The International Monetary Fund (IMF) has released new research on the effects of monetary policy on housing markets.

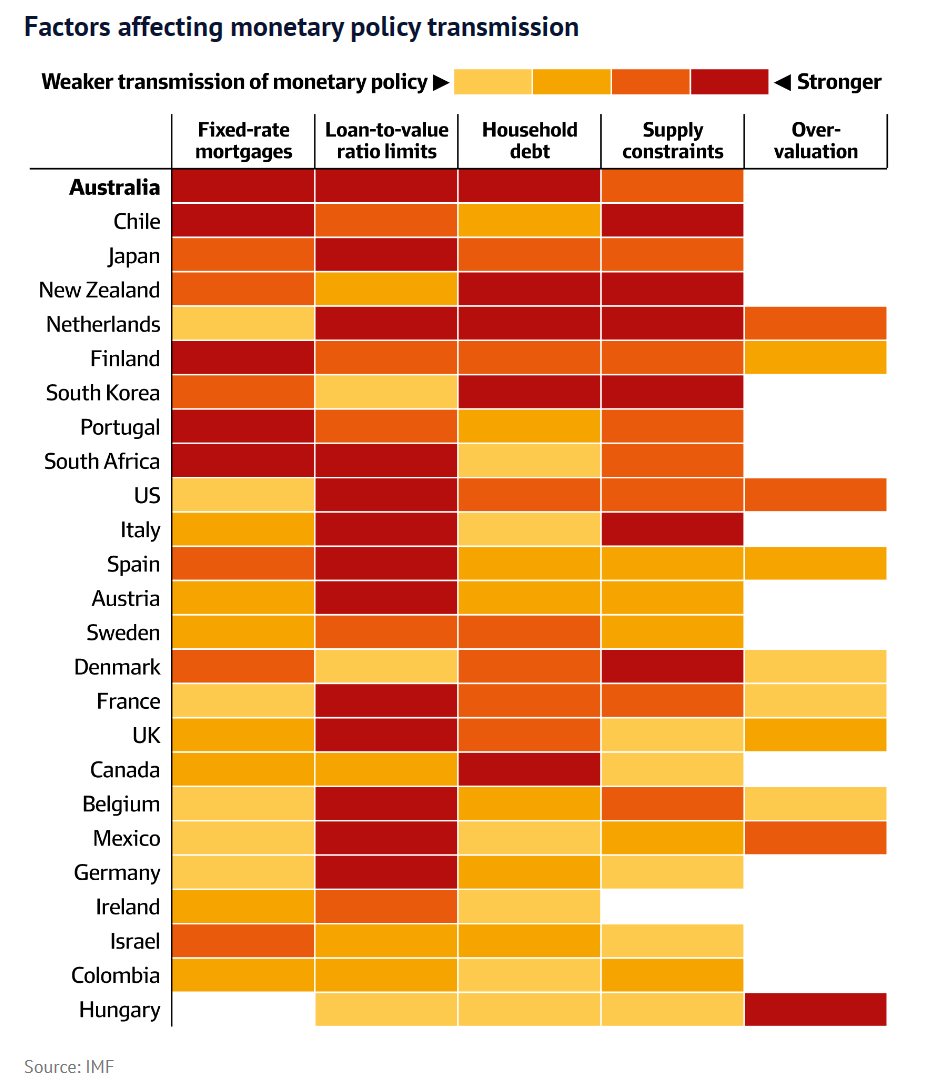

The IMF concluded that Australians are more sensitive to changes in interest rates than almost any other consumers globally.

