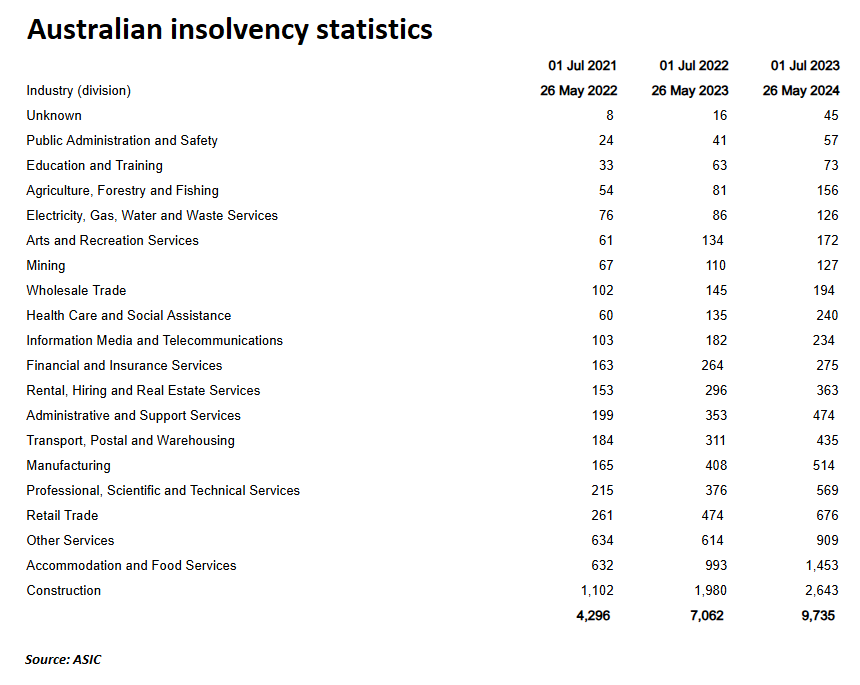

The latest Australian Securities and Investments Commission’s (ASIC) insolvency statistics show that construction firms are dropping like flies.

In the financial year to 26 May 2024, 2,643 construction firms entered external administration, a 140% increase on the same period in 2022:

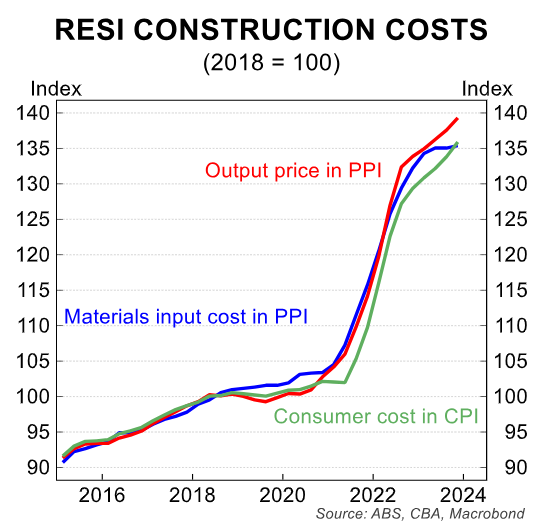

A combination of rising costs and declining demand is putting pressure on Australian home builders.

Residential construction costs have increased by between 30% and 40% since the start of the pandemic, depending on the measure:

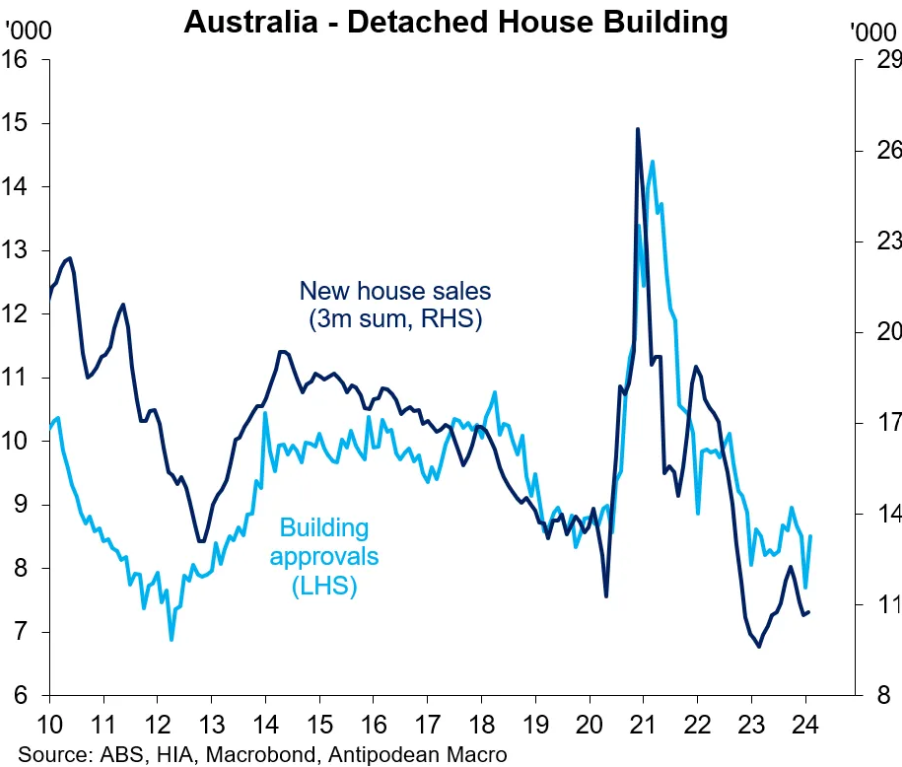

Buyer demand has also collapsed, as evidenced by the sharp falls in dwelling approvals approvals and new home sales:

Just when you thought the situation couldn’t get any worse for home builders, the sector is facing average hikes of 53% for domestic building insurance following the spate of builder collapses over the past year:

“The Victorian Managed Insurance Authority told builders on Thursday morning that charges for domestic building insurance would increase by an average 53% from 6 August, 11 months after all premiums were increased by 43%”.

“The increase includes a 65% lift in premiums for new homes, single and multi-unit dwellings and owner builders. Insurance for renovations will increase by 20%”.

The surge in insurance premiums is a dagger through the hearts of those hoping to see a deflation in building costs.

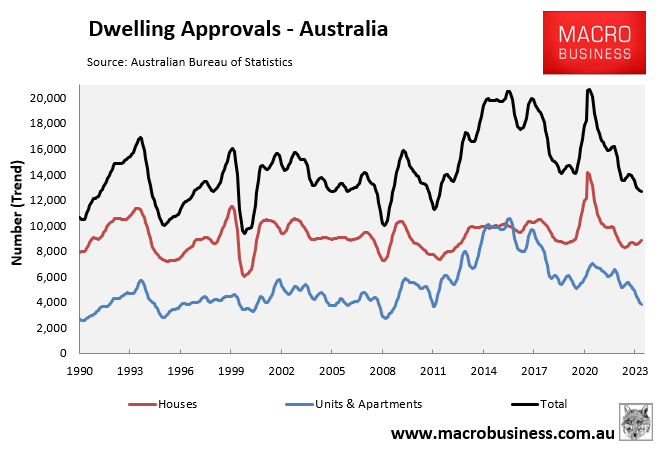

It also represents another fatal blow to the Albanese government’s target of building 1.2 million homes over five years, which is already running well behind.

The latest trend in dwelling approval data suggests an annual run rate of only around 150,000 homes approved for construction, which is roughly 90,000 below the Albanese government’s target of 240,000 annually:

The upshot is that housing supply will continue to undershoot population growth, resulting in worsening housing shortages.

The only realistic solution to Australia’s housing supply crisis is to take the pressure off demand by slashing net overseas migration.

Australia’s housing shortage will only reduce when the migration program is calibrated at a level that is well below the nation’s capacity to build homes and infrastructure.