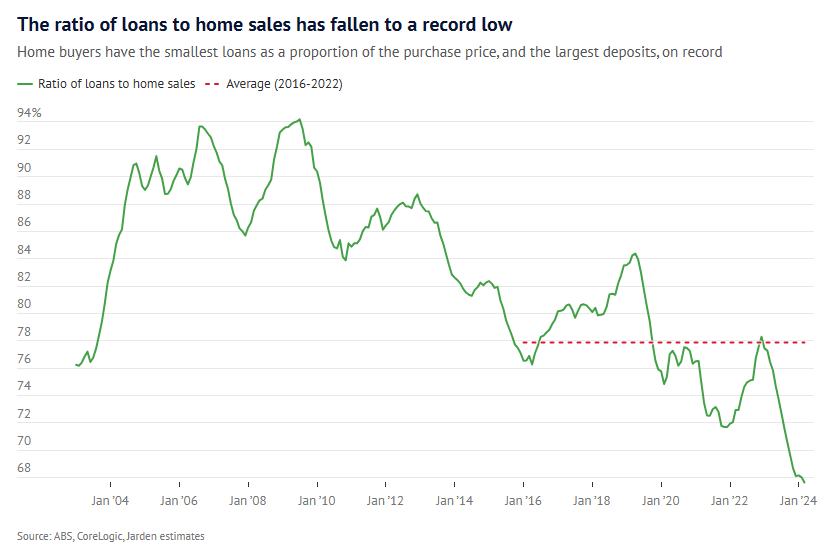

Domain reports that the average home deposit as a proportion of sale prices in Australia has hit record levels of more than 32%:

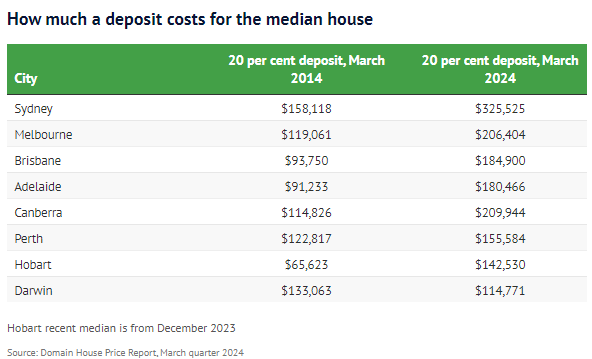

This comes as the amount of money required for a 20% deposit has roughly doubled over the past decade across Australia’s capital cities:

“What we’re seeing is the people who are willing and able to buy housing in this market are skewing to higher wealth”, Jarden chief economist Carlos Cacho said.

“People are not able to borrow as much as they were before so they have to fund more of their purchases with cash on average”.

“The buyers in the current market are less constrained by borrowing capacity and they’re less reliant on funds from a bank”, he said.

Will Unkles, director and mortgage broker at 40 Forty Finance, said it was usual for clients to rely on their parents to help them save for a deposit.

“We find that most clients that get help from mum and dad, it’s supplementing their savings”, he said.

“As to how much, it can vary wildly, anywhere from $50,000 to $1 million”.

