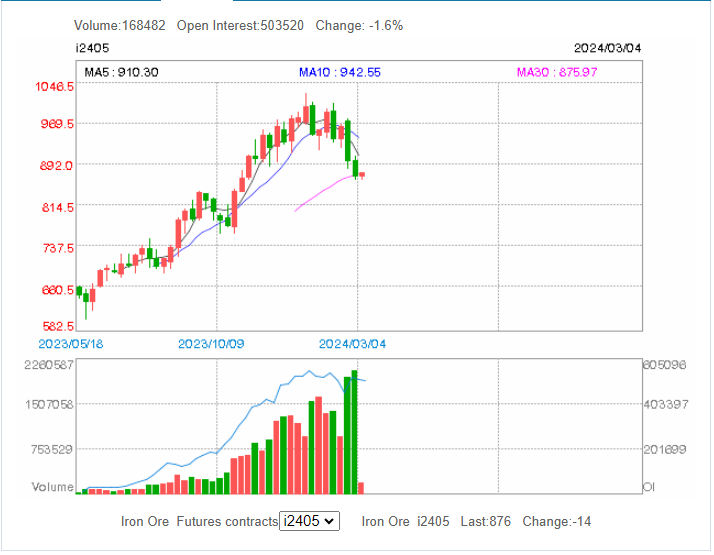

On Friday night, Dalian futures tumbled to the recent lows:

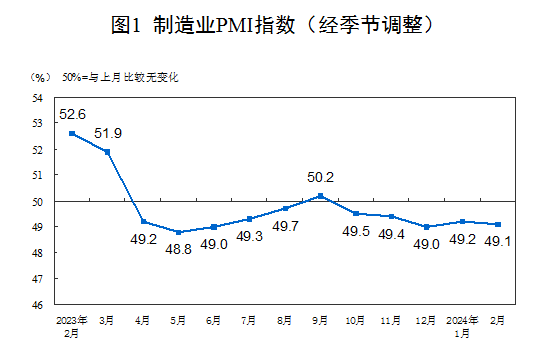

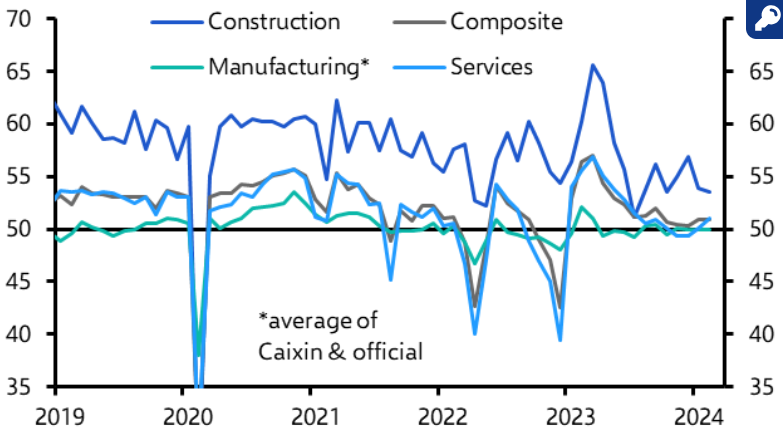

It had good reasons with Chinese PMIs weak:

In February , the manufacturing purchasing managers index ( PMI ) was 49.1% , down 0.1 percentage points from the previous month.

The new orders index was 49.0% , the same as last month and still below the critical point, indicating that manufacturing market demand has declined compared with last month.

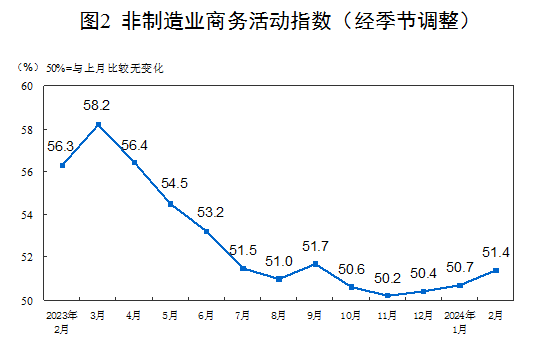

The Services PMI was slightly better:

In February , the non-manufacturing business activity index was 51.4% , an increase of 0.7 percentage points from the previous month and higher than the critical point, indicating that the pace of non-manufacturing expansion continues to accelerate.

In terms of industries, the business activity index of the construction industry was 53.5% , a decrease of 0.4 percentage points from the previous month; the business activity index of the service industry was 51.0% , an increase of 0.9 percentage points from the previous month. From an industry perspective, the business activity index of industries such as road transportation, air transportation, catering, monetary and financial services, ecological protection and public facilities management, and culture, sports and entertainment are all in the relatively high boom range of above 55.0% ; the business activity index of industries such as real estate and resident services is Continue below the critical point.

The new orders index was 46.8% , down 0.8 percentage points from the previous month, indicating that non-manufacturing market demand continued to decline. In terms of industries, the new orders index of the construction industry was 47.3% , an increase of 0.6 percentage points from the previous month; the new orders index of the service industry was 46.7% , a decrease of 1.0 percentage points from the previous month.

