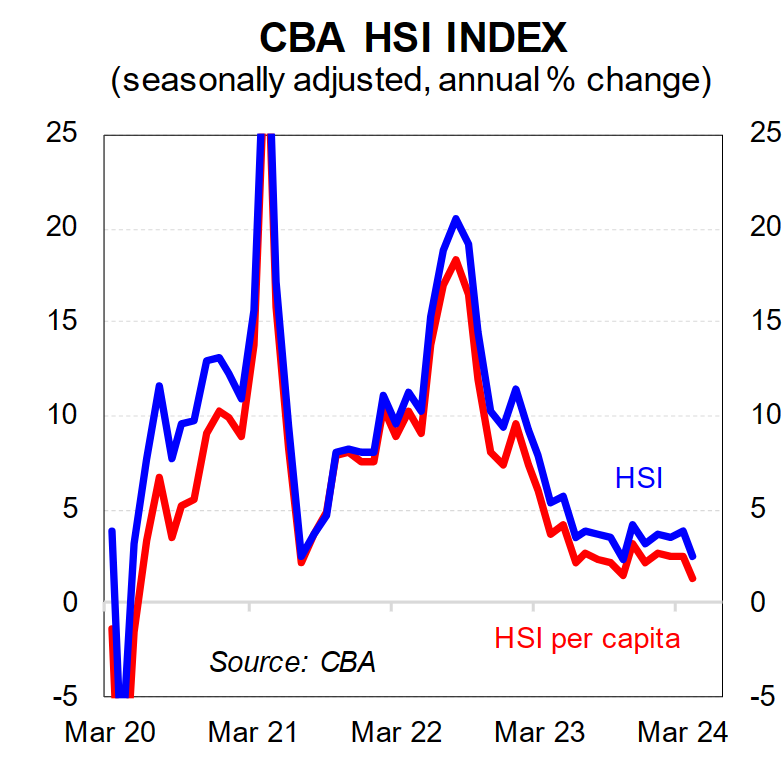

This week, CBA released its Household Spending Insights (HSI) survey for April, which is based on spending data from CBA customers.

According to CBA, per capita household spending rose just 1.4% over the year to March, well below CPI inflation of 3.6%:

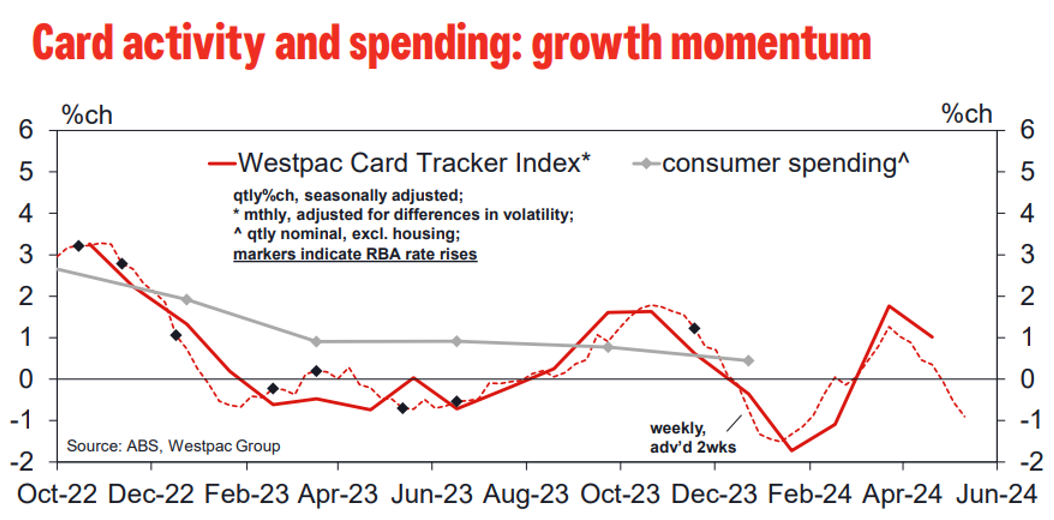

On Tuesday, Westpac released its credit card activity report for March, which also recorded falling spending growth.