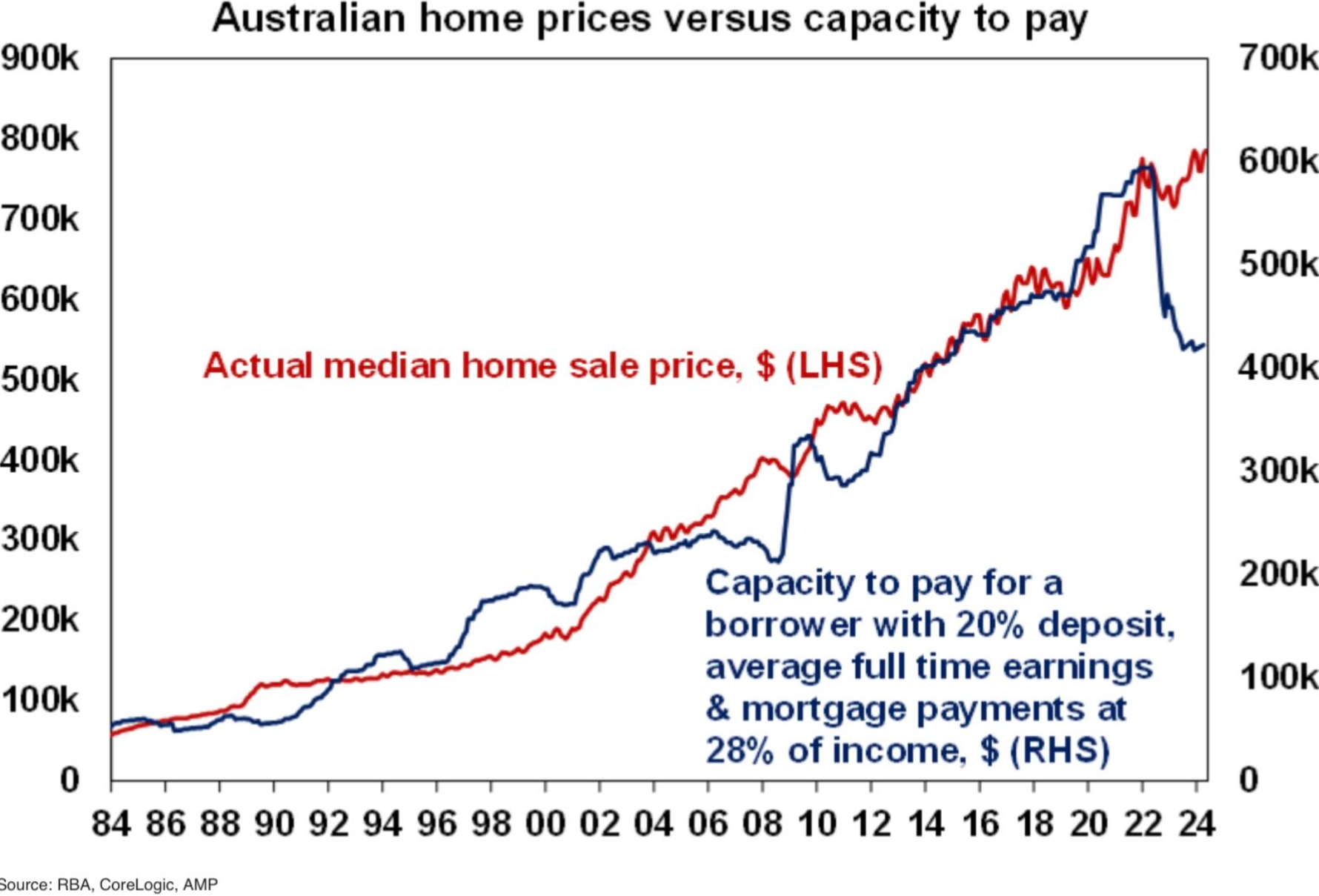

Carlos Cacho noted that economists are grappling with the breakdown between borrowing power and house prices, which has left them “with a situation where it’s not clear what the driver of property will be in the long term”.

“For an average income household in Australia today they cannot afford the median house any more”.

“It’s much the same as what we’re seeing in other data, CBA data showing we’re skewing to wealthier buyers, PEXA’s data on cash buyers”.

Cacho’s observation about the break-down in the relationship between borrowing power and prices is illustrated by the below chart from AMP:

As you can see, a giant gap has emerged between median home sale prices and capacity to pay via borrowings.

