According to the most recent set of CoreLogic and PropTrack home value statistics, Perth is at the forefront of the nation’s price boom, with a spectacular rise in home values in the year to March.

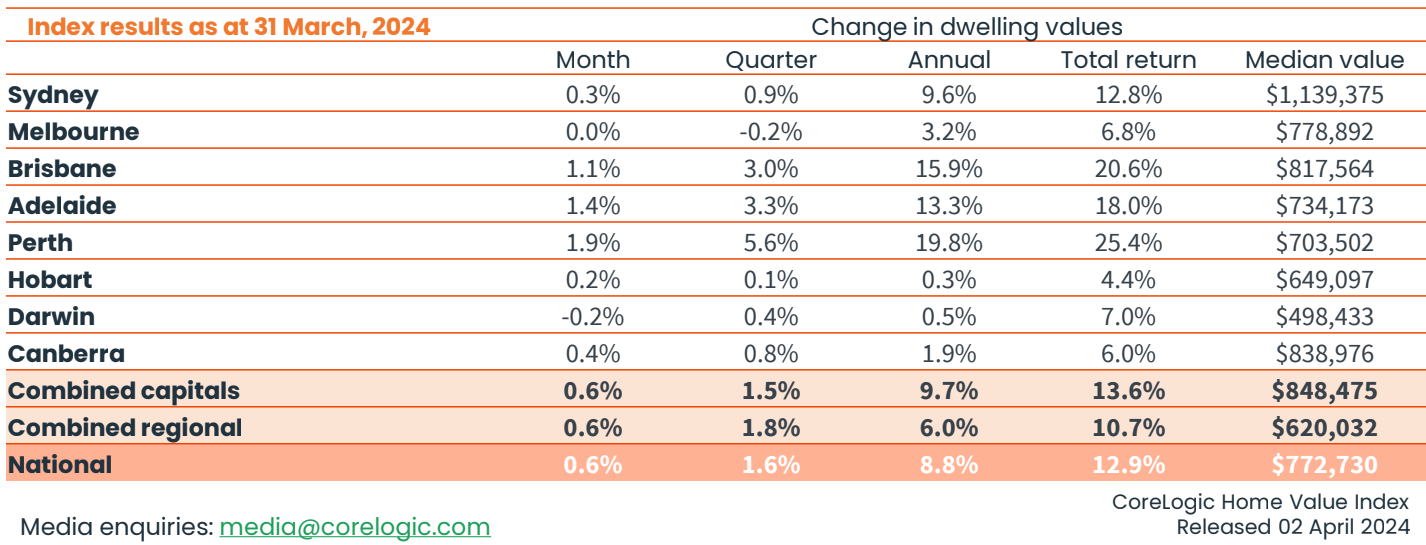

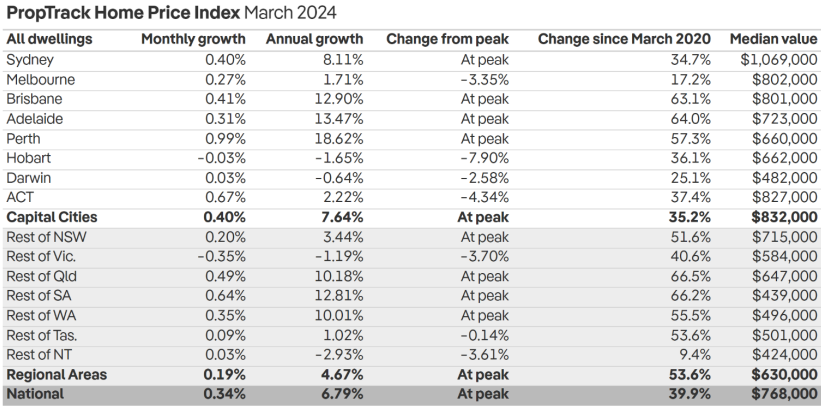

CoreLogic’s daily housing values index reported that Perth dwelling values increased by 19.8% in the year to March, considerably above the combined capital city growth rate of 9.7%.

PropTrack’s dwelling values index reported that Perth values increased by 18.6% in the year to March, well above the combined capital cities’ annual growth rate of 7.6%.

