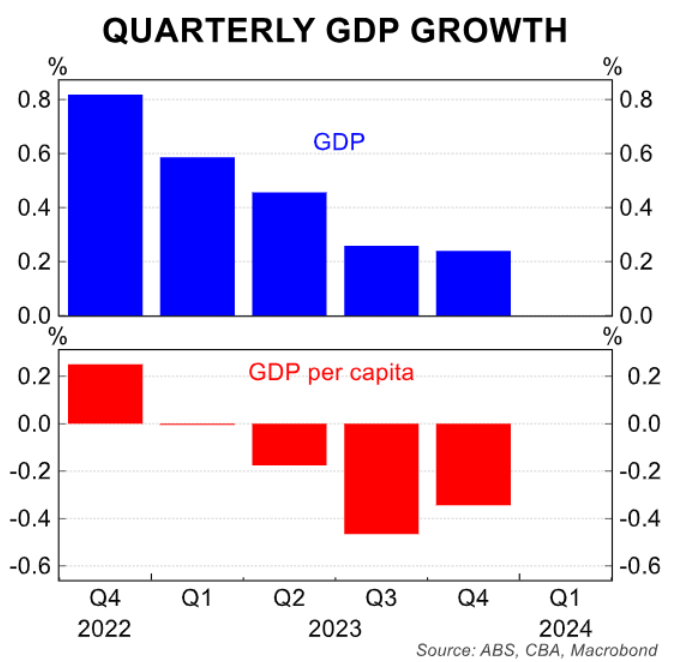

The most recent national accounts from the Australian Bureau of Statistics (ABS) showed that GDP per capita fell by 1.0% in 2023 following four consecutive quarters of decline:

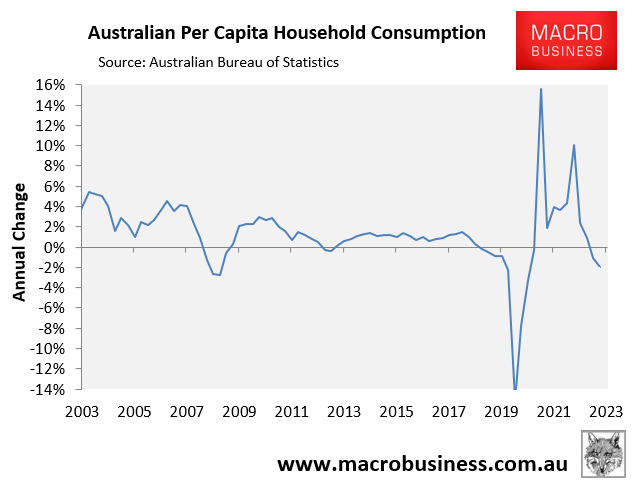

The household sector has driven the recession, with Australia’s real per capita household final consumption declining by 2.5% in 2023:

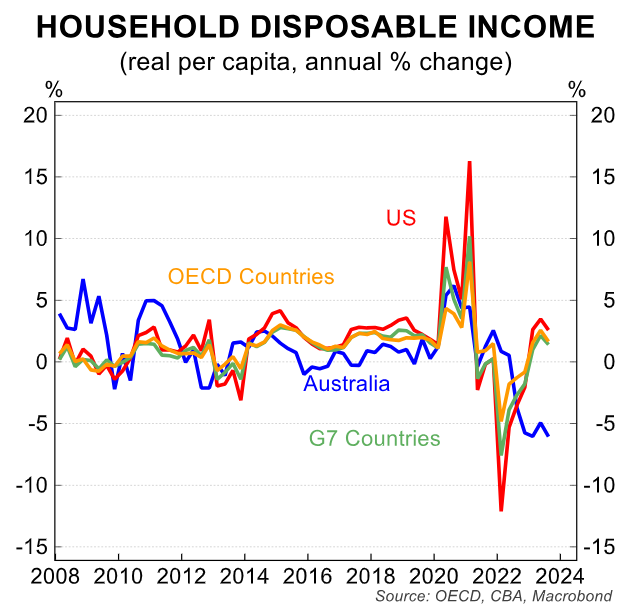

This sharp decline in real per capita household consumption followed a world-record 6% decline in real per capita household disposable income in 2023:

The latest economic data suggests that Australia’s economy has fallen deeper into recession, at least in a per capita sense.

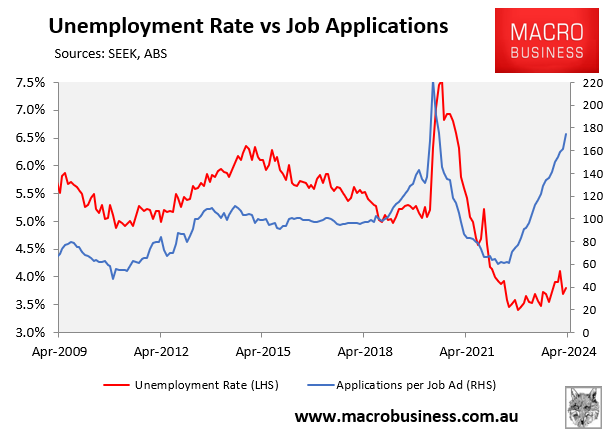

Last week, SEEK released its April employment report, which showed that the number of applicants per job ad has rocketed way above pre-pandemic levels:

This data suggests that the number of job seekers has risen well above the number of available jobs.

