DXY rebounded and its uptrend is intact:

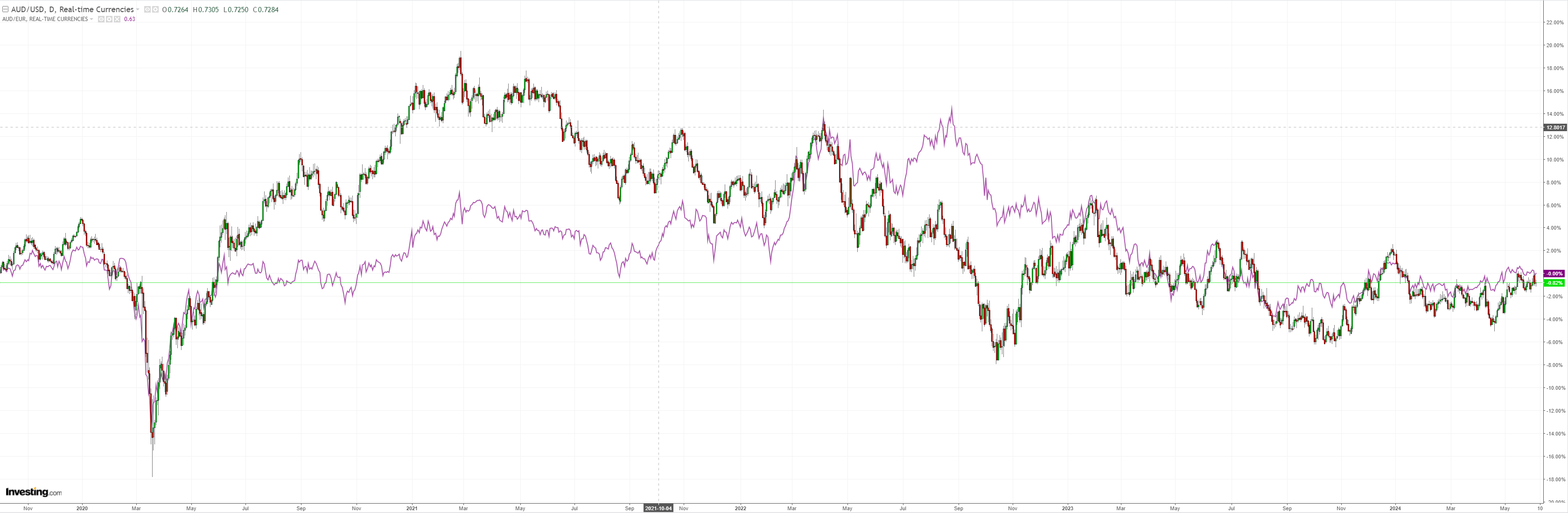

AUD held on:

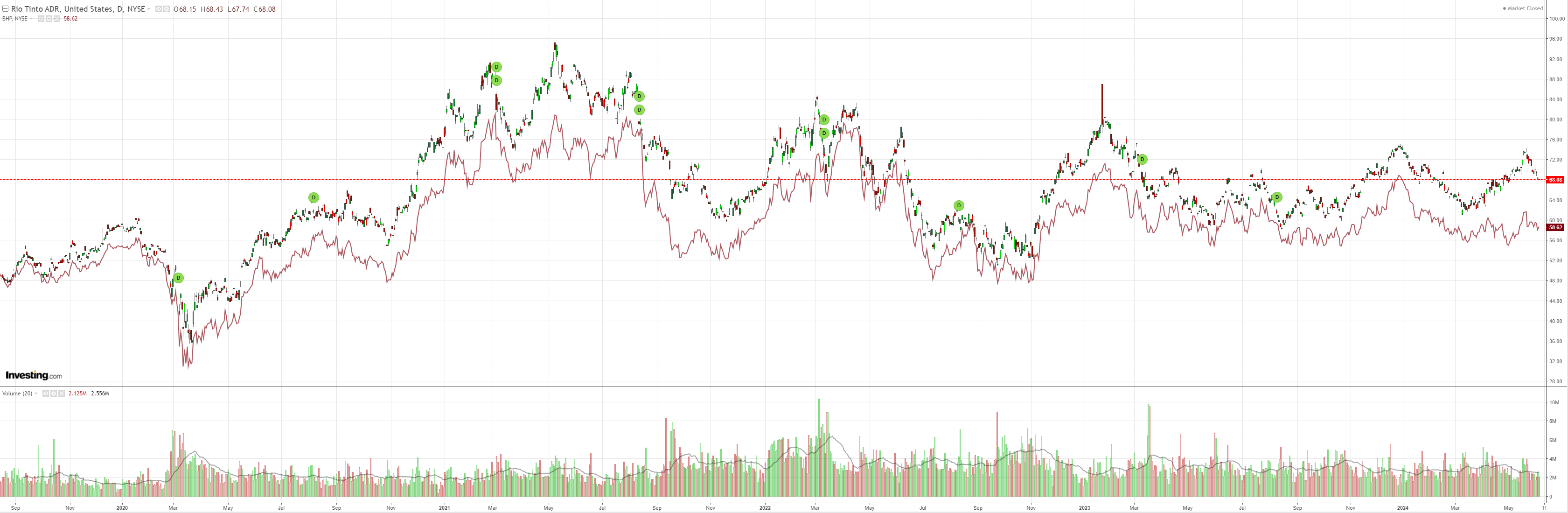

North Asia downdraft returned:

Commodities bounced:

EM too:

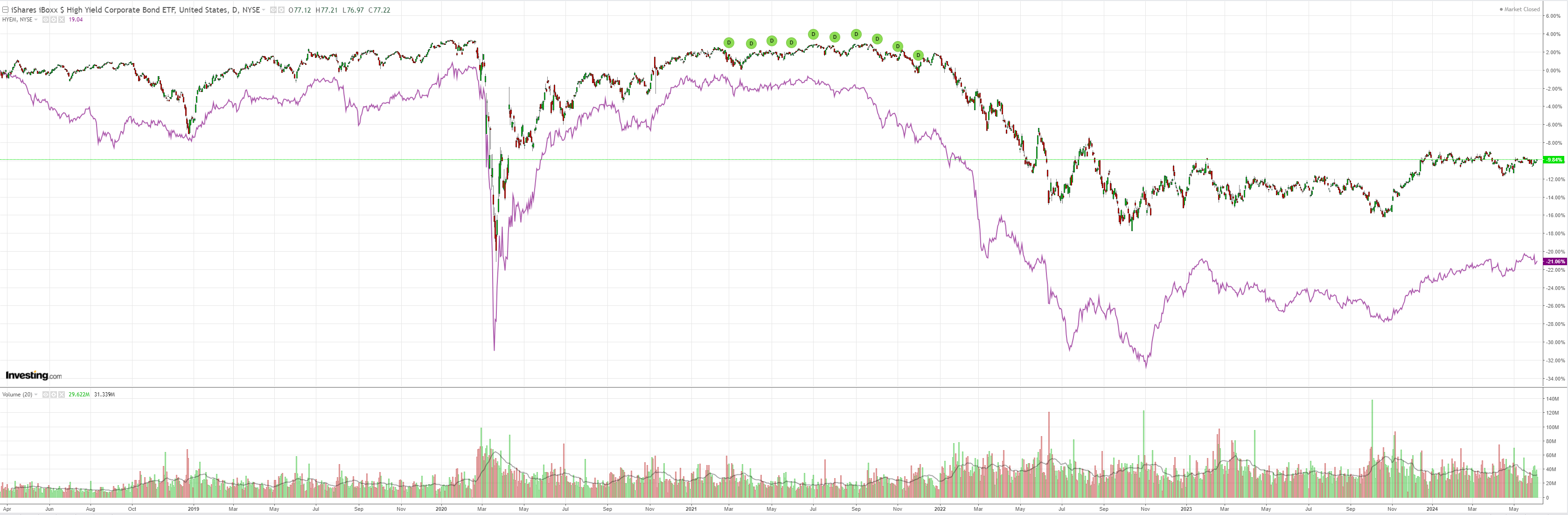

And junk:

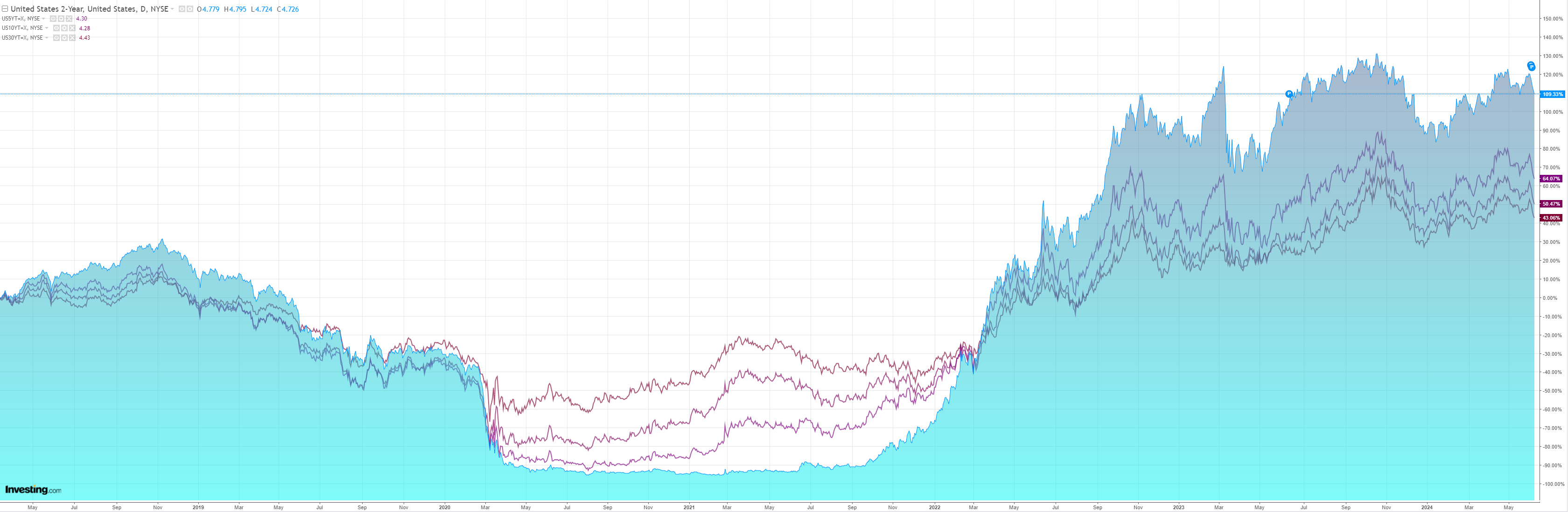

Yields fell smartly again:

ATH for stocks!

