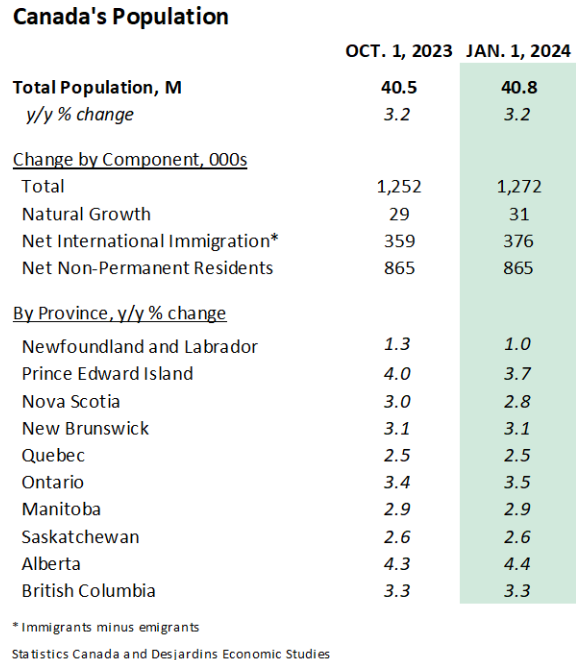

Statistics Canada last week reported the largest increase in the nation’s population in history, with 1.27 million residents added in 2023, with 98% of that growth coming from net overseas migration:

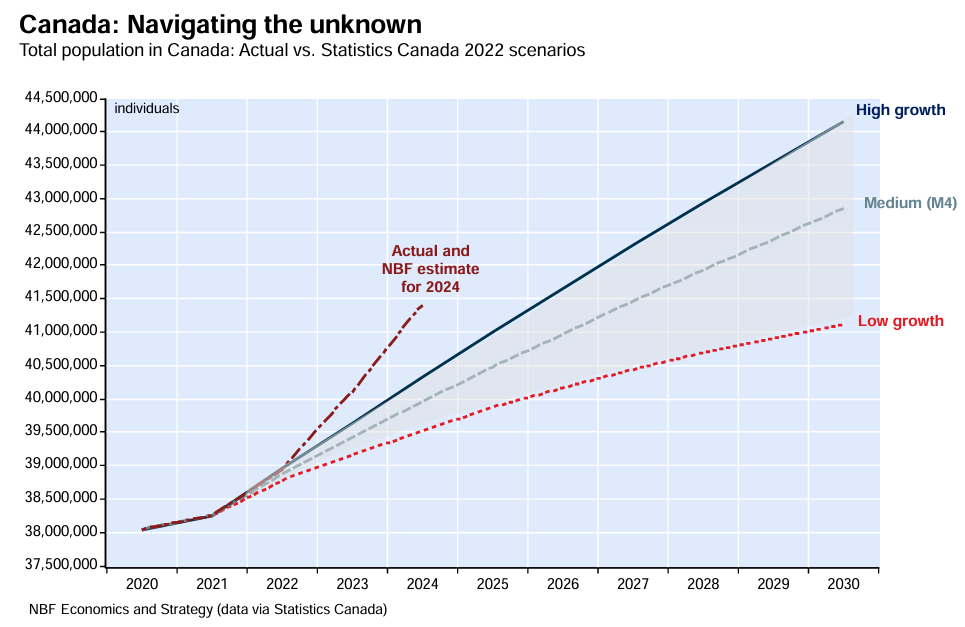

The following chart from the National Bank of Canada shows that the population increase has blown way past Statistics Canada’s “high growth” forecasts:

“Economists, businesses, municipalities, and even our own central bank are struggling to calibrate business plans or policies against a demographic unknown”, writes Stéfane Marion & Daren King from the National Bank of Canada.

“We estimate that Canada’s population is on track to reach just under 41.5 million people this year”.

“As shown, this is well above even the most aggressive scenario published by Statistics Canada (most forecasters have historically based their projections on the intermediate scenario)”.

