Bloomie with the sour note:

…at a major industry gathering in the iron-ore trading hub of Singapore this week, the murky prospects for Chinese real estate were still a major worry for market participants.

“There’s no real sign that things are turning around on construction,” said Atilla Widnell, managing director at Navigate Commodities Pte., who was at the gathering in the city-state. “Manufacturing was a bright spot but it has slowed. The bulls point to steel exports but you only get strong exports when the domestic market is in bad shape.”

…“The slowdown is structural, and there’s nothing that can compensate for the decline in construction steel demand,” said Tomas Gutierrez, an analyst at Kallanish Commodities, who was also in Singapore.

Some sense there. The week ended with weak steel but slightly better iron ore:

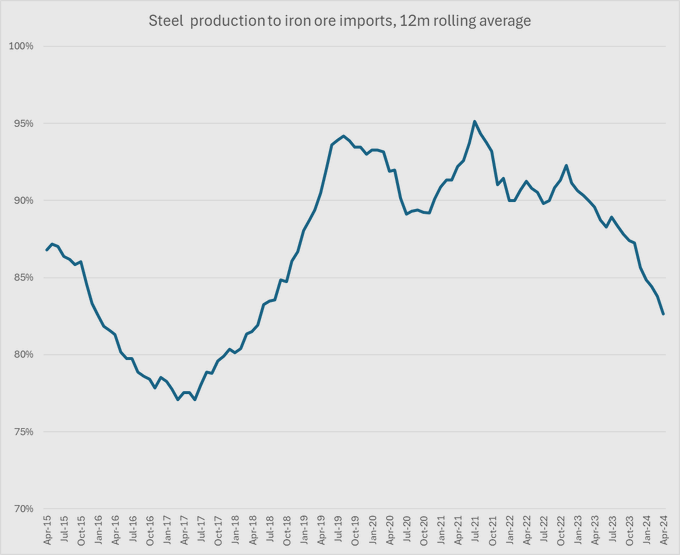

But the truth is, China is over importing iron ore as steel production inexorably fades:

We are only a few months away from the 2015 bottom. What then? China starts storing it in kitchen cupboards?

No, imports will fall and so will the iron ore price as the great cost curve shakeout begins.