Eleven years ago, the Grattan Institute, led by Energy Program Director and former Origin executive Tony Wood, published a series of publications and reports advocating against domestic gas reservation.

This campaign began just as six export trains were readying to swallow-up East Coast gas supply in Gladstone, Queensland.

“Strong Asian demand and high prices are inducing Australian producers to export their gas. That means local consumers will have to pay higher prices.”, Tony Wood wrote in June 2013.

“With more than $160 billion forecast to be invested in LNG production, the export industry is good for the economy. Governments should therefore resist self-interested calls from some industries to reserve gas or cap prices for the domestic market”.

“One reason that reserving gas is a bad idea is that there is no shortage of gas”.

“Capping prices for the domestic gas market is a very bad idea. It amounts to a tax on producers and a subsidy for domestic gas users”.

“Protectionism of this sort may provide some short-term price relief for targeted industries, but it tends to mean inefficient businesses and less investment. Ultimately it leads to higher prices and damages the economy for us all”, Wood wrote.

The Grattan Institute also lobbied for Western Australia to abandon its domestic gas reservation policy:

“WA industry has become addicted to cheap gas. The State Government should be trying to break the cycle of dependency. Instead, its decision to reserve 15% of gas from export projects for domestic use is just feeding the habit”, Grattan wrote in The West Australian in October 2013.

“Since WA households use only 2% of the State’s gas, the reservation policy mainly supplies gas to industry”.

“Gas users want the government to continue the reservation policy”.

“However, why should the Government interfere in the gas market to support the interests of industrial gas users? Gas reservation is a bad deal for WA taxpayers”.

“By forcing the gas exporters to sell to the domestic market market, the policy acts as a de facto tax on export projects. Yet, unlike a tax, it does not deliver revenue for government and taxpayers. Instead, all benefits flow to gas users”.

Grattan’s recommendations have clearly aged like milk.

Without domestic gas reservations, East Coast gas users have faced hyperinflation in both gas and electricity prices, fueling national inflation, making industry less competitive, and aggravating cost of living pressures.

In contrast, Western Australians have had some of the world’s lowest gas and energy prices.

Former WA Premier Mark McGowan explained his state’s gas reservation policy in late 2022, which was derided by major oil and gas companies:

“In 2006, Alan Carpenter brought in our domestic reservation scheme in Western Australia,” [McGowan] said.

“Some of the major oil and gas companies at that point in time said it was a catastrophe, compared us to Venezuela, said there’d be no further investment.

“We’ve had hundreds of billions of dollars of investment since then, despite all those claims, and we’ve got plentiful local gas at a reasonable price”.

A parliamentary inquiry looked into the efficiency of Western Australia’s domestic gas reservation policy, which requires gas projects to set aside 15% of their output for domestic consumption.

WA Premier Roger Cook told a parliamentary inquiry examining the efficiency of Western Australia’s domestic gas reservation policy that the gas belongs to Western Australians, thus they should have priority in its use.

Thus, Roger Cook effectively gave the middle finger to the captured “experts” at the Grattan Institute.

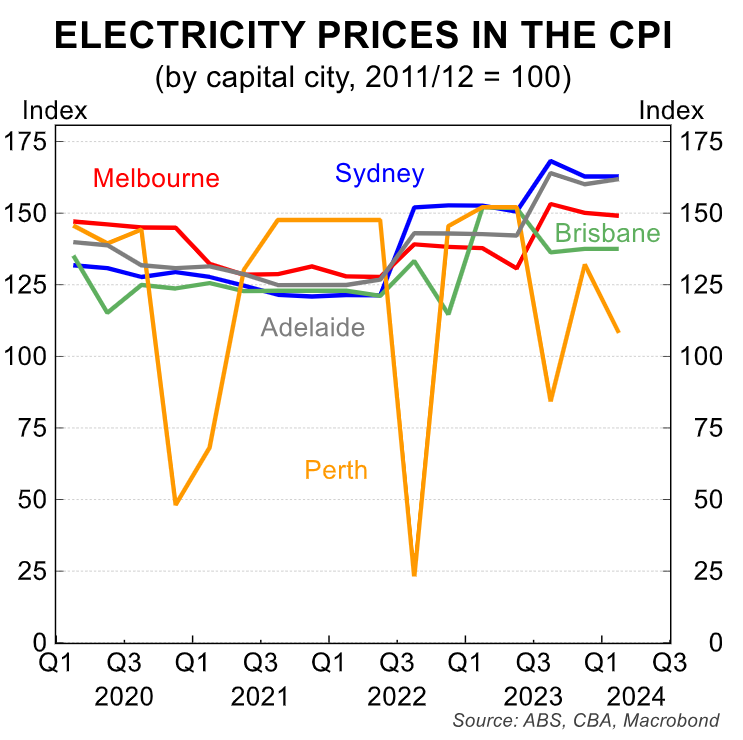

On Thursday, CBA produced the following chart showing how electricity prices in WA are lower today than they were in Q1 2020 before Russia invaded Ukraine.

By contrast, electricity prices in the other states have risen over the same time period (Note: Brisbane electricity prices have been suppressed by energy subsidies paid for by extra royalties on the coal industry).

The above chart measures electricity prices only, which are heavily influenced by gas prices (as the key firming fuel).

A similar chart on gas prices would be far worse.

The below chart from Q1 2022 illustrates the difference between East and West Coast gas prices after Russia invaded Ukraine:

“With energy prices at eye-watering levels around the world, we believe that Western Australia now has the lowest gas prices in the OECD”, EnergyQuest said in September 2022.

“Western Australia is a low-energy price paradise”…

“WA electricity prices are also much lower than in the National Electricity Market on the east coast, averaging $64 a megawatt-hour, while NEM prices were more than four times higher at an unprecedented $284/MWh”, The AFR reported.

“WA’s electricity market is at the same time less emissions-intensive than the NEM and coal powers only 38 per cent of generation, compared with 59 per cent, EnergyQuest said in an analysis of the June quarter”.

The East Coast was left paying some of the highest gas prices in the world, whereas Western Australia enjoyed low and stable prices.

With access to cheap and reliable gas, Western Australia has also pivoted away quicker from dirty coal, lowering emissions.

Sadly, the federal government listened to the rotten advice of the captured Grattan Institute, failed to reserve East Coast gas, and locked residents and businesses into high energy costs, higher national inflation, and higher interest rates.