What a difference a month makes in the world of Australian economics.

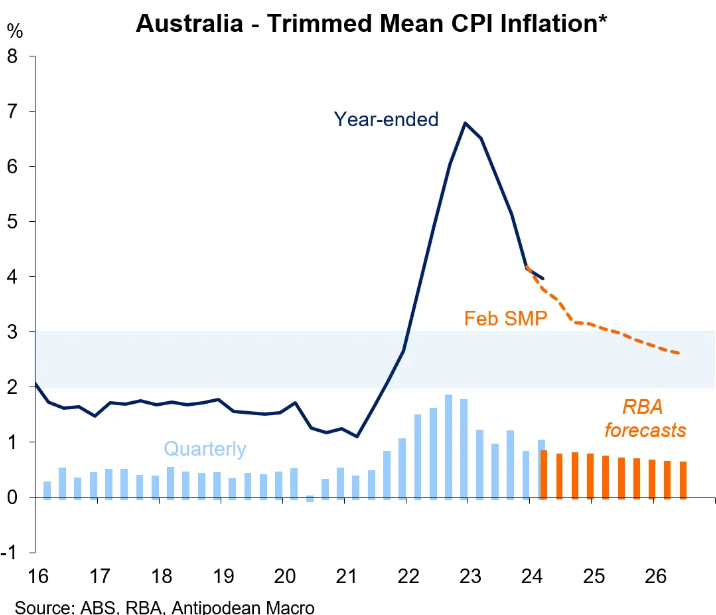

On 24 April, the Australian Bureau of Statistics (ABS) released the March quarter consumer price index (CPI), which recorded stronger growth than economists and the Reserve Bank of Australia (RBA) had forecast.

This led to a conga-line of economists tipping that the RBA would hike interest rates.

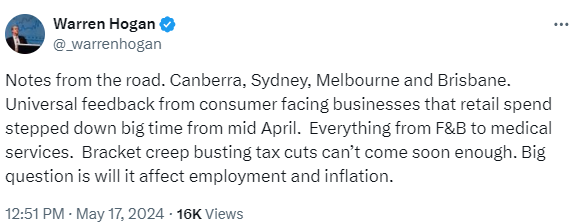

Judo Bank’s Warren Hogan was most hawkish, tipping three interest rate hikes by the end of the year.

However, it appears that Hogan is backing down on his aggressive call, noting that liaison with businesses across the nation suggests that consumer spending “stepped down big time from mid-April”:

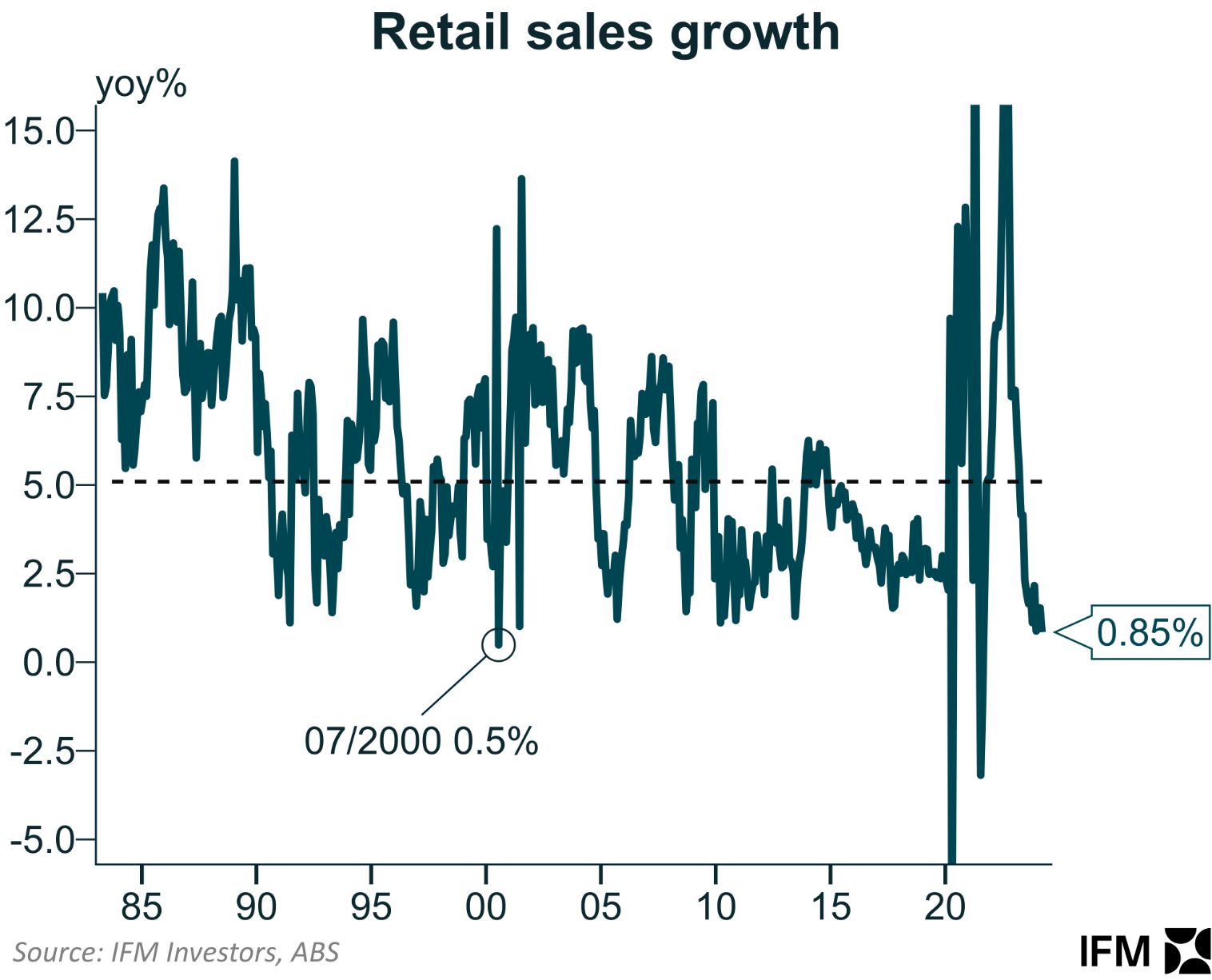

If this is true, then it should be sounding alarm bells at the RBA, given the latest retail sales data shows that annual retail sales growth fell to its lowest level since 2000 outside of the pandemic in March:

