On Friday, the Australian Bureau of Statistics (ABS) released its Labour Account for the March quarter of 2024, which showed that private sector job growth has collapsed.

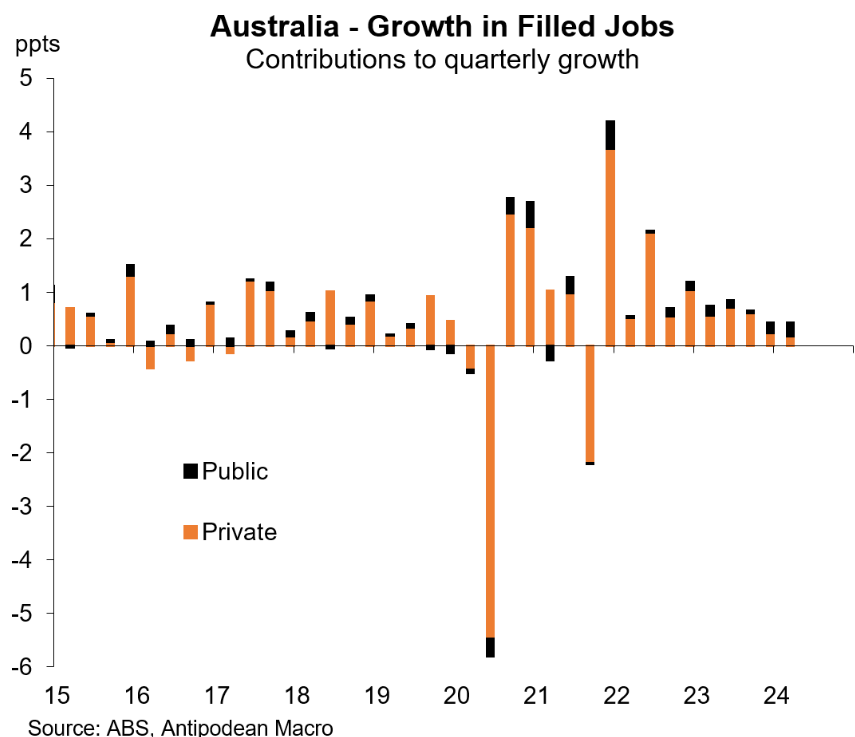

As illustrated in the following charts from Justin Fabo at Antipodean Macro, the public sector contributed more to net jobs growth over the most recent six months than the private sector:

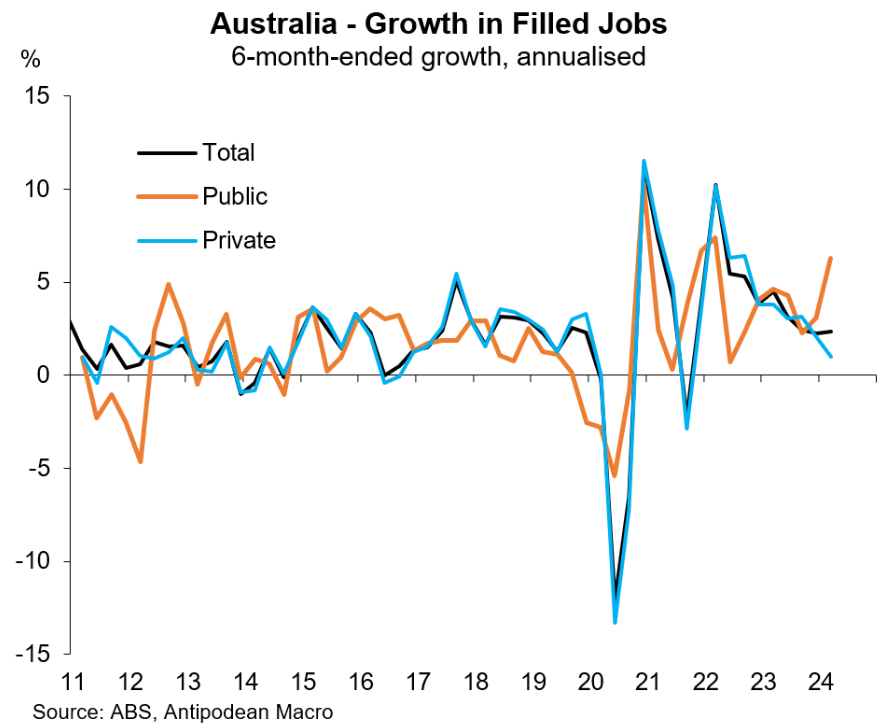

As a result, private-sector jobs grew at only a 1% annualised rate over the six months to Q1 2024, versus nearly 7% for the public sector:

