In this week’s Treasury of Common Sense with Clinton Maynard from Radio 2GB, I explained why Australia’s tax system is unfair to workers and younger Australians and desperately requires fundamental reform.

Edited Transcript:

Australia’s tax system is heavily reliant on personal income taxes. We collect an inordinate amount of revenue from income taxes.

At the same time, the percentage of workers in the economy continues to shrink because we have an ageing population. We have the big baby boomer bulge entering retirement.

So, we are effectively squeezing a diminishing pool of workers with high taxes to try and fund everything.

It’s just not right and that’s one of the reasons why the government keeps trying to run this big migration program. Because it is trying to import taxpayers instead of the sensible solution, which is to broaden the tax base.

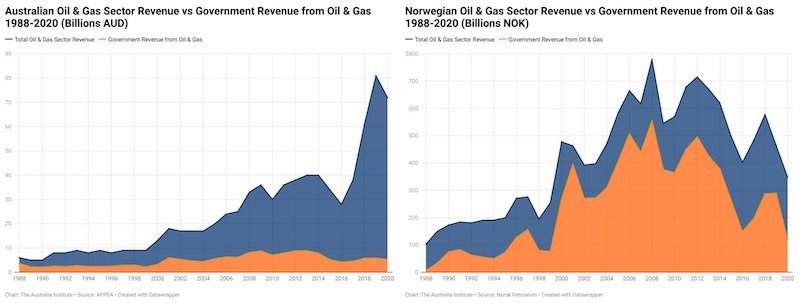

One way you do that is through the GST. Another way is to start taxing our resources properly, like they do in other countries like Norway and Qatar.

Those countries raised tens of billions of dollars in revenue by taxing their resource industry property. We don’t do that here in Australia.

As a result, we are incredibly highly dependent on personal income taxes, which are smashing working Australians.

The problem is that working Australians have been hammered by a triple whammy over the past few years.

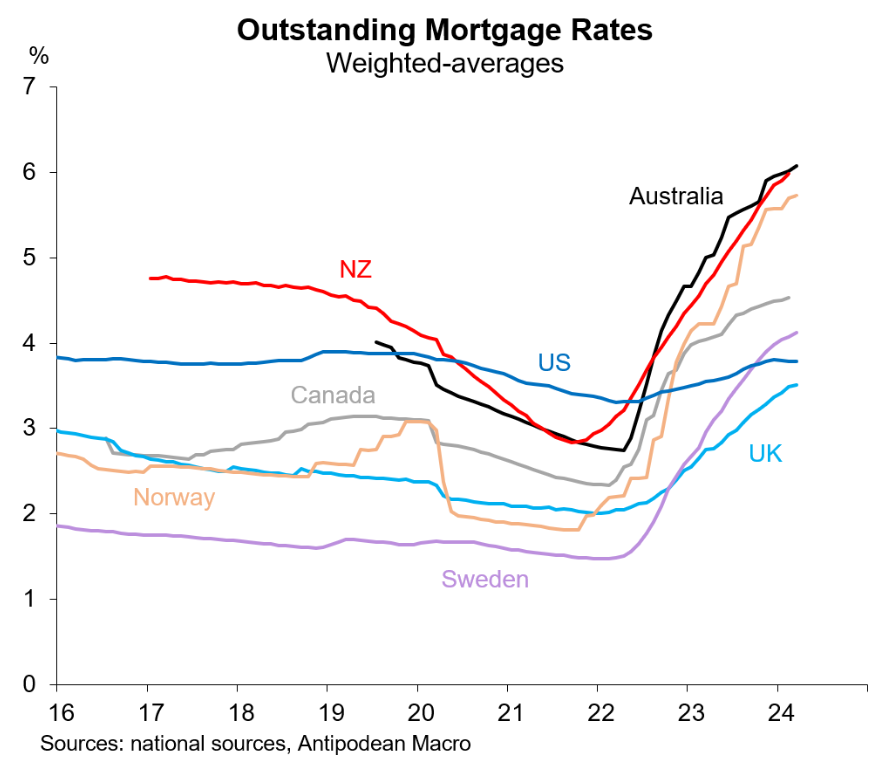

First of all, working Australian have been hit by this massive rise in interest rates, which has smashed mortgage holders.