The next chart from Westpac plots Westpac Card Tracker’s quarterly growth pace alongside nominal spending growth from the national accounts:

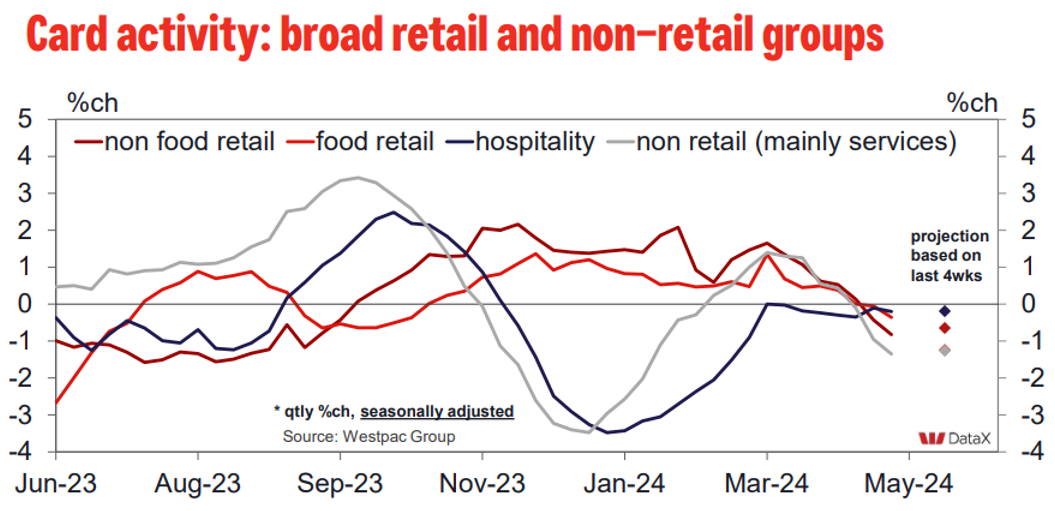

According to Westpac, “momentum had a weak finish to 2023, recovering in Q1 but falling away again through March-April, dropping back into negative over the last two weeks”.

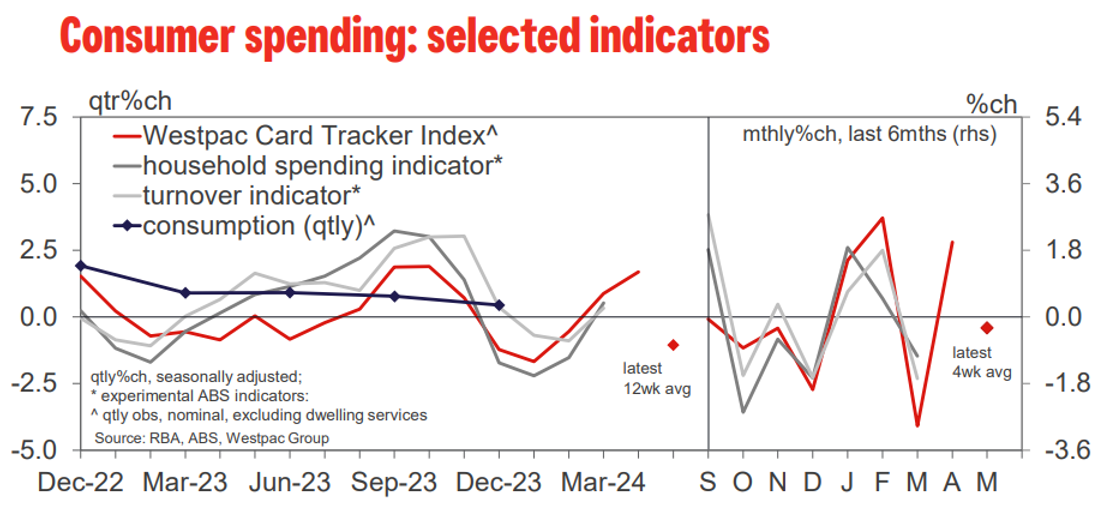

“Other timely indicators confirm the weak March month. The ABS household spending indicator looks to have declined 1.1% in the month while the ABS monthly business turnover indicator, based on ATO data on BAS statements, suggest consumer sector activity recorded a 1.7% decline (Westpac estimates of seasonally adjusted activity)”.

