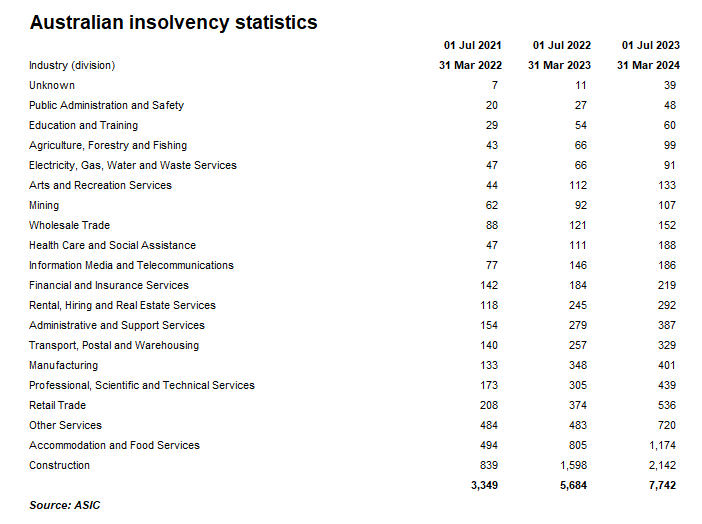

New data from the Australian Securities & Investments Commission (ASIC) shows a big jump in external administrations in March, with 7,742 firms going under in the nine months to 31 March 2024:

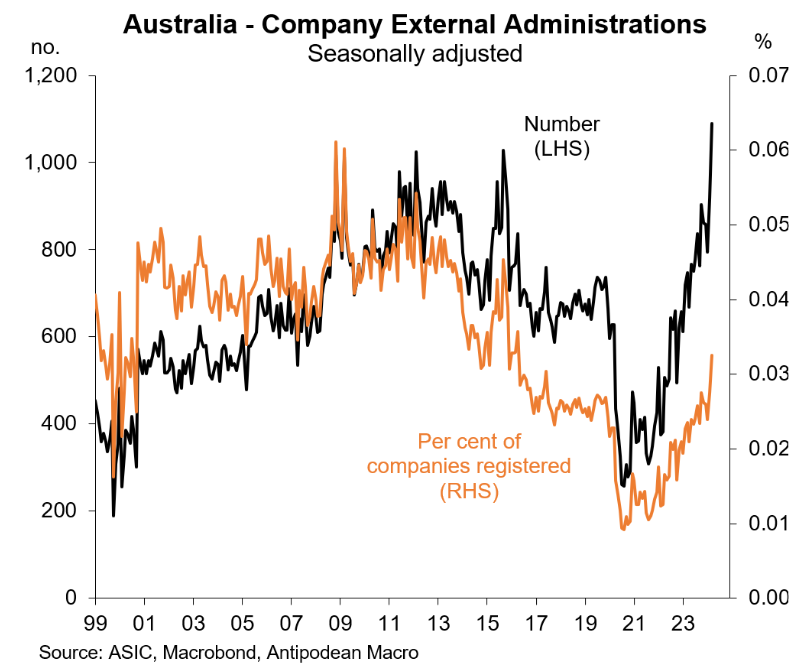

The following chart from Justin Fabo at Antipodean Macro shows that insolvencies surged in March to their highest number in decades:

Construction continues to lead the nation’s insolvencies, with 2,142 firms going under in the nine months to 31 March 2024, a 34% increase on the same period in 2023 and 155% above 2022.

