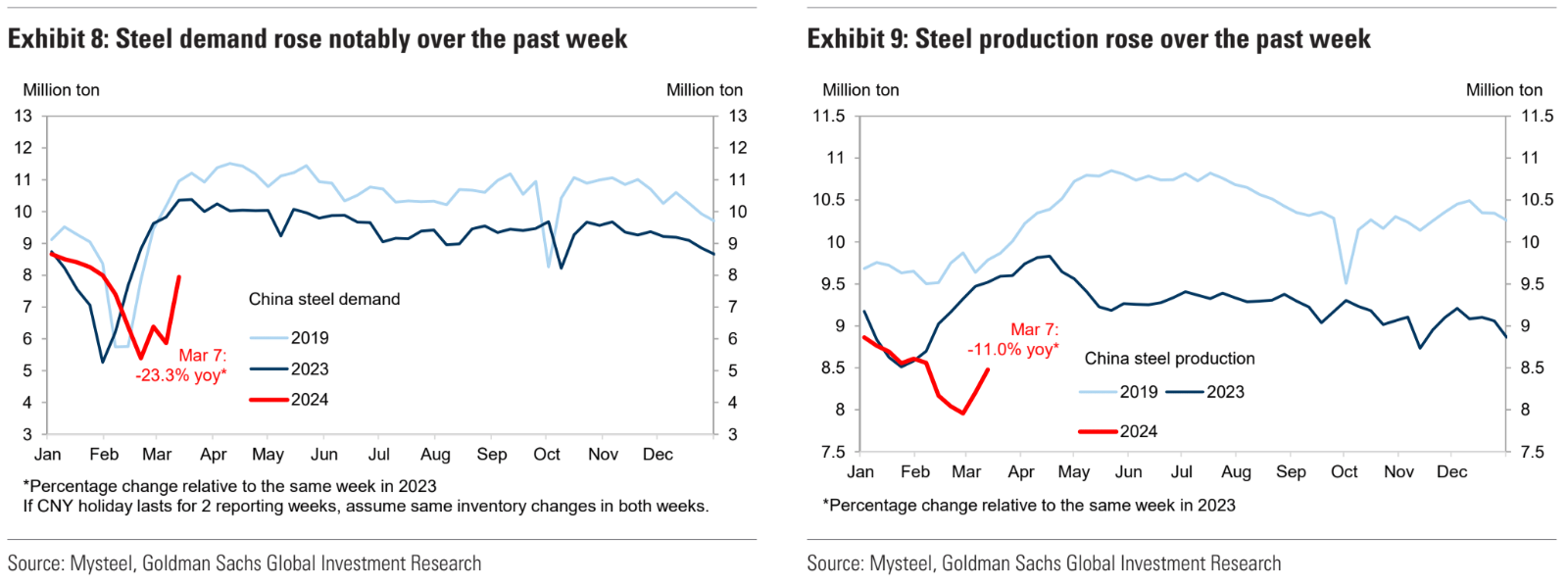

Leading indicators are bad:

Sentiment is bad. MUFG:

Iron ore prices are under pressure with the market underwhelmed by the absence ofdetailed policy announcements to stimulate China’s economy at the National People’s Congress (NPC).

The relative dearth of new measures is reinforcing an increasingly pessimistic mood in Chinese commodity markets.

Iron ore has now slumped by a fifth from a high in early January, andthere are few signs of a ramp-up in constructionactivity, despite China entering its seasonal peak period for building in March and April.

Meanwhile, during the Two Sessions, Liu Zhongmin, National Committee of the Chinese People’s Political Consultative Conference standing committee member, submitted a “Proposal on Improving China’s Iron Ore Supply and Pricing Influence”.

The session highlighted that China’s main challenges are that iron ore supply and pricing influence are not dominated by China.

He made five suggestions to the Chinese government, in this regard.

One is to increase domestic iron ore production and support the development of the scrap steel industry, while another is to accelerate the development of the iron ore reserve system.

Moreover, a national iron ore trading centre should be established, and an iron ore price index compiled and promoted to compete for international trade pricing power.

Seasonality be damned. Iron ore is not done falling.