“Recall that in its January MPR, the Bank of Canada projected population growth of 2% in 2024. The current path is at least 3%, or 50% faster than the BoC assumed”, the authors wrote.

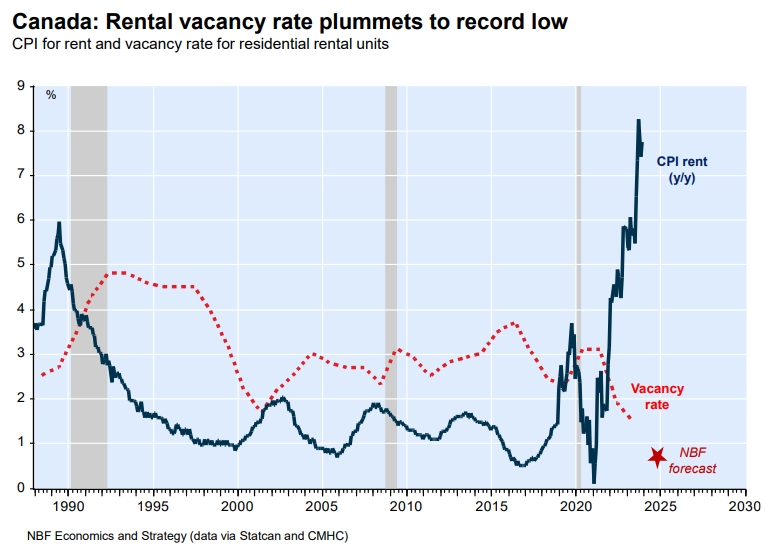

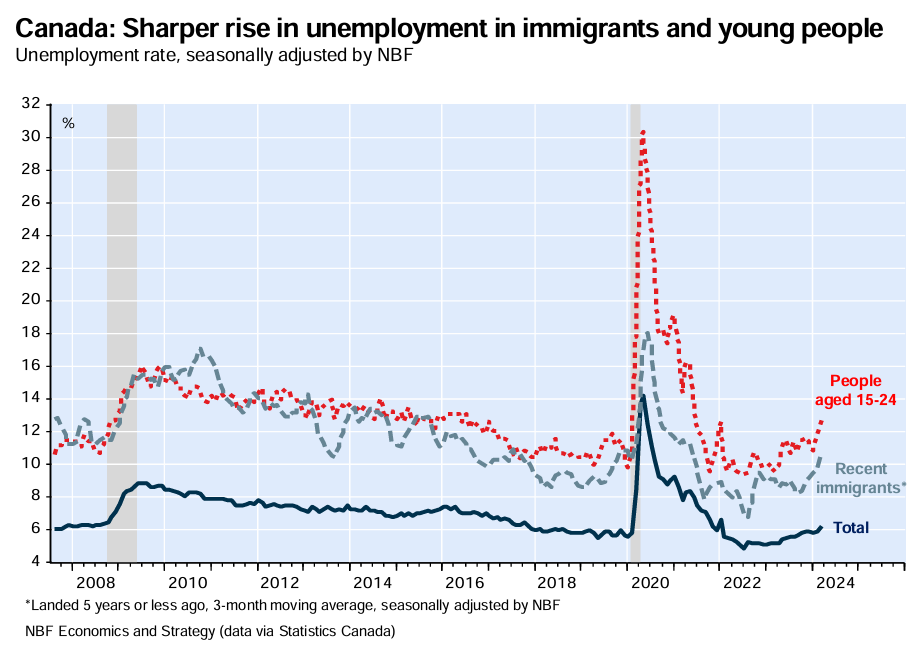

In addition to creating the worst rental crisis in living memory, Canada’s population boom has also caused the unemployment rate to skyrocket.

The latest March employment report from Statistics Canada revealed an unprecedented quarterly increase in Canada’s working-age population: a whopping 300,000 in Q1 2024 (or 3.7% annualised).

Meanwhile, Canadian employment decreased by around 2,000 in March, below consensus expectations of a 25,000 increase.

