Westpac has released a report on Australia’s economic outlook that highlights the underlying fragility of the economy.

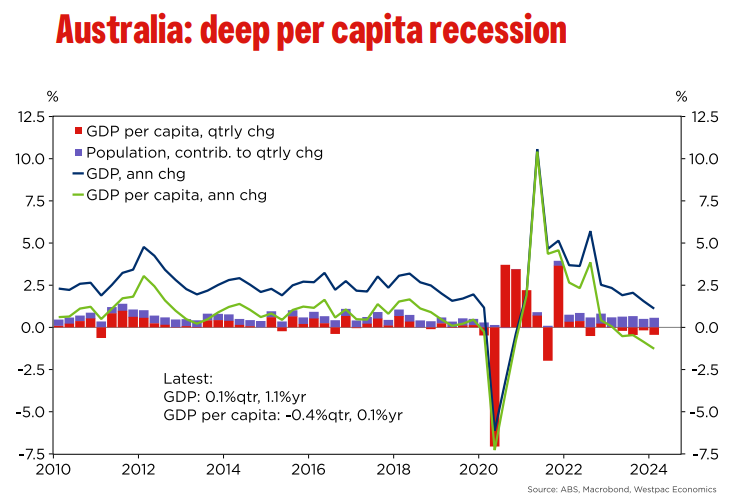

“The Australian economy limped into 2024, with economic activity expanding just 0.1% over the first three months of the year”, notes Westpac.

“Over the year to the March quarter, the economy expanded 1.1%yr – the slowest pace since the early 1990s recession, outside of the pandemic”.

“The extent of the weakness is particularly telling when considered against population growth, which is running at 2.4%yr. Australia has now recorded four consecutive quarters of declining per capita GDP”.

Westpac notes that the Australian economy is being held up by record public spending:

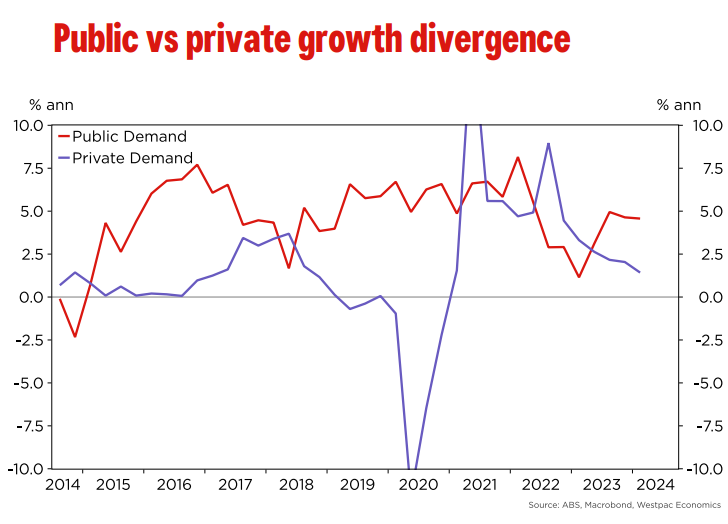

“Domestic demand edged 0.2% higher over the quarter with solid growth in public demand balancing near-flat private demand, which includes assistance to households in the form of electricity subsidies”.

