The 2023 calendar year was an absolute shocker for Australian households.

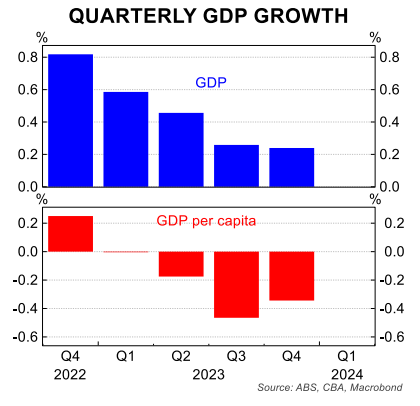

Real per capita GDP fell by 1.0% following four consecutive quarterly declines:

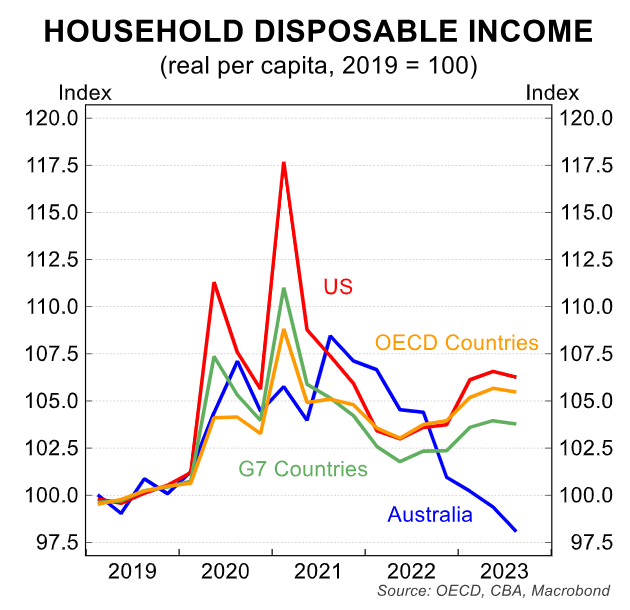

Households were hit harder, experiencing one of the sharpest declines in real per capita incomes in the world:

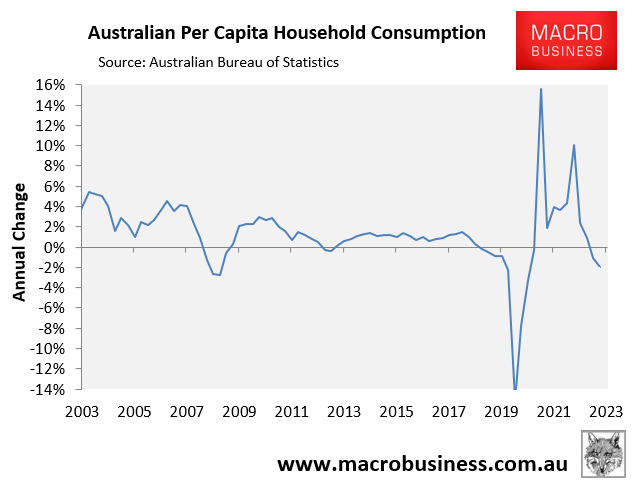

Real per capita household consumption also declined by 2.5% in 2023, which was worse than the 1.0% decline in per capita GDP:

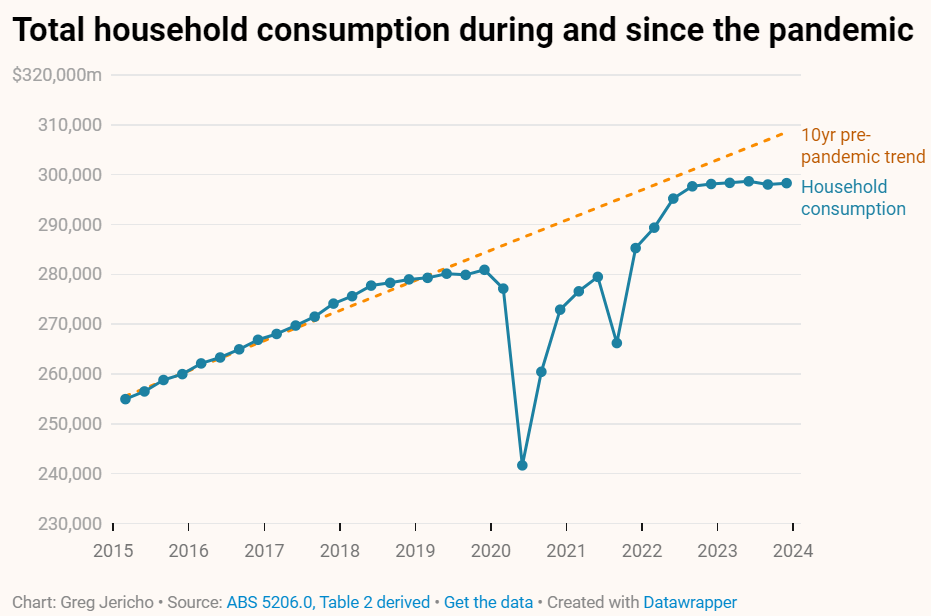

The next chart from Greg Jericho shows that total household consumption is running well below trend, despite unprecedented population growth:

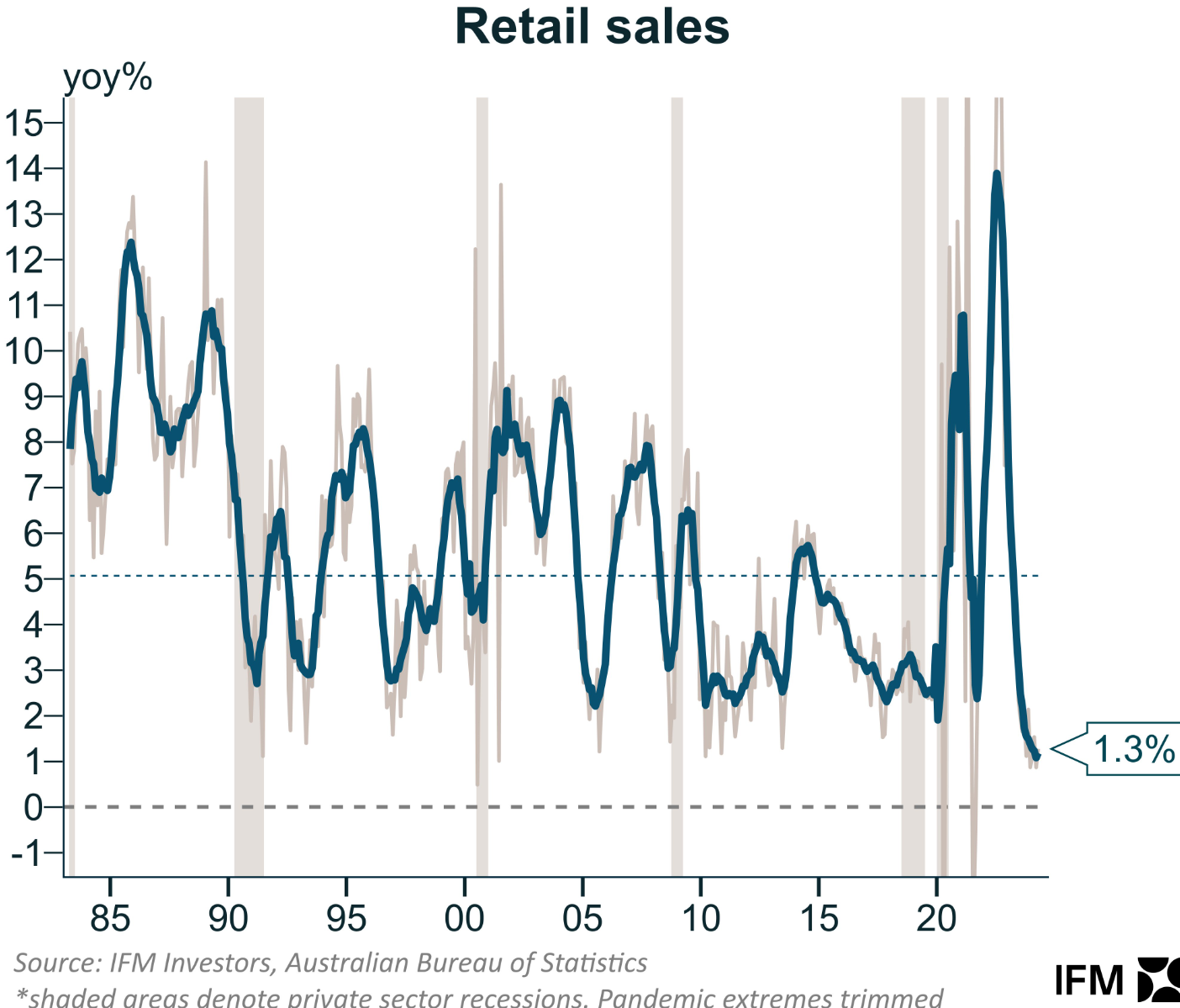

This week’s retail sales data from the Australian Bureau of Statistics (ABS) suggested that the per capita recession has worsened.

Annual retail sales growth plunged to its lowest level in more than 30 years outside of the pandemic lockdown:

