The latest Westpac Melbourne-Institute Survey shows a massive disconnect between Australians’ perceptions of home values and their buying habits.

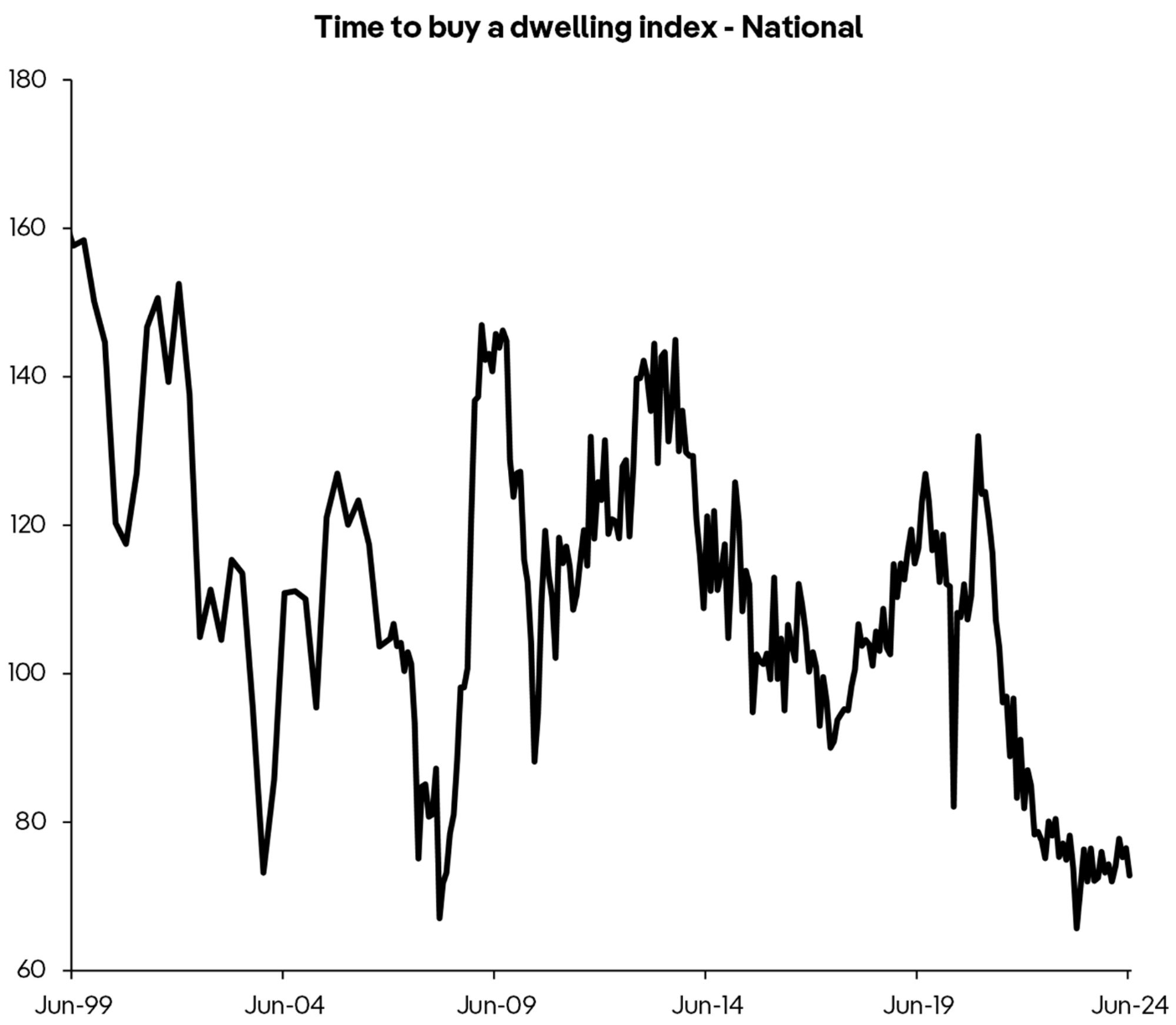

As illustrated in the following chart, the “time to buy a dwelling” index is hovering close to a record low:

Source: Westpac-Melbourne Institute

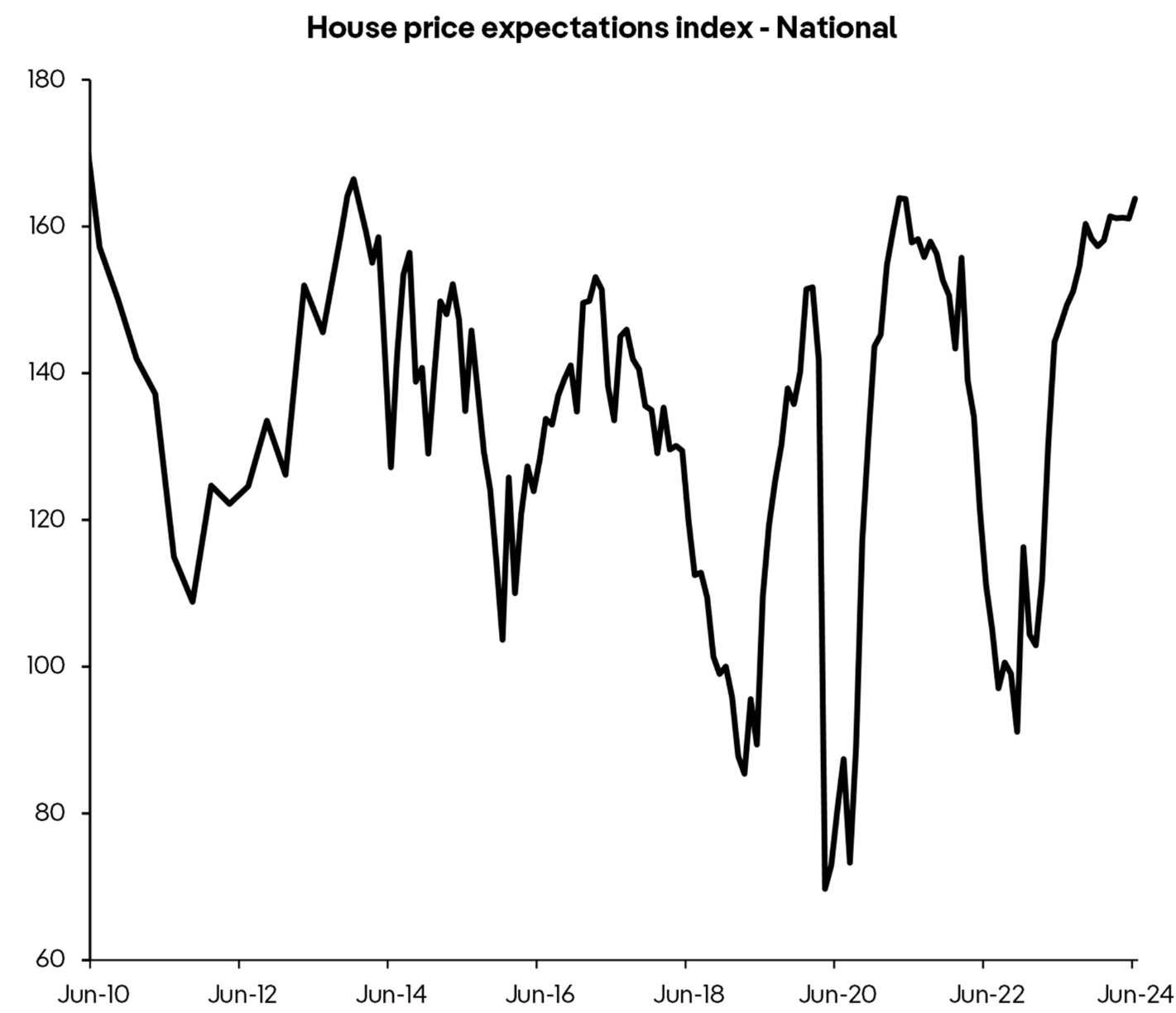

Nevertheless, the “house price expectations” index is the highest since May 2021 and close to a series high:

Source: Westpac-Melbourne Institute

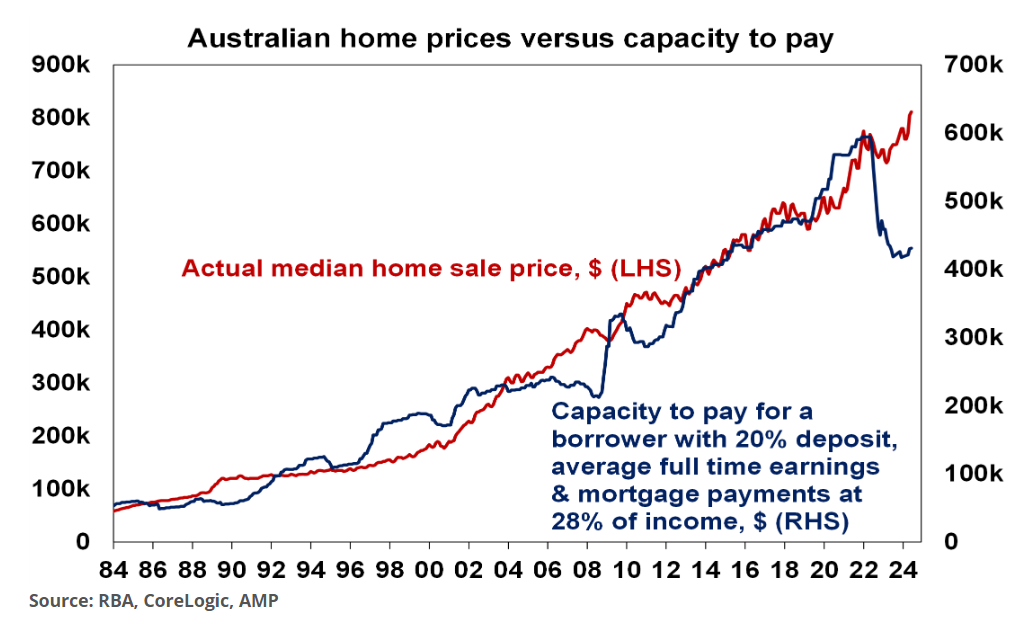

The combination of high interest rates and prices has sent housing affordability and capacity to pay to record lows:

Yet, Australians are buying anyway because of the “Fear of Missing Out” (FOMO) and expectations that prices will continue to rise.

This is why economist Warren Hogan described the current housing situation as “FOMO on steroids”.

“The perception that there is a massive shortage of homes motivates people to do whatever they can to get in [to the housing market], no matter how ridiculously expensive houses are”, Hogan told The AFR this month.

“People have the view that the shortage is going to last for a long time and that will mean prices will just continue to rise. And it’s not just fear of prices going up by 3% in the next three weeks, it’s the expectation that prices will go up by 20% in the next two to three years”…

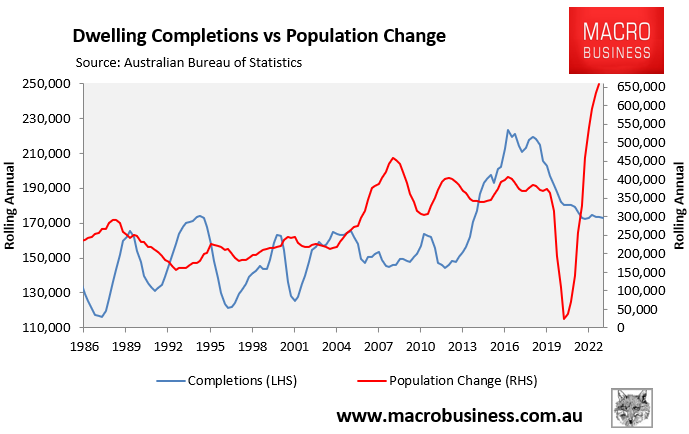

“Australia has never had a severe shortage like this in recent history”…

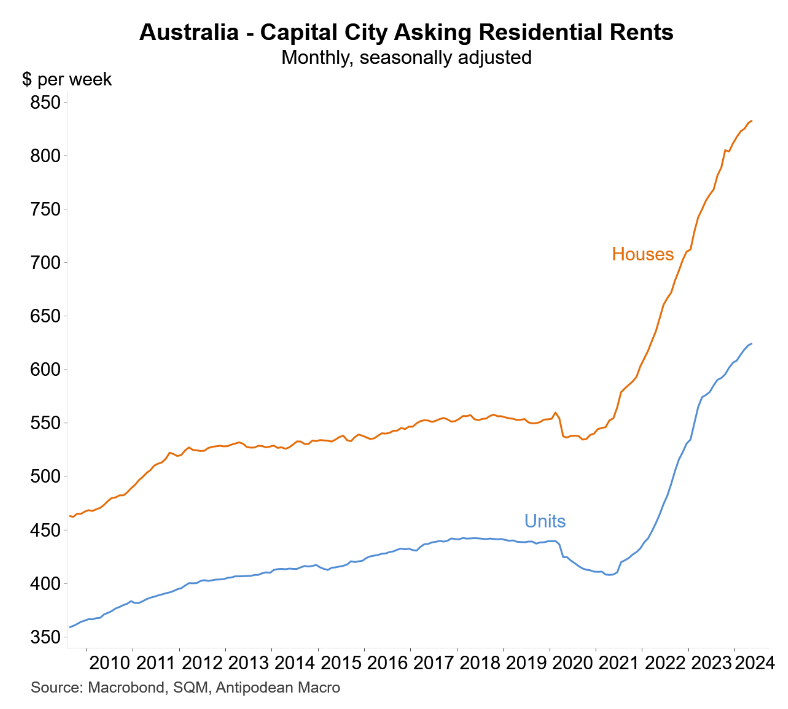

“The reality is that there is price tension in the housing market because rents are going up, because of the shortage of rental property, which is underpinning demand from first-home buyers and investors”.

“It’s not just the bank of mum and dad, it’s also the bank of grandparents, or the bank of aunties and uncles”, Hogan said.

The record growth in the population on the back of one million net overseas migrants landing over two calendar years, combined with the collapse in dwelling construction, has created an unprecedented shortage of housing across Australia, which is expected to persist.

Accordingly, the rental crisis is expected to roll on and on, pressuring Australians to do everything they can to leverage into the market.

“FOMO on steroids” is the perfect description for the current situation at play in Australia’s housing market.

The federal government has created the housing ‘Hunger Games’.