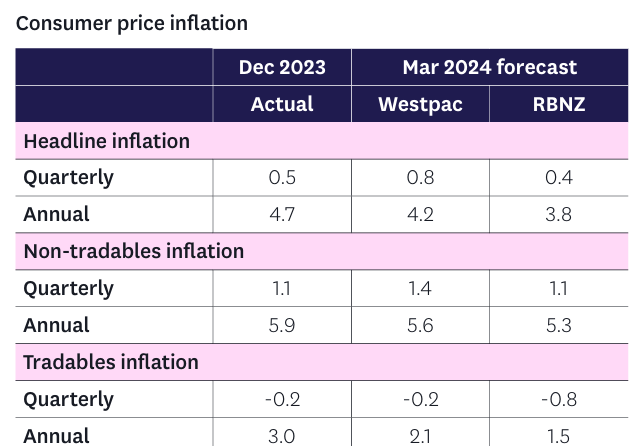

Westpac predicts that New Zealand CPI inflation will rise by 0.8% in the March quarter.

That would see the annual inflation rate drop to 4.2%, down from 4.7% at the end of 2023.

However, CPI inflation would still be stronger than the Reserve Bank assumed in its February Monetary Policy Statement.

Westpac notes that while inflation pressures are easing, that decline is occurring gradually, with measures of core inflation lingering at levels above the Reserve Bank’s target range.

Source: Westpac

Other major bank, ASB, expect a lift in headline CPI of 0.7% in Q1 24. This would bring annual inflation down to 4.1%, but above where the Reserve Bank expects based on the latest forecasts.

Westpac expects the Reserve Bank to keep rates on hold until February 2025, whereas ASB expect the first cut to arrive in November 2023.

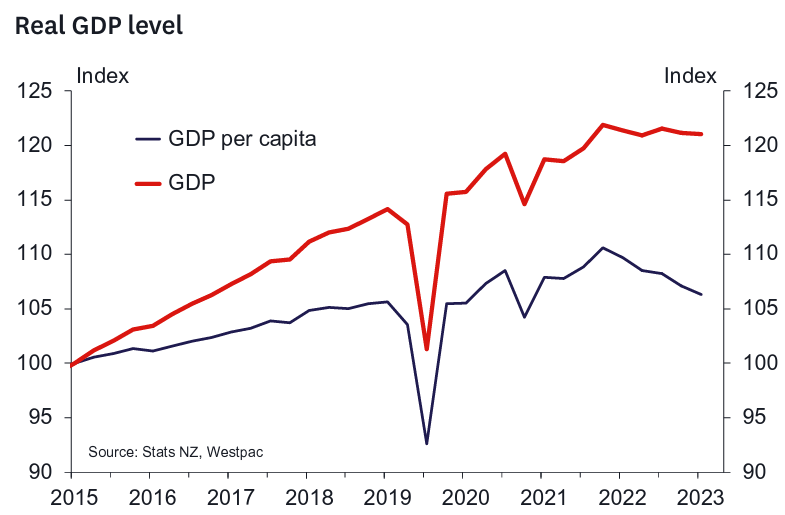

While CPI inflation is forecast to remain sticky, New Zealand’s economy continues to falter.

The economy is already mired in a technical recession:

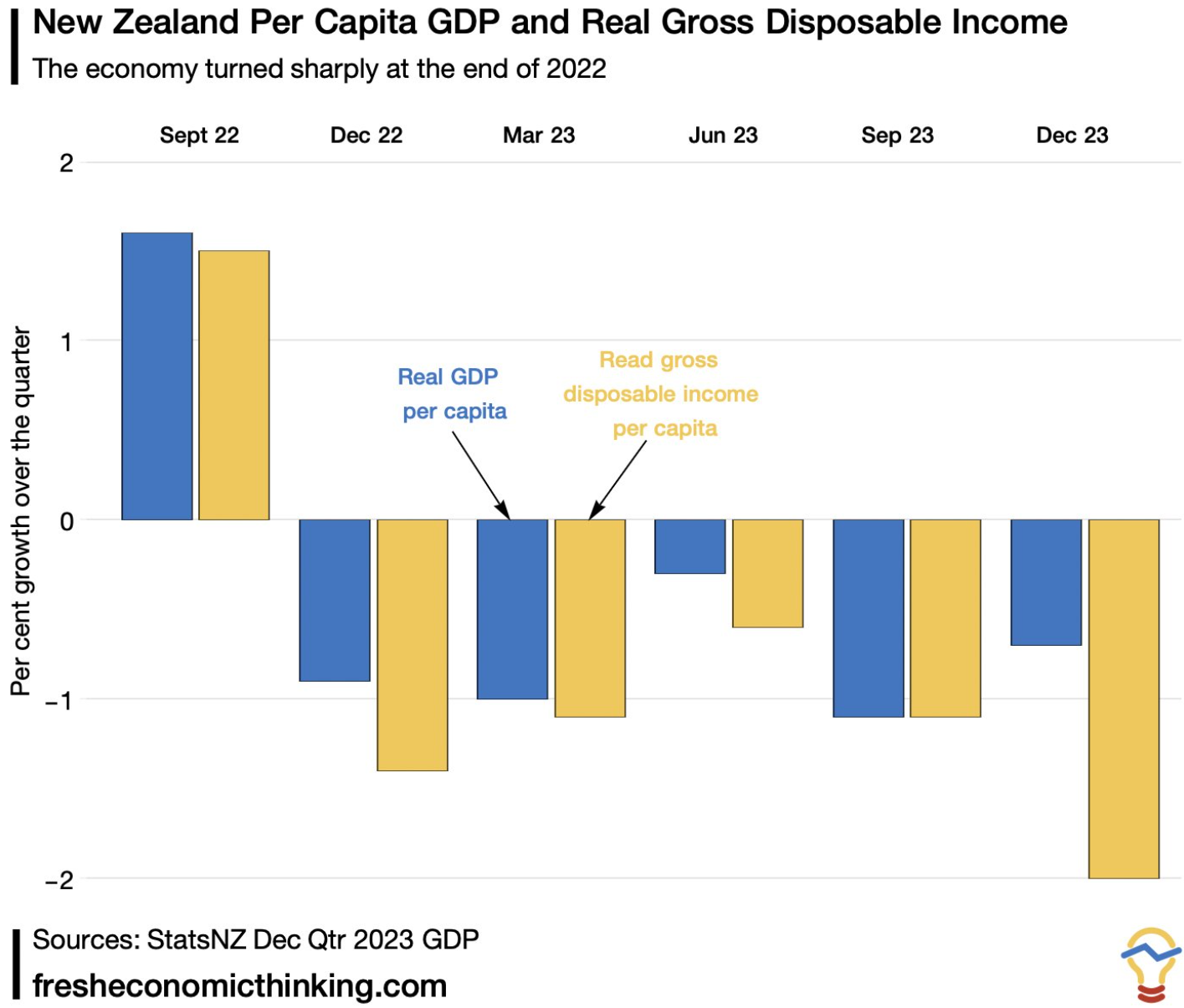

And per capita outcomes are far worse given New Zealand’s population has ballooned by 2.7%:

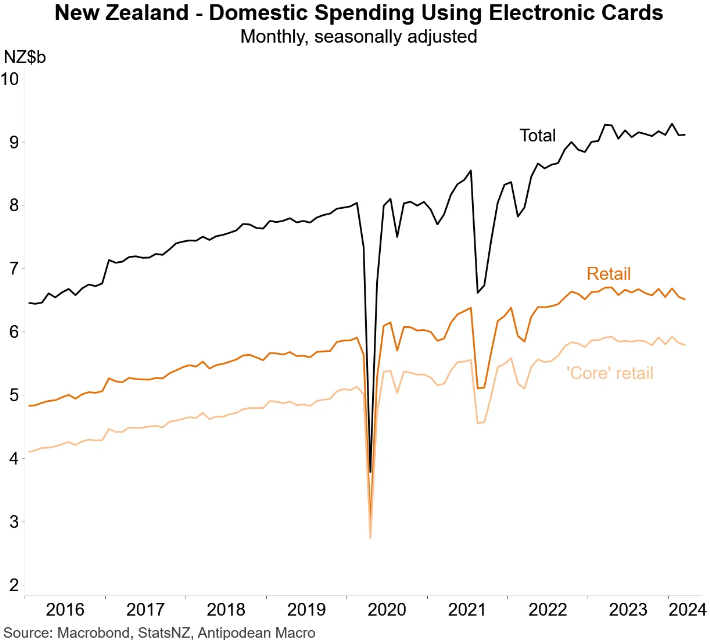

Retail spending has fallen sharply in real, population-adjusted terms:

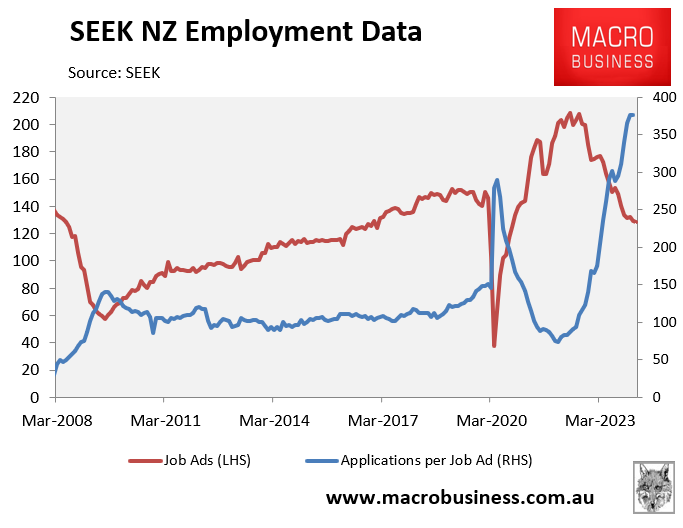

And the labour market is stalling with the number of applicants per job ad soaring to record levels, pointing to rising unemployment in the period ahead:

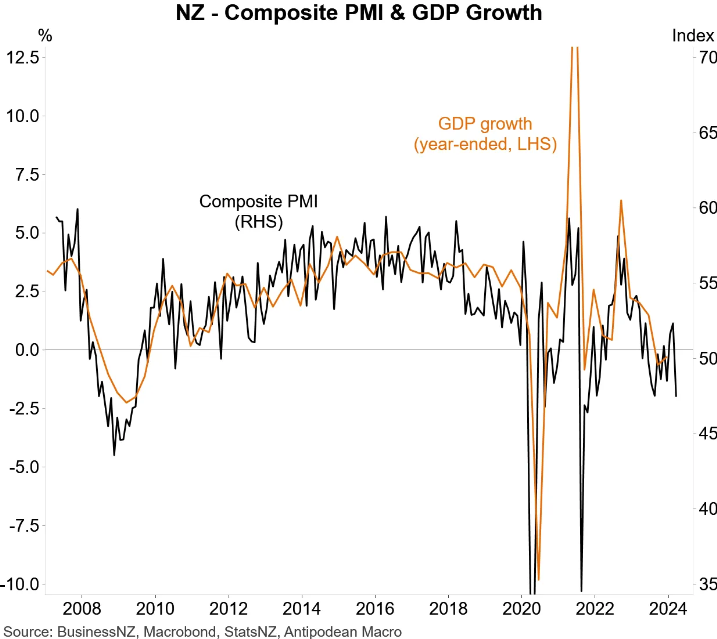

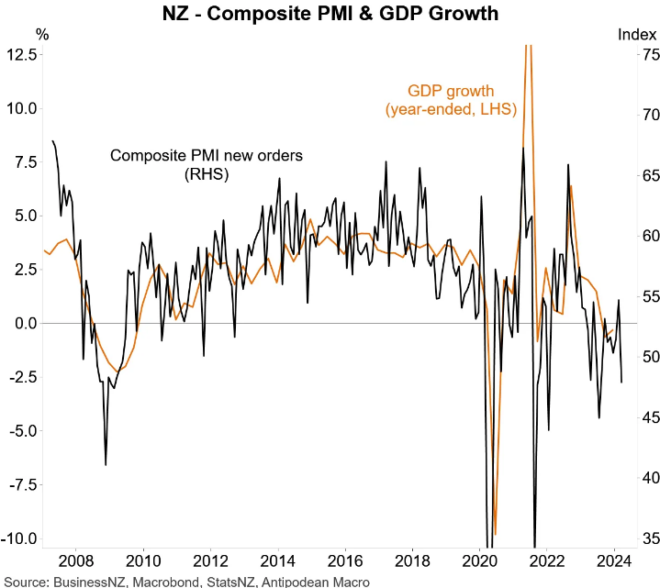

On Wednesday, the composite PMI was released, which suggests that New Zealand’s growth stalled in the first quarter.

The following charts from Justin Fabo at Antipodean Macro, which plot the composite PMI and new orders against GDP growth, tell the tale:

In short, the Reserve Bank is caught between stubborn services inflation and a recessionary economy.

I still expect the weakening economy to win out and for the Reserve Bank to cut rates in the second half.