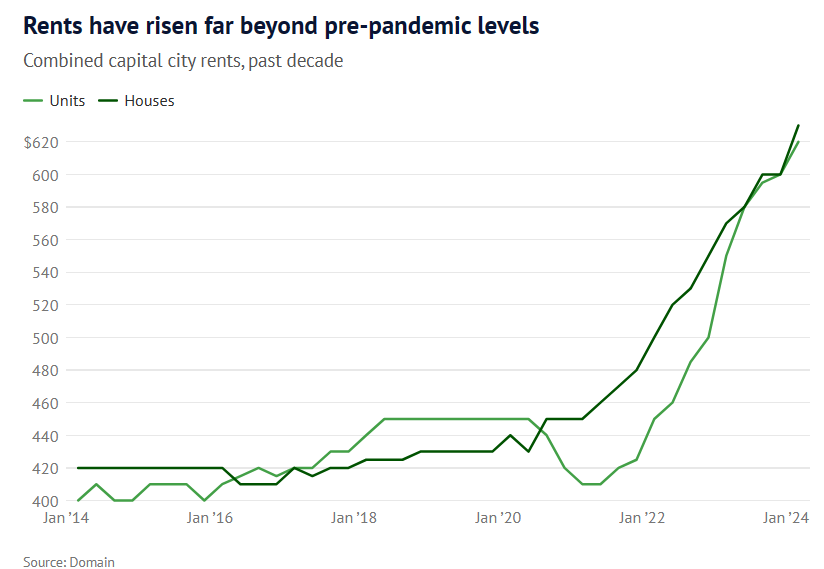

Workers have also been smashed by rising rents, which have smashed tenants.

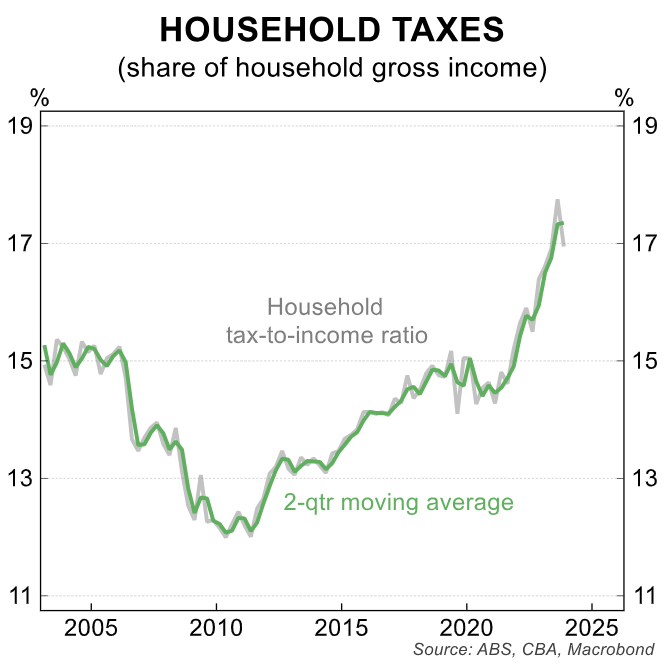

Workers have also been smashed by soaring income tax payments, because of huge bracket creep over the past year or so, which has lifted everyone into higher average tax rates.

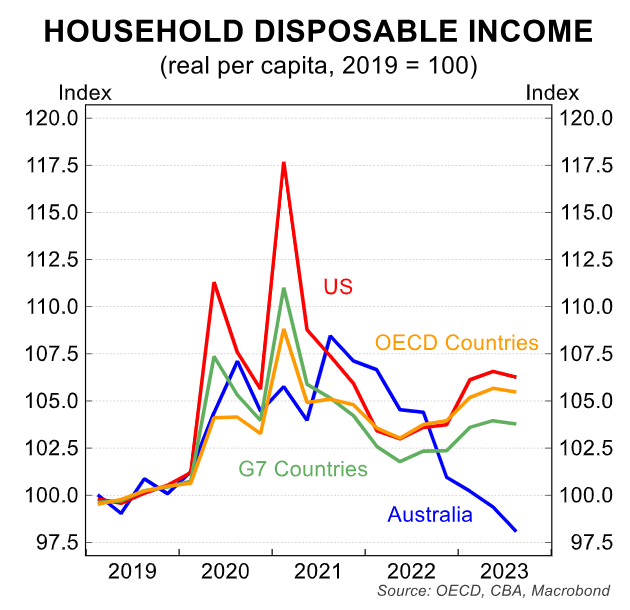

So, working households have been hit three times and those three factors are the primary reason why Australian households suffered the world’s biggest decline in real household disposable income last year.

