The AEMO is out with its biennial roadmap of the energy transition and it is ugly:

The possibility that replacement generation is not available when coal power stations retire is real and growing, and a risk that must be avoided. The sooner firmed renewables are connected, the more secure the energy transition will be.

That depends on how we define “secure”.

Nuclear power is much less likely to be ready on time than renewables and storage, but gas will still set the price, as it does today.

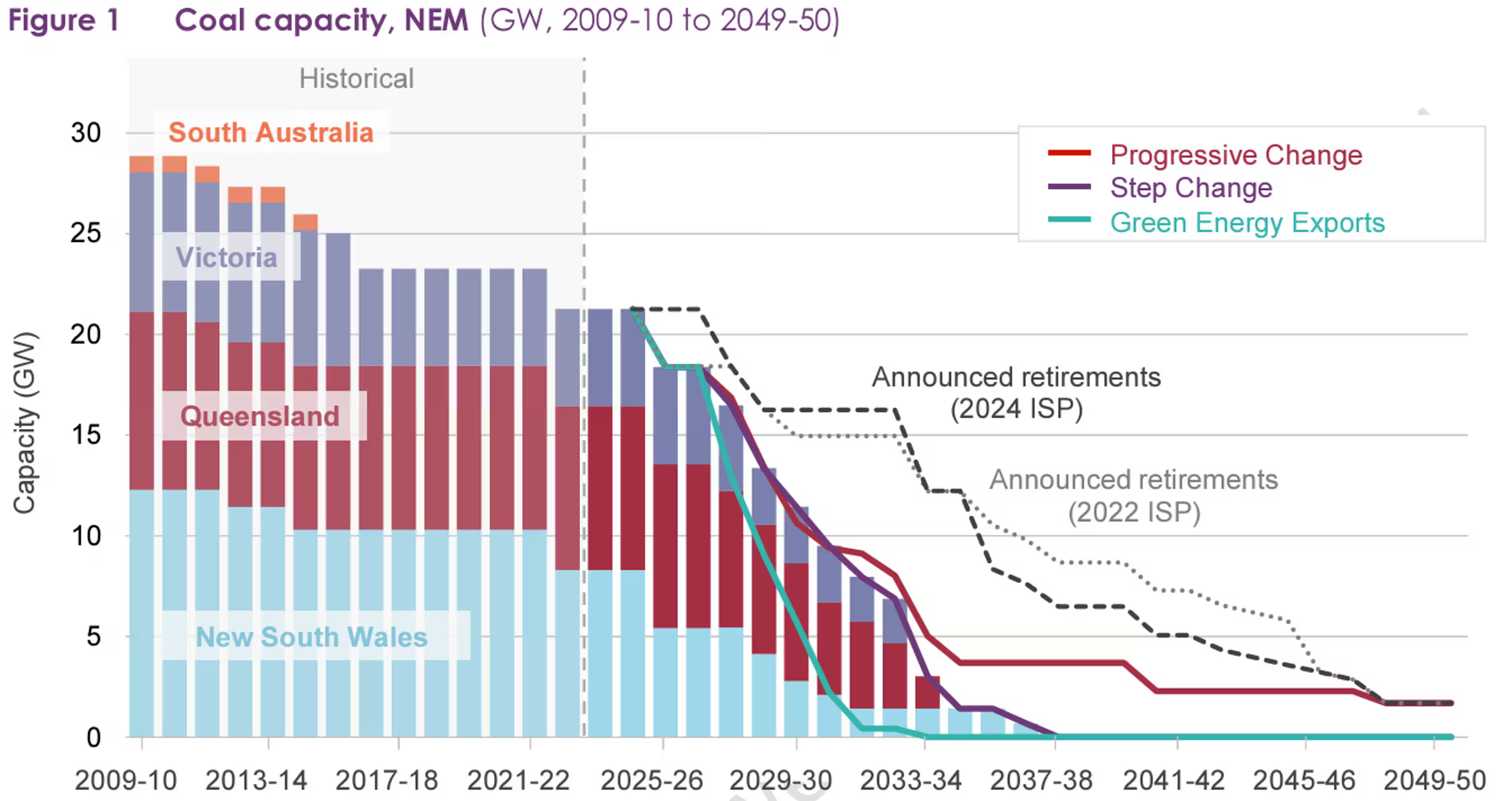

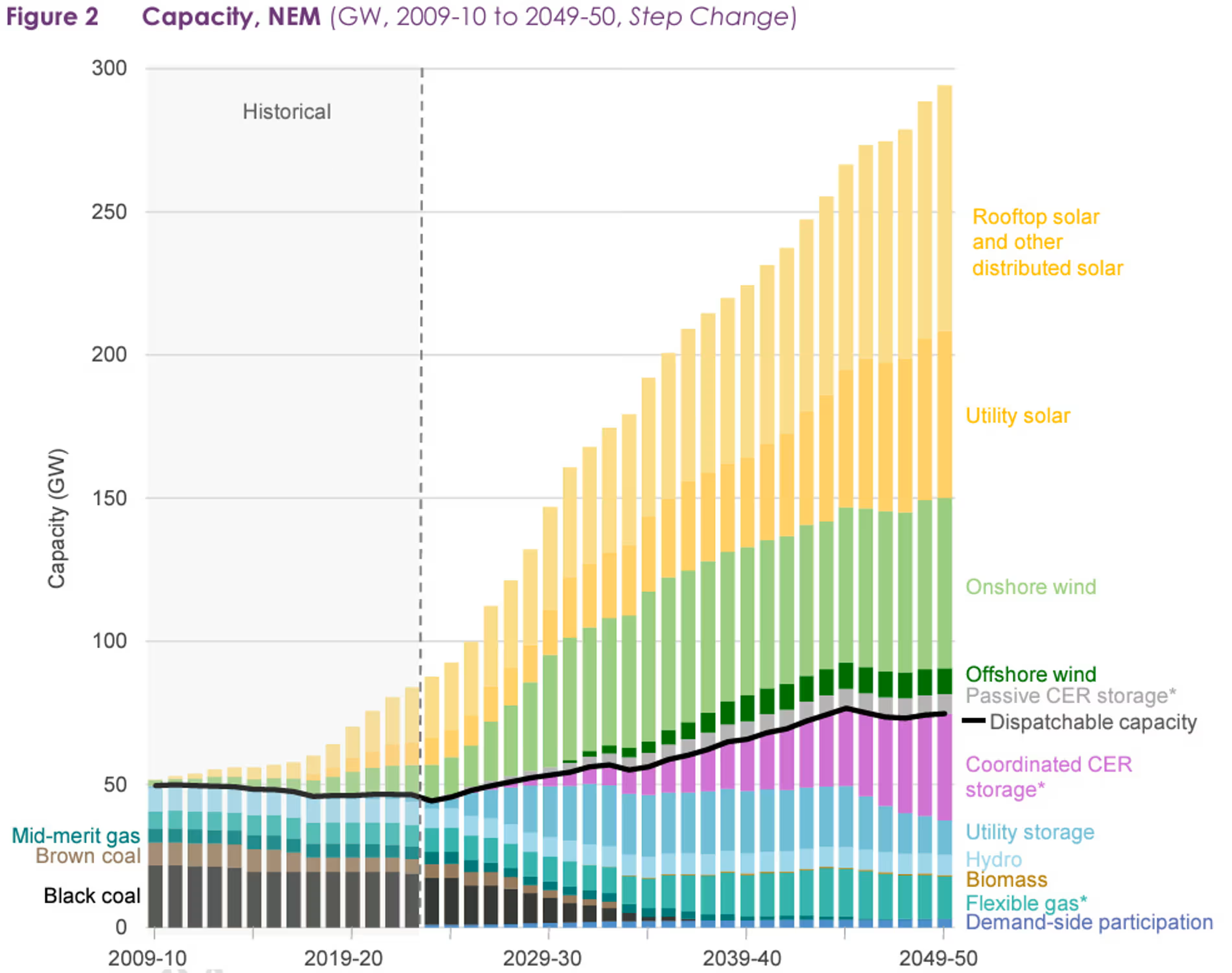

That is where the AEMO vision runs aground. In the renewables plus storage scenario, we need more gas, not less, rising from 11.5Gw of capacity today to 15GW in 2050:

This gas generation is a strategic reserve for power system reliability and security, so is not forecast to run frequently. A typical gas generator may generate just 5% of its annual potential, but will be critical when it runs.

In short, AEMO foresees Australian energy prices skyrocketing unless more gas is secured for Australian use.

This is not it:

The federal government has given the all-clear for a long-stalled $1 billion-plus gas project in Queensland, clearing the way for the fossil fuel to flow by the end of next year.

But the approval of Senex Energy’s Atlas project, owned by South Korean steel giant Posco and Gina Rinehart’s Hancock Prospecting, will reignite a fraught debate over the role of gas in the energy mix.

The decision to grant environmental clearance for Atlas brings to an end an approvals process that has lasted almost two years. The environmental application for the development sprawled over more than 1800 pages and included detailed scientific assessments by ecology and groundwater experts.

Senex led the boycott of Australian markets after Albo installed the Code of Conduct for gas suppliers. The Senex supply will do nothing to ease Australian gas prices. Some will land locally but it will also be exported. Moreover, Senex gas will displace other local gas that will go offshore.

Without blanket domestic reservation, there will never be lower gas prices for the NEM.

Which brings us to this disgraceful traitor:

Resources Minister Madeleine King conceded gas prices could increase but wouldn’t exceed the government’s cap, nor would they “go up into the stratospheric kind of pricing” from two years ago.

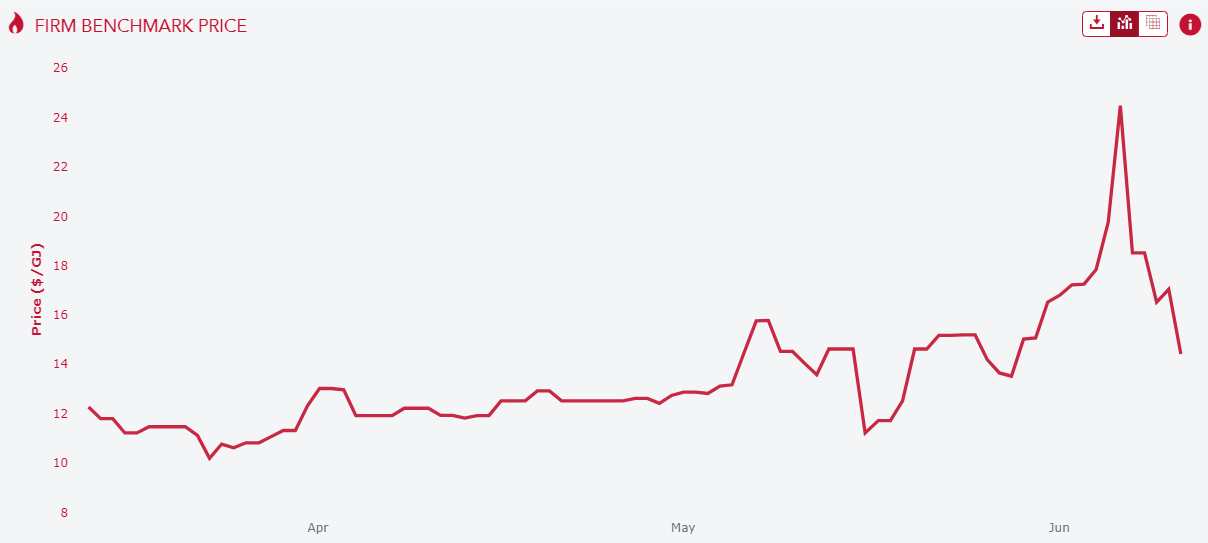

Right. The gas price has been above the cap for months, and it hit its second-highest price ever this week. What a shame power generators can’t burn lies!