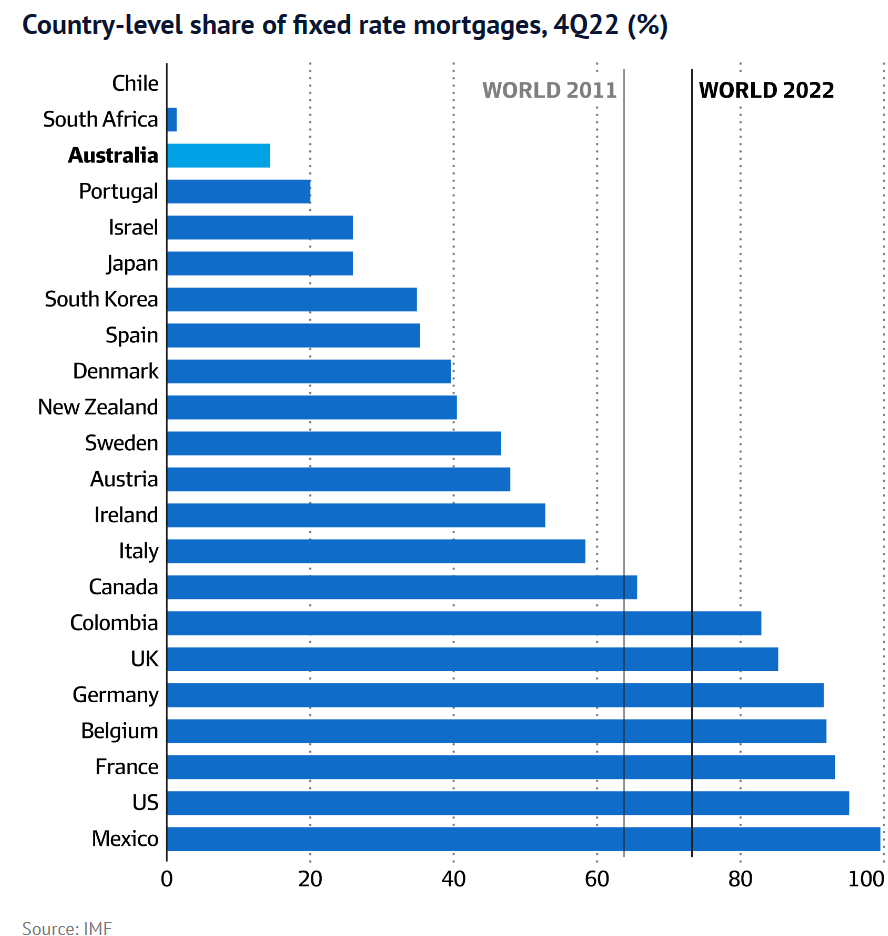

It stated that Australia’s sensitivity to rate rises was due to its high level of household debt, looser lending rules, and the dominance of variable-rate mortgages, with over 80% of the Australian mortgage market typically priced at a variable interest rate.

These factors mean that most Australian mortgage holders will see their interest rate adjusted soon after the Reserve Bank of Australia (RBA) changes the cash rate.

“In an economy like Australia dominated by variable rate lending, a 100 basis point increase in interest rates caused consumption to fall by 0.5% over two years, the IMF estimated”.

“But in an economy dominated by fixed rates such as the United States, consumption increased by 1.5% since the majority of households did not feel the pinch of rising borrowing costs”…

“In countries with above-average household debt ratios like Australia, a 100 basis point increase in interest rates caused house prices to fall by 5% over two years. In countries with low levels of household debt, the price decline was a more modest 2%”.

