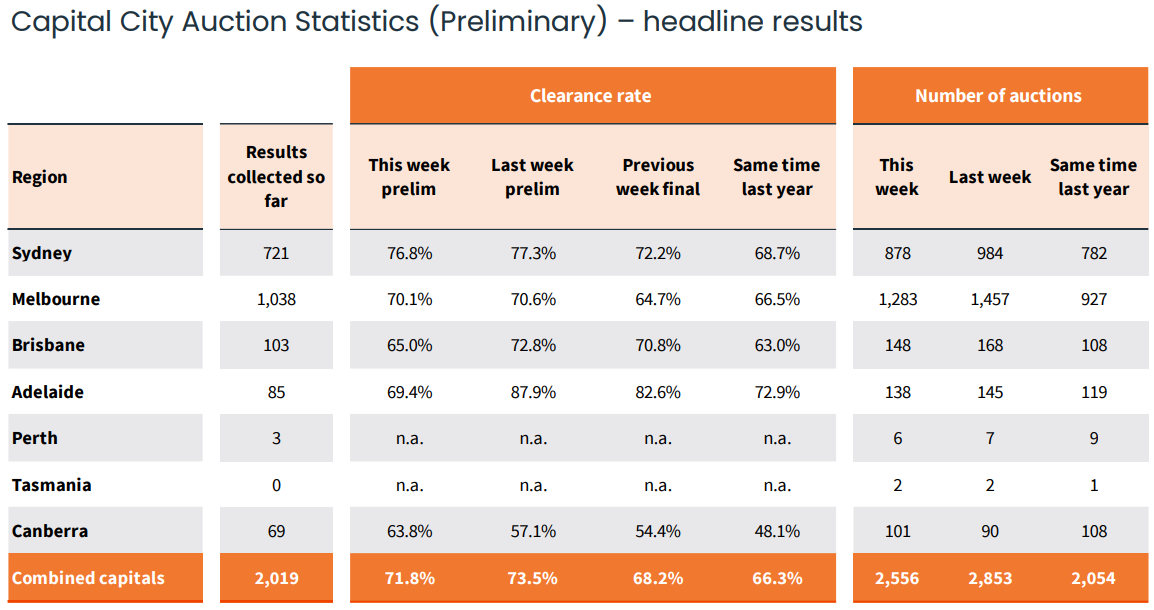

CoreLogic has released its preliminary auction results for the weekend, which reported a national capital city clearance rate of 71.8%, down from 73.5% last week (revised down to 68.2% once finalised):

Source: CoreLogic

With an average downwards revision of -5.9% so far this year, CoreLogic expects the final clearance rate to come in around 65-66%.

The preliminary clearance rate in the two largest auction markets, Melbourne and Sydney, fell 0.5% from the previous week, with Sydney (76.8%) continuing to outperform Melbourne (70.1%).

In its commentary accompanying the results, CoreLogic reported that “the trend in auction clearance rates remains well above late last year when preliminary clearance rates were in the mid 60% range and finalised results were settling in the mid 50% range”.

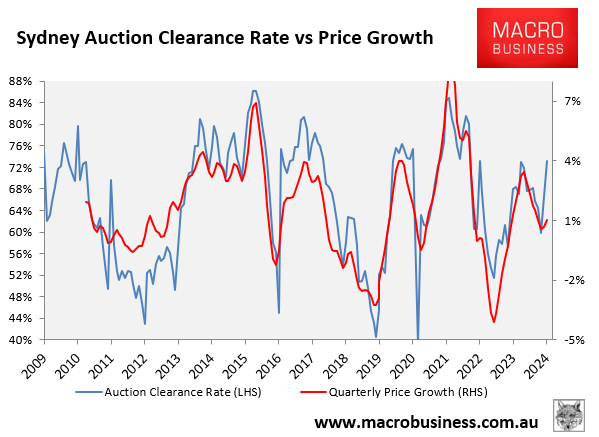

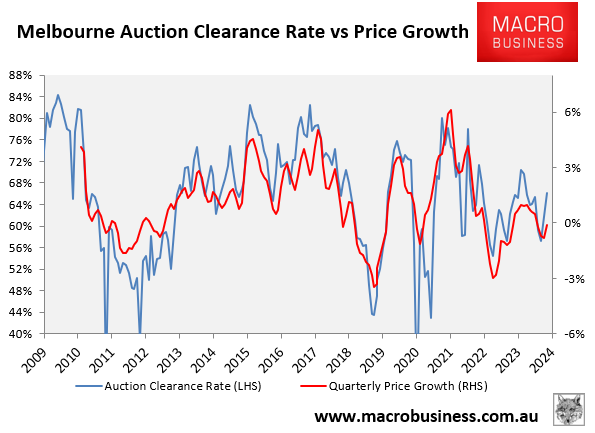

“The stronger clearance rate relative to last year coincides with a re-acceleration in value growth, with CoreLogic’s Home Value Index reporting a pick up in the pace of growth in January and February”.

Indeed, the below charts plot the rebound in clearance rates against quarterly value growth.

Both Sydney and Melbourne have seen auction clearances rebound strongly this year, which has led smaller rebounds in price growth.

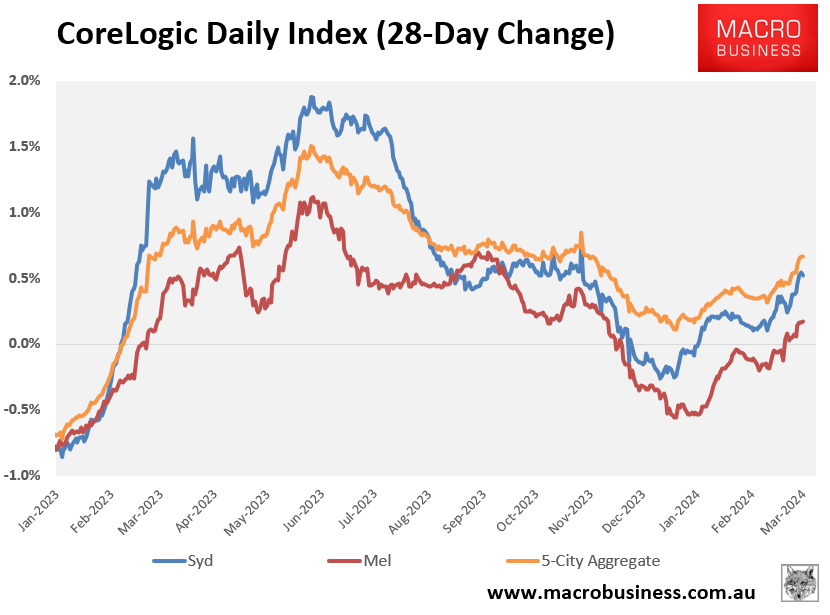

CoreLogic’s 28-day change also shows a marked pick-up in value growth this year:

That said, CoreLogic also notes that “clearance rates have been softening since the second week of February when a preliminary clearance rate of 76.2% was recorded”.

“Although the current trend in auction clearance rates is conducive to further growth in values, if clearance rates continue to ease we could see some momentum leave the re-acceleration”.