And how is it that keeping gas prices below a war-profiteering price of $70Gj, 2300% above historical averages, is now the benchmark for success?

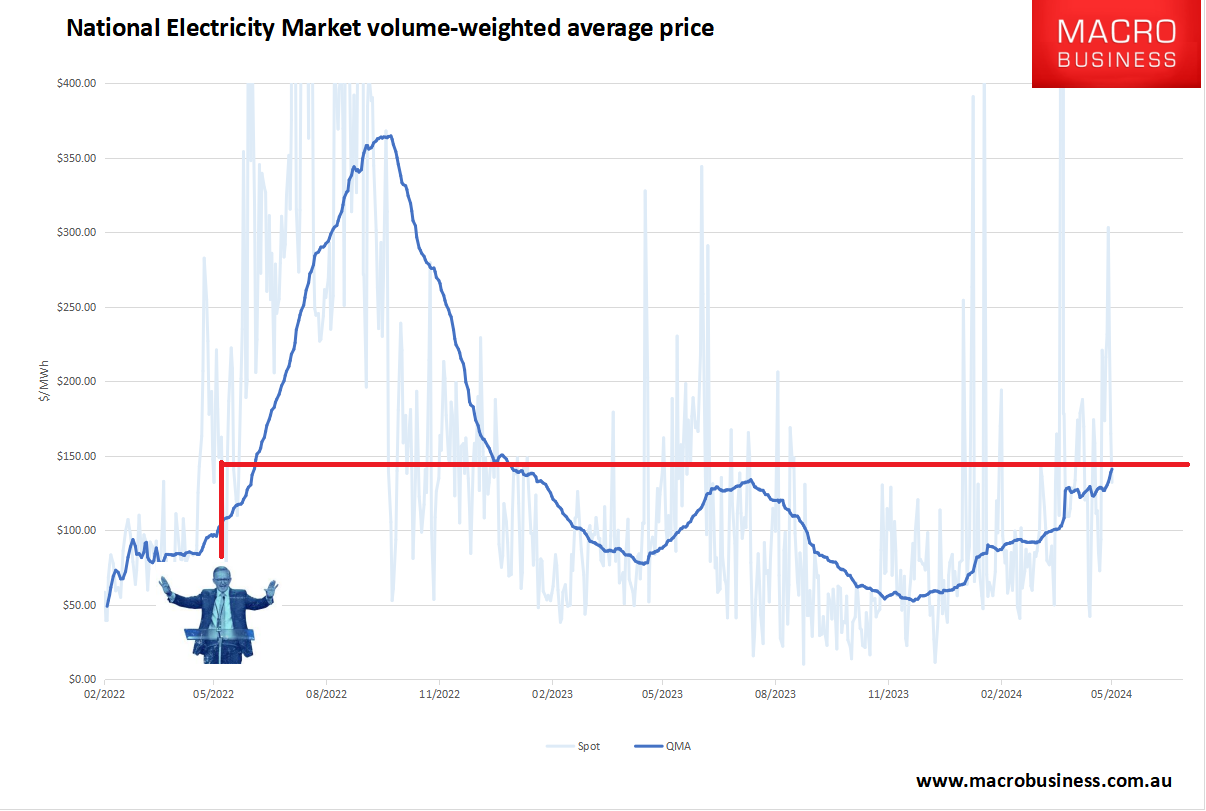

Electricity speaks for itself, shifting from a pre-Albo average of $50-60MWh to a post-Albo average near $150MWh:

A global gas glut is coming in the second half of the 2020s to deliver some relief. But unless somebody addresses the gas cartel, Australian energy prices are going to the moon.

The lights are going out as well.