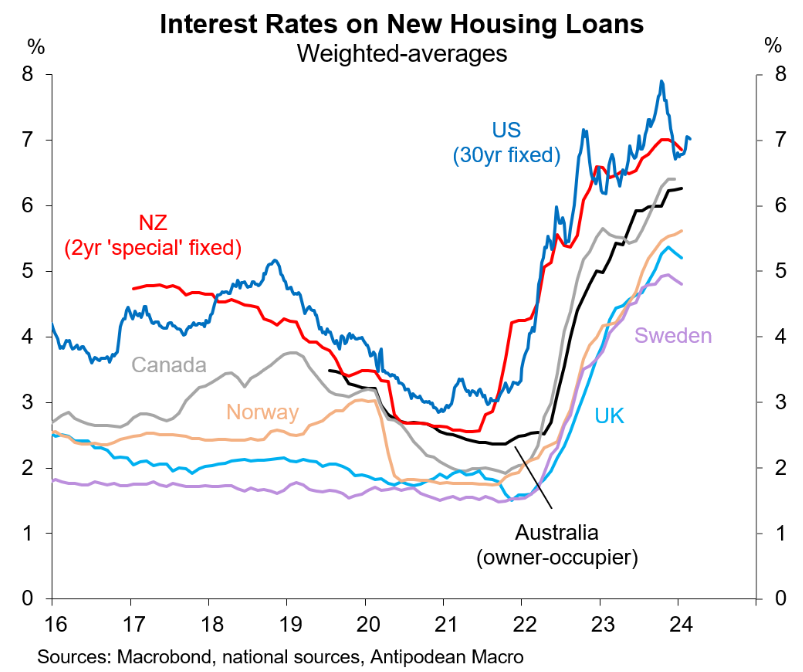

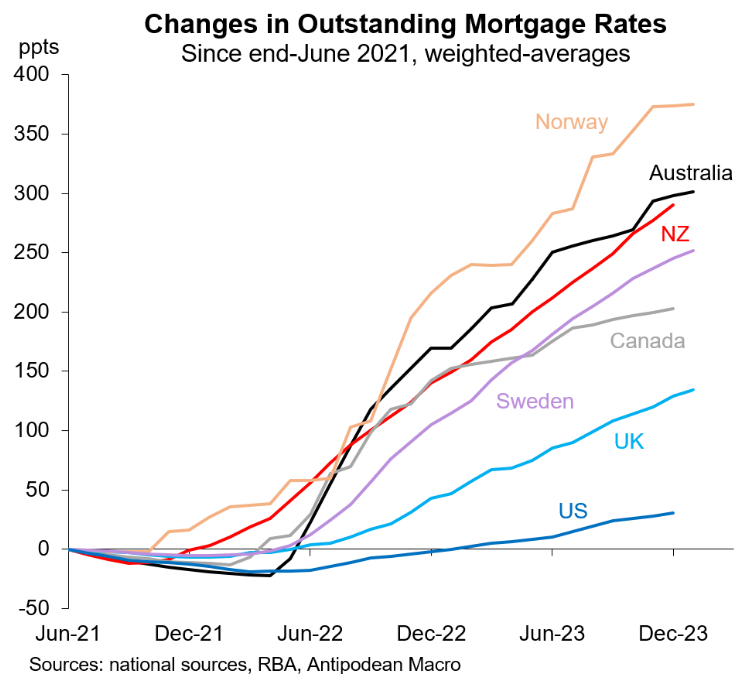

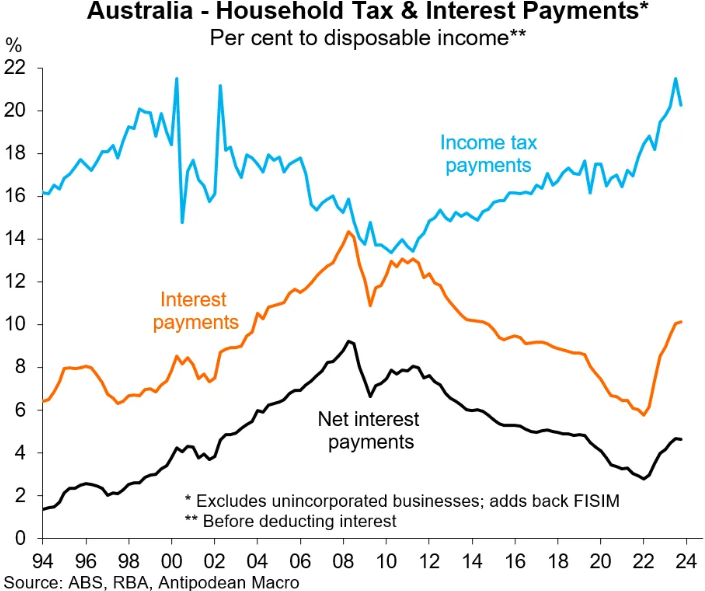

The following charts by Justin Fabo at Antipodean Macro support the IMF’s findings.