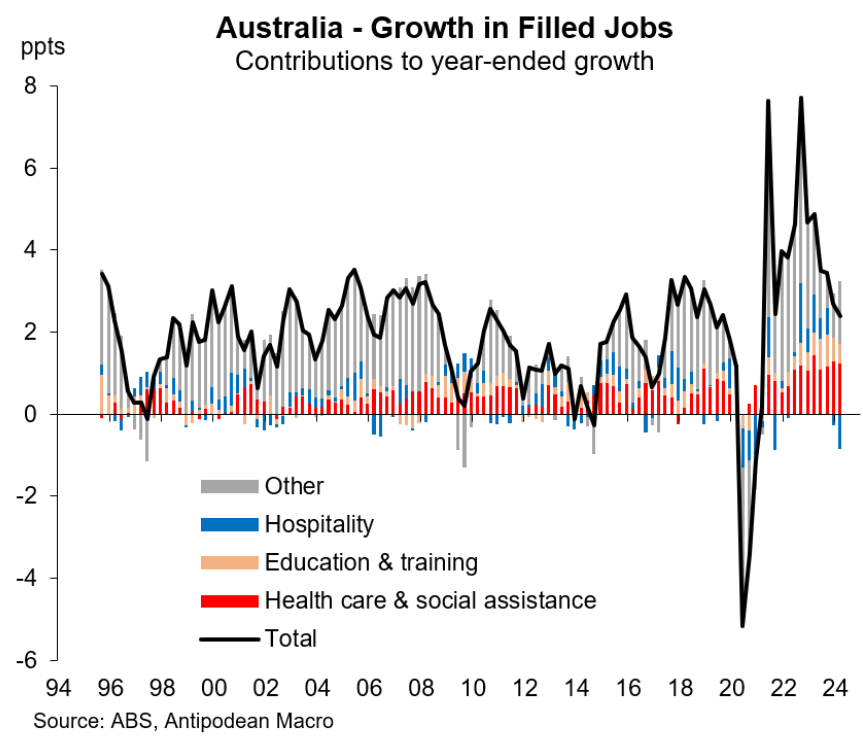

Investment bank Jarden estimated that nearly one-third of jobs created in 2023 were in NDIS-related sub-industries like allied health and non-childcare social assistance.

This trend appears to have continued into 2024, with health care & social assistance continuing to drive job growth in Australia:

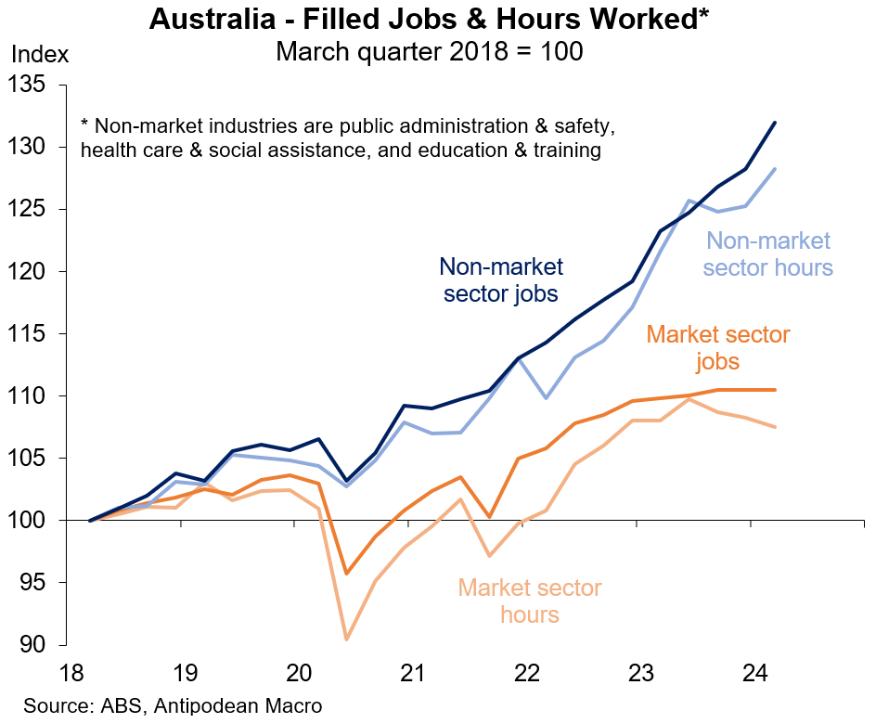

In fact, the non-market sector of Australia has boomed while the market sector of the economy has stagnated:

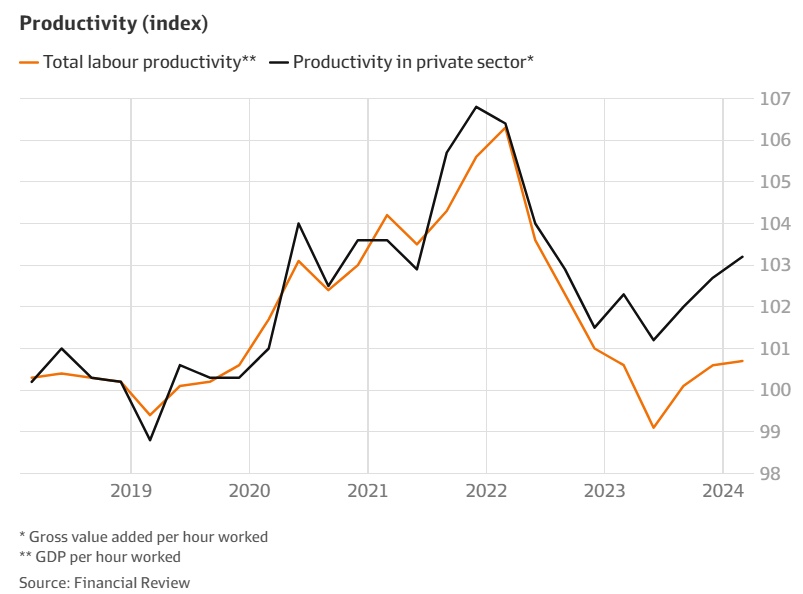

These results are an ominous sign for Australian productivity, since non-market sector jobs historically have experienced far lower productivity growth than the market sector:

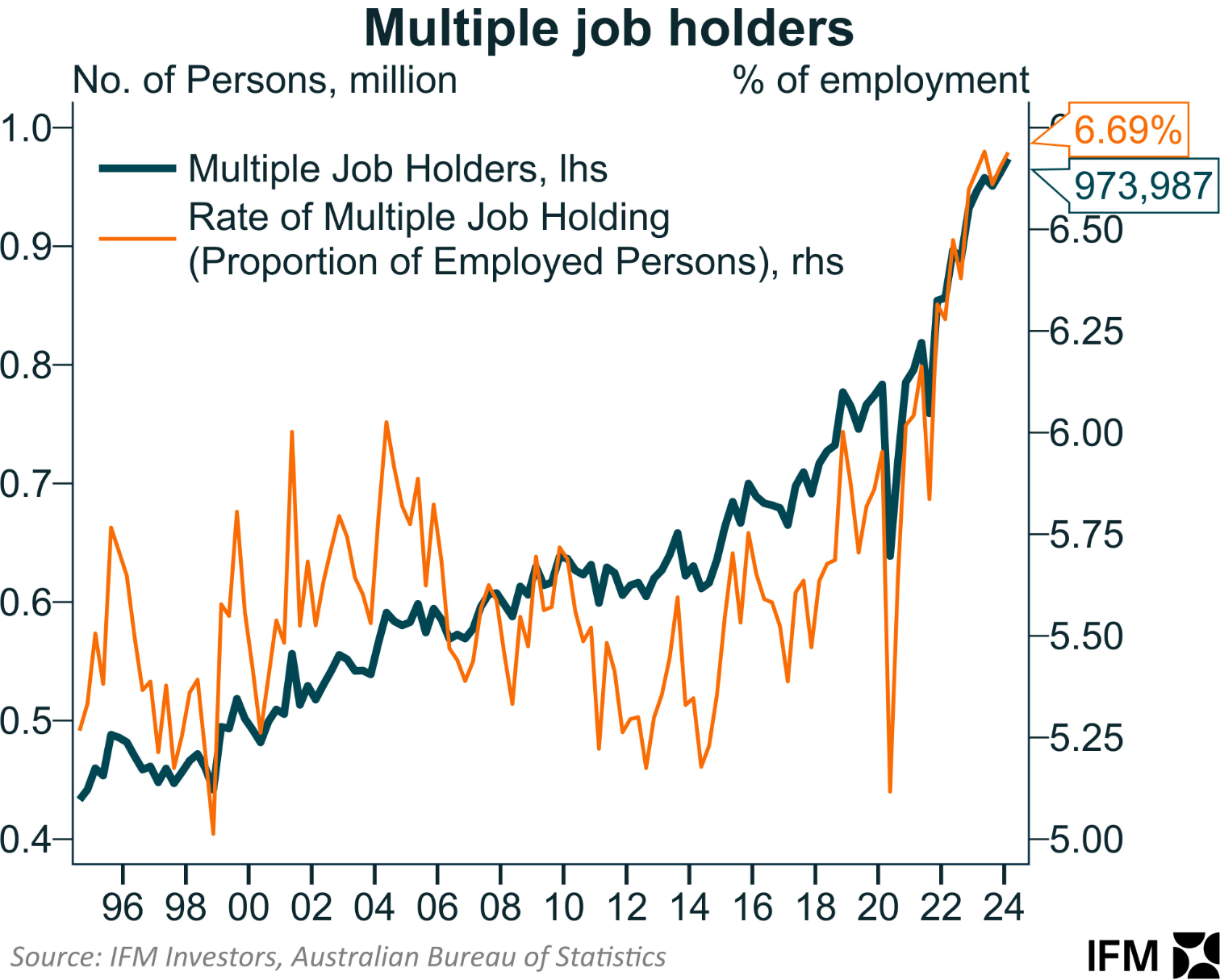

Finally, the ABS Labour Account showed that a record number and share of Australians worked multiple jobs in the March quarter:

As you can see above, the number of people working multiple jobs has steadily increased over recent years, likely reflecting cost-of-living pressures.

In the face of negative real wage growth, rising mortgage repayments and rents, and broader cost-of-living pressures, Australians are looking for more hours or additional work to make ends meet.