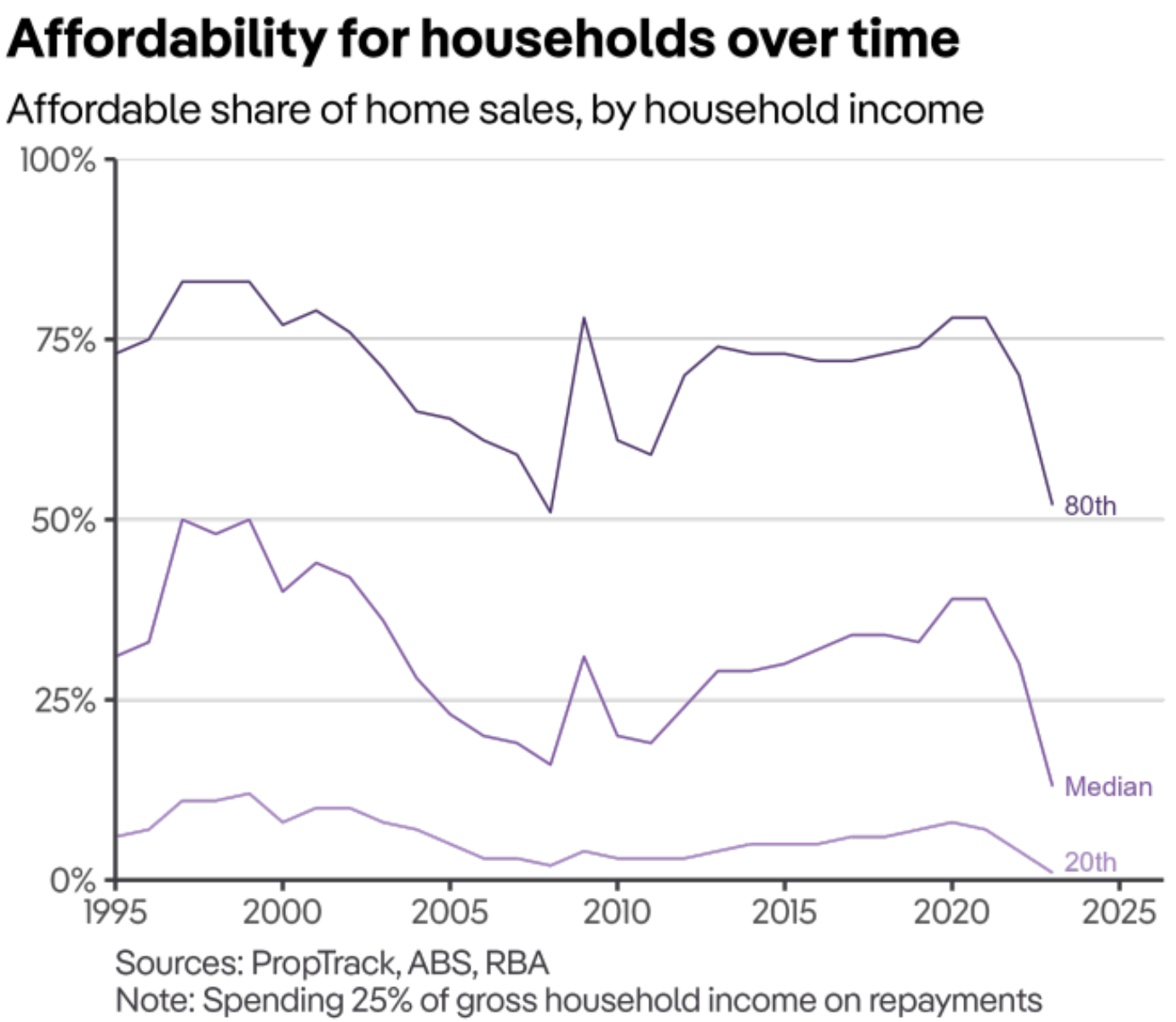

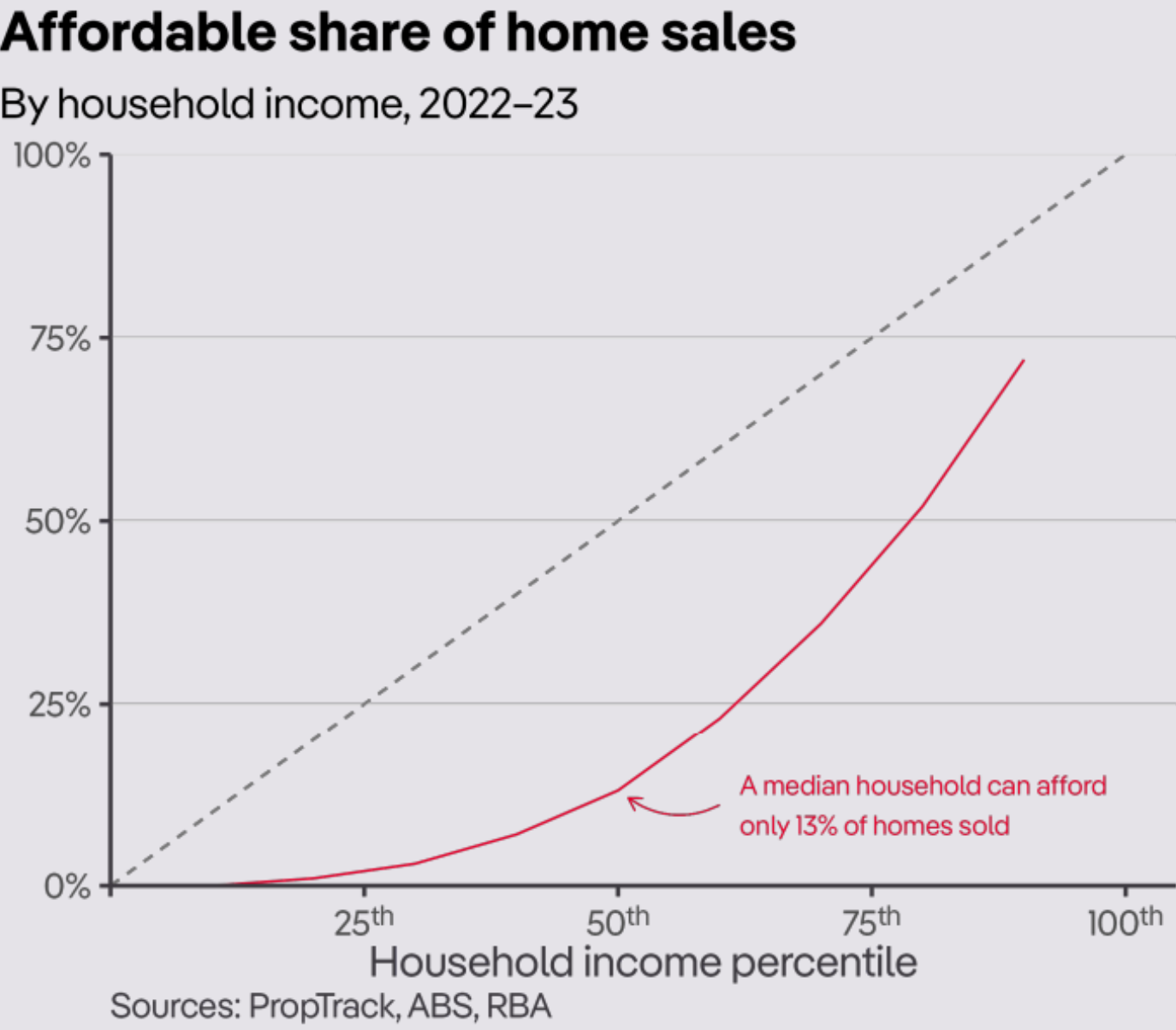

This decline in loan affordability is also illustrated by the following chart from PropTrack showing that affordability is its worst level in at least 30 years:

Only 13% of homes sold in Australia are affordable to the median household, according to PropTrack:

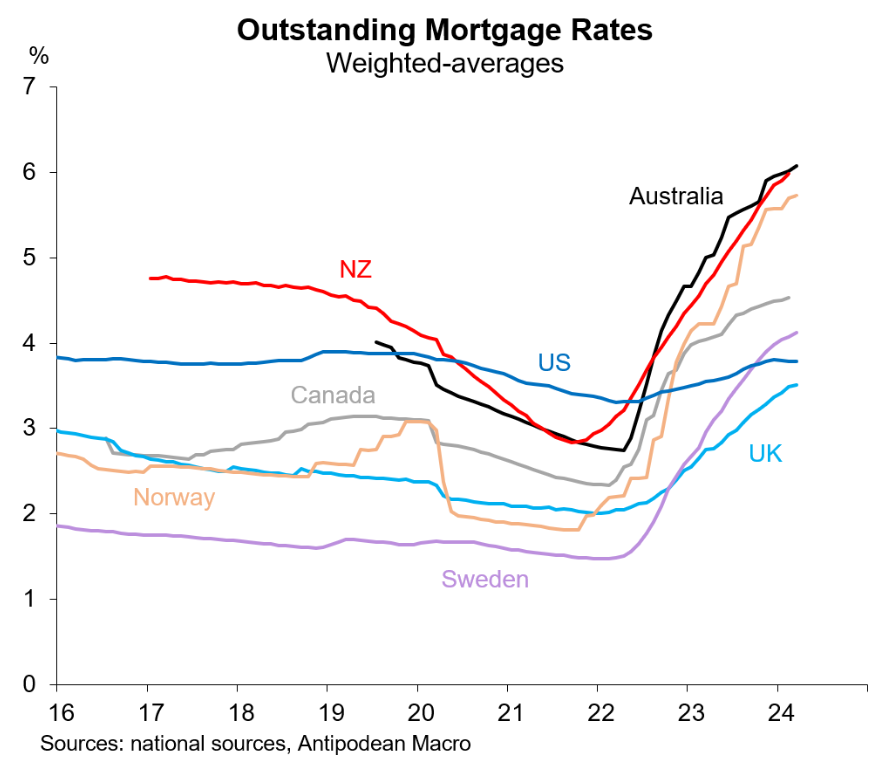

This collapse in affordability reflects the combination of rising home prices and soaring mortgage rates:

The bottom line is that unless you have wealthy parents willing to gift you money, your chances of purchasing a first home are severely diminished.