Data from CommBank iQ shows that the cost-of-living crisis and high interest rates are having a disproportionate impact on Australians’ spending habits based on their generation.

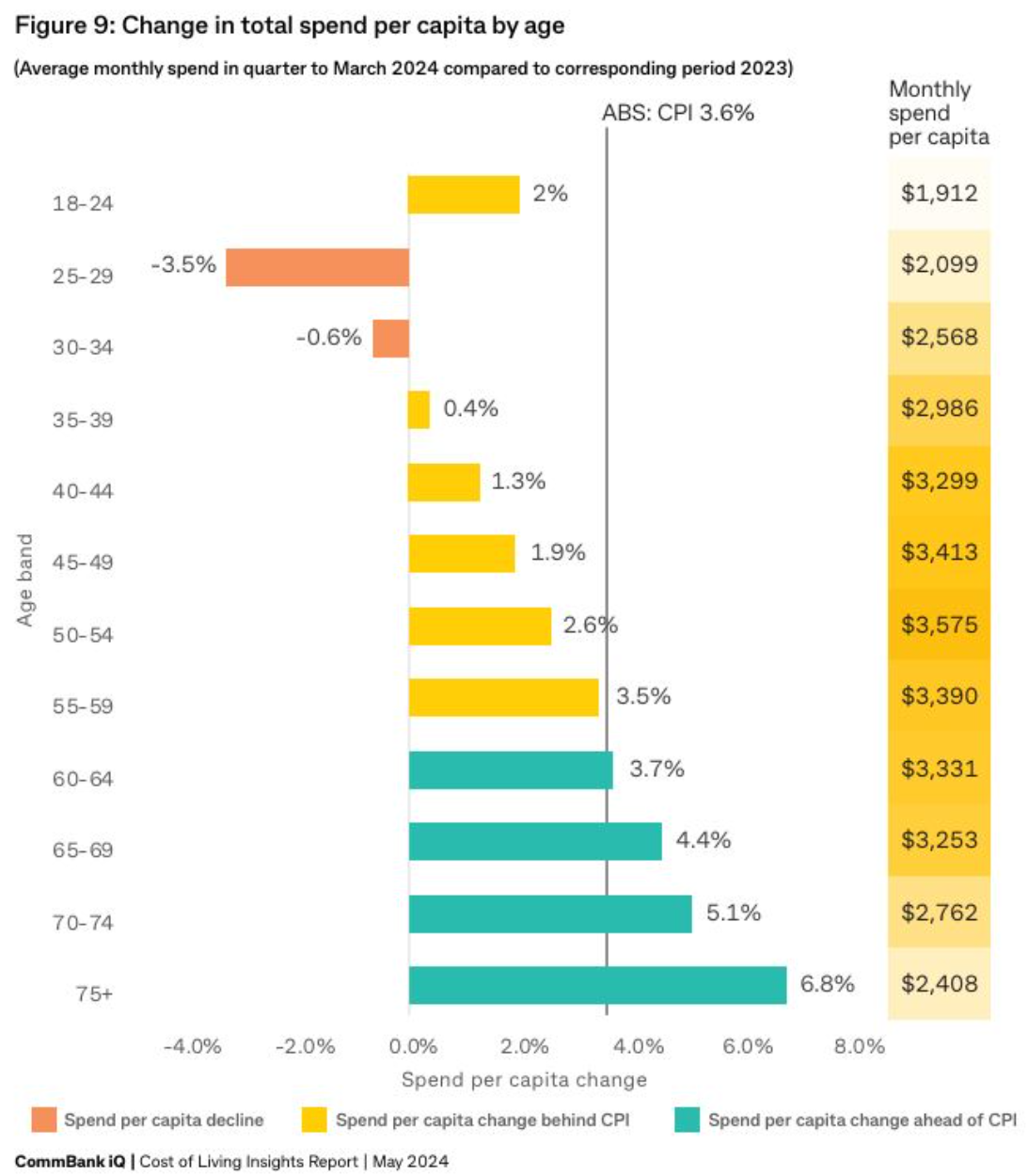

As illustrated below, Australians aged over 60 increased their spending by more than CPI inflation in the year to March 2024, whereas Australians aged under 60 increased their spending by less than inflation over the same period.

