Tuesday’s retail sales figures suggested Australia’s per capita recession has deepened.

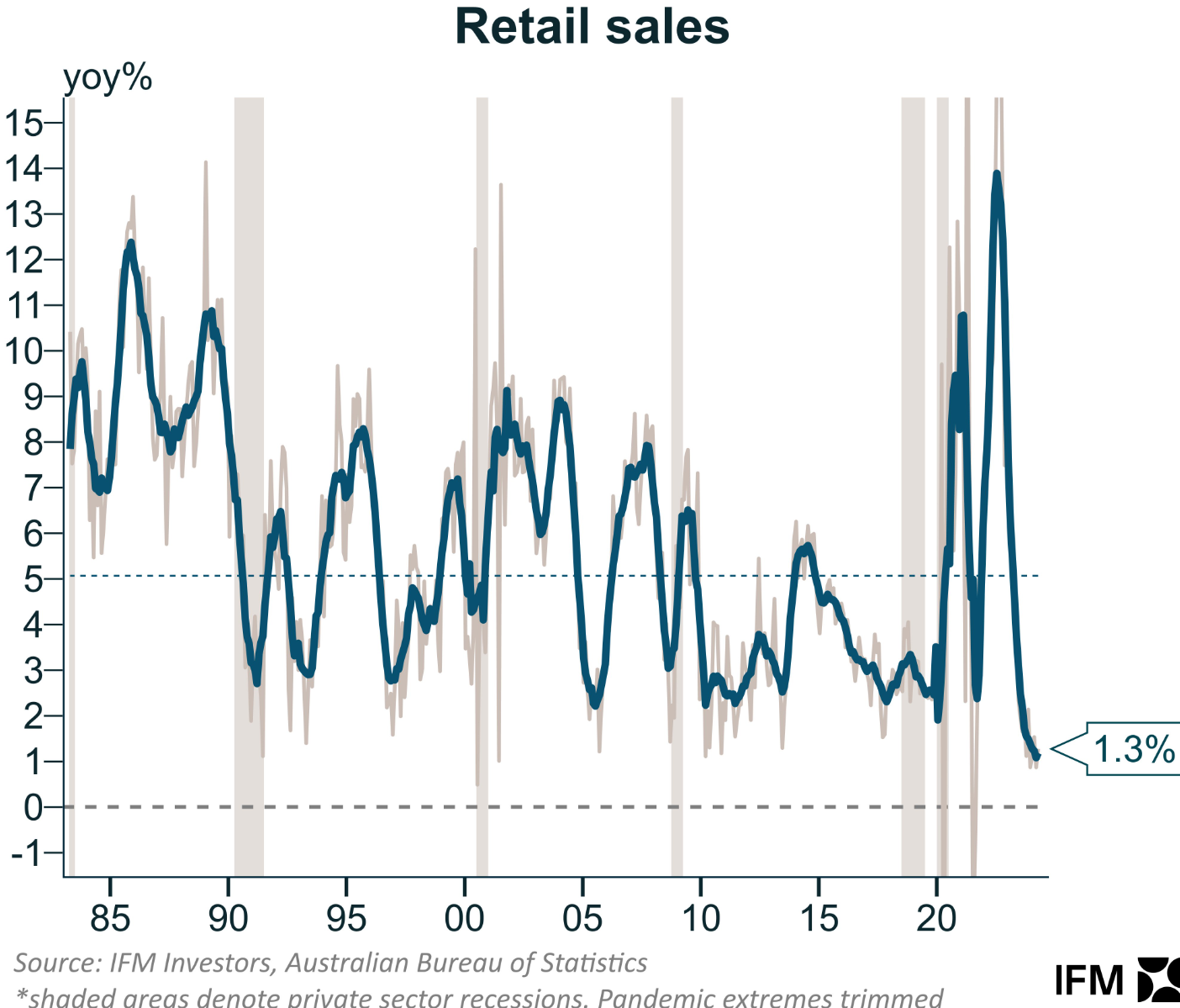

As the following chart from IFM Investors chief economist Alex Joiner shows, Australia’s annual retail sales growth of just 1.3% was the worst result in at least three decades outside of the pandemic:

This annual growth in retail sales of 1.3% compares to annual CPI inflation of 3.6% and population growth of around 2.5%.

