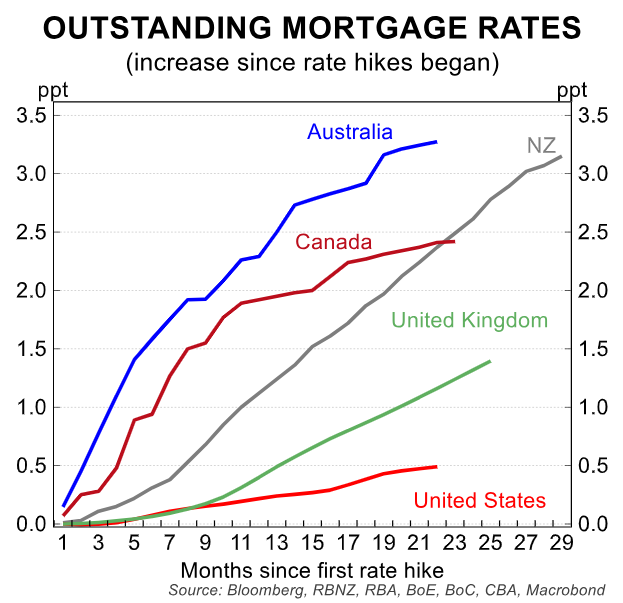

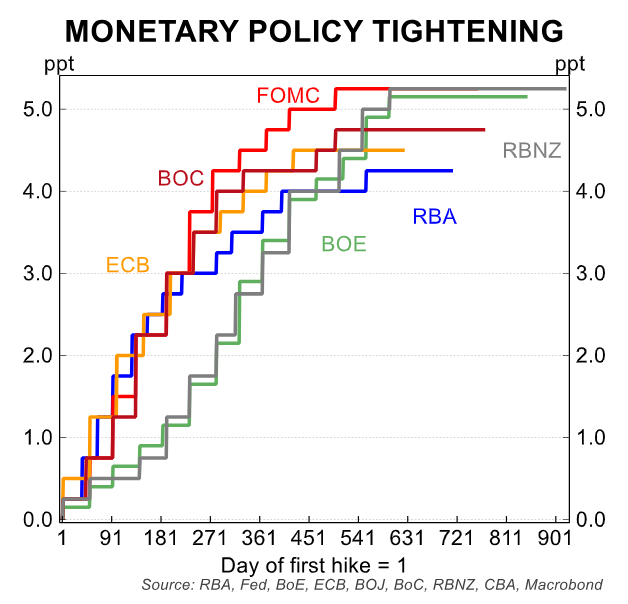

Australians have experienced one of the largest increases in mortgage rates in the world:

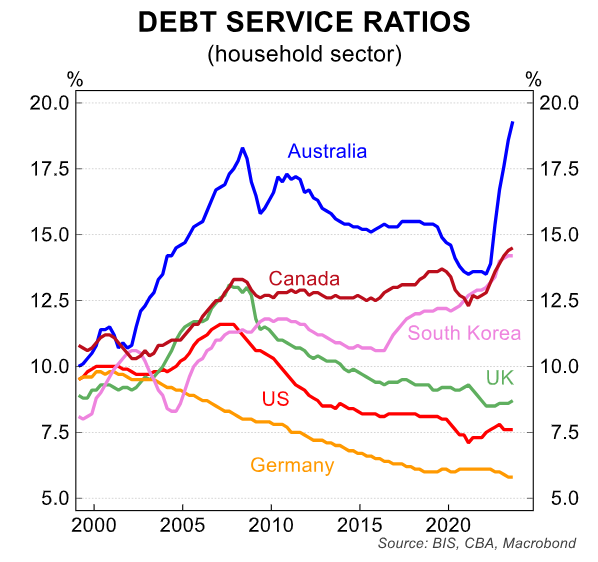

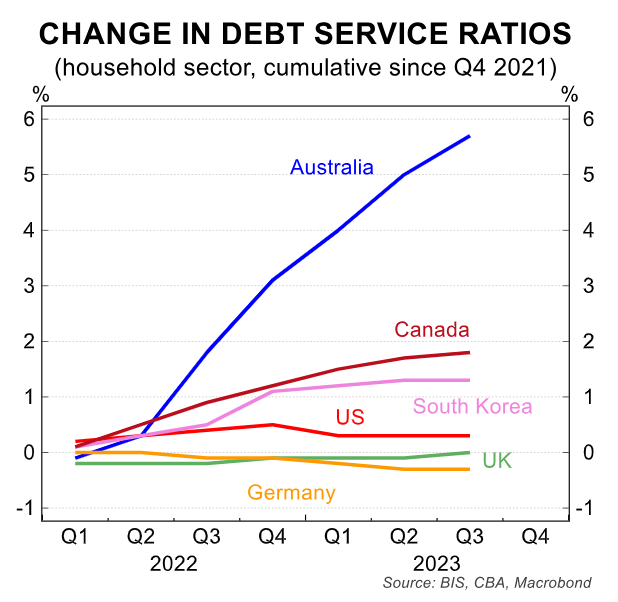

We have also experienced the largest rise in debt servicing costs:

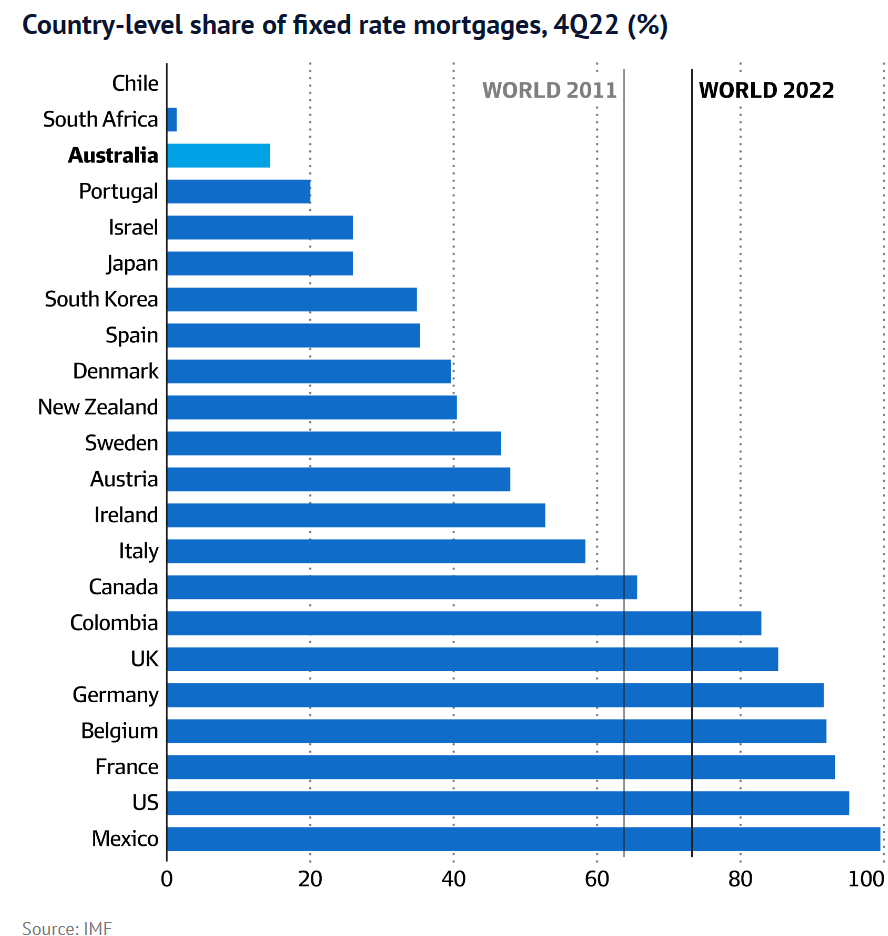

The reason should be obvious: Australia has one of the highest concentrations of variable rate mortgages in the world, whereas our fixed rate mortgages are typically of short duration (i.e. three years or less):

This has meant that Australian mortgage repayments have risen much faster than elsewhere, despite the Reserve Bank of Australia (RBA) lifting official interest rates by less than elsewhere:

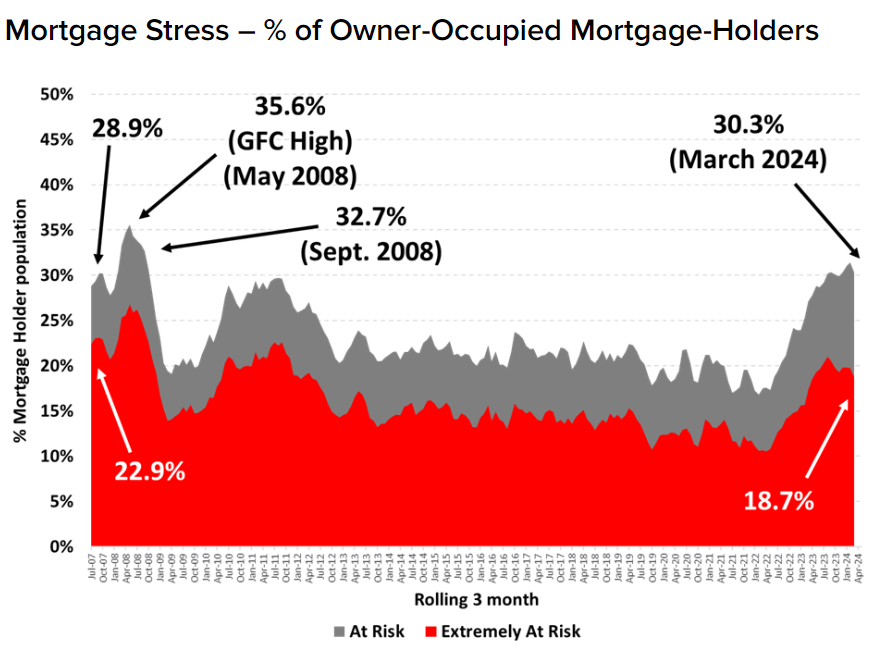

As a result, new research from Roy Morgan Research estimates that 724,000 more Australians are ‘At Risk’ of mortgage stress nearly two years after interest rates first began to increase:

“The number of Australians ‘At Risk’ of mortgage stress has increased by 724,000 since May 2022 when the RBA began a cycle of interest rate increases”, Roy Morgan says in its latest mortgage stress report.

“Official interest rates are now at 4.35%, the highest interest rates have been since December 2011, over a decade ago”.

“The number of mortgage holders considered ‘Extremely At Risk’, is now numbered at 918,000 (18.7% of mortgage holders) which is significantly above the long-term average over the last 10 years of 14.4%”.

The good news is that the percentage of Australians experiencing mortgage stress fell slightly in March, to 30.3% from 31.4%, reflecting stable mortgage rates and wage growth.

“The level of mortgage stress in March is the lowest so far this year and this month’s decline has been driven by rising household incomes which has reduced the financial pressure on some mortgage holders”, Roy Morgan notes.

Nevertheless, as the charts above show, Australian mortgage holders are copping it harder than residents of other nations.

If you want to save thousands of dollars in mortgage repayments, try the MB Compare n Save mortgage comparison tool. It takes less than a minute.

And if you choose to refinance, Compare n Save will handle the process.