We know that the consumer is smashed. Now we see that the supply side of the economy has responded to that weakness with a large destocking pulse.

These are classic recession dynamics as inventory drawdowns bash GDP lower.

Westpac has more.

Business inventories fell by even more than we anticipated and will be a substantial drag on Q4 growth.

Inventory levels contracted by a large -1.7%, a sharp swing from a significant rise last quarter, up by +1.2%.

That outcome was much weaker than expected, Westpac at a forecast -0.3% and the market median 0.0% (range -0.7% to +1.3%).

That inventory run-down will subtract -1.0ppt from activity, a substantially larger drag than was expected, Westpac -0.5ppts and market median -0.4pppts.

Inventories fell across the consumer sectors, -1.1%, and the volatile business sectors, -2.6% after a +3.1%.

Sales were soft but remained positive – just, advancing by a tepid 0.2%. That tends to suggest that private domestic demand edged higher in the period, as we anticipate.

Headline company profits jumped by 7.4%, exceeding our top of market forecast of 4.2%, and well above the market median of 1.1% (range -1.0% to +4.2%).

It was all mining profits, up by 17.3%, on higher commodity prices. Non-mining profits ex finance edged lower, down by -0.4%, as we anticipated.

We assess that the headline profits number grossly exaggerates actual profit growth in the period – due to a “double upward bias”, as we foreshadowed.

This is an accounting survey – which books an increase in prices of inventories as a profit (the IVA), which it is not (in an economic sense).

Profits ex finance IVA adjusted rose by 3.6% in the period, we calculate.

In addition, we detect the National Accounts are using a different seasonal factor – typically, the National Accounts Q4 profit reads are softer than those in the BI survey. This potentially may trim the profit rise to around 2½% or so.

Wage incomes (wages time employment) was disappointing coming in at a rise of only 0.9%.

Given high inflation, higher interest rates and additional tax obligations, this points to the risk of a further decline in real household disposable income for households, adding to the pressure on consumer spending power.

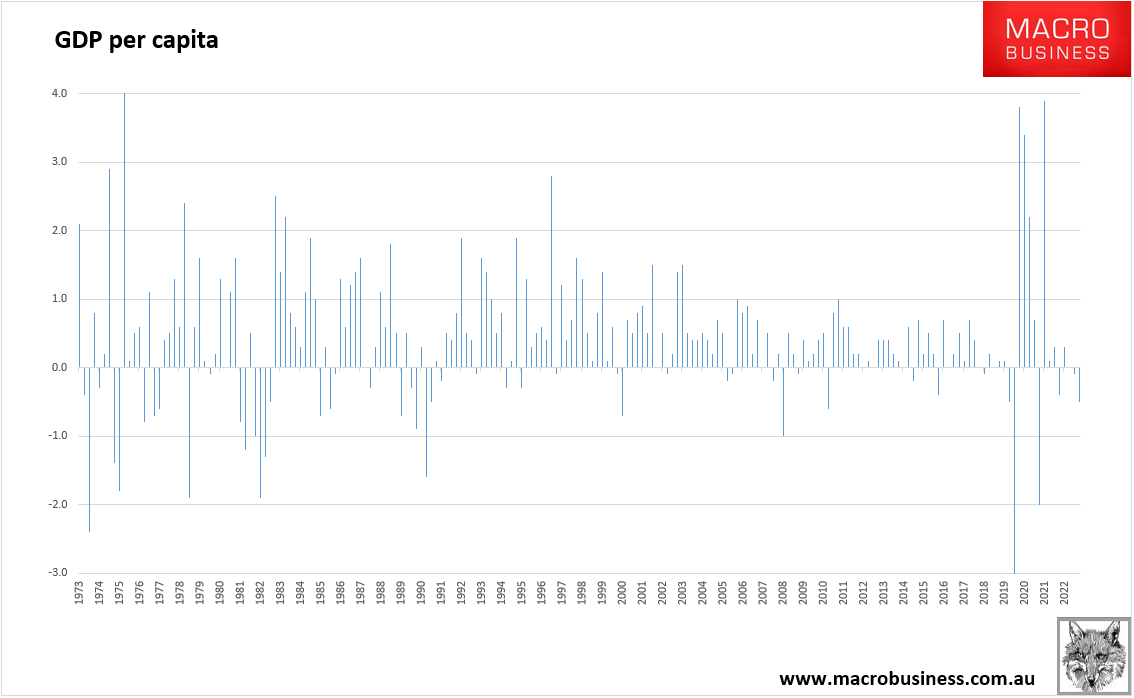

Given the level of immigration, printing headline negative GDP is an almighty achievement. It is doubtful we’ll get consecutive quarters of falling growth for the iMSM to make the recession official.

But over the five quarters since Albo came to power, growth has fallen an aggregate 0.4%. Assuming a very likely sixth quarter of falling per capita growth, Treasurer Jim “Chicken” Chamlers will break a 40-year record (going back the 1990) for the longest stretch of falling living standards.

I want to say it is all bad luck. But calamitous policy errors in energy and immigration policy have made it much worse than it needed to be.

Finally, Jim “Chicken” Chalmers has measured up to his mentor Paul Keating.