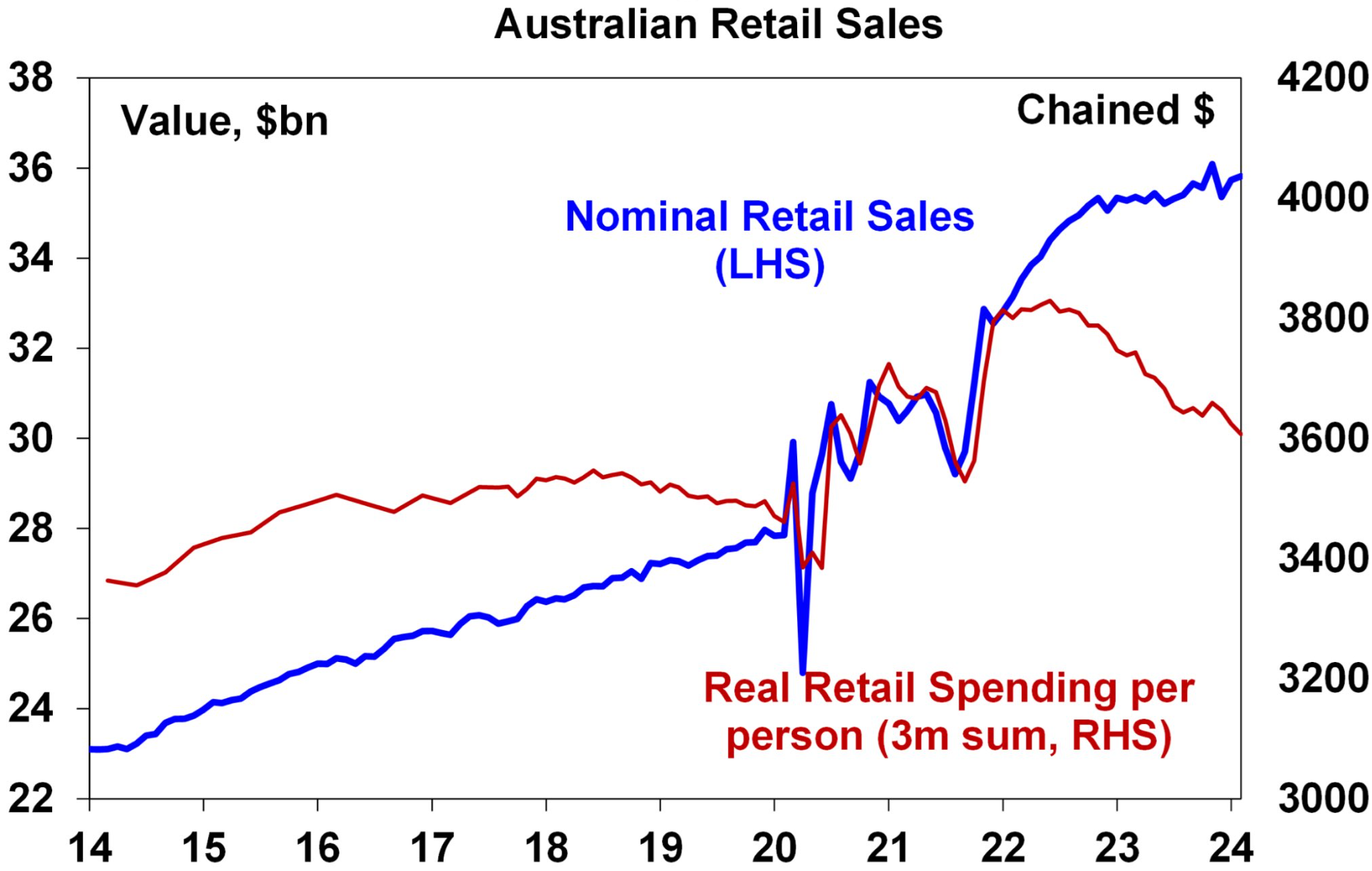

As a result, the following chart from Shane Oliver at AMP shows that real per capita retail sales have plunged:

Source: Shane Oliver (AMP)

CBA economists Belinda Allen and Stephen Wu diagnosed the situation as follows:

“Households are cutting back on spending for three key reasons”.

