Crossbench senators Jacqui Lambie and David Pocock have asked the Parliamentary Budget Office (PBO) to cost options for possible changes to negative gearing. Senator Lambie claims negative gearing is part of Australia’s housing affordability problem.

All the options that the PBO was asked to look at were ‘grandfathered’ so that existing property investors would be unaffected.

These options include:

- Removing the CGT discount for new rental properties purchased after July 1 and halving it for newly built homes.

- An escalating series of proposals would provide a 25% CGT discount for new homes owned for over three years, remove negative gearing for second and subsequent investment properties, and disallow deductions for vacant homes.

Along with support from the Greens, the federal government needs the help of Lambie and Pocock to pass legislation in the Senate if the Coalition opposes it, and their plan to curb negative gearing for investment properties is claimed to raise $6 billion a year for housing supply.

“Tax reform on its own won’t solve the housing crisis but it can be a powerful tool to drive new supply and should be on the table for sensible debate”, Senator Pocock said.

I no longer view negative gearing as a significant driver of Australian house prices, given New Zealand banned negative gearing on April 1, 2019, and then saw house prices record one of the world’s largest booms over the pandemic.

However, negative gearing skews the property market away from first-time purchasers and costs the federal government a lot of lost income.

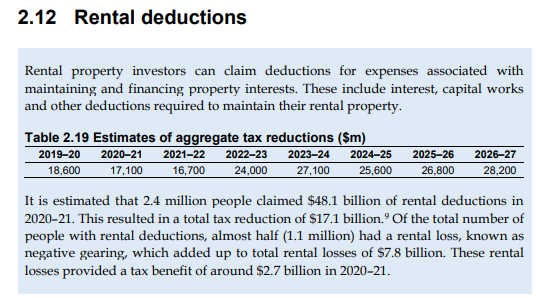

These losses were detailed in the Australian Treasury’s 2023-24 Tax Expenditures and Insights Statement Report:

Source: Australian Treasury

According to the Treasury, “rental losses provided a tax benefit of around $2.7 billion in 2020-21”.

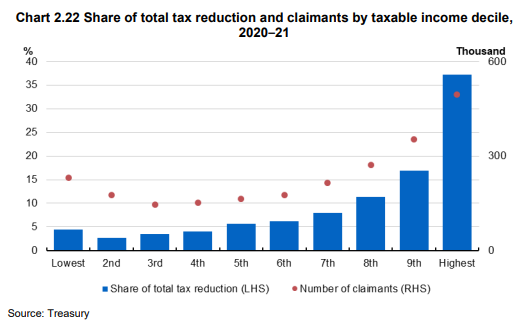

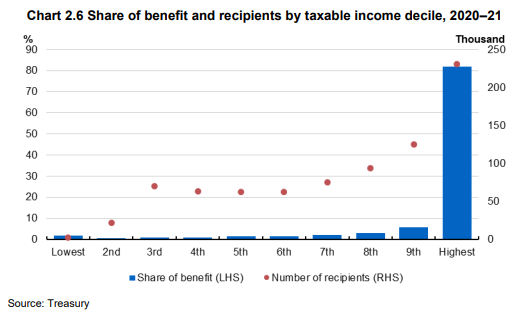

Furthermore, these tax breaks primarily benefit higher-income households:

As indicated above, rental losses are forecast to have climbed dramatically since 2020-21 due to the sharp rise in interest rates and investor mortgage payments. As a result, tax benefits will have increased significantly.

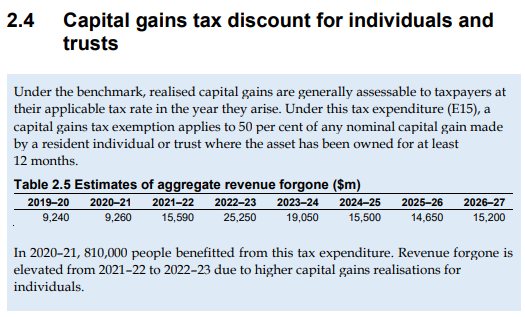

The Australian Treasury estimates that the capital gains tax (CGT) discount, which “applies to 50% of any nominal capital gain made by a resident individual or trust where the asset has been owned for at least 12 months”, will cost approximately $25 billion in foregone income in 2022–23:

Source: Australian Treasury

Furthermore, the vast bulk of these tax breaks go to high-income individuals:

Clearly, it makes policy sense to limit negative gearing and CGT exemptions solely on equity and budget sustainability grounds.

Otherwise, the tax money will have to be made up elsewhere by taxing worker wages even more heavily.

However, don’t expect negative gearing reform to impact house prices or rental affordability significantly.

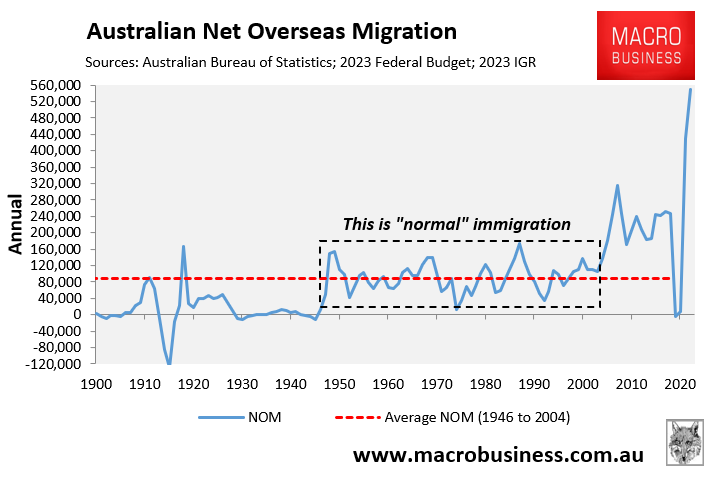

On these fronts, the crossbench senators should target Australia’s extreme immigration policy, which ensures that housing demand always runs ahead of supply.