At the same time, working households have also experienced a really sharp rise in their cost of living. Part of that is because of this rent and mortgage story.

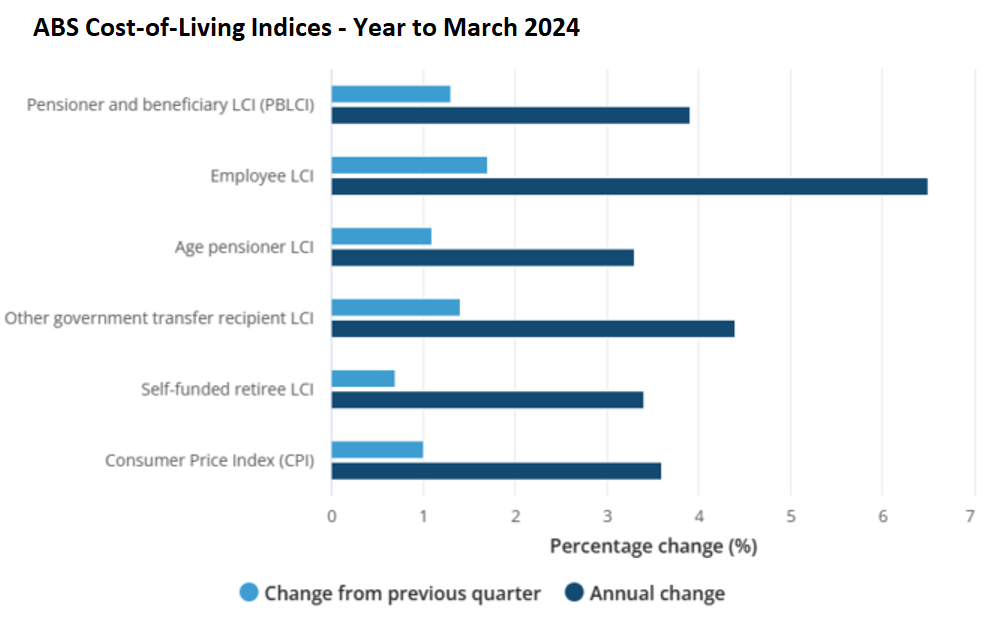

According to the Australian Bureau of Statistics, the living cost index, which was released earlier this month, rose by 65% in the year to March for working households.

This rise in cost-of-living was nearly double the CPI inflation rate of 3.6% and wage growth of 4.1%.

However, while working households are getting squeezed by those three factors, older Australians are actually traveling well.

Older Australians typically own the homes outright. Therefore, they have been largely untouched by surging mortgage repayments, surging rents, and the surge in personal income taxes because most of them no longer work.

The cost of living index that was released by the ABS showed that for self-funded retirees and age pensioners, their cost of living only rose by 3.4% and 3.3% respectively, in the year to March, which was actually below CPI inflation.

So, working Australians are getting hammered by their cost of living going up at nearly double the inflation rate, while older Australians’ cost of living is going up by slightly less than inflation.

