Everything Treasurer Jim “Chicken” Chalmers touches turns a deep shade of brown.

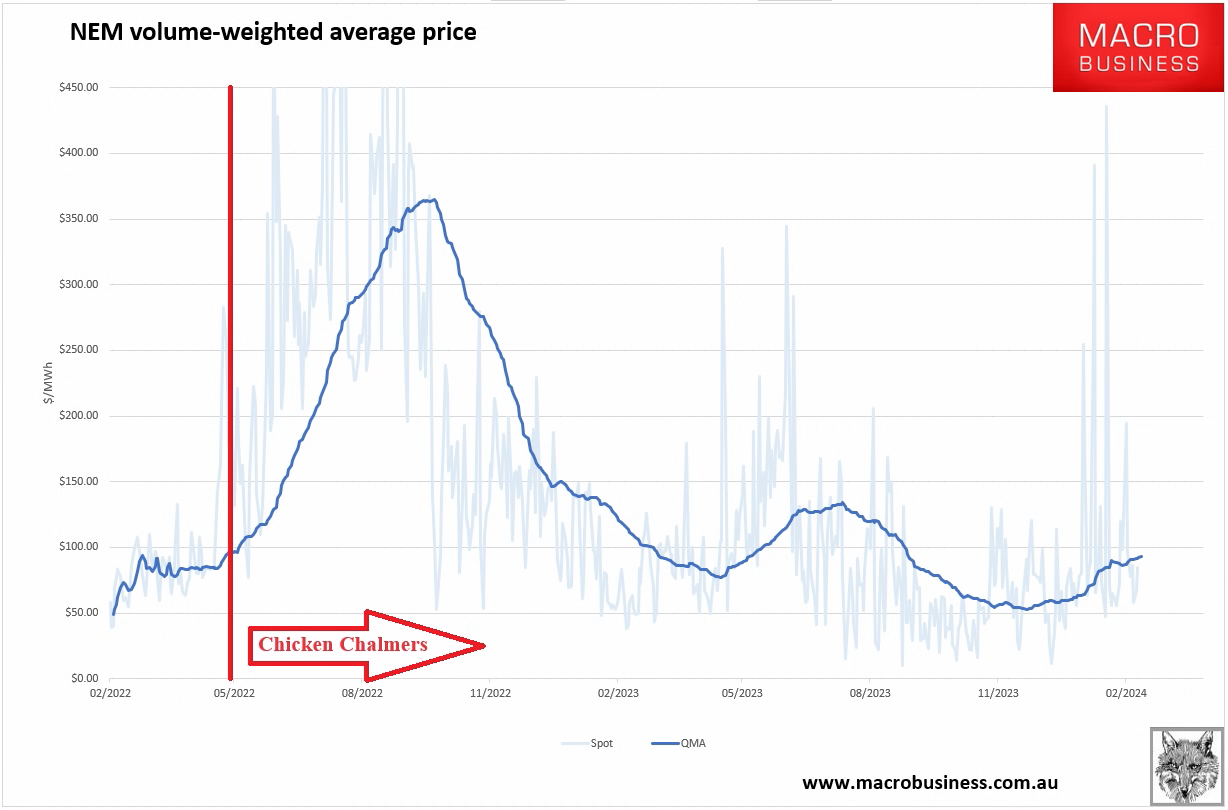

In his short tenure, this fearful Treasurer has allowed energy prices to hit unthinkable highs:

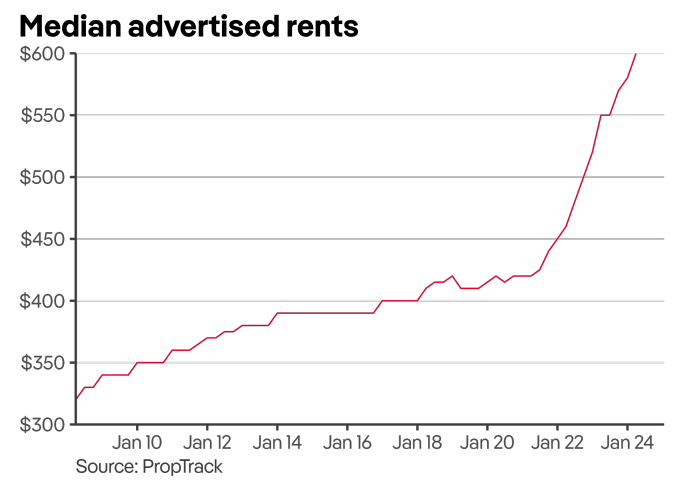

Is directly responsible for the worst housing crisis in living memory:

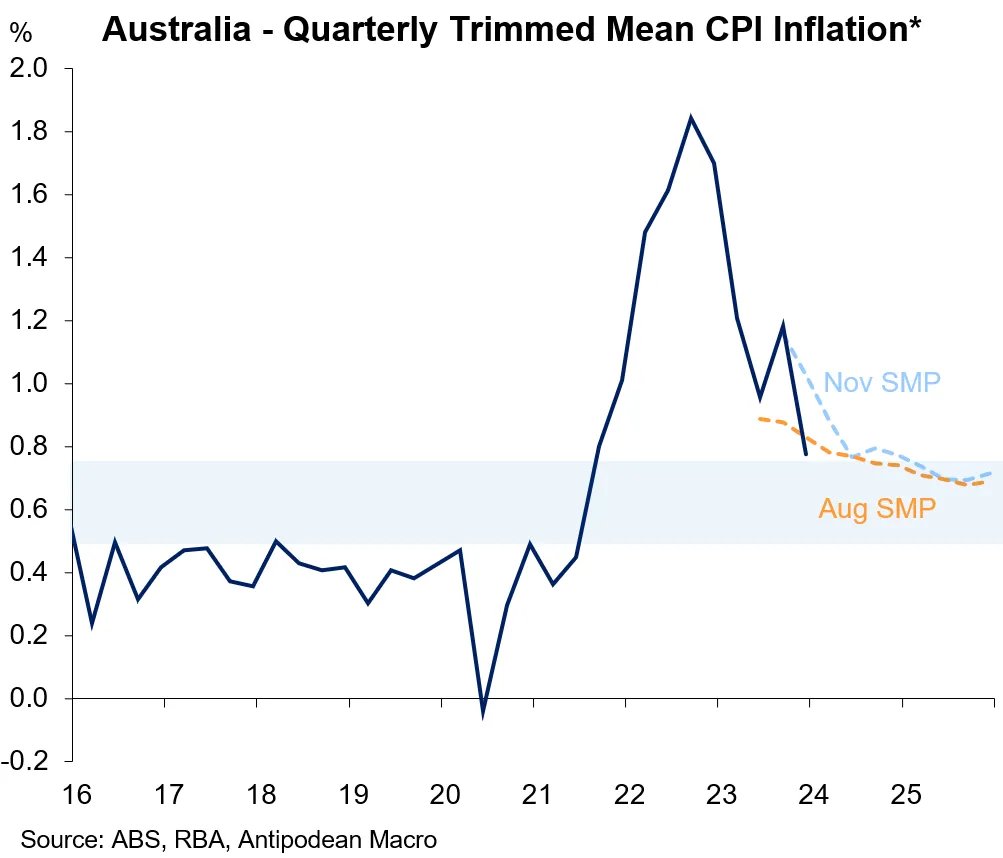

And personally delivered about half of the worst inflation shock in half a century, as well as the steepest rise in interest rates:

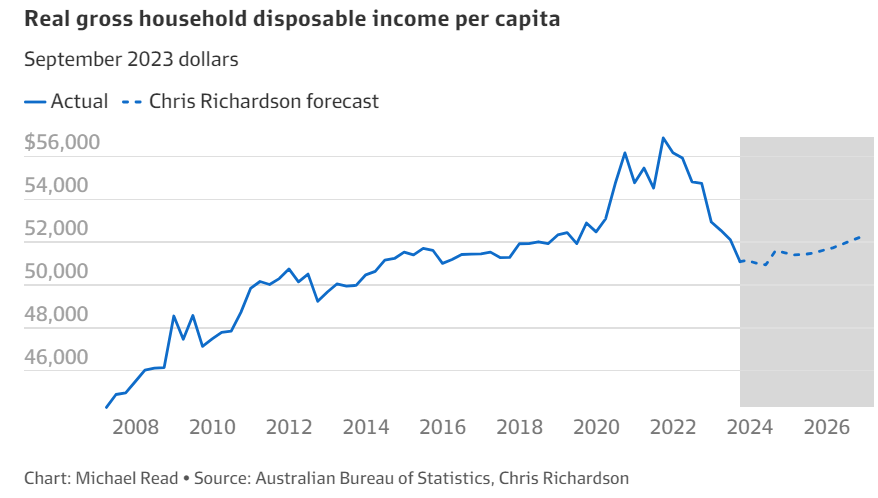

In so doing, Chicken Chalmers has pecked living standards to death in under two years:

The reasons are well-documented at MB:

- When Ukraine War energy profiteering began, Chamlers hid in fear of political blowback.

- When the Business Council demanded wages be smashed by unprecedented mass immigration, Chalmers jumped to attention like a slapped corporal.

- As the nation burned, Chalmers was busy with vainglorious well-being indexes using an abacus.

Now, Chalmers’s signature reform is falling apart:

Treasurer Jim Chalmers may be forced to secure the support of the Greens to legislate his planned overhaul of the RBA, after rejecting the Coalition’s demand that all existing board members be appointed to the new interest-rate setting board.

The independent RBA review’s signature recommendation was the creation of separate boards for interest rate setting and governance. While the Coalition supports the recommendation in principle, the major parties are at loggerheads over which board the six current external RBA board members should serve on.

Dr Chalmers said existing RBA board members will be asked whether they would like to stay on the monetary policy board, or whether they would like to serve on the governance board.

The RBA was only reformed because it failed so badly in the last business cycle. Yet here we are, offering the board that oversaw that failure its choice of sinecures. This follows Chalmers appointing the 2IC of the same failure to the top job.

In consequence, Chicken Chalmers has left the central bank hanging like a half-shaved scrotum during its most crucial policy period in decades. Now, he is unmaking the entire reform endeavour.

How do we explain this Chalmer’s curse?

Jim “Chicken” Chalmers served his apprenticeship as assistant to Treasurer Wayne Swan and had a front-row seat to mining interests’ gutting of the tax system during the great Rudd coup of 2010.

A young Chalmers learned his baleful lesson, and all Australians are now paying the price of the poltroon.