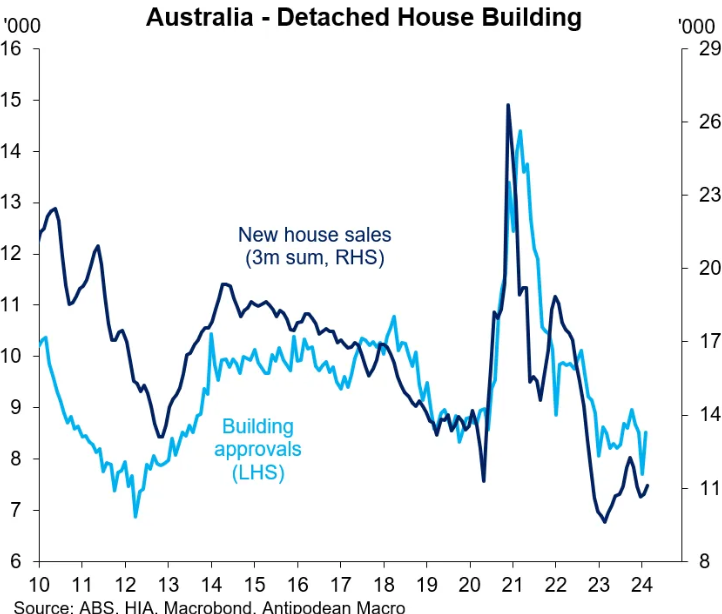

Home builders, in particular, are facing harsh economic headwinds.

First, high interest rates have increased their cost of financing while also stifling buyer demand.

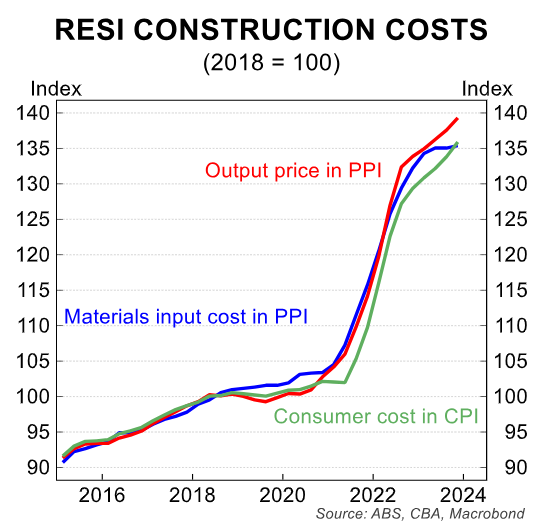

Second, home builders are contending with the 30% to 40% rise in construction materials prices since the beginning of the pandemic, which has driven up the cost of new homes and forced many builders on fixed-price contracts to go under:

Finally, home builders are competing for scarce labour against state government ‘Big Build’ infrastructure projects.

The upshot is that margins have been crunched and builders struggle to turn a profit.

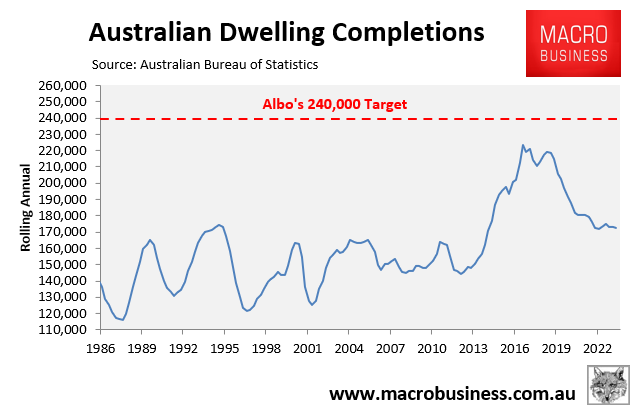

It also means that the Albanese government’s target of building 1.2 million new homes has no hope of materialising.

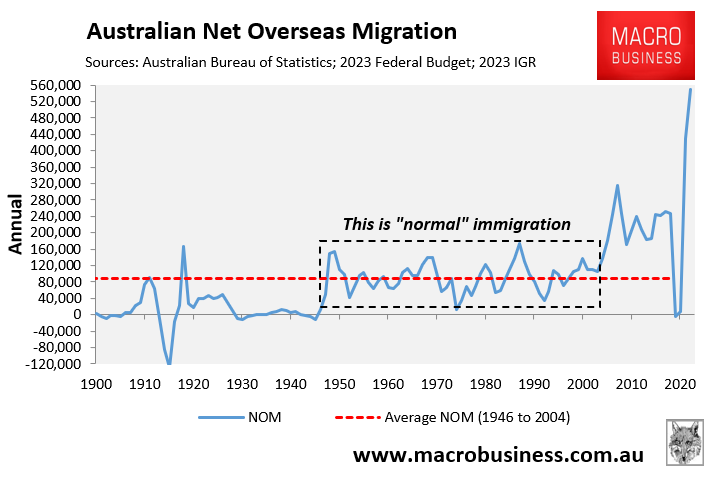

For tenants, rents will continue to rise as long as the Albanese government keeps the throttle on immigration.