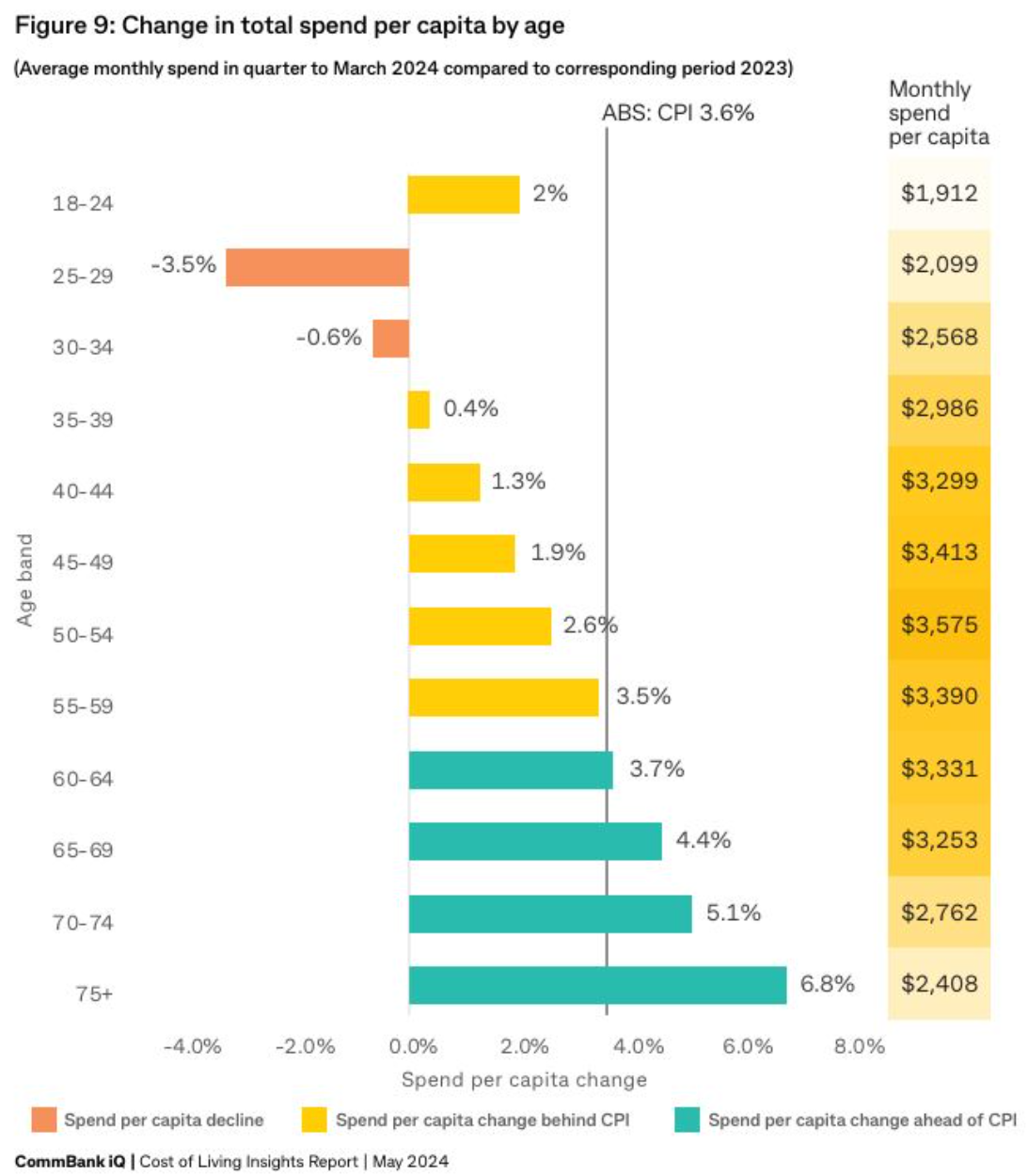

Additionally, CBA released survey data earlier this month that demonstrated that younger Australians’ spending increased less than inflation in the previous year. They’ve actually suffered a real cut in their expenditure, which is why retail sales have fallen.

By contrast, Australians aged over 60 have seen their expenditure go up by more than CPI inflation over the past year.

This spending by older Australians is actually helping to keep CPI inflation higher than it would otherwise be because we have more overall spending in the economy.

This spending is preventing the RBA from lowering interest rates, which is then hurting younger Australians with mortgages.

What this essentially shows you is that Australia should raise the GST to 15% in exchange for lower income taxes. And if you did that, the government would be able to tax more of the spending by wealthy older Australians.

AT the same time, the government would be able to reduce its reliance on personal income taxes and also slow spending and aggregate demand in the economy.

Any equity concerns for lower income earners and those on fixed incomes could be overcome by compensating those people with direct fiscal transfers, increases in JobSeeker or the Aged Pension, or rebates to make them no worse off.

I think raising the GST to 15% is a hell of a lot fairer than continually punishing one-third of Australians carrying owner-occupier mortgages with high interest rates to try and tame inflation, and punishing working Australians with forever higher income taxes.

It’s just a much fairer option and it broadens the taxpayer base.

More importantly, we need to tax our resources properly.

The broader point is that we have a really unfair tax system at the moment, which is just smashing a shrinking pool of working Australians that are actually being productive.

Those same people tend to be the ones who have mortgages and are getting smashed by high mortgage rates to try and tame inflation.

Richer older Australians who own their homes outright are unaffected by any of these things and are not paying enough tax.

I just think that is fundamentally unfair and the tax system does need to be broadened to take the pressure off personal income taxes.

Higher consumption taxes through GST are one way to do it and the other, which is actually more important, is to tax our resources properly.