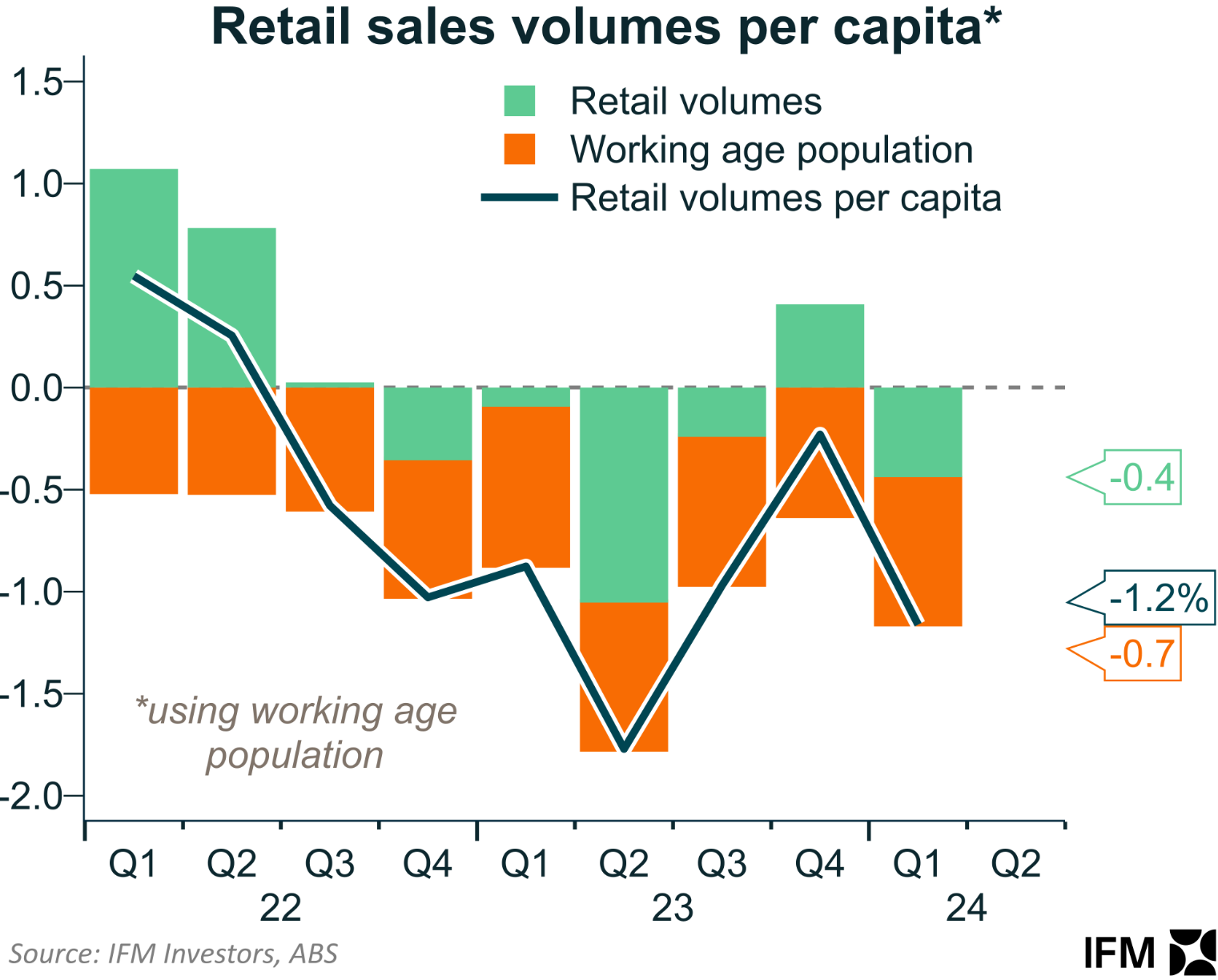

Real per capita retail sales had also fallen nearly 6% below their mid-2022 peak as of the March quarter:

This followed seven consecutive quarters of negative per capita retail sales growth:

Almost all the data released since last month’s CPI inflation shocker has been weaker than expected.

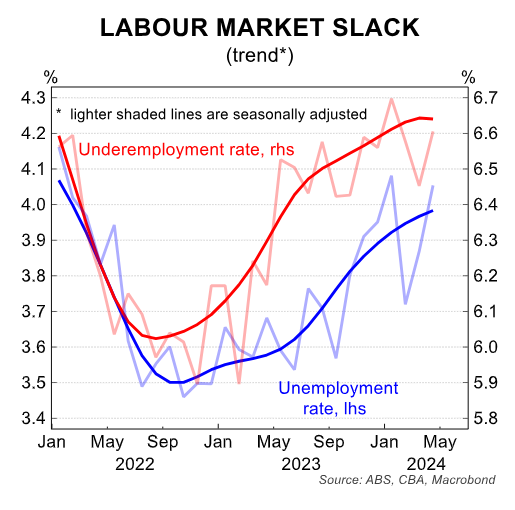

Australia’s unemployment rate lifted 0.2% to 4.1% in April, with the underemployment rate also edging up by 0.1% to 6.6%:

The unemployment rate is now perilously close to the RBA’s end-of-year unemployment forecast of 4.3%.

Hours worked were flat in April but are now down 0.8% over the past year, another sign of a softening labour market and the switch to part-time.

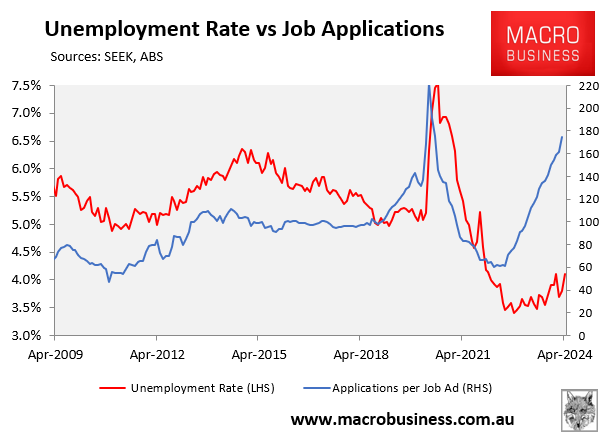

The data follows the sharp rise in the number of applicants per job ad reported by Seek, which is tracking 55% higher than 2019 levels.

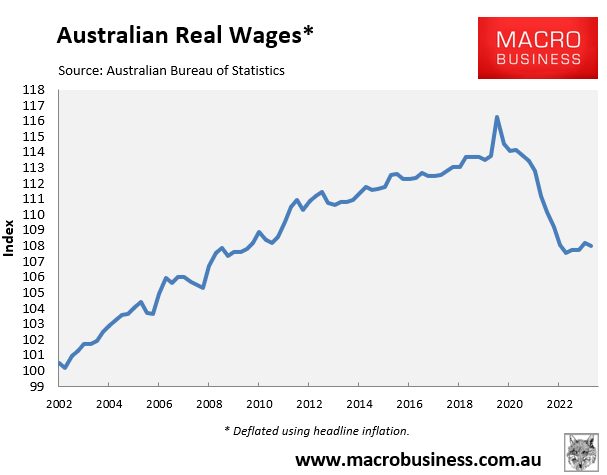

Meanwhile, the ABS wage price index recorded wage growth of only 0.8% in the March quarter (3.2% annualised), which was below economists’ and the RBA’s expectations.

Wage growth was also lower than the March quarter headline CPI growth of 1.0% and underlying inflation of 1.1%.

This means that Australian real wages are falling once more and are now 7.1% below their June 2020 peak.

Finally, last week’s NAB business survey recorded slower economic activity, slower employment growth, lower labour cost growth, and lower inflation. It also suggested that Australia’s per capita recession has deepened.

The RBA has two mandates: price stability and full employment.

Therefore, there is little likelihood that the RBA will hike rates when such weak conditions are present.

Accordingly, the next move in interest rates will very likely be down. It is only a question of when.