Australians aged between 25 and 34 outright cut their spending over the year.

As you can see, the increase in spending over the year more or less was correlated with age, with older households increasing their spending the most and younger households increasing their spending the least.

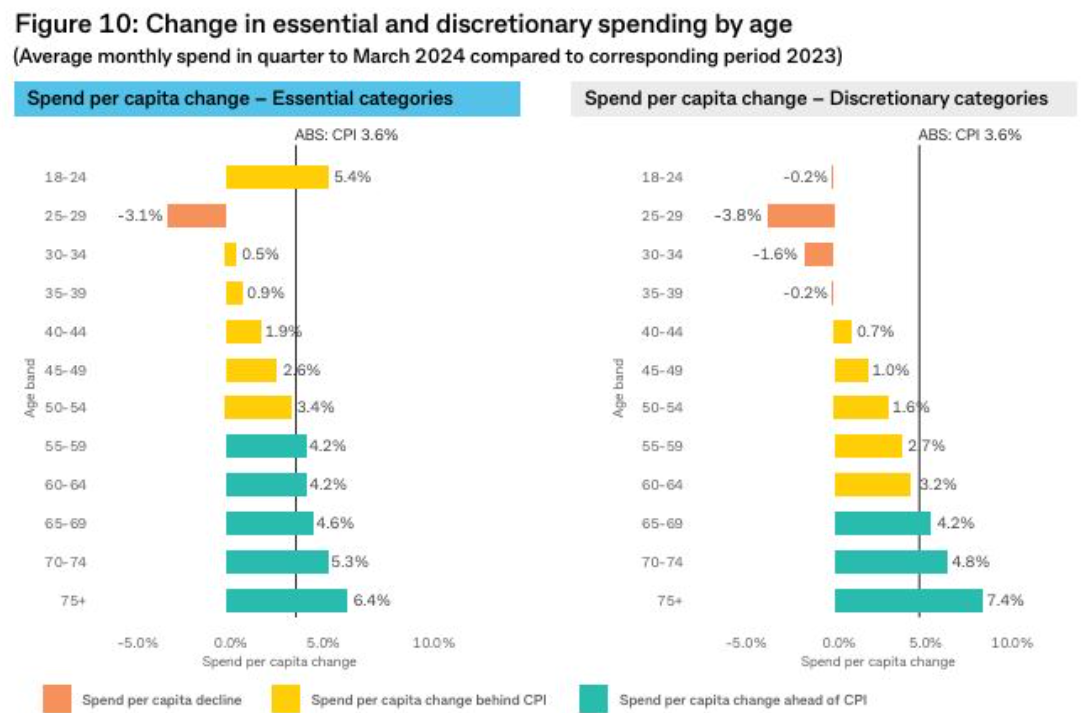

The following chart shows that older Australians increased their spending by more than inflation across discretionary and non-discretionary areas, whereas young Australians cut back on both areas:

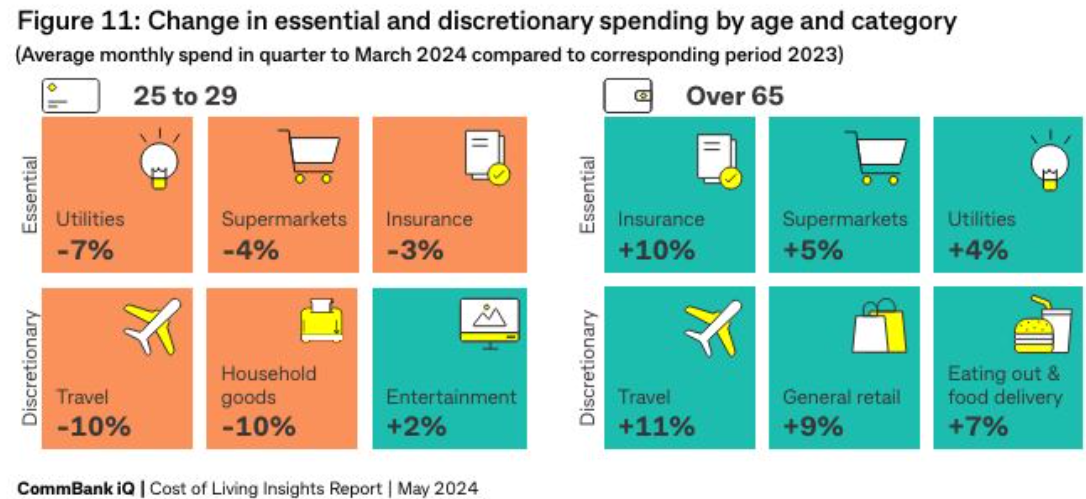

People aged 65+ increased their spending across all categories except charities in the March quarter.

