Westpac’s Home Ownership Report shows an increase in the share of Australians aspiring to own a home.

The survey found 44% of Australians plan to buy a new home in the next five years, up 9 percentage points since July 2023.

Damien MacRae, Westpac’s managing director of mortgages, said that while some purchasers have paused their housing plans due to increased living costs, many prospective homeowners remain committed to owning a home.

“Buyers are casting their expectations wider, willing to compromise on location and are forgoing everyday luxuries like food delivery”, MacRae said.

“They are also more inclined to relocate and move to apartment living”.

The survey found that 56% of aspiring homeowners planned to buy with their spouse, up 16% from 2021. Three-quarters were also willing to buy somewhere they hadn’t previously considered, a 9% rise.

Half of those polled were thinking about ‘rent-vesting’, in which buyers rent a property that meets their needs while holding an investment property, to attain their aim of owning a home.

As the price of detached homes has risen, potential purchasers have begun to explore other types of accommodation, according to the survey.

While 39% of potential buyers are seeking to buy a detached home, 18% are looking to purchase an apartment or unit, up from 11% in 2021.

12% of prospective buyers are seeking a townhouse, double the share in 2021.

Thus, according to Westpac’s survey, the Great Australian Dream of home ownership remains alive and well.

The problem is that while Australians still aspire to own a home, it has become harder than ever to actually do so.

