You could run a country successfully by doing the opposite of whatever Chanticleer advises:

The heartbreaking battle facing first home buyers is getting harder, according to asurvey of home ownership intentions from Westpac.

Compared to 2021, first home buyers expect it will take six months longer to raise a deposit that is almost $4000 smaller as cost-of-living pressures rise.

The proportion of first home buyers who expect to take more than five years to raise a deposit has increased from 14.3 per cent three years ago to 18.5 per cent – but half of that group expect they’ll need a decade or more to save.

It’s not “heartbreaking”. It is criminal.

Nobody will accuse me of being a fan of the economic model of house price inflation. I have spent my entire adult life trying to break it.

But the reality facing Australia right now is that house prices are a secondary consideration.

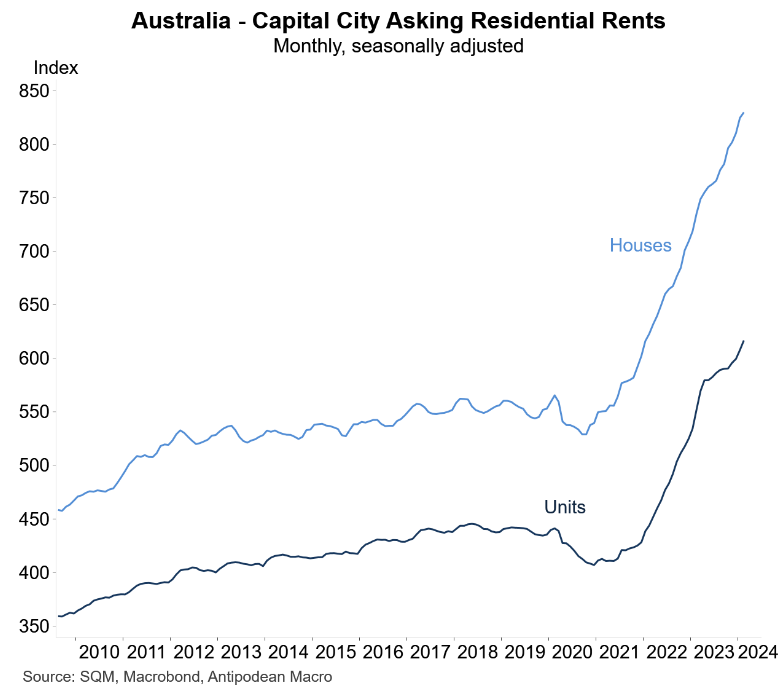

Rent inflation is the more significant issue. It is dehousing Australian youth and the vulnerable in droves. Kicking them onto streets, creating tent cities, forcing them into ghettoes, and overwhelming support services.

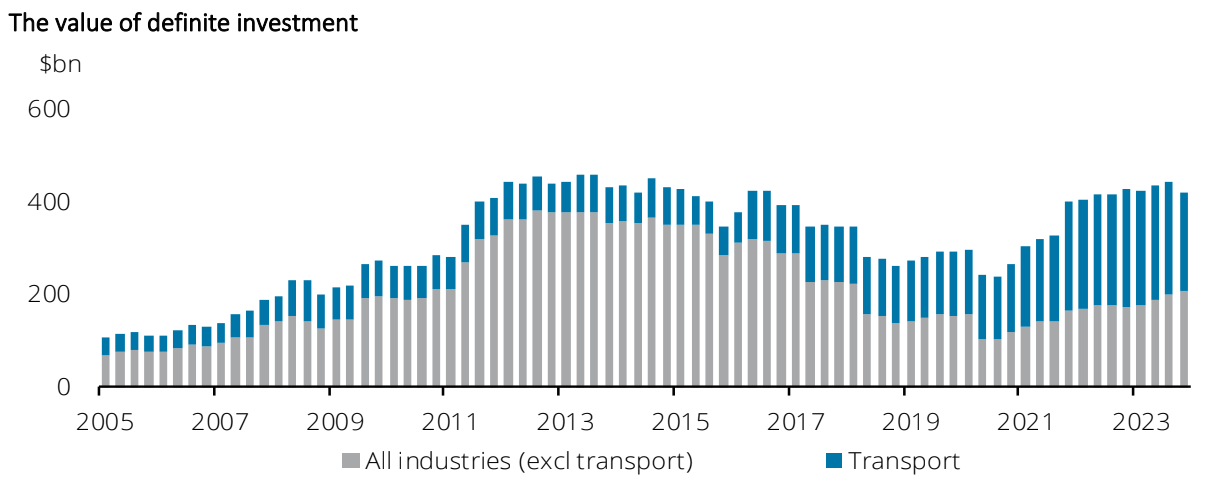

Meanwhile, dwelling construction is collapsing because Mad Albo’s immigration tsunami has forced states to crowd out dwelling construction with infrastructure builds that are sending building material prices nuts:

Not to mention Mad Albo’s energy shock, which impacted building material input costs more than most sectors.

There is no problem with building approvals, but a considerable backlog is growing. The problem with dwelling construction is that the cost of building has increased by 30%, making it uneconomic to build.

Fixed price contracts made before the price spikes are making it worse as builders go bust.

There are only two answers.

Either building input costs come down. Or house prices go up. A lot.

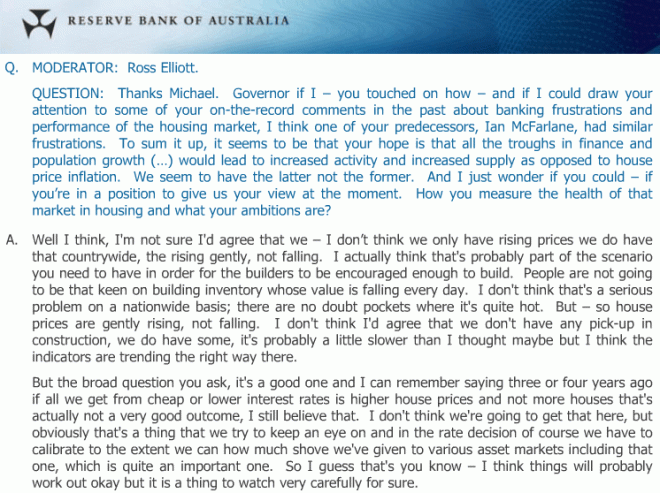

The RBA can only address the latter. As Glenn Stevens once said:

As the 2012-2015 post-mining bust transpired, a dwelling construction boom only started when the RBA cut rates enough to fire up house prices.

Don’t get me wrong. If I were the benevolent dictator, I would immediately freeze immigration to let rents and building materials deflate.

But suppose you are a Canberra maniac, AFR shill, Greens dill, or blood-sucking corporation that believes supply is the only rational response to the rental crisis.

In that case, your only solution is for the RBA to keep cutting rates until capital values make more dwelling construction viable and attractive.

Ironically, this will do more to lower inflation than tight monetary policy.

That’s how bad is the macro management of Mad Albo and Chanitcleer.