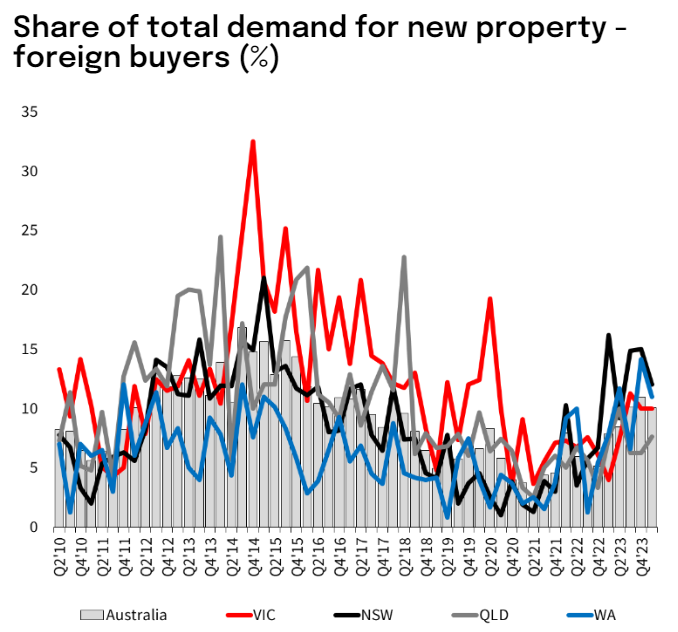

According to the quarterly NAB property survey, the share of foreign buyers in new Australian housing markets dropped from 11% in Q4 to 10% in Q1, but is above the long-term survey average (9.1%).

The market share has nearly five-fold increased since the COVID-19 pandemic in mid-2021, when it was barely over 2%.

Foreign purchasers’ market share in new property markets decreased in Q1 due to declines in NSW (12%, down from 15% in Q4) and WA (11%, down from 14.2%). In Q4, foreign purchasers increased in QLD (7.6%, down from 6.3%) and held flat in VIC (10%).

The market share of international customers is above average in all assessed states.

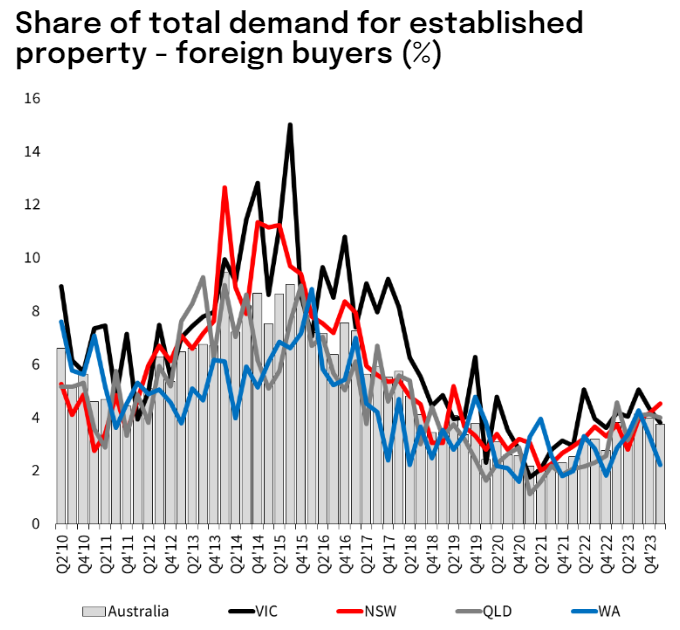

In established housing markets, foreign purchasers dropped to 3.8% (4.0% in Q4), remaining below the average (4.7%).

Market share rose to 4.5% in NSW from 4.2% in Q4.

Other states saw market share decline in Q1: QLD (4.0%), VIC (3.8%), and WA (2.2%).

Foreign buyers’ market share in established property markets in Q1 remained below long-term averages across all states.

The last chart is the kicker. That is a very modest rebound given the extreme levels of immigration.

This bares out recent reports that Chinese buyers, in particular, have turned sellers of Aussie property.