With the labour force participation rate holding steady and the population rising by 91,000 over the month, Canada’s unemployment rate soared by 0.3 percentage points to 6.1%, 0.2% higher than consensus expectations:

The assessment by the National Bank of Canada’s economics team is dire:

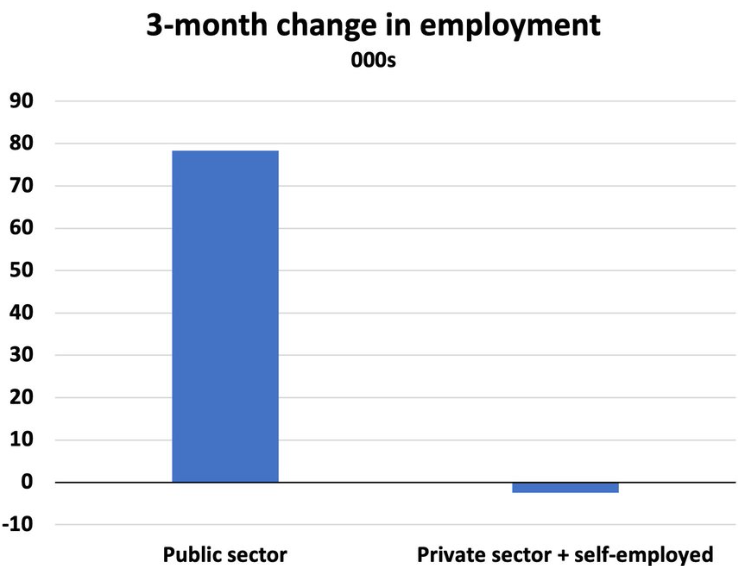

“Private-sector employment made up for the previous month’s losses, but the fact remains that this segment is experiencing a decline that began in mid-2023 and raises eyebrows in the current demographic context”.

Source: Ben Rabidoux

“The employment rate has fallen for the sixth consecutive month, while hiring is no longer keeping pace with population growth”.

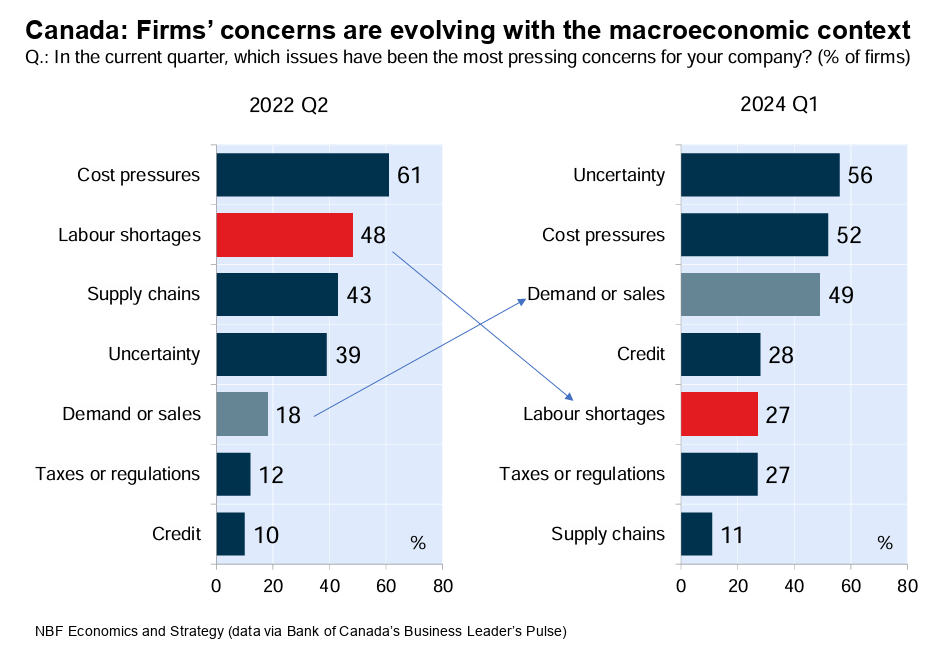

“None of this is surprising, and is consistent with the Business Outlook Survey data published earlier this week. Since the tightening of monetary policy, the proportion of companies experiencing labor shortages has plunged drastically (48% to 27%)”.