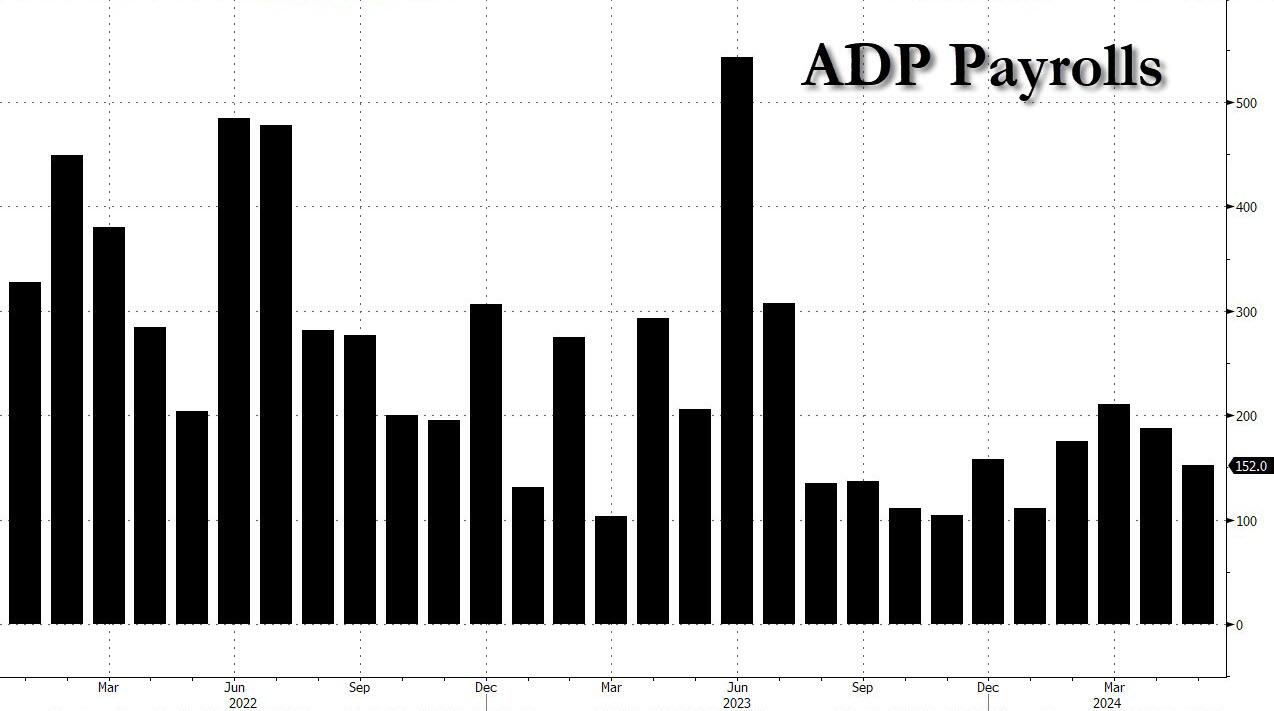

US ADP was soft but not markedly so and it does not correlate well with BLS anyway:

Private sector employment increased by 152,000 jobs in May and annual pay was up 5.0 percent year-over-year, according to the May, according to the April ADP® National Employment ReportTM produced by the ADP Research Institute® in collaboration with the Stanford Digital Economy Lab (“Stanford Lab”).

…“Job gains and pay growth are slowing going into the second half of the year,” said Nela Richardson, chief economist, ADP. “The labor market is solid, but we’re monitoring notable pockets of weakness tied to both producers and consumers.”

ISM services popped:

Economic activity in the services sector grew in May after contracting in April for the first time since December 2022, say the nation’s purchasing and supply executives in the latest Services ISM® Report On Business®. The Services PMI® registered 53.8 percent, indicating sector expansion for the 46th time in 48 months.

And the Bank of Canada cut rates:

CPI inflation eased further in April, to 2.7%. The Bank’s preferred measures of core inflation also slowed and three-month measures suggest continued downward momentum. Indicators of the breadth of price increases across components of the CPI have moved down further and are near their historical average. However, shelter price inflation remains high.

With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points. Recent data has increased our confidence that inflation will continue to move towards the 2% target. Nonetheless, risks to the inflation outlook remain. Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour. The Bank remains resolute in its commitment to restoring price stability for Canadians.

The takeout from that is central banks will not wait until inflation is back in their target ranges. They will cut as the trend approaches the upper bound.

The ECB will be next tomorrow.

The developed market easing cycle has begun. Now the question becomes:

- have they moved too early to deliver their mandate, or

- have they acted in time to prevent a harder landing?

If the first plays out, AUD will fall. If it is the second, AUD will rise.

My base case is option two.