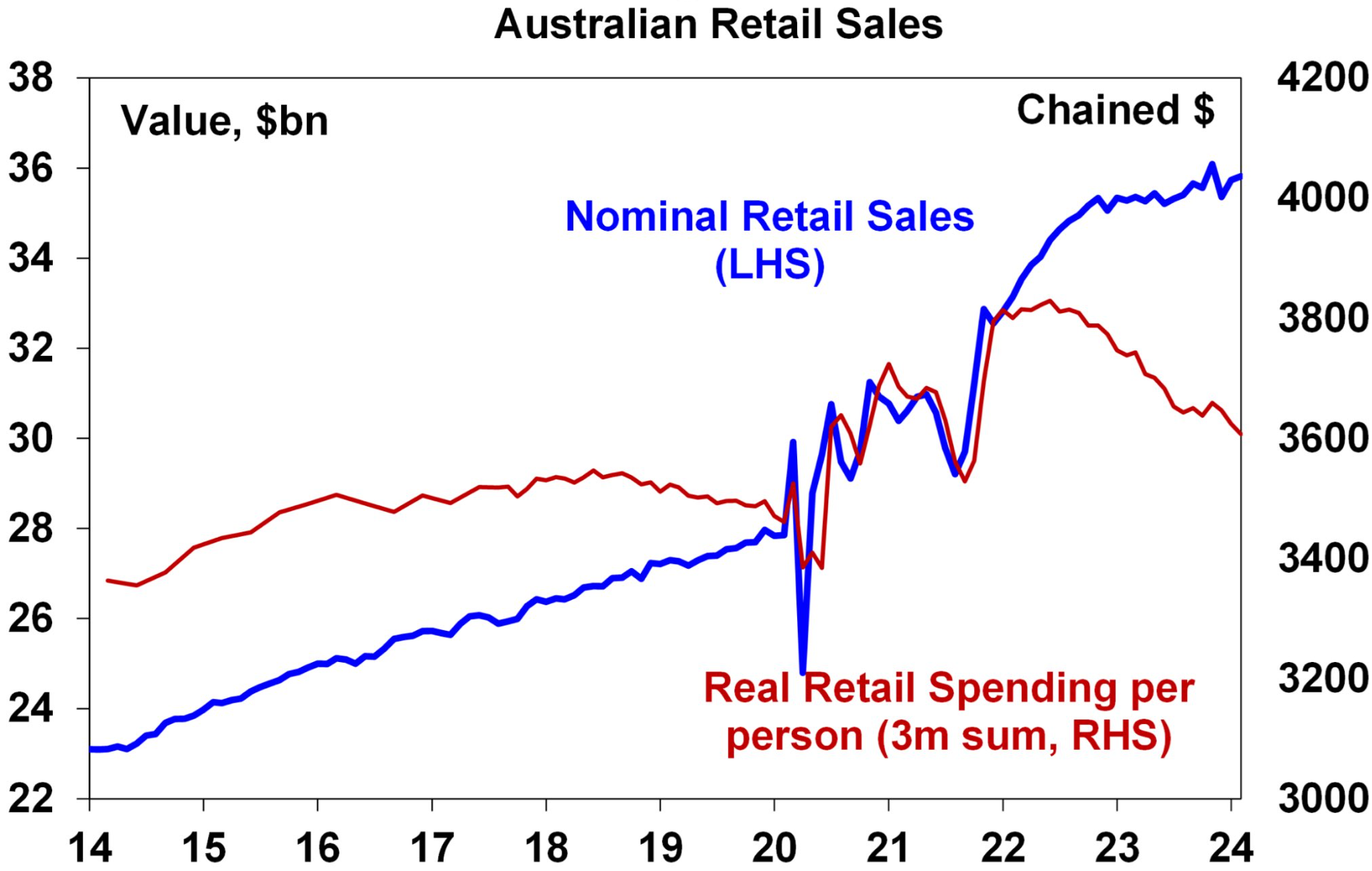

Real per capita retail sales also plummeted by around 4.5% in the year to April:

Source: AMP

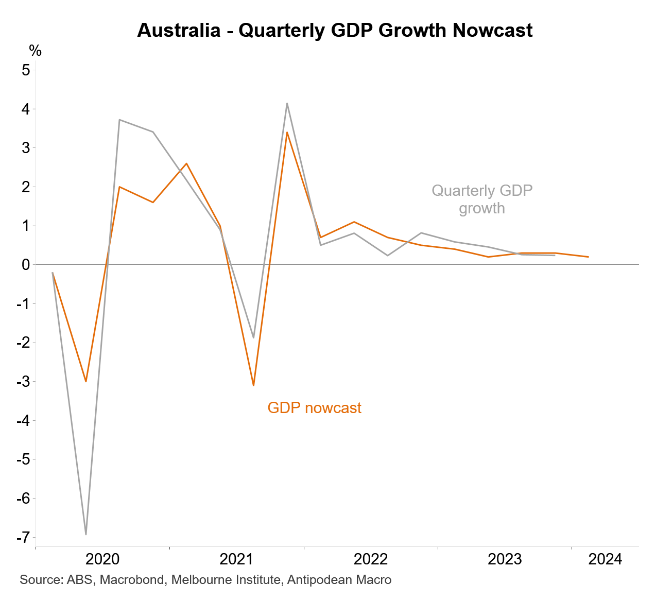

On Thursday, the Melbourne Institute released its latest nowcast for Australia’s Q1 GDP growth, which is plotted below by Justin Fabo at Antipodean Macro:

The Melbourne Institute tips that Australia’s GDP growth was 0.2% in the March quarter, which is well below the expected 0.5% to 0.6% population growth expected over the quarter.

As a result, Australians are set to endure the fifth consecutive quarterly decline in per capita GDP when the ABS releases the Q1 national accounts next week.

Even worse, the household sector will be the main contributor to this decline in GDP because it continues to experience difficulties with high interest rates, rent, energy costs, personal income taxes, real wage declines, and general cost-of-living pressures.