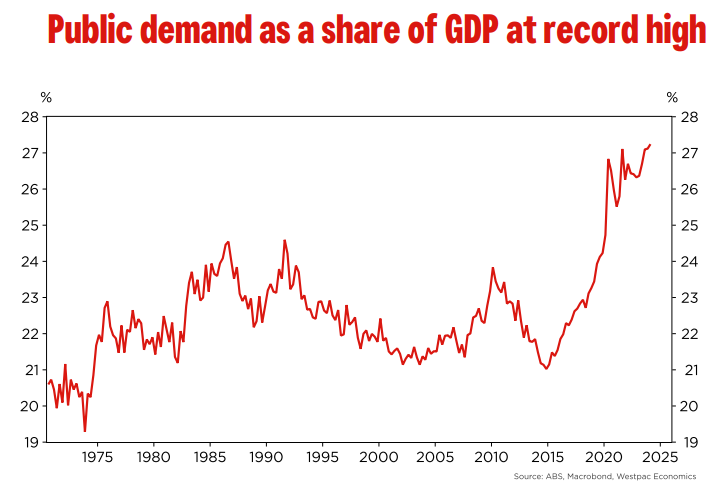

“As a share of the economy, public demand reached 27.2% of GDP, eclipsing the pandemic peak of 27.1% and well above the pre-pandemic average of just over 22%, illustrating the growing size of public demand in the economy”.

This record public demand has come from two primary sources: record infrastructure investment from the states and enormous growth in NDIS and aged care spending from the federal government.

