New Zealand’s economy and labour market continue to deteriorate.

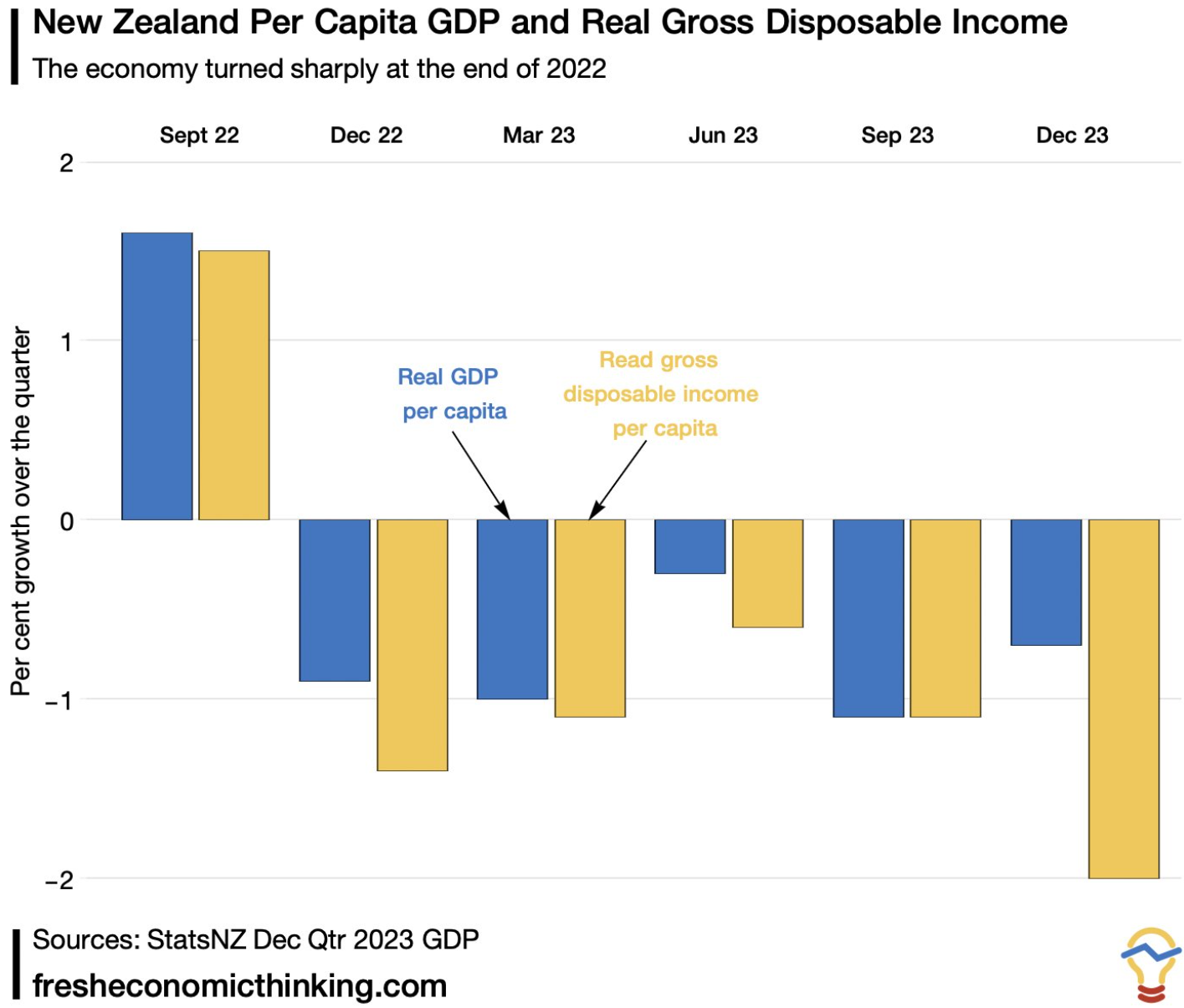

Overall GDP growth is declining, while per capita outcomes have collapsed amid a 2.7% increase in New Zealand’s population in 2023.