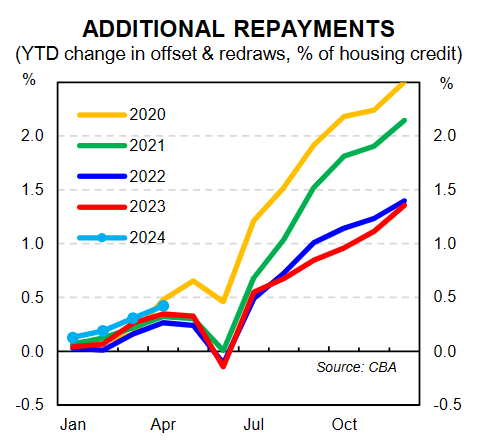

“The first is the high opportunity cost of not saving given the high level of interest rates”.

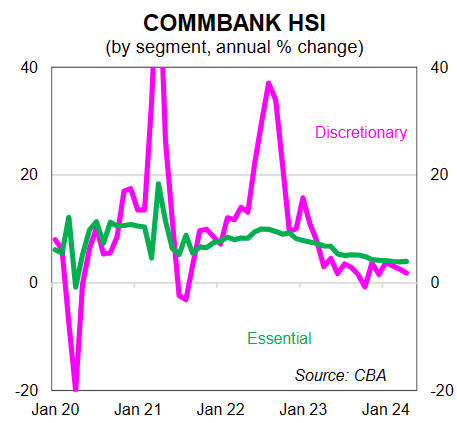

“Second is the impact from non-discretionary inflation with households having to devote a larger share of wallet to fund these purchases. We can see the difference in trend between essential and discretionary spending in the CBA Household Spending Insights data”.

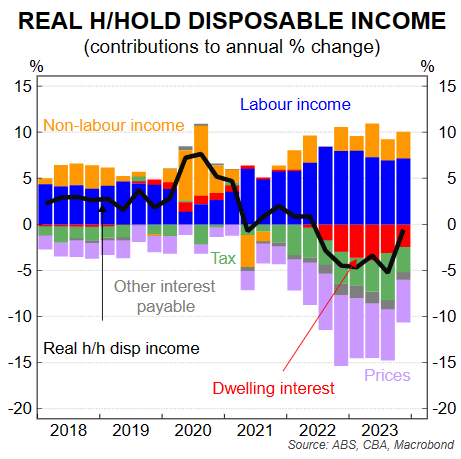

“The third has been the overall hit to real household disposable income”…

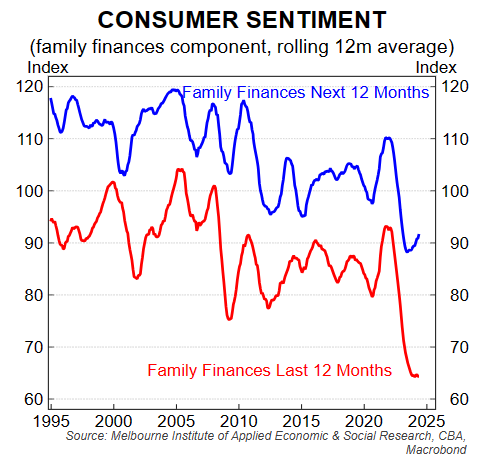

“Consumers are currently behaving very cautiously. This is consistent with the very depressed levels of consumer sentiment and surveyed measures of pessimism towards family finances”.

The upshot is that the case for further interest rate hikes has vanished amid the collapsing consumer economy.

The next move in interest rates is down. It is only a matter of when.