The latest round of dwelling value data from CoreLogic and PropTrack shows that Perth is leading the nation’s price boom, recording explosive growth over the year to March.

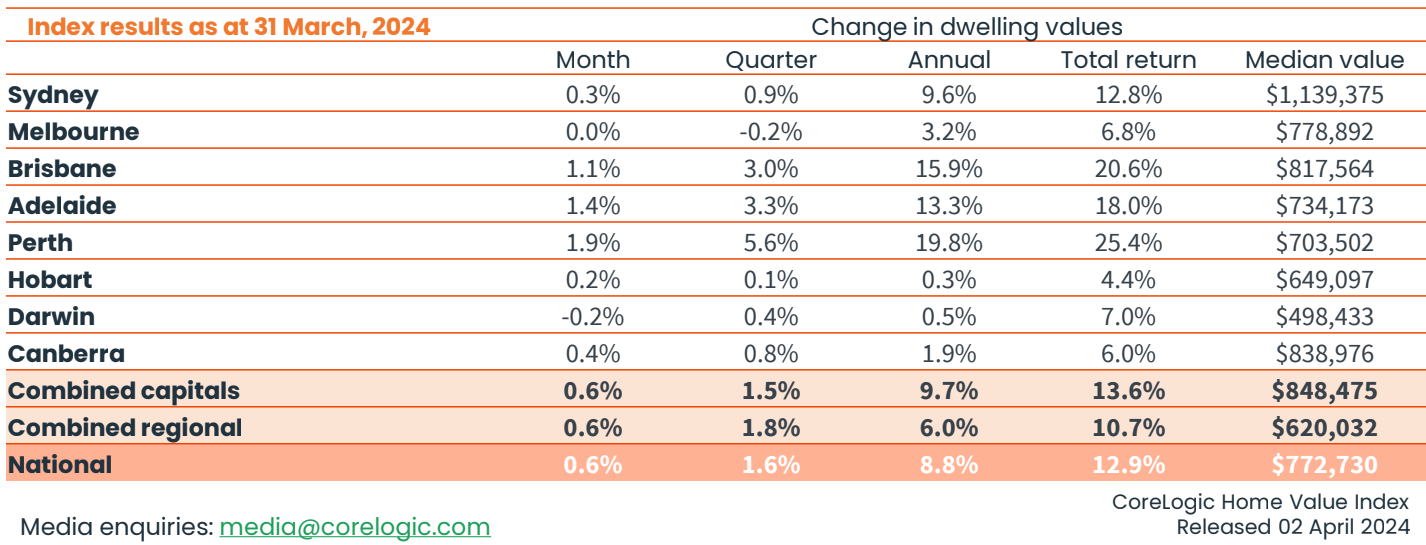

CoreLogic’s daily dwelling values index showed that Perth dwelling values rocketed by 19.8% in the year to March, easily eclipsing the 9.7% growth recorded across the combined capital cities:

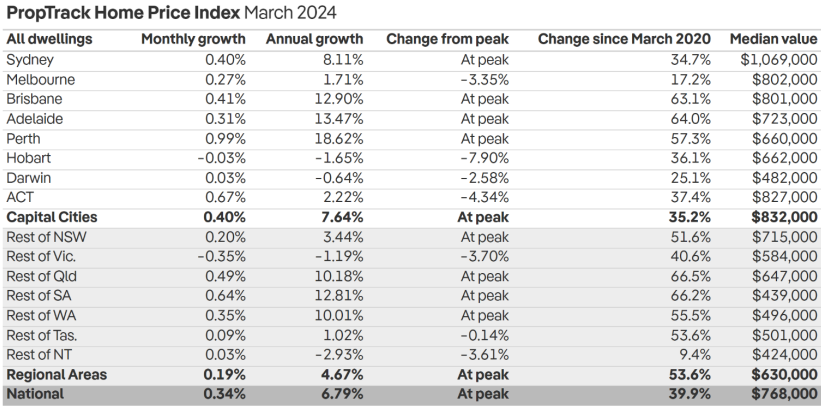

PropTrack’s dwelling values data likewise showed that Perth values soared by 18.6% in the year to March, well ahead of the 7.6% annual growth recorded across the combined capital cities:

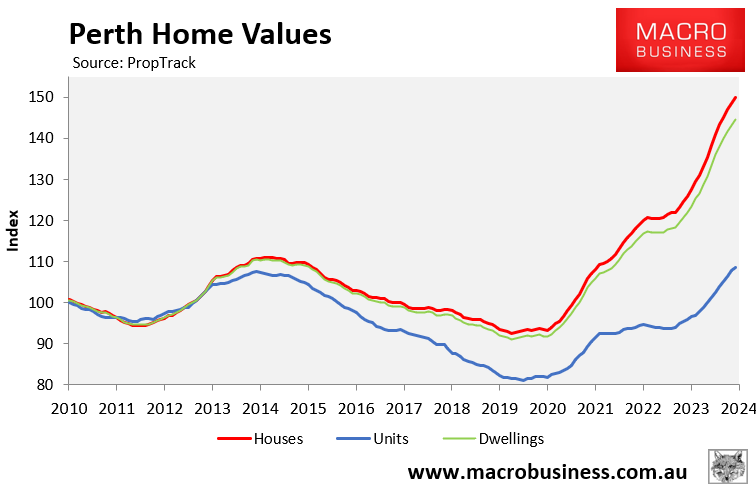

The next chart plotting PropTrack’s series shows that Perth dwelling have have soared 23.6% from their trough in July 2022, driven by detached houses (24.5% growth):

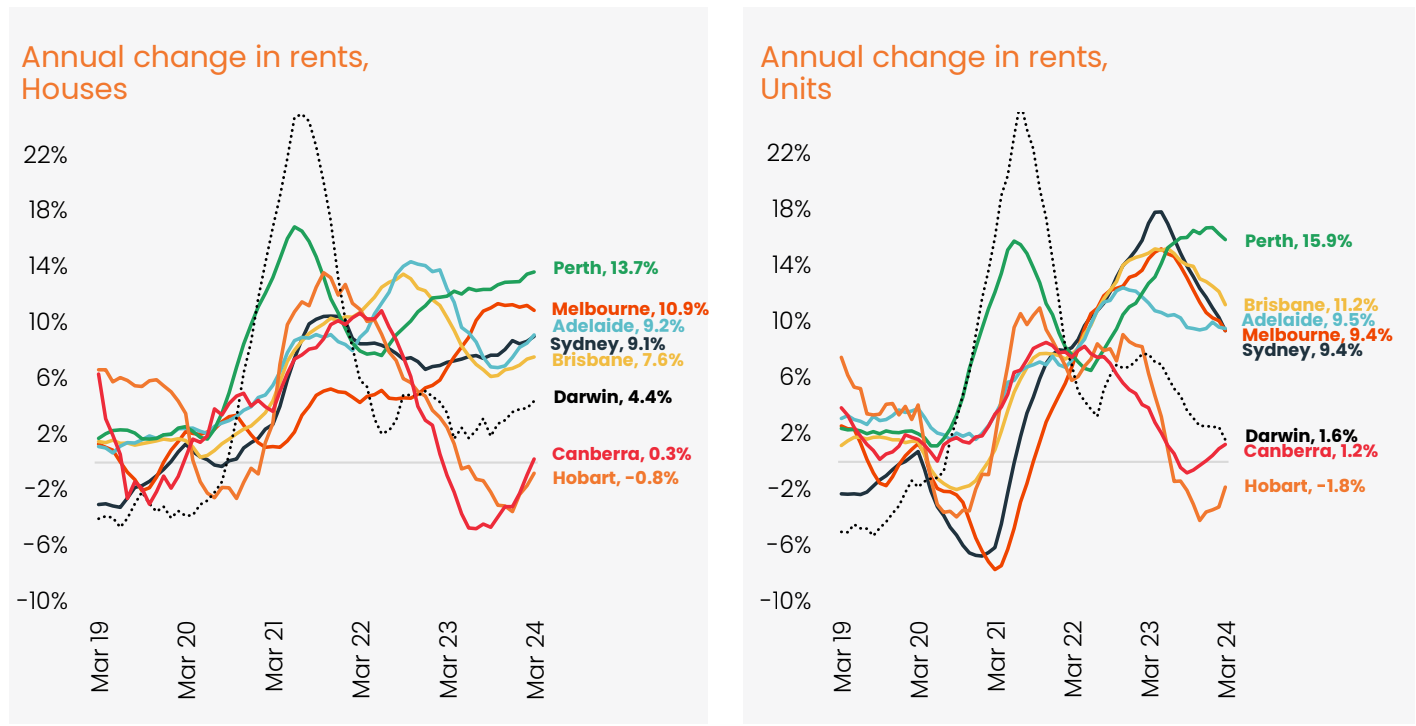

It is not just home prices that are booming, but rents as well.

