If you have time, make sure that you watch the below interview with David Flint from ADH TV.

In the interview, I explain in detail why expensive energy prices threaten Australia’s economic future.

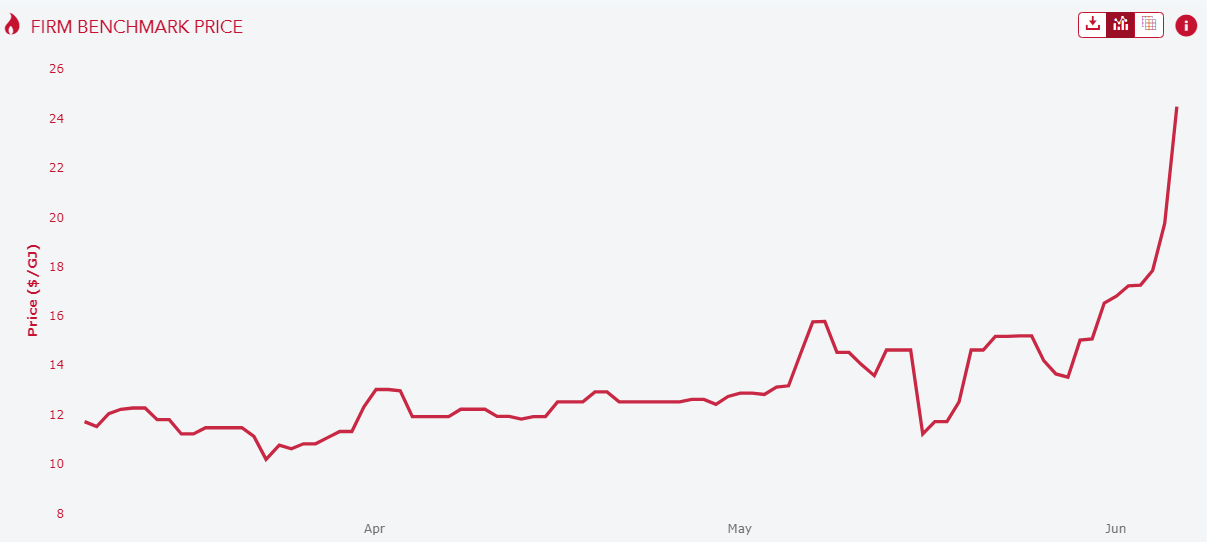

This interview was recorded on Thursday when the East Coast gas price was $20 a gigajoule.

The price hit $24 on Friday, double the Albanese government’s $12 price cap and roughly 800% above the historical average of $3.

By way of comparison, the US is now the world’s largest gas exporter (it overtook Australia a year or so ago) and its residents pay only $US2.50 ($A4) a gigajoule. Therefore, Americans pay around one fifth of what Australians pay.

The AEMO warned on Friday that Victoria faces imminent gas shortages and may soon have to decide whether households or manufacturers receive gas.

During a housing crisis where we need homes, Brickworks chief executive Lindsay Partridge told The AFR that the company might have to close its operations because of gas shortages and high prices.

“It is not if but when. This situation could have been avoided but we are in a position where Victoria will have to choose between keeping businesses going or providing heat to homes”, Partridge said.

“If they cut us off, it would take us two weeks to restart operations, but if they cut heating off – old people will die”.

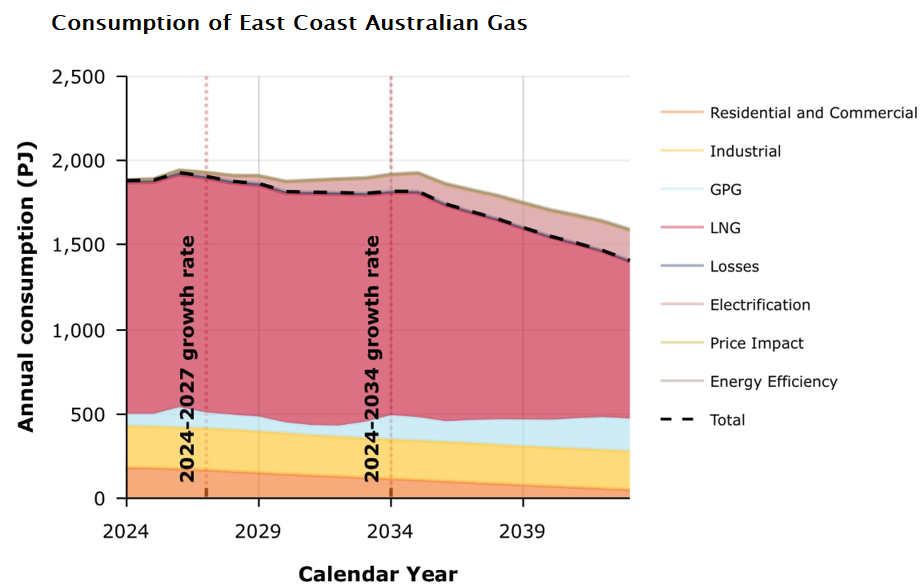

How is it that Australia’s East Coast, which exports around 80% of its gas, is experiencing shortages and globally high prices?

Australia is the equivalent of a Middle Eastern oil country with respect to gas. We are an energy superpower. Australians should have abundant supply and pay just above the marginal cost of supply for gas, not the world’s highest prices.

Could you imagine residents of a Middle Eastern oil-exporting country paying $2.50 a litre for petrol and being told that the country may soon run out of oil? That is effectively what is happening on the East Coast with respect to gas.

As a result, Australians also pay some of the highest electricity prices in the world, since gas sets the marginal price of electricity.

The reason for the energy failure is because Australia’s East Coast is the only gas exporting jurisdiction in the world that does not reserve its gas for domestic use. The US does it. Western Australia does it. Everywhere else does it.

The combined hyperinflation of gas and electricity prices is feeding the cost-of-living crisis as well as CPI inflation. It also means that Australian interest rates will remain higher for longer.

The federal government must follow Western Australia and implement a domestic reservation system for the East Coast, alongside regulating domestic gas prices at $6 a gigajoule. The government should also impose a per gigajoule levy on LNG exports.

Australians must get a fair financial return from gas exports as well as pay a fair, regulated cost-plus price for gas used domestically.