In contrast, people in the 25-29 age group reduced their overall spending by 3.5% year-on-year; this includes essential goods and services such as groceries, insurance, and utilities.

There are three Australia’s at the moment.

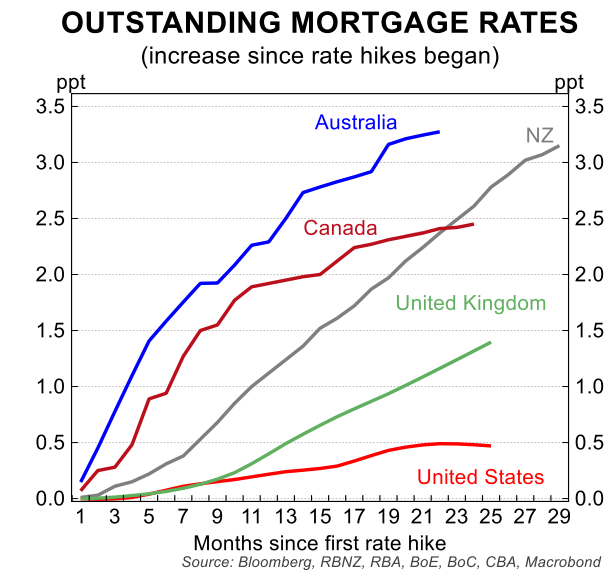

The sharp increase in mortgage payments is having a significant impact on about one-third of households with owner-occupier mortgages.

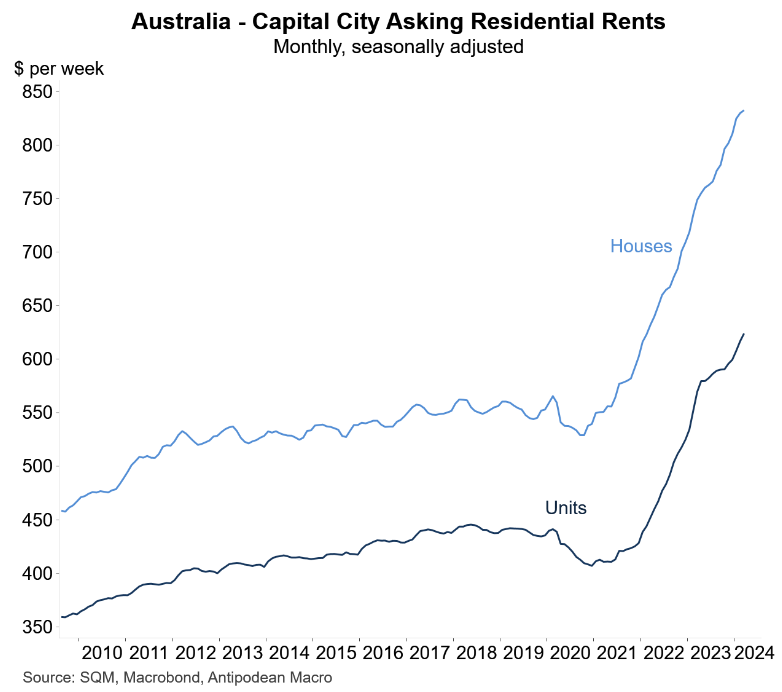

Rents are rising quickly and are crushing about one-third of households.

Rising mortgage rates and rents have no effect on the other one-third of households because they own their homes outright. These households tend to be older Australians, mostly baby boomers.

Many of these baby boomers are also benefiting from increased investment returns.

While the rest of Australia is reducing expenditure to help control inflation, older Australians are overspending and acting against the RBA.