The Albanese Government’s open border policies have somewhat worsened Australian inflation.

Westpac notes that the March quarter National Accounts showed a rising gap between ‘essential’ and ‘discretionary’ Australian economic sectors.

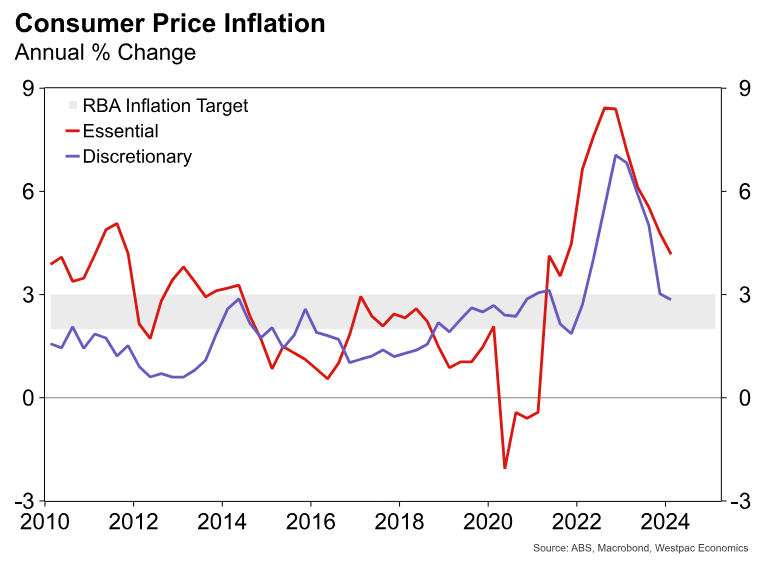

After peaking at over 7.1% at the end of 2022 and falling for almost two years, discretionary inflation fell inside the RBA’s 2-3% target in the March quarter.

However, essentials inflation remained high at 4.2%.

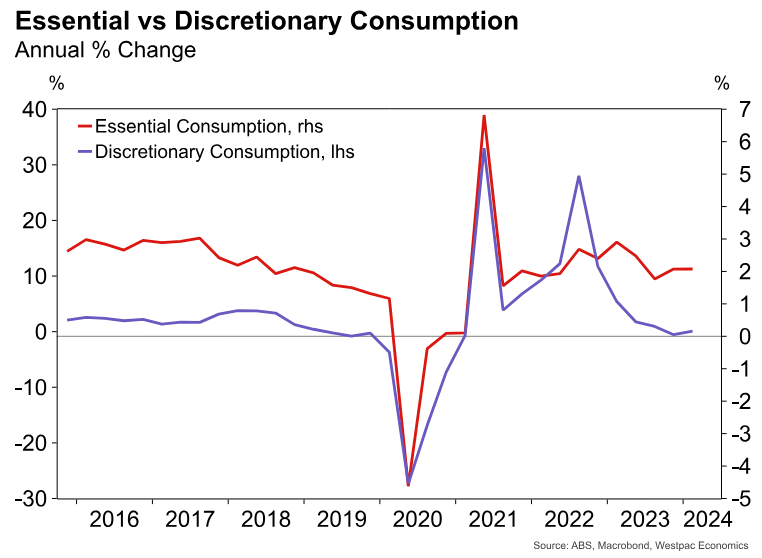

Monetary policy affects discretionary goods and services demand and inflation the most, notes Westpac.

Households tend to change spending from most discretionary to least discretionary in response to disposable income pressures or incentives to save rather than spend.

Thus, monetary policy can alter demand for vital products and services by less.

This is evident in household consumption. In the year to the March quarter, household spending on discretionary items grew 0.1% while necessary items rose 2.1%.

RBA policymaking is further complicated by its inability to impact short-term demand for vital products and services.

Thus, discretionary inflation must fall significantly more if essential inflation remains high.

Moreover, says Westpac, the RBA faces much greater difficulty on the supply side, where monetary policy has even less direct impact.

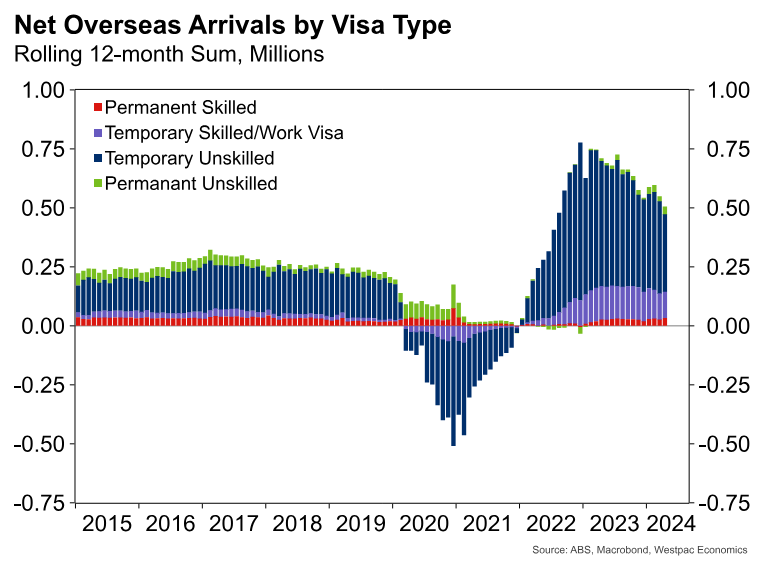

Reopening international borders has increased labour supply.

However, low-skilled visa holders—mostly students—have dominated the increase in the labor supply.

Deflating discretionary sectors rely more on low-skilled labour and imported manufactured items where supply has improved.

Conversely, highly trained professionals in healthcare, construction, and education have not increased fast enough, while new workers have increased the draw on essential supply.

This is also illustrated by official government data showing an oversupply of low-skilled workers and an undersupply of high skilled workers:

In short, Westpac is implicitly arguing that the Albanese Government has brought in the wrong kind of workers and, by doing so, is stalling the RBA’s efforts to control inflation.