“Note that even with these monthly declines, quarterly growth rates remain in slight positive – in the 0-0.5%qtr range – consistent with a flat quarter for real consumer spend”, notes Westpac.

The above Westpac data is not adjusted for population growth, which likely tracked at nearly 2.5% in the year to March.

Therefore, Australian households are cutting back spending heavily in real per capita terms.

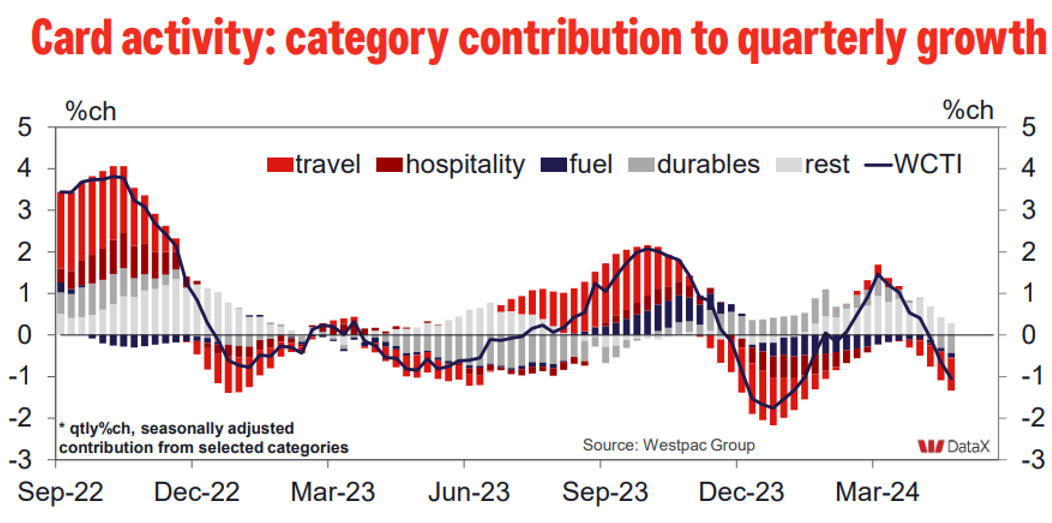

Westpac also notes that discretionary household spending has fallen most heavily, reflecting cost-of-living concerns.

“Discretionary categories are showing outright declines in quarterly terms, across both goods and services”, Westpac says.

“Essentials have maintained positive growth but with momentum slowing markedly. Since late 2022, the detailed segments with the biggest declines in per capita activity have been: housing-related durables, hospitality, travel and vehicle-related segments, all down 6-10%”.

“Retail segments have also shown a clear weakening – card activity in the segment swing back to outright quarterly declines over the last two weeks, the contraction running at its fastest pace since mid-Sep”, Westpac notes.

“All broad retail segments – basic food, hospitality and non-food retail – are seeing outright declines, albeit with hospitality holding up a little better”.

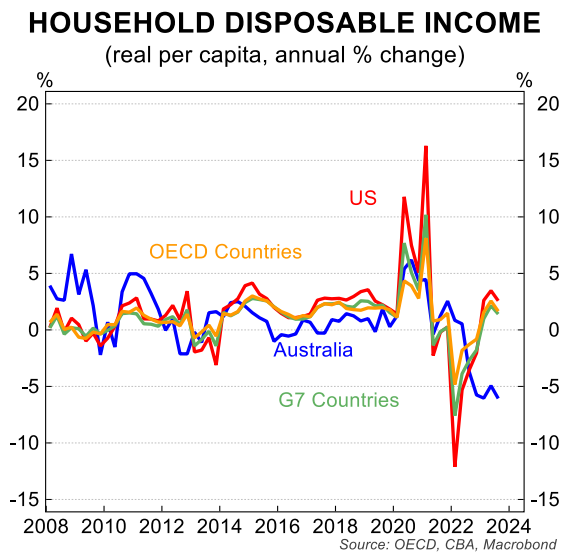

The decline in spending makes sense given Australian household disposable incomes fell by 6% in 2023, recording one of the world’s biggest declines:

The slump in household spending and incomes is another reason why the Reserve Bank of Australia (RBA) is highly unlikely to lift interest rates further.

To the contrary, the next move in interest rates will be down. It is only a matter of timing.