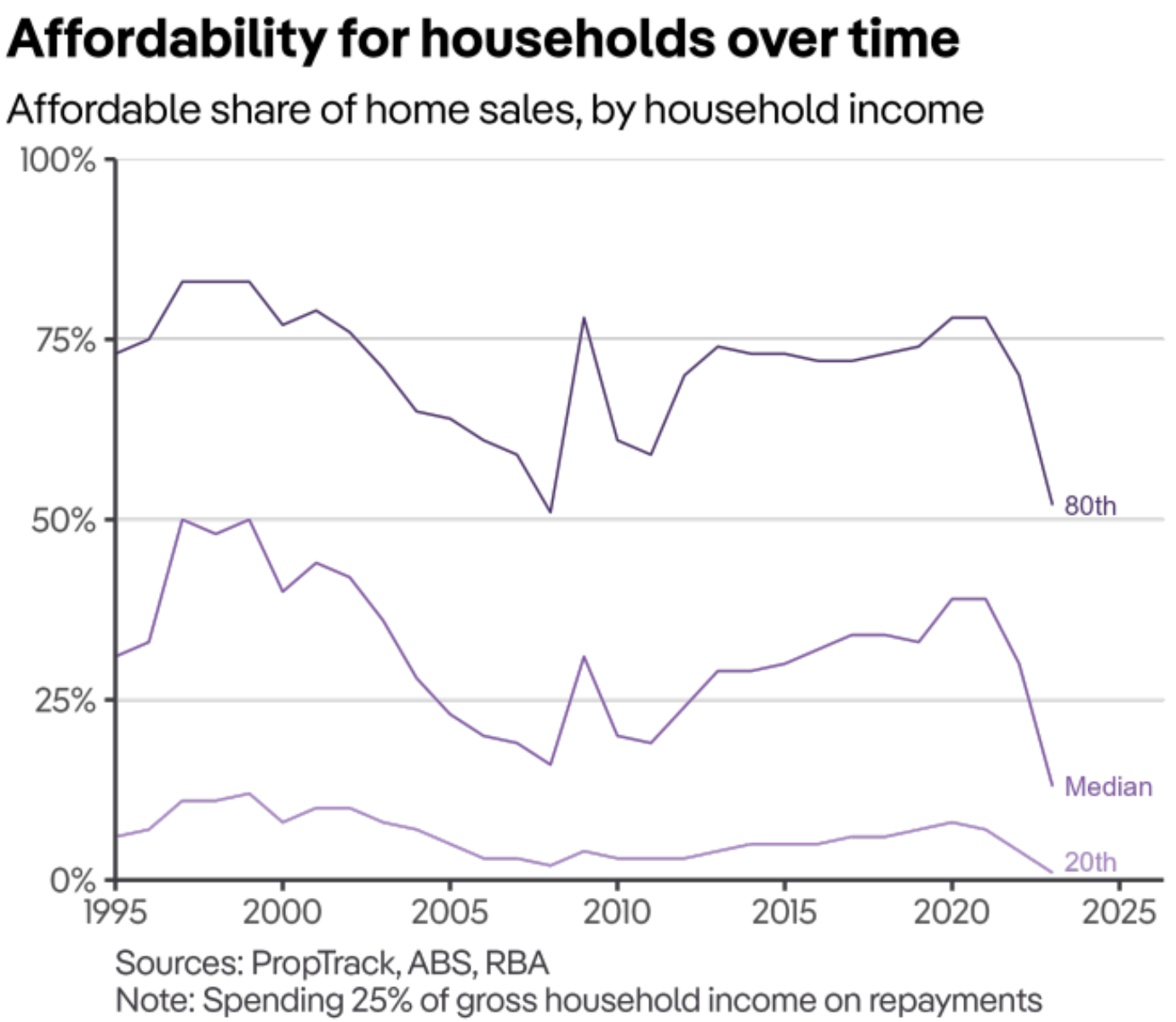

Recent analysis from PropTrack showed that Australia’s median housing affordability was the worst in at least 30 years:

This decline in affordability is broad-based, impacting both higher and lower-income earners alike.