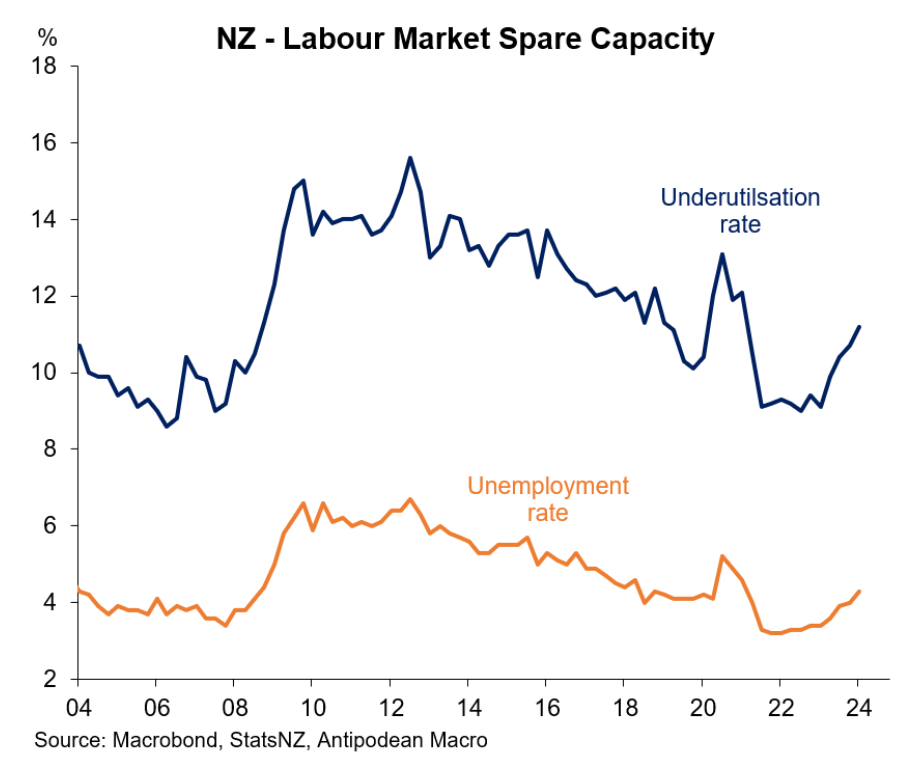

New Zealand’s unemployment rate rose more than expected in Q1 to 4.3% (up 1.1ppts from the trough). The labour underutilisation rate also jumped:

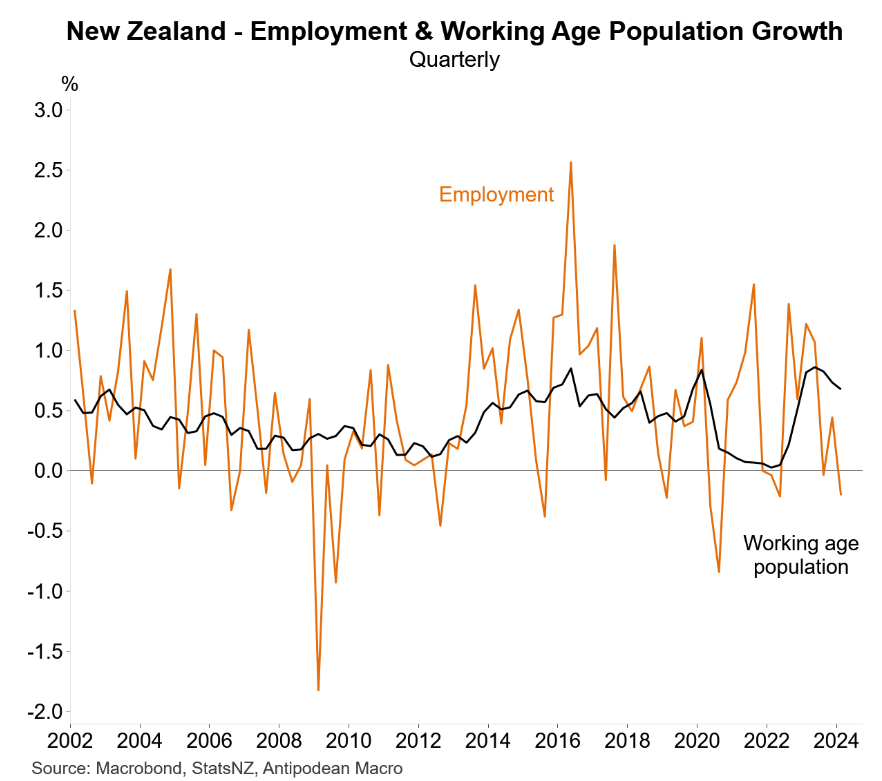

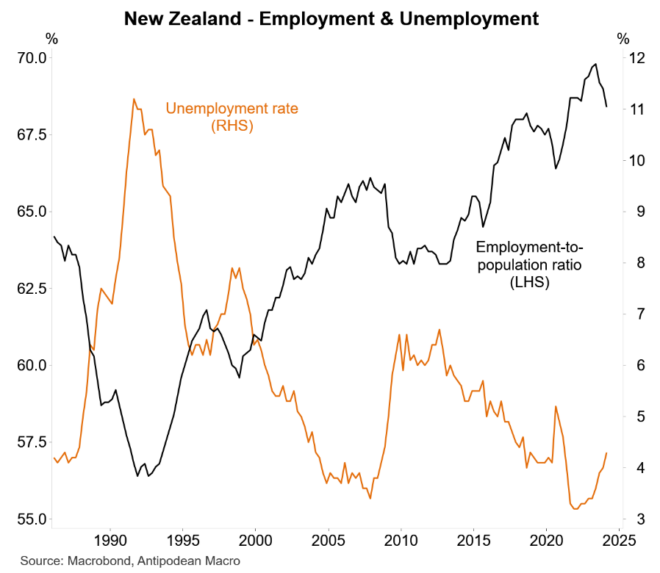

The lift in New Zealand’s unemployment and underutilisation rates occurred alongside a 0.2% quarterly fall in employment and a significant 0.6% decline in the employment-to-population ratio:

On Friday, Seek released its April employment report for New Zealand, which raised more alarm bells.

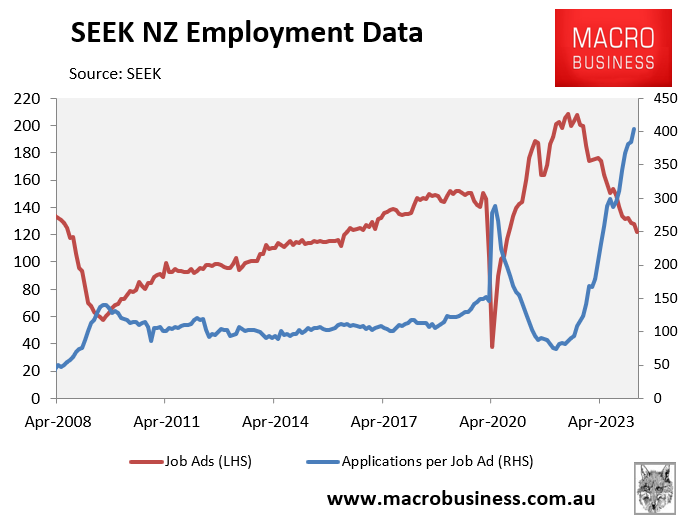

As illustrated below, the number of jobs advertised on Seek have fallen below pre-pandemic levels.

More importantly, the number of applicants per Seek job ad has surged 40% above the pandemic peak and is now tracking 233% above April 2019 levels:

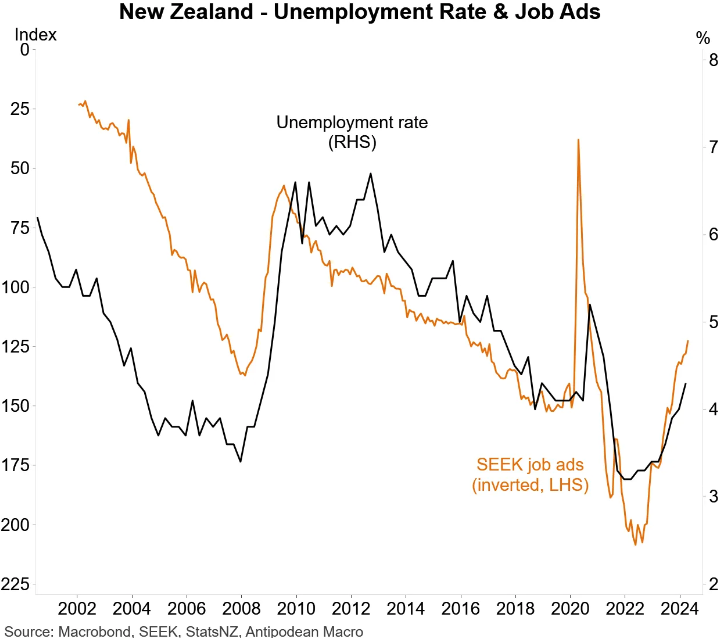

As the following chart from Justin Fabo at Antipodean Macro shows, Seek’s job ad data points to a further lift in unemployment:

Obviously, the outlook would look much worse if New Zealand’s unemployment rate was plotted against applications per job ad.

Regardless, the latest labour market data suggests that New Zealand’s recession has deepened.

The Reserve Bank will need to loosen monetary policy soon or it risks a significant increase in unemployment and underemployment.