According to CoreLogic, Perth house rents soared by a nation-leading 13.7% in the year to March, whereas Perth unit rents jumped by 15.9%:

Source: CoreLogic

Despite this rampaging growth, Perth housing is still relatively affordable.

As shown in the first table above from CoreLogic, Perth’s median dwelling value of $703,500 was still 17% lower than the combined capital city average of $848,475 as of 31 March 2024.

The same can be said for PropTrack’s series, which has Perth’s median dwelling value of $660,000 sitting 20.7% below the combined capital city average of $832,000.

The affordability gap is unlikely to last, with the former president of the Real Estate Institute of WA, Damian Collins, tipping that Perth home values could increase by a whopping 20% to 30% over the next three years, thanks to a once-in-a-generation “supercycle”:

“(Perth property) prices need to rise at least 20% to get to fair value, and 30% or more is possible in the next three years”, Collins told The West.

”Our chronic shortage of homes is not solvable with the labour shortage we have”.

Collins claimed that annual population growth of 3.3% supported the anticipated price increases.

According to official data released last month by the Australian Bureau of Statistics (ABS), WA expanded by about 25,000 people in the three months to September 2023, an increase that would ordinarily require the construction of approximately 10,000 new homes.

However, due to slow completion rates in the construction sector, the state is currently recording an average of 4,000 to 4,500 new houses per quarter.

Separately, new Property Council modelling predicts that Western Australia’s housing deficit will grow by nearly 25,000 homes by the end of 2027.

The Western Australian Treasury expects that an additional 239,000 people will live in the state between 2024 and 2027, necessitating the construction of around 92,000 more homes.

However, using the existing market capacity, the modelling suggests that a maximum of 67,000 new dwellings could be developed in that timeframe.

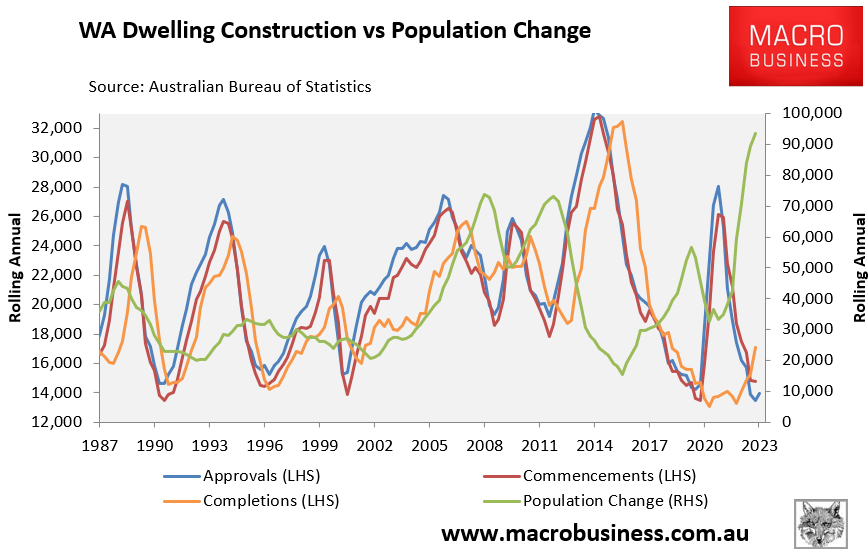

The next chart plotting population growth against dwelling construction illustrates the growing shortage:

ABS estimates show that Western Australia added only 14,700 dwellings (net of demolitions) in the year to September 2023, against a population increase of 93,600.

This means that Western Australia added only one new home for every 6.4 new residents over the year—the worst result in the nation.

This is why Western Australia is leading the nation in house price and rental growth and why Perth housing won’t remain affordable for long.

That said, Perth is a boom-bust housing market and could easily be followed by a price crash if and when commodity prices crash, similar to what happened in the six years following the 2014 peak (see Perth Home Values chart above).