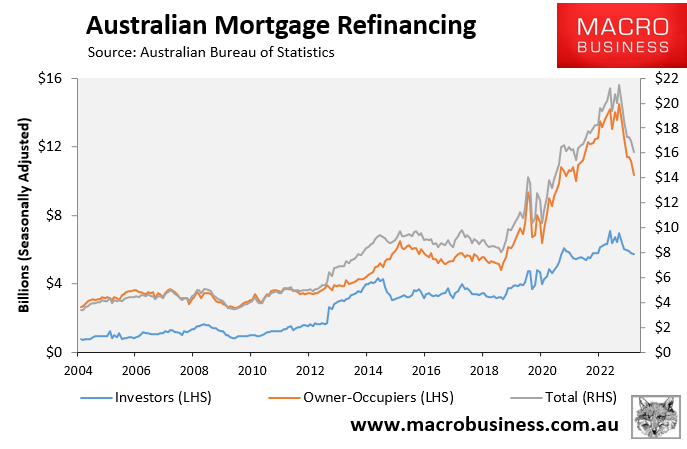

Over the last three years, Australia has experienced the biggest boom in mortgage refinances in its history.

Monthly mortgage refinances peaked in mid-2023 at $21.5 billion, up from roughly $10 billion in mid-2020, according to the Australian Bureau of Statistics.

However, the mortgage refinancing boom has well and truly ended, with total refinance activity declining considerably to $16.1 billion in January.

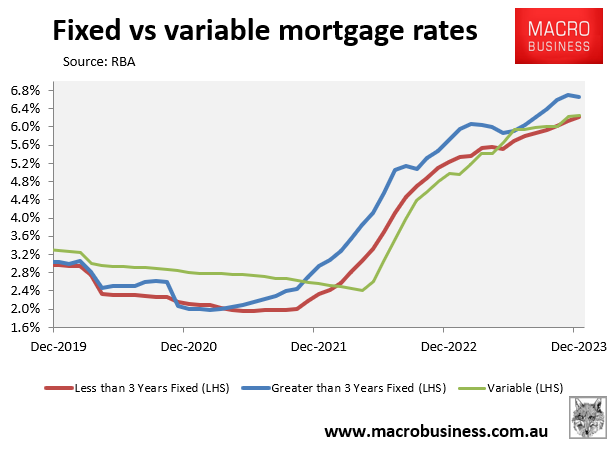

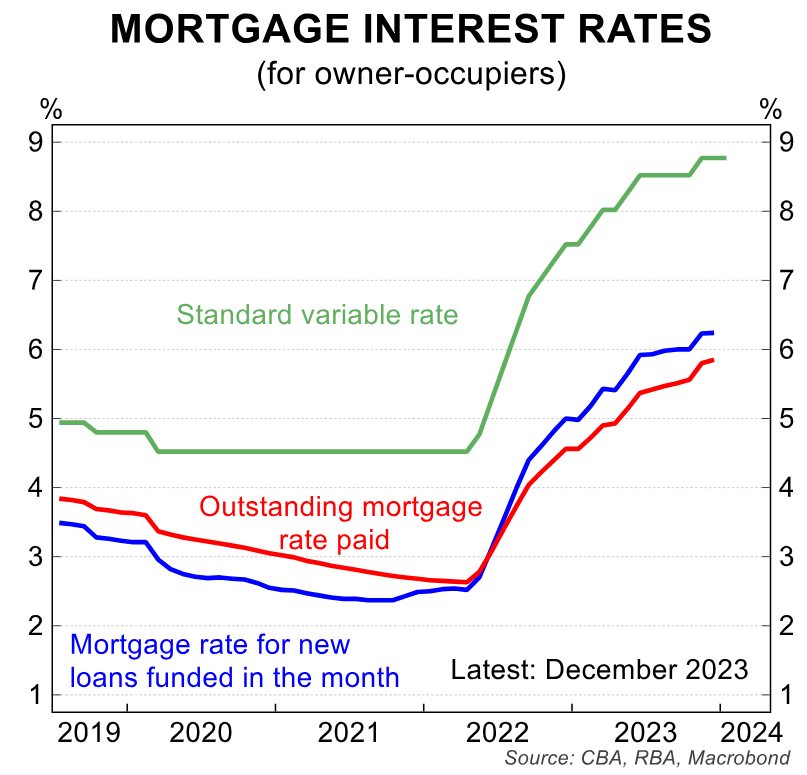

The shift from ultra-low fixed-rate loans of around 2% to variable rates of between 6% and 7% prompted a considerable chunk of these borrowers to look for a better deal with a different lender:

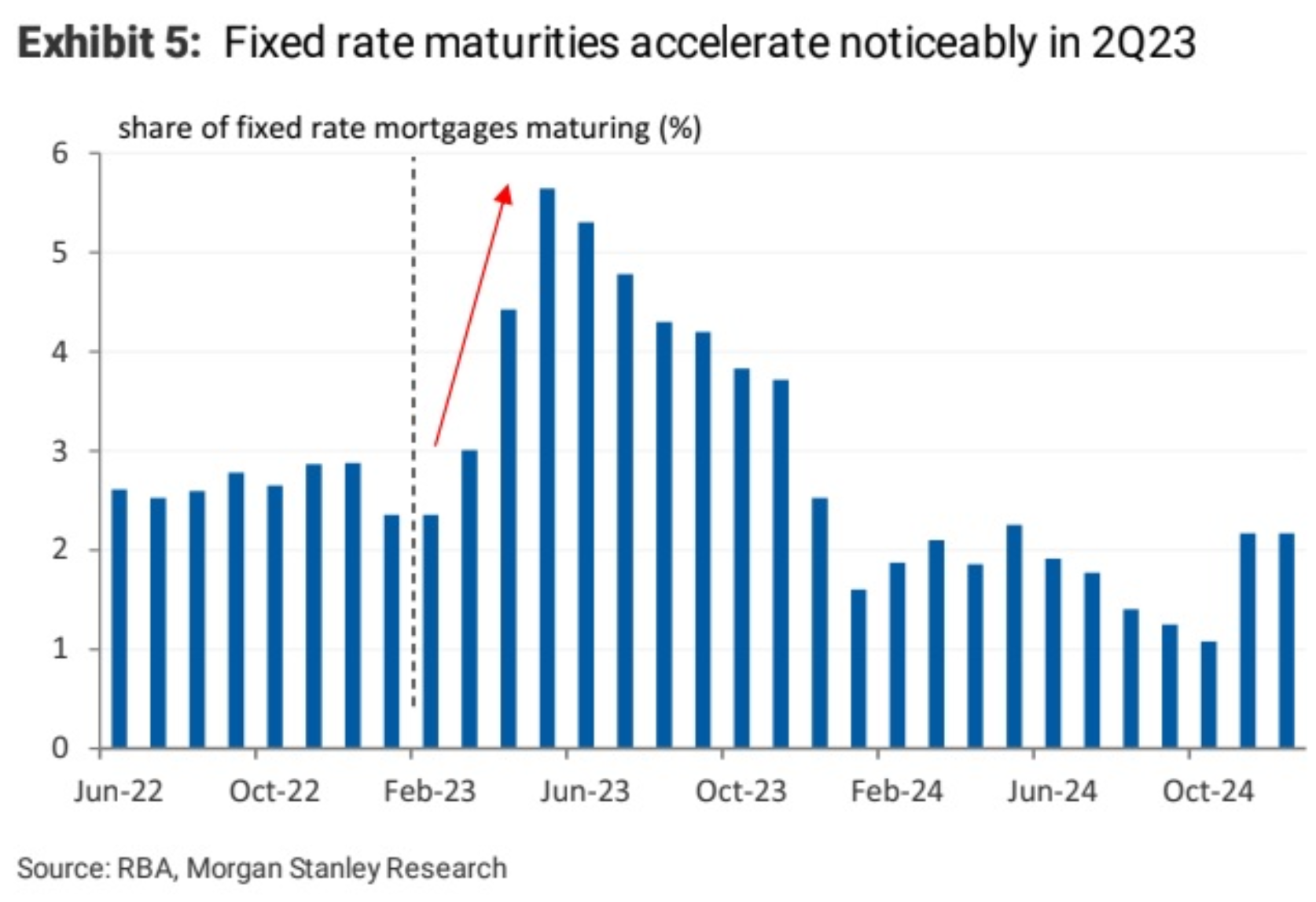

However, the fixed-rate mortgage cliff has now mostly run its course, meaning the bulk of cheap pandemic fixed-rate mortgages have now expired:

Therefore, the pool of buyers looking to refinance has shrunk significantly from last year.

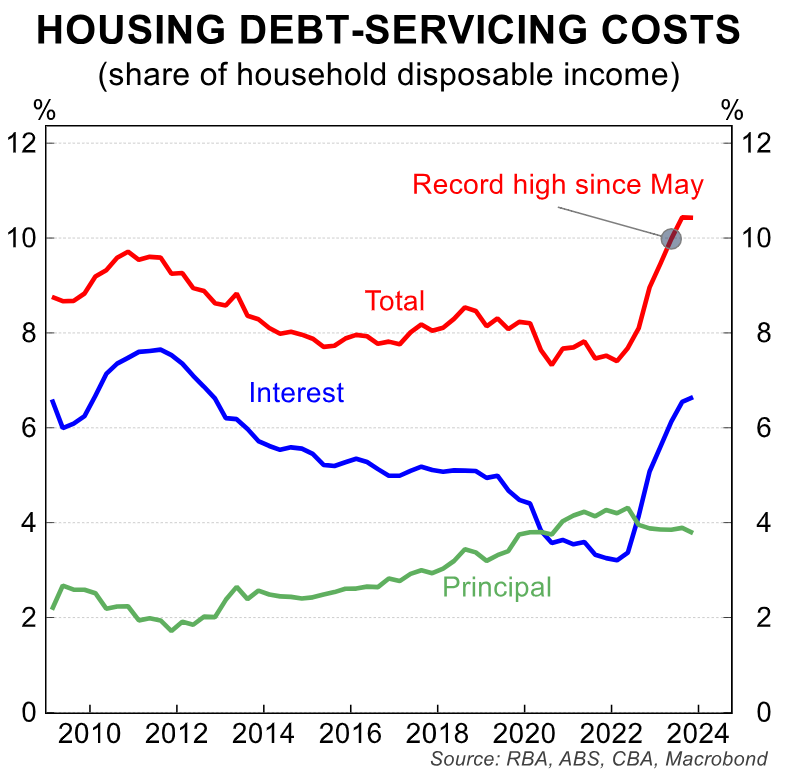

A record proportion of Australian households’ incomes are currently being devoted to debt repayments:

The CBA also warned on Wednesday that debts servicing costs will continue to rise as the remaining cheap pandemic fixed rate mortgages reset to variable:

In turn, mortgage refinancing activity could remain above average for a while yet, although the boom is now well past the peak.

If you are looking to save thousands of dollars in mortgage repayments, try the MB Compare n Save mortgage comparison tool. It takes less than a minute.

And if you choose to refinance, Compare n Save will handle the process.