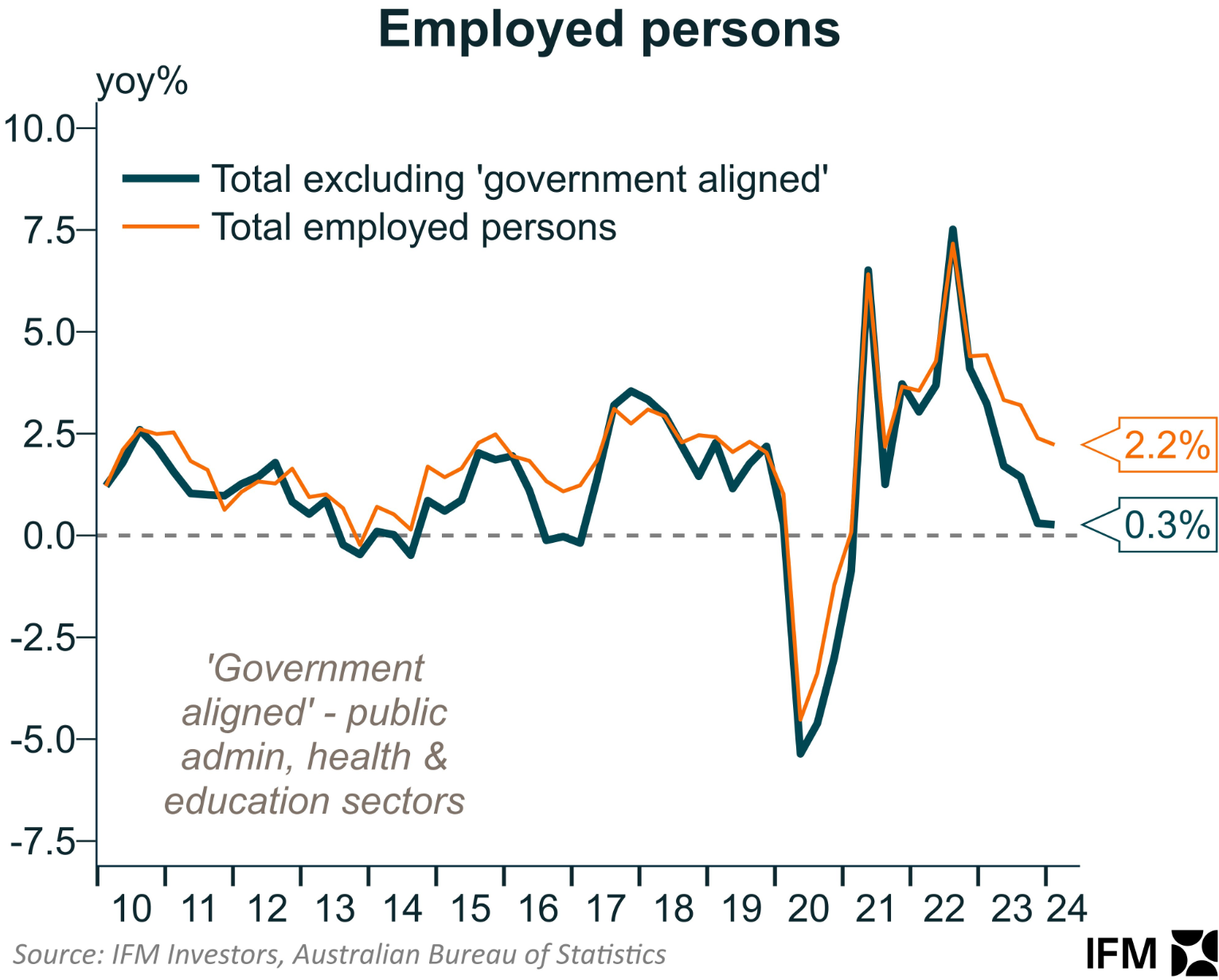

The above charts on economic growth are being reflected in the labour market, where ‘government-aligned’ jobs are booming, whereas market sector jobs are flatlining:

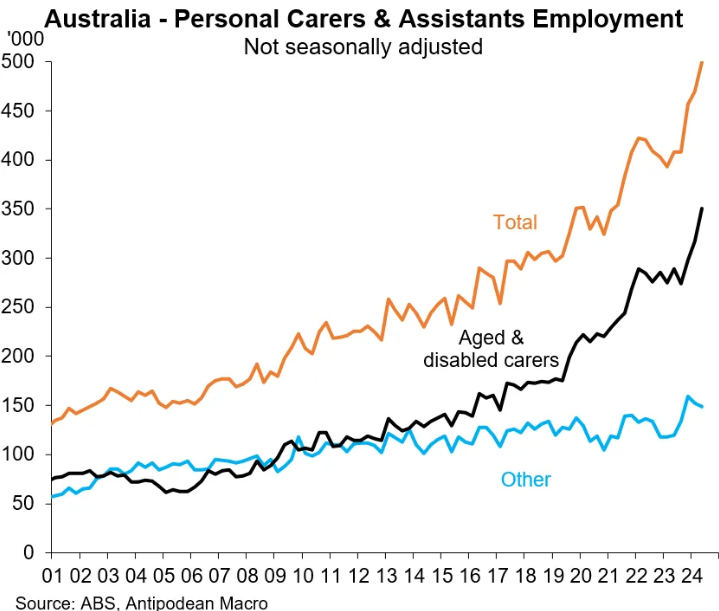

The unprecedented growth in personal care jobs is particularly startling:

The reality is that without the stimulus of record public spending, the Australian economy would be experiencing a technical recession and a very deep per capita recession.

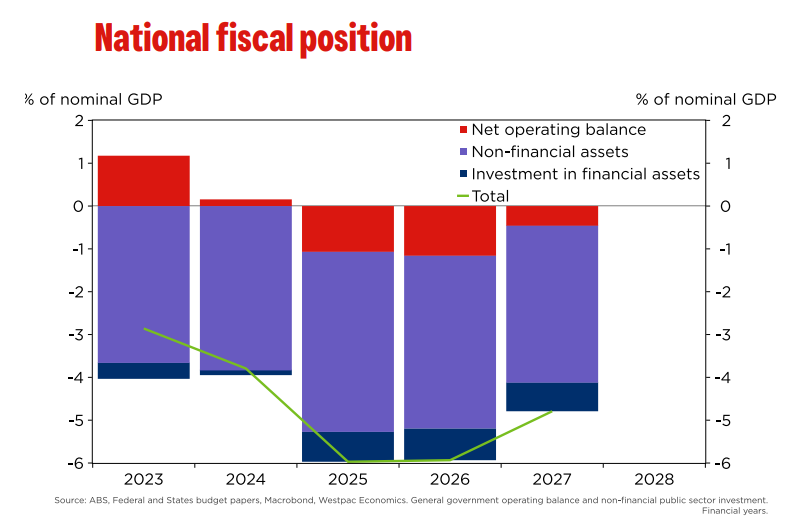

The explosion of public spending has driven the combined state and federal governments deeper into debt:

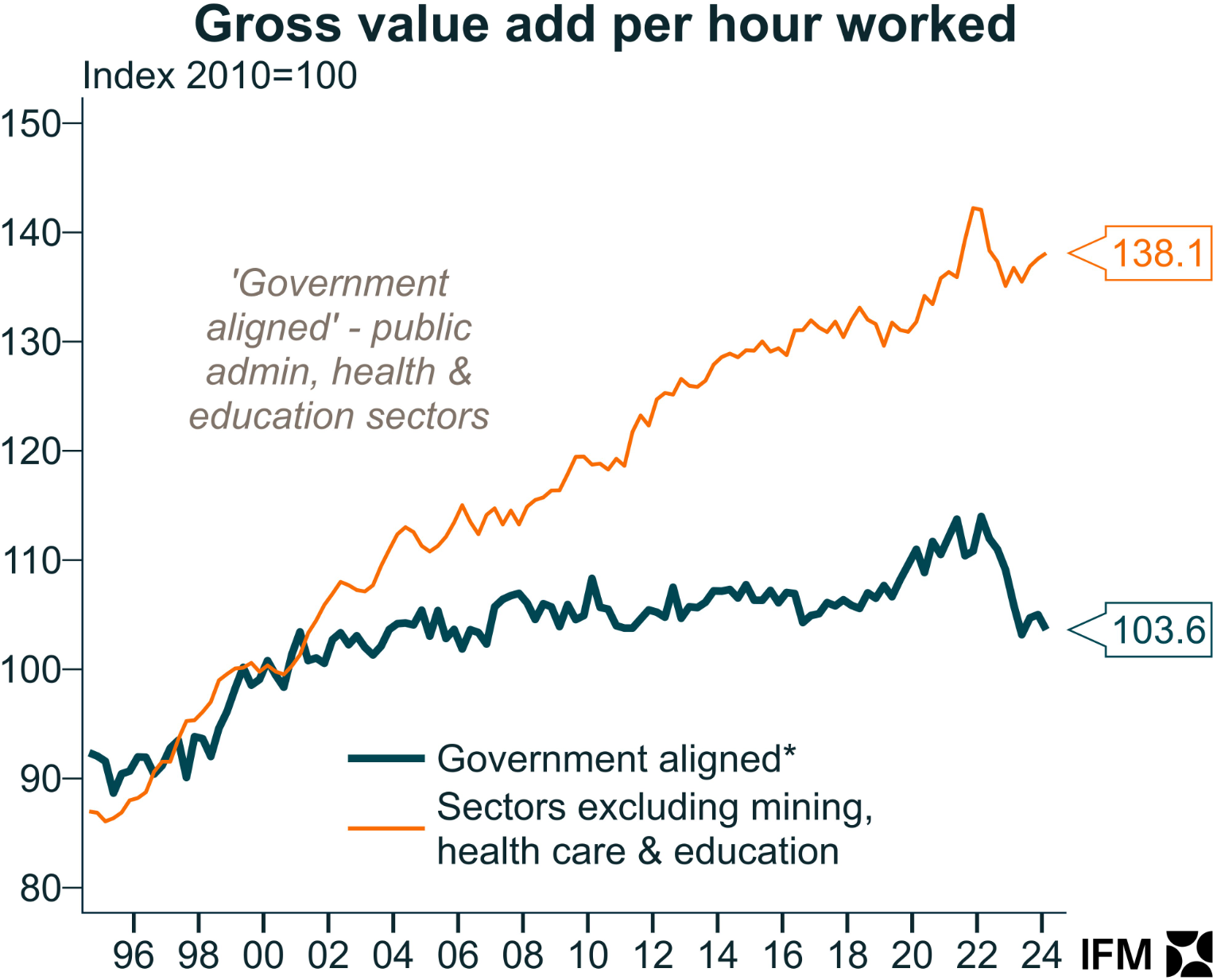

It is also contributing to Australia’s poor productivity growth, given that ‘government-aligned’ jobs are typically far less productive than market sector jobs:

Australia is turning into a bedpan economy reliant on public sector support.