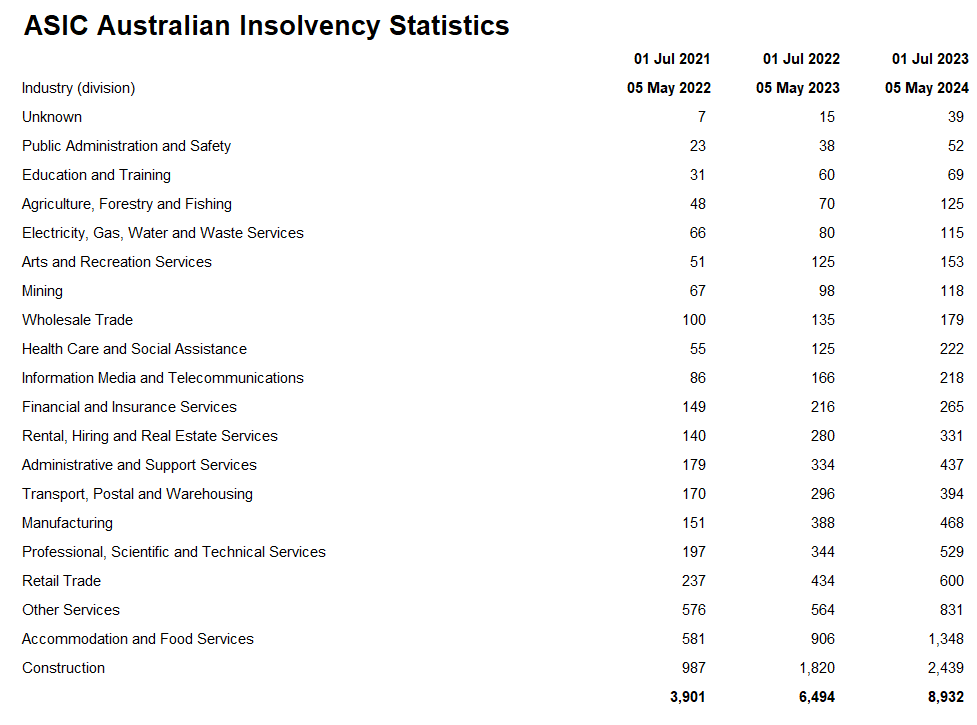

According to new data from the Australian Securities and Investments Commission (ASIC), the number of firms entering external administration continues to skyrocket, with 8,932 firms going out of business in the 10 months ending 5 May, 2024:

Total insolvencies have more than doubled from the same period in 2022, when 3,901 firms entered external administration.

As shown in the table above, the construction sector continues to lead Australia’s insolvencies with 2,439 building companies entering administration so far this financial year.

This represents a roughly 150% increase on the number of construction firms that entered external administration in the same timeframe in 2022.

Australian home builders, in particular, have been hit hard.

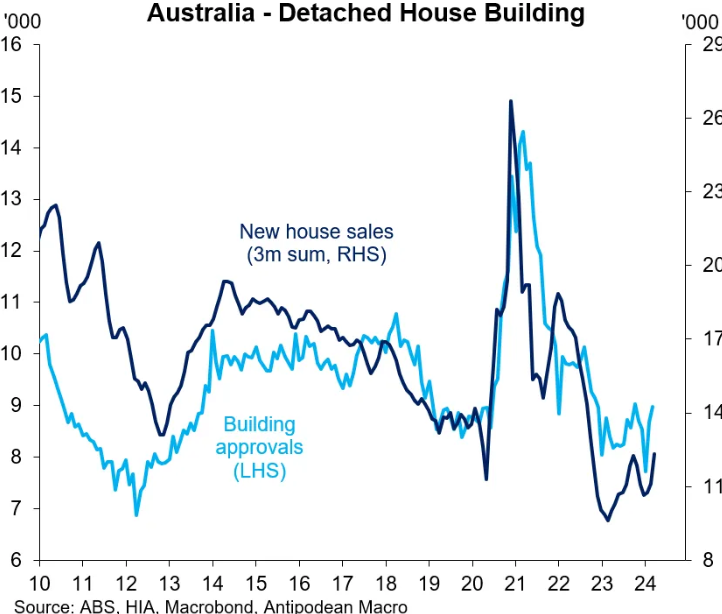

High interest rates has increased the cost of financing while also reducing buyer demand. As a result, both new home sales and dwelling approvals have collapsed to cyclical lows:

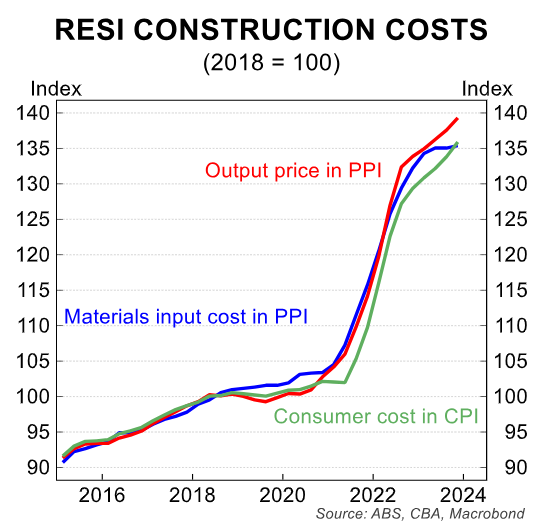

Australian home builders are also contending with the hyperinflation of construction and labour costs since the beginning of the pandemic. These have driven up the cost of building new homes and driven many builders on fixed-price contracts into administration or liquidation:

Finally, home builders must compete for scarce workers against state government ‘Big Build’ infrastructure projects.

As a result, margins have shrunk, and builders are struggling to make a profit.

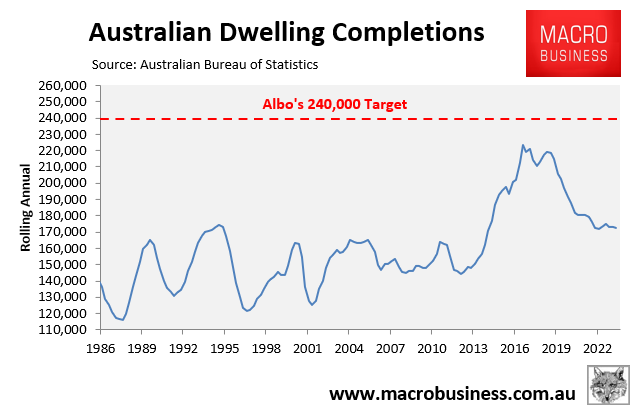

It also means that the Albanese government’s target of constructing 1.2 million new dwellings has little chance of success.

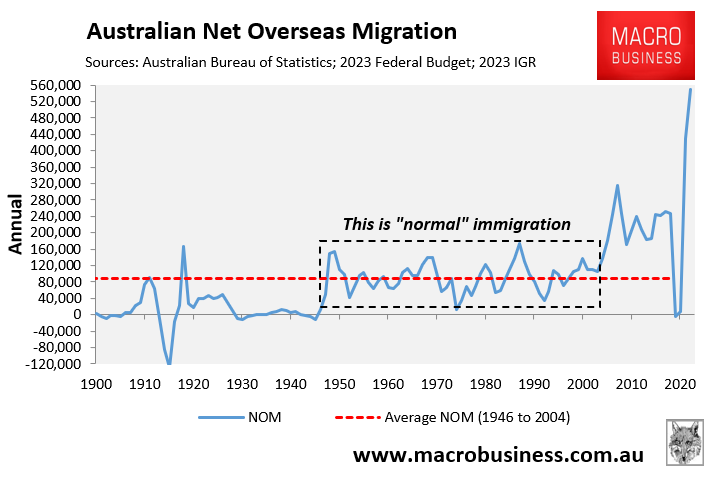

Australian tenants will continue to pay higher rents as long as the federal government runs an immigration program that is well beyond the nation’s capacity to build homes and infrastructure.