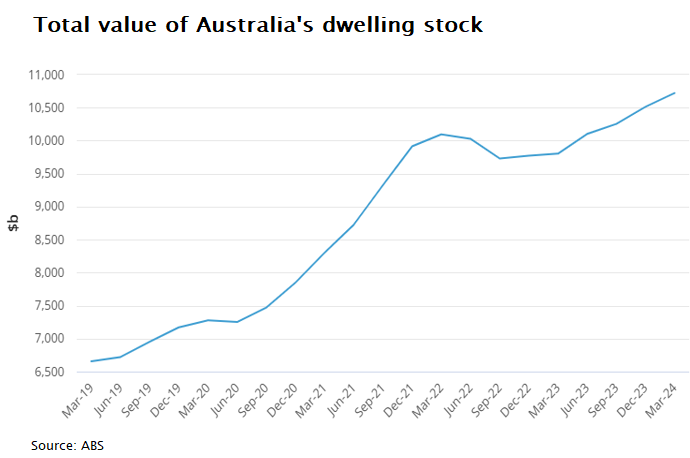

Earlier this month, the Australian Bureau of Statistics (ABS) released data showing that the total value of Australia’s dwelling stock rose to a record high of $10,721 billion in the March quarter:

As a result, the average value of an Australian home hit a record high of $959,300.

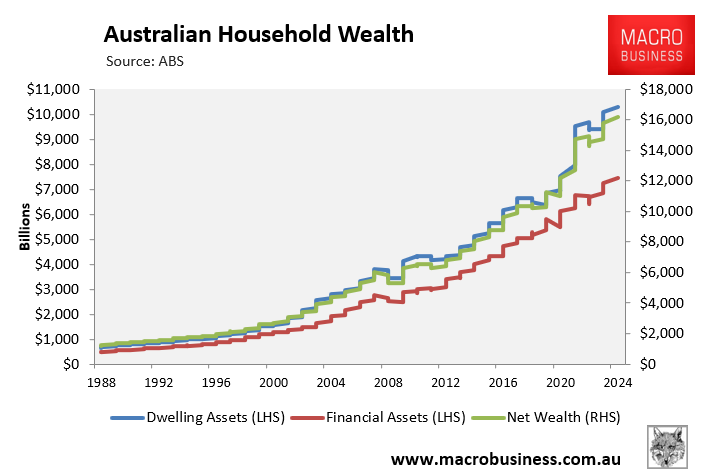

On Thursday, the ABS released data showing that net household wealth increased to by $431.5 billion (2.7%) over the March quarter of 2024 to a record high $16,208.3 billion:

Australia’s household wealth is dominated by housing, which was valued at $10,299.8 billion in the March quarter. By comparison, household financial assets were worth $275,374.54 billion.

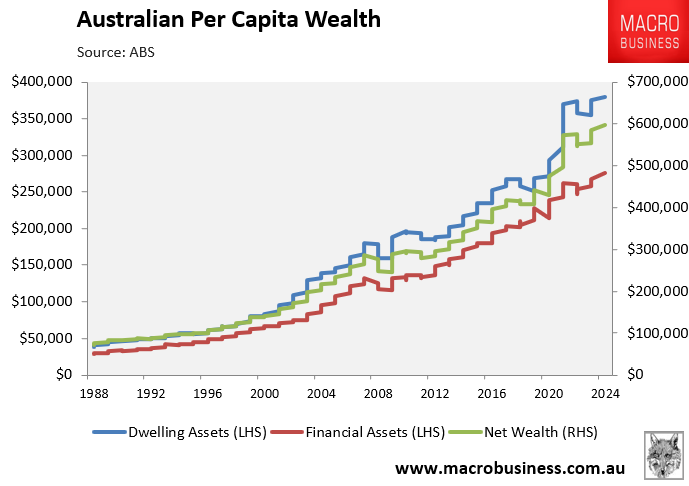

The next chart plots household net wealth and assets on a per capita basis:

The average resident held $598,056 of net wealth in the March quarter of 2024.

The average resident also held $380,043 worth of housing assets and $275,374 worth of financial assets over the quarter.

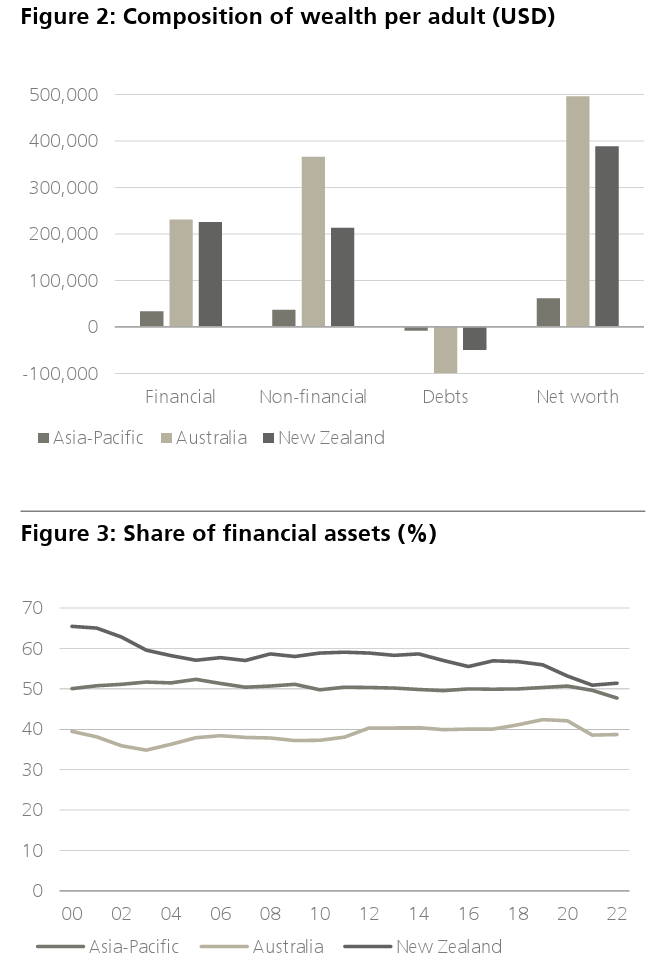

The inflated value of our housing is the key reason why Australians always rank among the wealthiest people in the world in Credit Suisse’s Global Wealth report:

Source: Credit Suisse

Australia’s wealth is highly concentrated in housing (non-financial), according to Credit Suisse:

Source: Credit Suisse

However, is having so much wealth tied-up in overpriced homes genuinely beneficial to Australians?

Everyone requires a place to live, and expensive housing provides no value to the vast majority of owner-occupiers, who must sell and buy in the same market.

Expensive housing also penalises new entrants or those who are priced out of the market. The former are required to obtain big mortgages and live a life of debt enslavement, whereas the latter are compelled to forever rent on insecure short-term leases.

This system has created a nation of housing “haves” and “have-nots”, resulting in increased inequality.

Would Australia really be worse off if the median home cost $392,000 instead of $785,000, total mortgage debt was 70% of disposable income rather than 140%, and the banking sector was smaller and less profitable?

The answer is a definitive no. Having less debt to repay would benefit Australian households, while the broader economy would benefit from productivity-boosting factors such as decreased land costs, increased business lending, and a more balanced economy.

Australia would also be a more egalitarian nation with a broader base of home ownership and less wealth concentration.