Although interest rates on new housing loans in Australia have risen to around the average of developed nations:

The average interest rate on outstanding housing loans in Australia is among the highest in the developed world:

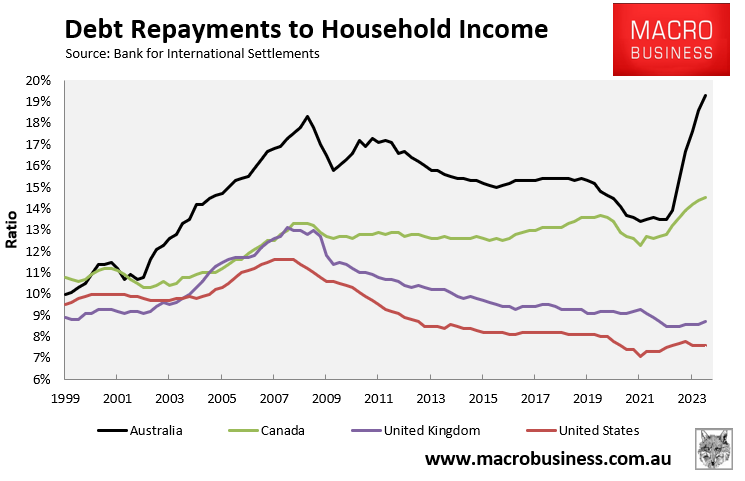

Data from the Bank for International Settlements (BIS) as of the September quarter of 2023 also shows that principal and interest debt repayments as a share of household income have risen far more than in other Anglosphere nations:

Australian households spent a record 19.3% of their disposable incomes on debt repayments in the September quarter of 2023, compared to only 14.5% in Canada, 8.7% in the United Kingdom, and 7.6% in the United States.

The data above shows why the RBA does not need to hike official interest rates as much as other countries to lower demand and inflation.

Australian households have already been impacted particularly hard by the RBA’s monetary tightening measures.

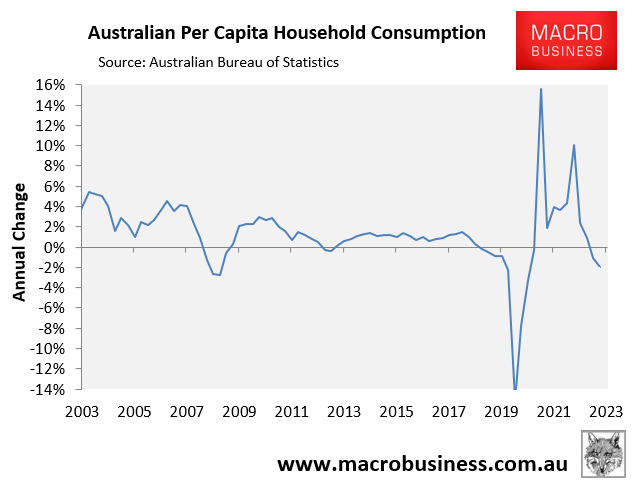

As a result, Australian household consumption has fallen sharply:

Australia’s real per capita household consumption fell by 2.5% in 2023 due to stagnant real earnings, rising mortgage rates, and increased income taxes.

With the economy contracting in per capita terms amid a deep consumer recession, expect the RBA to begin a monetary easing cycle later this year.

If you want to save thousands of dollars in mortgage repayments, try the MB Compare n Save mortgage comparison tool. It takes less than a minute.

And if you choose to refinance, Compare n Save will handle the process.