“On the contrary, almost half of companies are concerned about customer demand (18% in Q2 2022) in the current uncertain environment”.

“They are right to be concerned, as monetary policy remains extremely restrictive, and in such a context we continue to anticipate a further deterioration in the labor market, with the unemployment rate approaching 7% by the end of the year”.

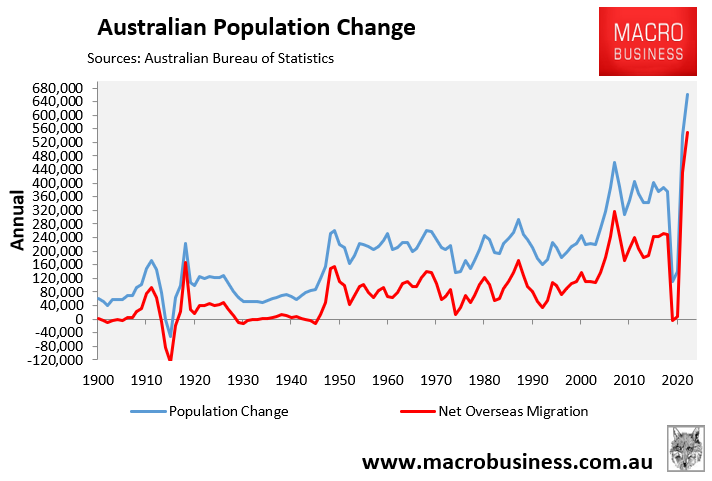

Australia is running a similar extreme immigration policy into a deteriorating economy and housing market.

This unprecedented population boom has created a similarly historic rental crisis in Australia, although our unemployment rate has yet to rise.

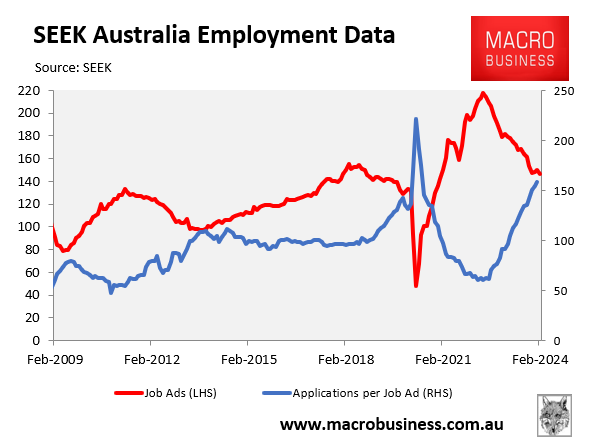

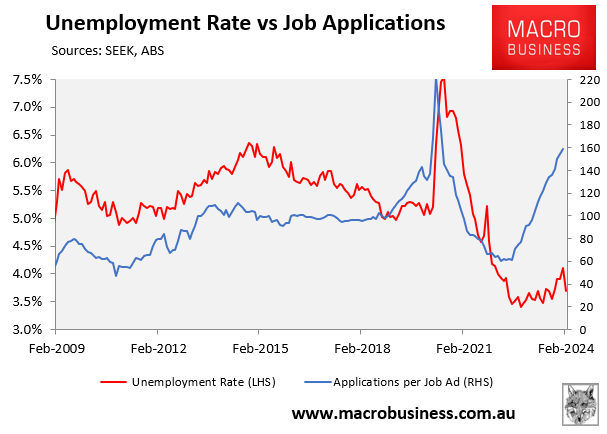

However, the forward-looking labour market indicators are poor for Australia, with job ads collapsing back to earth and the number of applicants per job ad soaring more than 50% above pre-pandemic levels:

This suggests that it is only a matter of time before unemployment launches in Australia, too:

Canada is an omen of what could happen in Australia if we continue with the same mass immigration policy.

We, too, will be caught in a population trap of falling productivity, perennial housing shortages, and per capita recessions.