Still not flash, and the Steel PMI wasn’t either:

The Caixin PMIs were bit stronger but construction is fading there, too:

What is more important now is what happens at the “Two Sessions” Monday and Tuesday when Beijing sets it economic goals for the year.

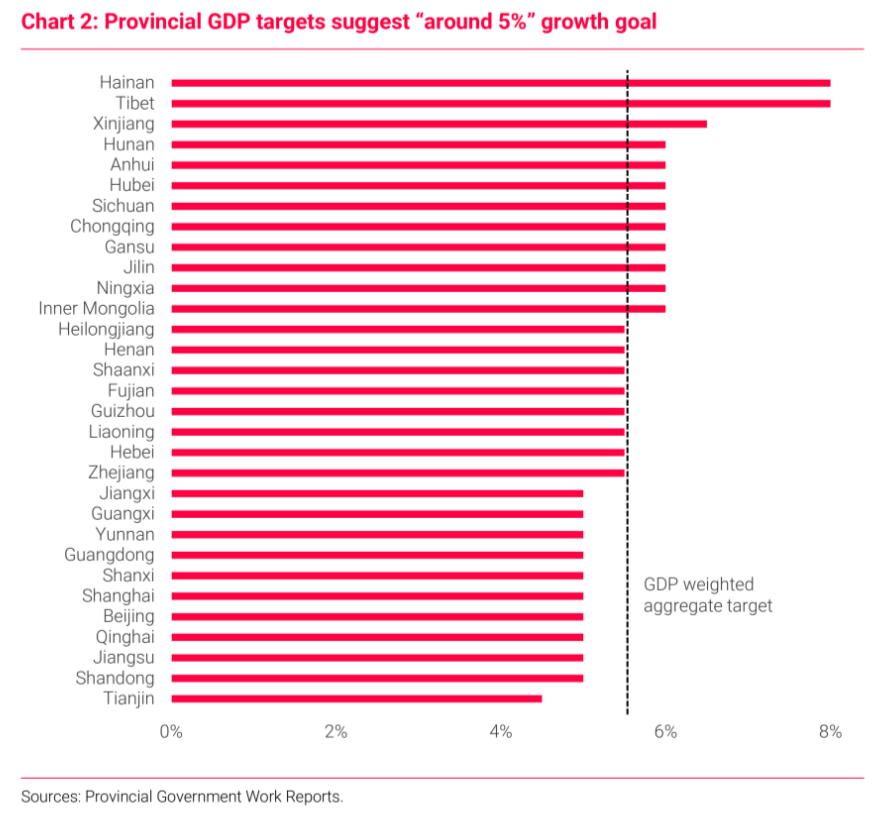

Regional government growth targets suggest the national target will be “around 5%”:

What is more important to remember is that 5% growth is not what it used to be.

When nominal growth was 8% and inflation detracted 3%, it was still a strong volume growth economy. Nominal growth at 3% adding back 1.5% deflation and other distortions is a very different economy.

Especially when the weakness pulling down real growth is volumes in commodity-intensive construction while the strong growth is in commodity-lite rising sectors like education and technology.

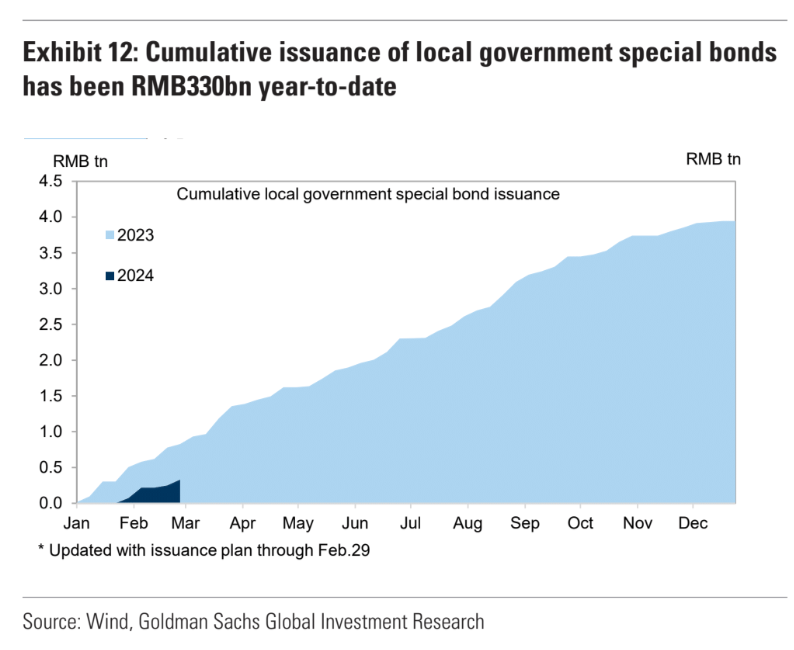

Despite seasonal tailwinds, iron ore may keep falling unless Beijing has a surprise beyond its already announced shantytown renovations and fading LGFV infrastructure: