Dimitris Valatsas, the chief economist at US advisory firm Aurora Macro Strategy, penned a note to clients last week where he warned that contractionary fiscal policy settings are likely to make New Zealand’s recession even worse.

“New Zealand has ample fiscal space to support the economy and it seems bizarre to me that it is not being used — and even more bizarre that the Government feels there is a need to reduce spending right now”, Valatsas wrote in an email.

“Policymakers have locked themselves into procyclical monetary and fiscal policy which, while deepening the slump”, he said.

Valatsas believes this approach is a policy mistake that would embed lower growth for longer.

“We perceive virtually no opposition to this austerity political narrative among policymakers at present, meaning that fiscal headwinds are likely to persist until the next election”, he said.

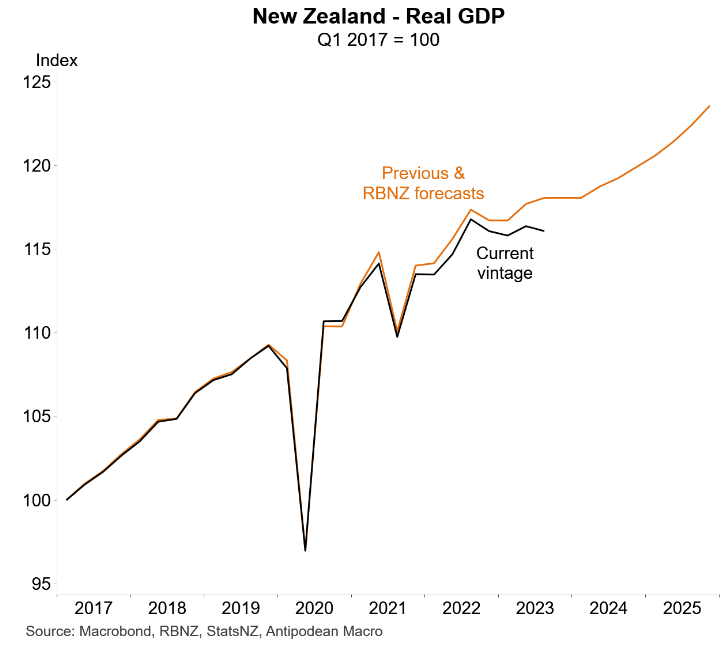

New Zealand’s economy is already embedded in recession, with per capita growth even worse:

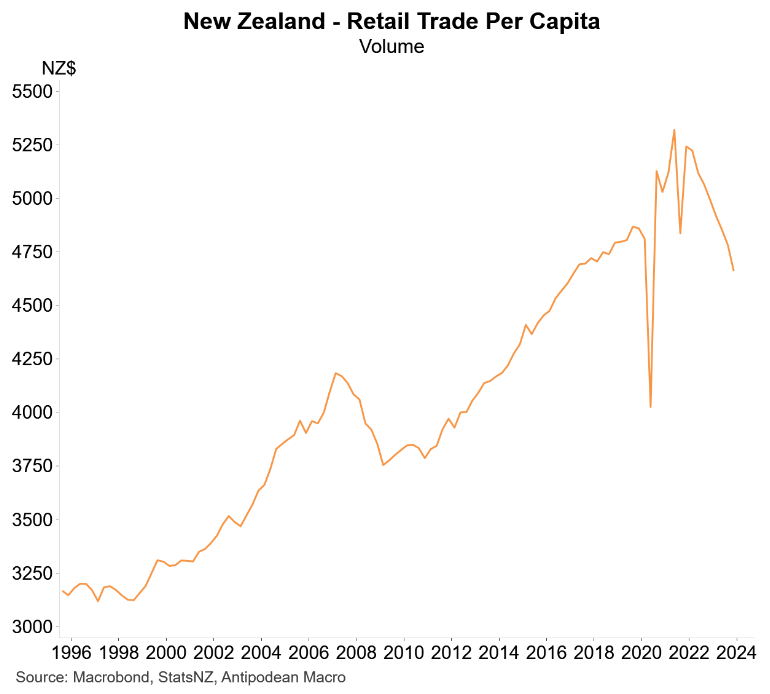

Retail sales have collapsed across New Zealand:

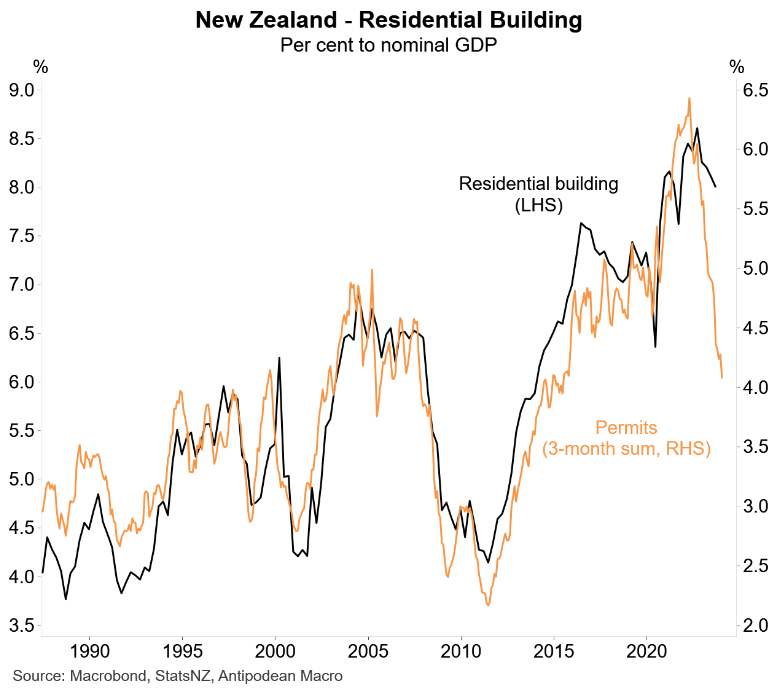

Housing construction is also facing an almighty crash, according to the latest building permit figures:

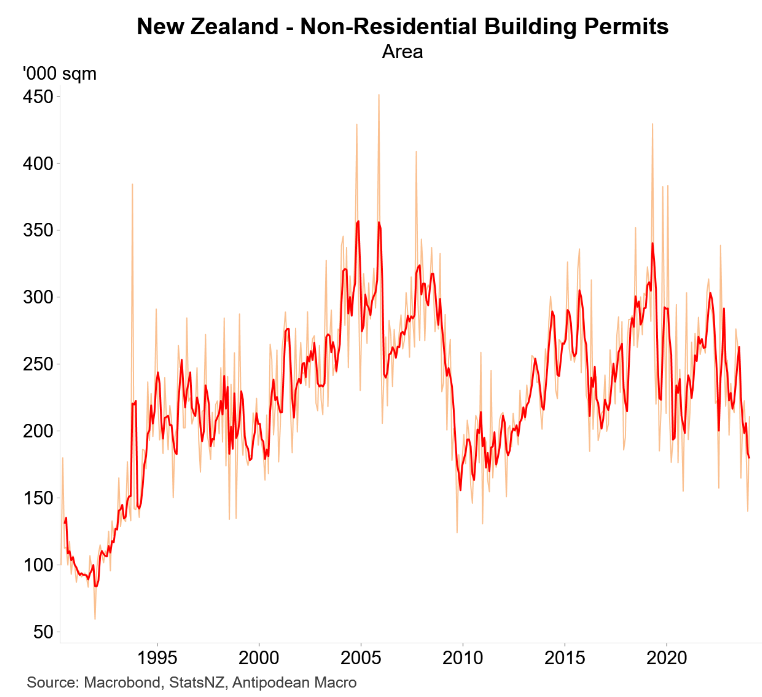

Non-residential building permits have also collapsed:

The new Luxon-led National government has chosen to pursue a debt reduction strategy at the same time as the economy is turning down.

This will inevitably worsen New Zealand’s recession.

The upshot is that the Reserve Bank will need to cut rates harder to compensate for the contractionary fiscal settings of the government.

Any economist still talking up rate hikes needs their heads read.