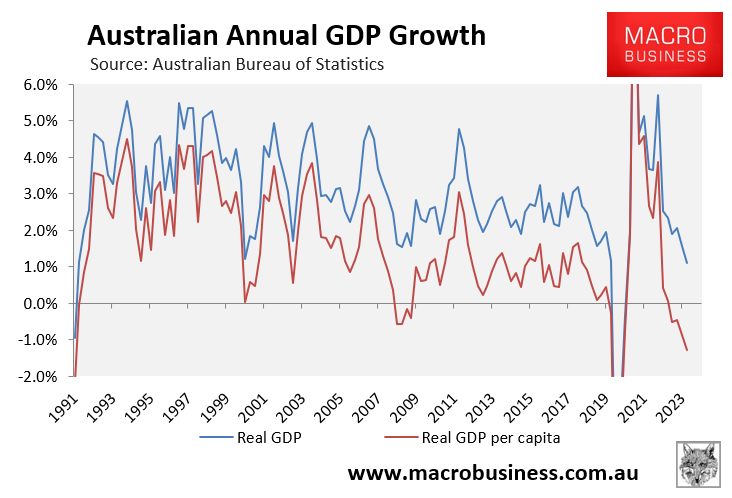

Hot on the heels of Wednesday’s shocking Q1 national accounts release, which recorded the weakest aggregate and per capita growth since the early 1990s recession outside of the pandemic:

The Australian Industry Group (Ai Group) released its Australian Industry Index, which measures changes in activity in Australia’s industrial sectors.

As illustrated in the following chart, the index “sank deeper into contraction in May as weakening demand dragged on activity”:

“All activity indicators fell materially in the month”, noted Ai Group.

“A significant decline in the new orders indicator around the holiday period is now passing through to the activity/sales and employment indicators”:

Capacity utilisation also continued to shrink, falling to just 73.5% in May:

Over the past six weeks, we have witnessed a procession of manufacturing firms either going broke (Qenos) or warning that they are looking to exit Australia.

Qenos, Australia’s last plastics manufacturer; Orica, the explosives manufacturer; Nestle; and PepsiCo each warned last month that Australia’s energy costs are far too high, making manufacturing in Australia uncompetitive.

So, while Prime Minister Albanese government continues to tout the government’s Future Made manufacturing policy, we have actual manufacturers warning that Australia is a bad place to do business because our energy costs are so high.

Clearly, the federal government needs to focus on fixing the energy market and delivering cheap energy.

Australia is an energy superpower. We should have the cheapest energy in the world. But through policy failure, we instead have some of the most expensive energy prices in the world.

These high energy prices are driving up our cost of living, pushing up CPI inflation, and sending our manufacturing industry broke.

Delivering cheap energy, for example via East Coast domestic gas reservation, would enable our manufacturers to survive and thrive.

It is also a far better policy than throwing taxpayer money at boondoggle renewable manufacturing projects via Albo’s Future Made.

There is no manufacturing future without cheap energy.