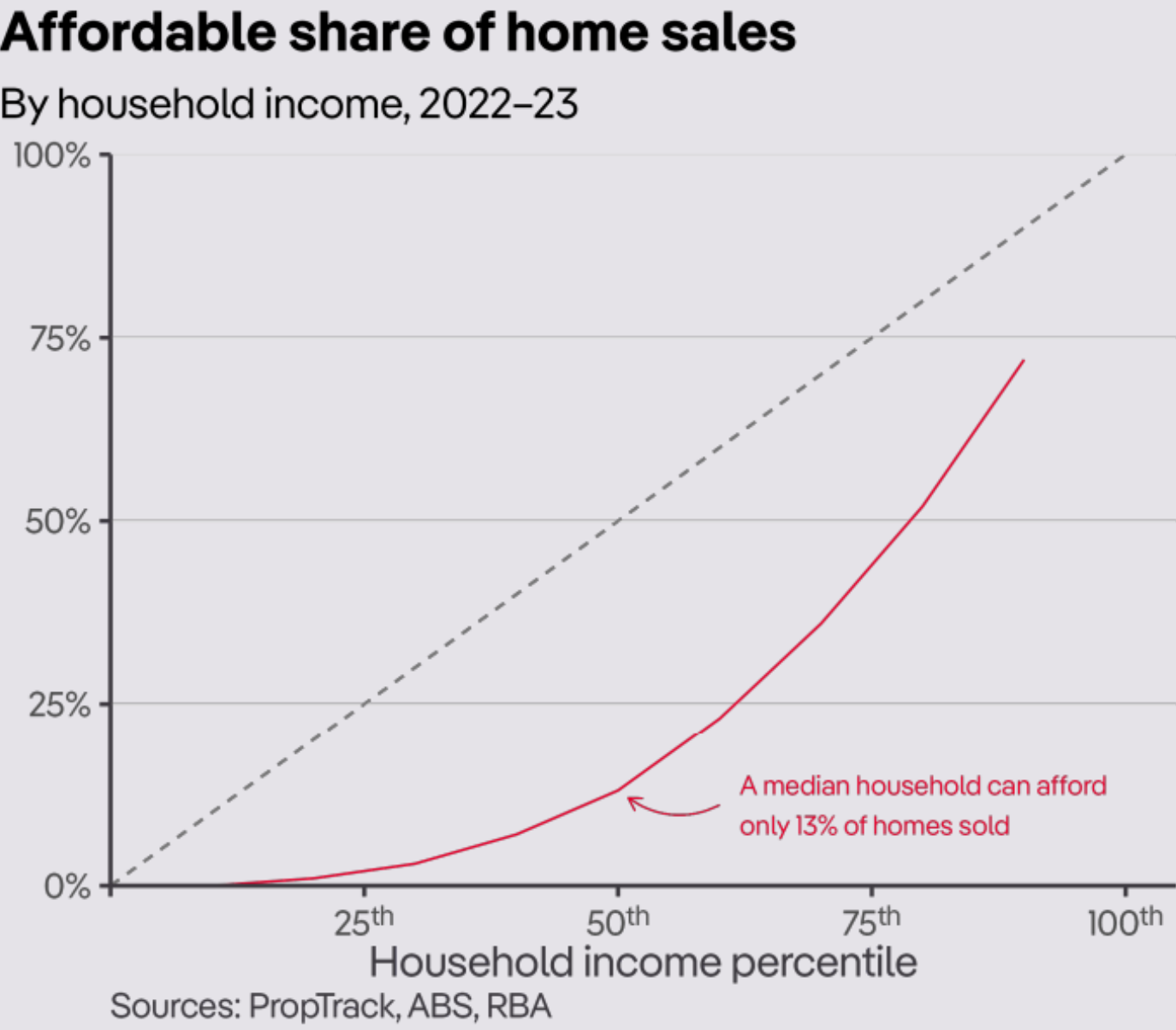

PropTrack also showed that a median household in Australia can only afford 13% of homes sold – an alarmingly low share:

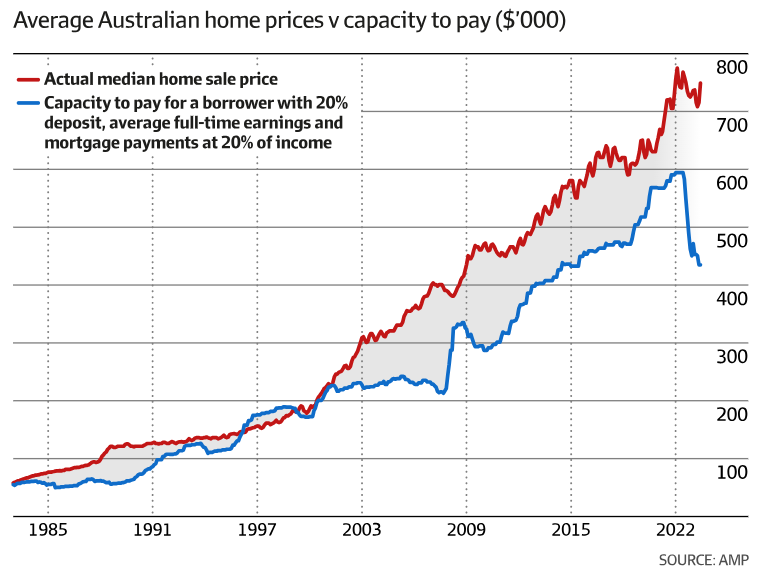

PropTrack’s analysis aligns with the below chart from AMP chief economist, Shane Oliver, which shows the record gap between median home prices and capacity to borrow:

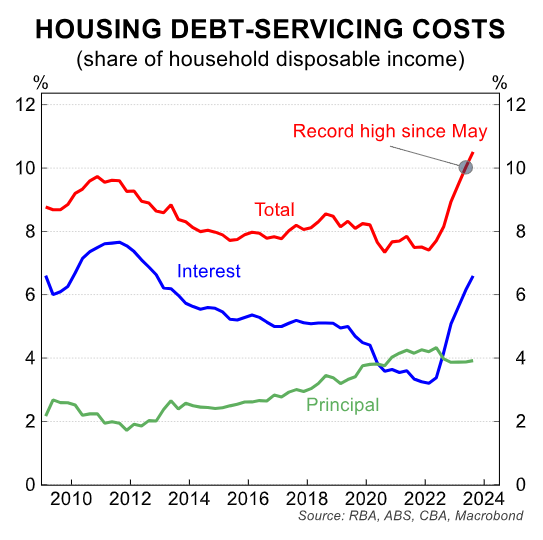

This declining borrowing capacity reflects the combination of higher housing values and soaring mortgage interest rates:

Mortgage affordability and the capacity to buy would obviously improve if the Reserve Bank of Australia slashed interest rates.

Rising home prices, however, would likely counteract the affordability benefit of such actions.

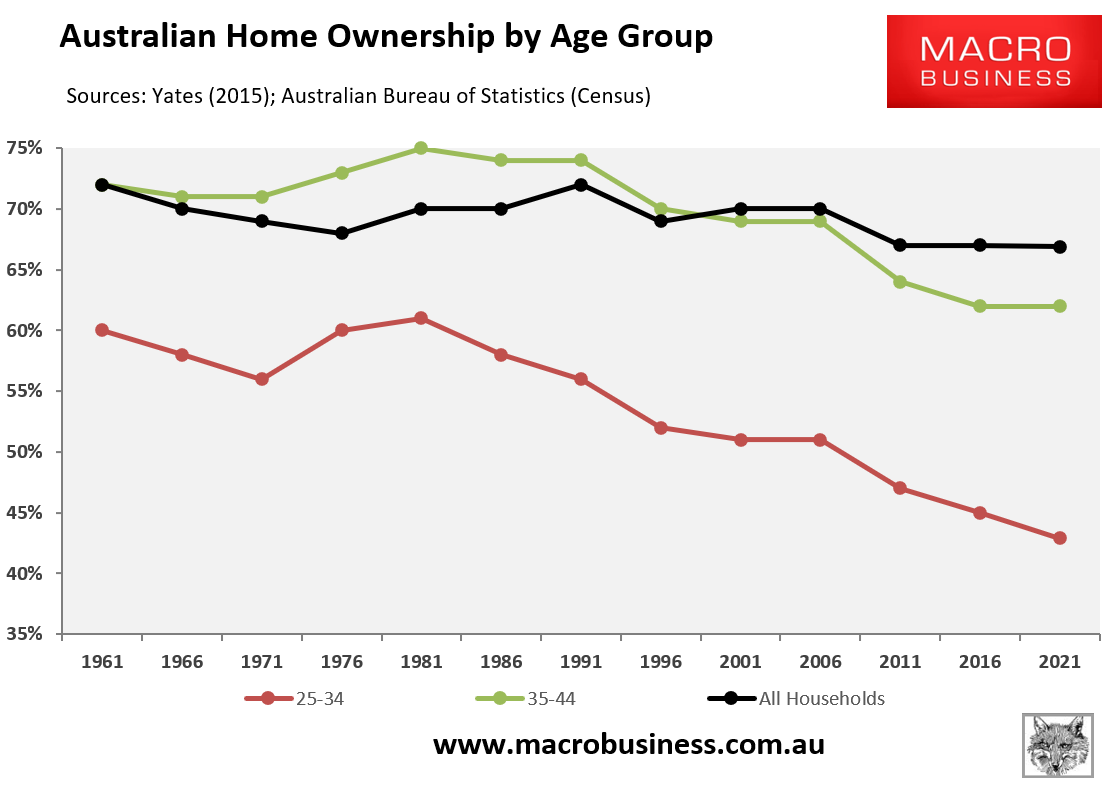

Younger Australians have experienced a significant decline in homeownership rates in recent decades, as illustrated below.

I can’t see the situation changing with the housing and immigration policies that are in place.

Australians might still yearn for dream of home ownership. But for many, it will remain that – a dream.