The ABS has released the May CPI inflation indicator, which is certain to put the Reserve Bank of Australia (RBA) on edge.

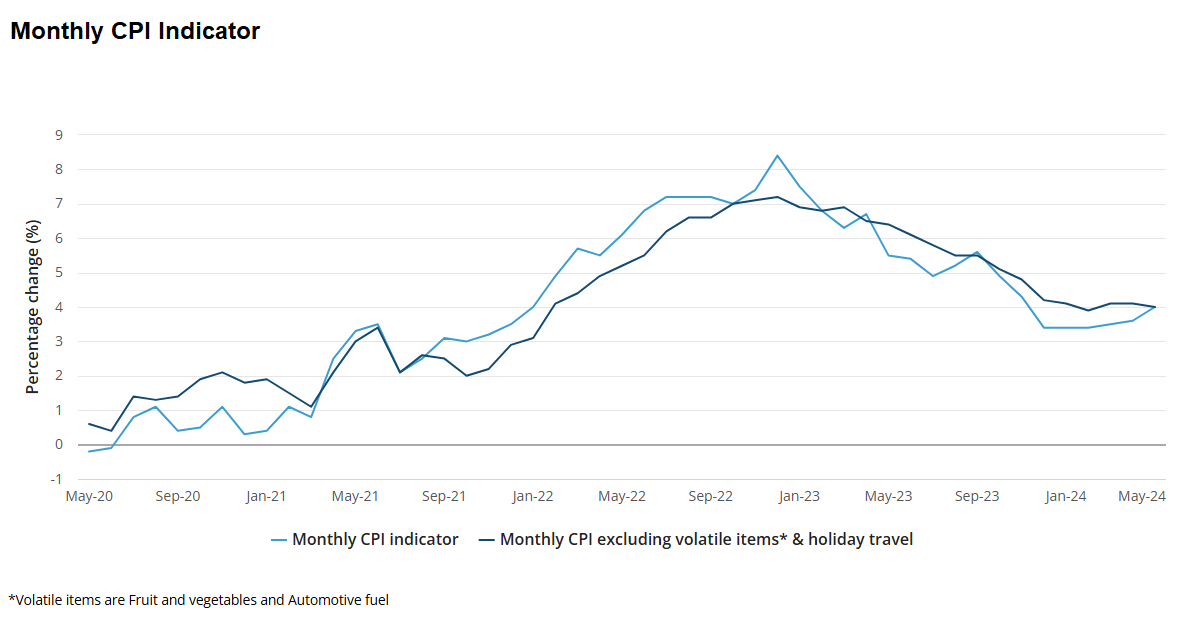

The CPI indicator jumped to 4.0% in the 12 months to May 2024, up from 3.6% in April:

The result was significantly above the 3.8% expected by economists.

The measure excluding volatiles and holiday travel also did not show any further disinflation.

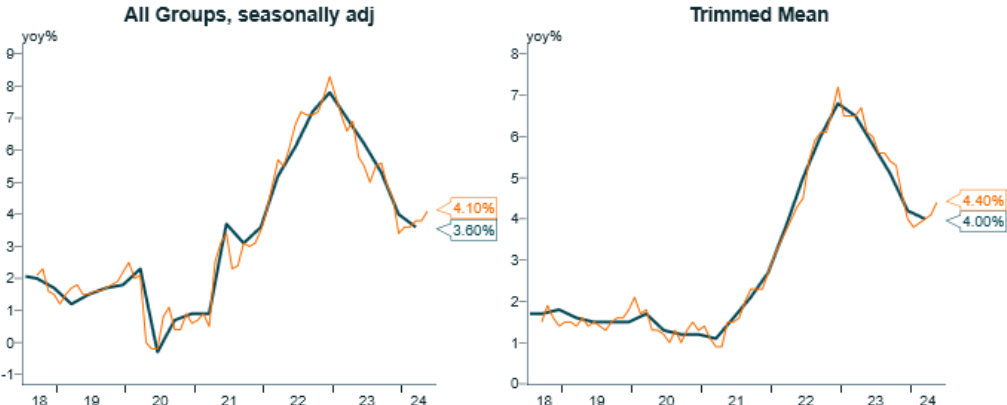

Worse, the trimmed mean and seasonally adjusted measures have accelerated:

Source: Alex Joiner

The ABS noted that “the most significant contributors to the annual rise to May were Housing (+5.2%), Food and non-alcoholic beverages (+3.3%), Transport (+4.9%), and Alcohol and tobacco (+6.7%)”.

Moreover, “electricity prices rose 6.5% in the 12 months to May, up from 4.2% in April”, whereas “rents increased 7.4% for the year, reflecting a tight rental market across the country”.

In other words, Alboflation in energy prices and rents continues to put upward pressure on CPI inflation.

Based on the above, the RBA is right to maintain its tightening bias.

Warren Hogan may end up being right, with further rate hikes a clear threat if the Q2 quarterly inflation print follows suit.