On Monday, the NAB business survey showed that the economy deteriorated further in April.

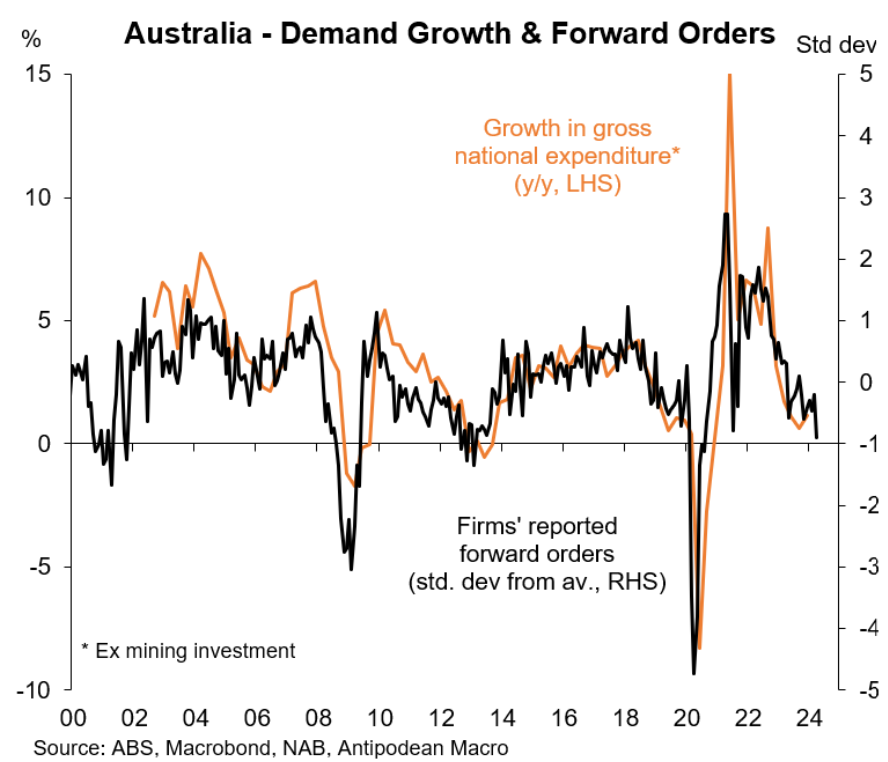

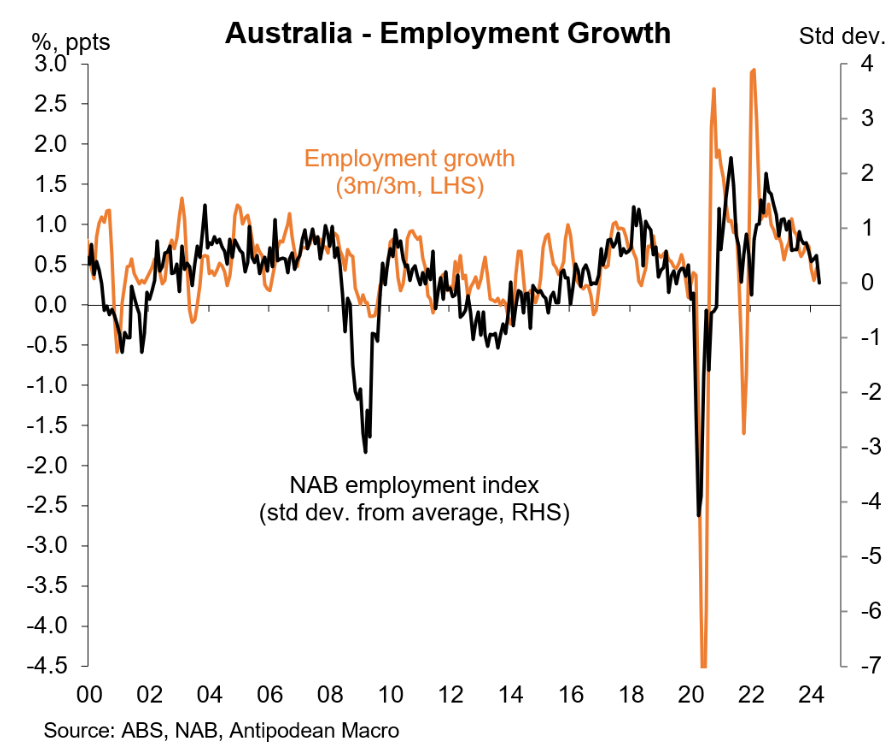

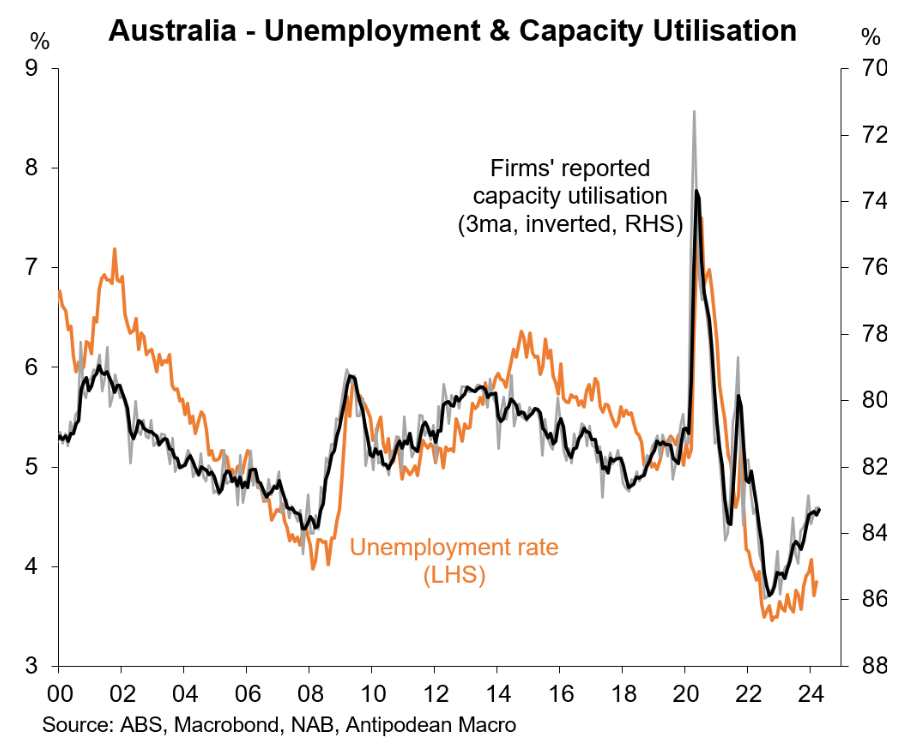

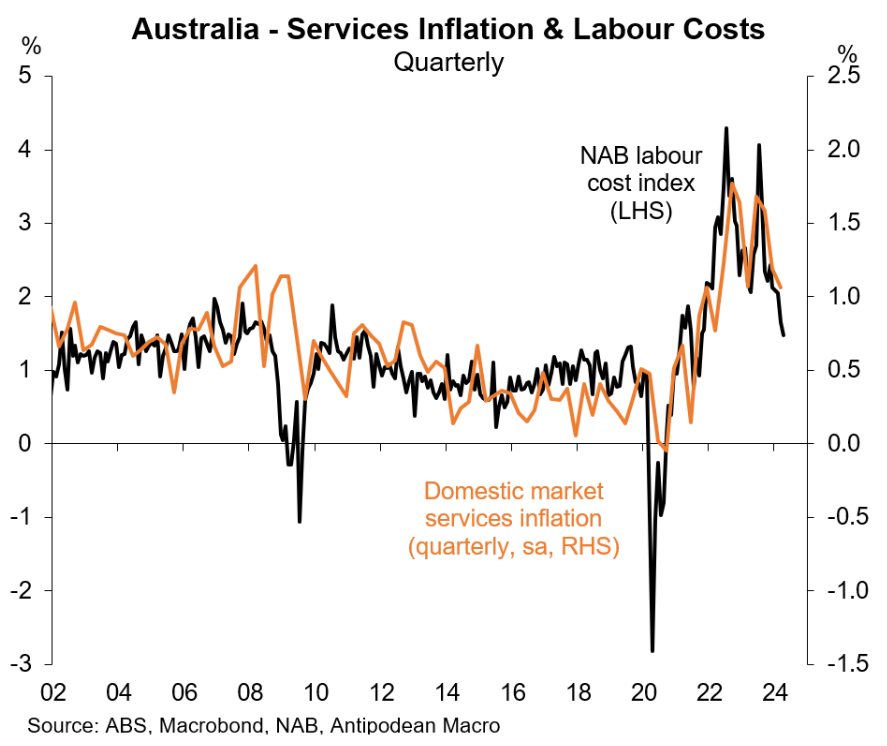

The below charts from Justin Fabo at Antipodean Macro tell the tale.

First, Australian firms reported weaker forward orders in April, consistent with ongoing weak growth in domestic demand:

Firms also reported that their hiring in April slowed to around average levels:

Capacity utilisation for Australian businesses has gradually eased for 2 years now, pointing to higher unemployment:

Finally, private-sector labour costs continued to slow in April, which points to slower services inflation:

Justin Fabo notes that “slower signals for activity, employment, labour coasts and inflation” from the NAB business survey “will have been met with a collective sigh of relief by the RBA”.

The case for additional interest rate hikes is evaporating amid the deepening per capita recession.