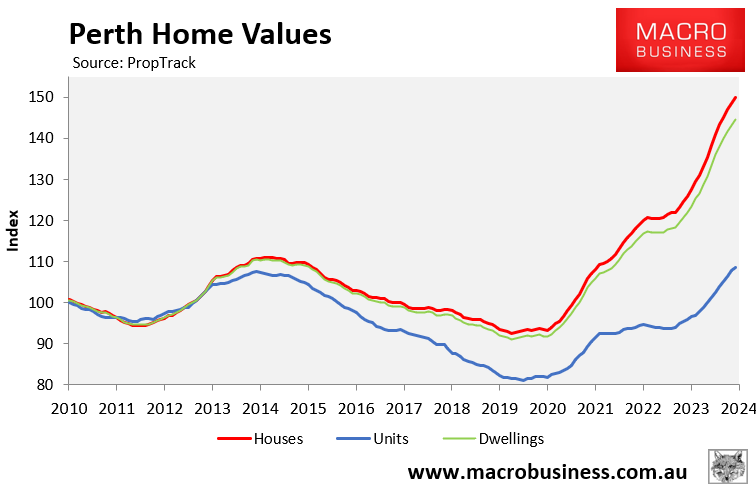

The following chart shows that Perth dwellings have increased by 23.6% since their low point in July 2022, with detached houses leading the way (24.5% growth):

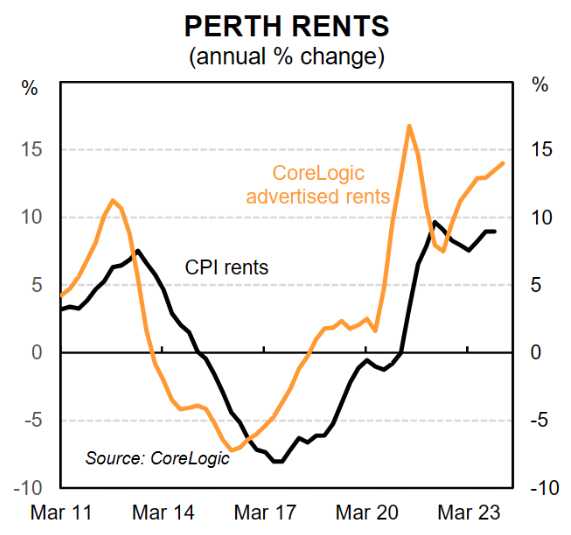

Rents are also increasing in tandem with rising property prices, up 14% in the year to March 2023:

Chris Christofi, CEO and founder of property investment and finance firm Reventon Group, said: “Perth has solidified its status as Australia’s real estate jewel in the crown”.

“An irresistible confluence of robust economic conditions, swelling population numbers, and extreme rental scarcity have forged an ideal environment for property value appreciation and investment prospects”.

“Properties are being snapped up in just 13 days on average”.

“Both local and interstate buyers recognise Perth’s immense potential across residential, commercial, and development fronts”, Christofi said.

Perth is primed for ongoing strong price appreciation.

The city is still relatively affordable despite its recent strong growth.

The first table above from CoreLogic shows that Perth’s median dwelling value of $703,500 was still 17% lower than the combined capital city average of $848,475 as of March 31, 2024.

PropTrack’s series likewise shows that Perth’s median dwelling value of $660,000 was 20.7% lower than the combined capital city average of $832,000.

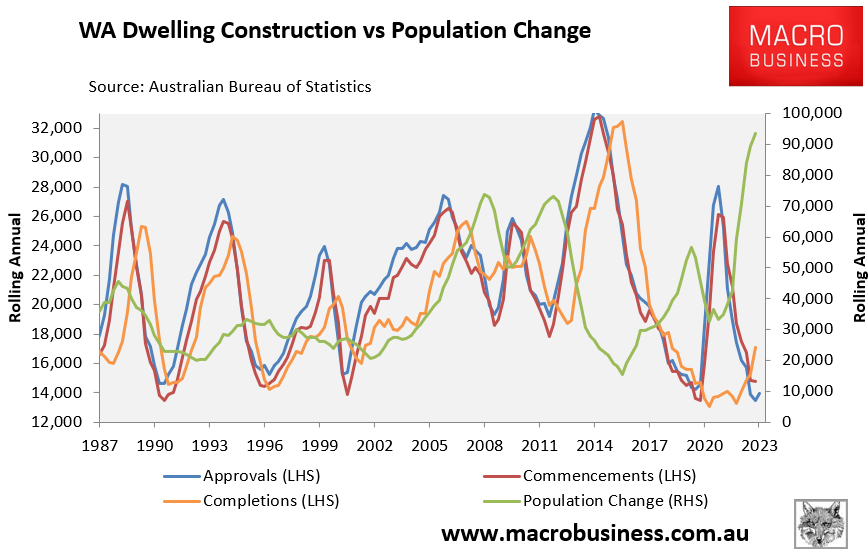

Perth also faces a monstrous housing shortage as population growth easily outstrips new construction.

According to ABS estimates, Western Australia added only 14,700 houses (net of demolitions) in the year to September 2023, while its population increased by 93,600.

This means that Western Australia added only one new home for every 6.4 new residents last year, the poorest performance in the country.

While the immediate indicators are strong, it should be recognised that Perth is a boom-and-bust market.

Between 2014 and 2019, Perth dwelling values fell by 18% in nominal terms (more in real terms) after the iron ore market crashed.

The same will likely happen again following the next commodity price crash.